Macroeconomic Indicators Vol II, Issue 6

Market Trends and Current Statistics

Key macroeconomic indicators that are likely to impact brokerages within the insurance industry.

The Future Of Retail Business

In recent years, the retail industry has faced significant challenges due to increasing use of online retailers, economic conditions, supply shortages and leadership missteps. Big name retailers like Bed Bath & Beyond, Toys R’ Us, and Sears are among those who’ve announced bankruptcy in the last five years. While it may seem like the pandemic is the obvious answer to their failures, there’s more to the story.

Reasons for some retail business failures

- Initially, Bed Bath & Beyond did well while competitors went under. However, eventual supply chain issues, and the failure of private label products, ultimately sealed the corporation’s fate.

- For Toys R’ Us, when big box stores such as Costco got into the toy business with lower prices, specialty toy stores just couldn’t compete.1

- Experts point to Sears’ decision to cut costs, instead of upgrading and innovating, as a key reason for their bankruptcy.2

- For other small retail businesses, there was a decline in purchasing of specialized products, such as wedding dresses or party supplies.

Does this signal the end of brick-and-mortar stores?

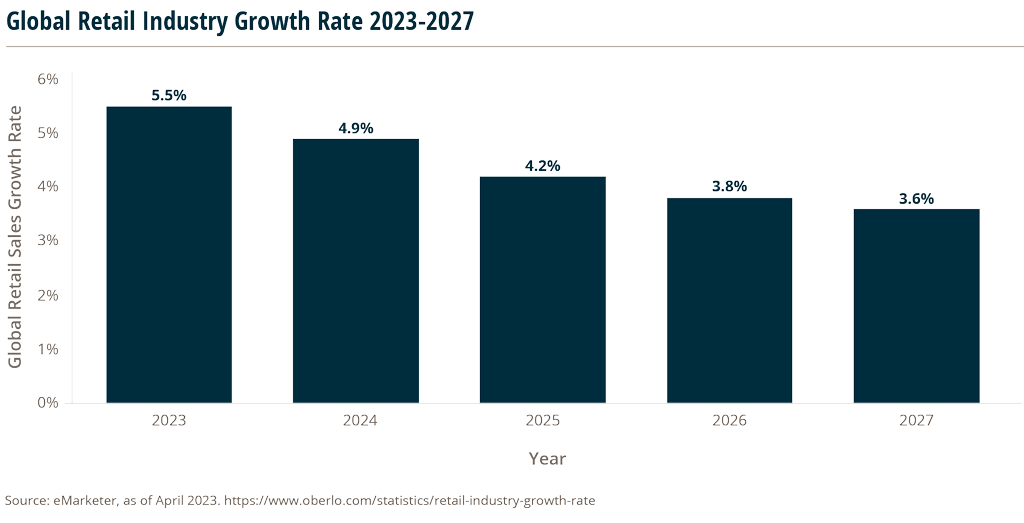

Not quite. Walmart, Home Depot, Target, and CVS are just a few of the retailers still bringing in impressive revenue.3 Even Amazon has physical stores, in multiple states, that offer groceries, apparel, and pre-made meals.4 Plus, consumers want to try out certain types of products in-person before they make a purchase. Industries such as clothing, furniture, and produce are safe for the time being. Overall, retail sales are predicted to continue growing, but at a slower rate.

The next phase of retail

Many of the top performing retailers have lasted because they adapted their business model to compete with online giants like Amazon or eBay. Walmart and Target are Amazon’s biggest competitors because they offer strong online shopping options (i.e., free shipping, fast delivery, same-day pickup) as well as a wide variety of products. Nowadays, most consumers enjoy the convenience of shopping for pharmacy products, food, and clothing all in one location.

There’s also the smart strategy of enhancing the experience of shopping at these retailers. Incorporating popular coffee shops, fast-food restaurants, or health care services inside retail locations is a smart way to draw shoppers in.

One-stop shopping, instead of specialized or limited products, is the future of retail.

Impacts to the commercial insurance market

While the commercial property insurance industry has struggled, loss of big retailers isn’t the main cause. High premiums, inflation, and inclement weather are factors hampering market growth.5 Still, there are opportunities for commercial insurers to strengthen their offer, even in volatile times. Experts recommend sharpening technical expertise and expanding product lines to increase relevance across the industry.

The Inverted Yield Curve Is Still Worrisome

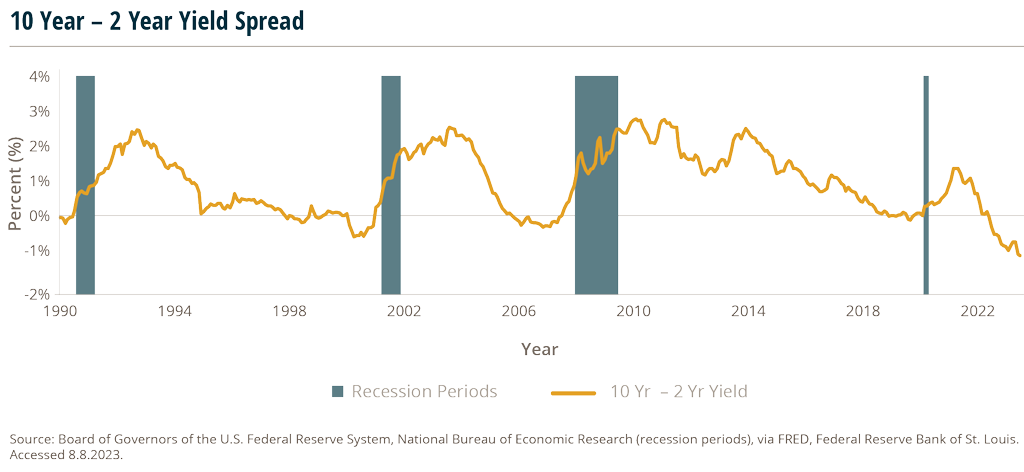

For over half a century, every economic recession in the U.S. has been preceded by an inverted yield curve. The curve displays the yields of U.S. treasury bonds at a specific point in time. In times of economic growth, yields on longer-maturity bonds (e.g., 10-year) exceed those of short-term bonds (e.g., 3-month, 1-year, or 2-year maturities), creating a positive slope in the curve.

However, it’s interesting to note that the relationship between long- and short-term bonds has flipped in periods preceding economic recession – with shorter-maturity bonds having higher yields than long-term bonds.

Since July 2022, the yield curve has sunk as the difference between short-term and long-term bond yields has inverted. Why does this matter? A common interpretation of this phenomenon is that investors expect future economic growth to be weaker than current economic growth, causing an increase in demand for longer-maturity bonds as investors seek to “lock in” current yield rates before they drop. As a result, many observers use the yield curve as a leading indicator to forecast economic activity, particularly recessions. Since most insurance brokers follow GDP (Gross Domestic Product) in revenue growth – stagnation or contraction in the economy potentially translates to the same for a firm’s revenue and value.

While the inversion of the treasury bond yield curve usually sparks an alert of an impending recession, inversion in the yield curve has not always led to economic recession in the past. There have been instances where the inversion was shallow and only lasted a few days before the curve returned to a positive slope, such as in 1998. However, the current inversion is the largest since 1981, lasting over a year, with the 10-year minus 2-year curve falling to -0.93% in July.

A reversion of the yield curve also does not indicate the economy has evaded a downturn. In fact, prior to the 1990-1991, 2001, 2007-2009, and even 2020 recessions the yield curve recovered to the point of 10-year bond yields exceeding 2-year bond yields for at least a couple of months before the following recession set in.

Could The Commercial Real Estate Reset Impact The U.S. Economy?

As a slowdown looms over the U.S. economy, the commercial real estate sector may add potential volatility and risk to the financial system.

Around $1.5 trillion in commercial mortgage debt comes due at year-end 2025, and default risk is greater due to tighter credit, higher interest rates and a decline in property values from lower vacancies.6

As investors and lenders in commercial real estate are dealing with changes in how and where people work, shop, and live, higher interest rates are making it more expensive to buy or refinance buildings. Owners facing large principal payments may prefer to default instead of borrowing more. Regional and smaller banks hold about 70% of commercial real estate debt, adding to risks for the U.S. banking system.7 Earlier in the year, the U.S. experienced the collapse of three regional banks, partly due to their investments in financial instruments that are sensitive to interest rate moves.

The challenges in the commercial real estate sector are also being seen globally, as countries in Europe and Asia grapple with the same secular trends. In Europe, office prices are expected to fall more than 25%, and almost 13% in the Asia-Pacific region.

In the U.S., which has more remote workers than Asia and Europe, values for offices are down 30% since March 2022, according to Green Street, a data analytics firm.8

Furthermore, values of apartment buildings have declined 21%, while malls are down 18%. Some institutional investors such as Blackstone, Brookfield and Pimco have already ceased payments on some buildings in order to better prioritize cash and resources.

Major U.S. cities affected the most

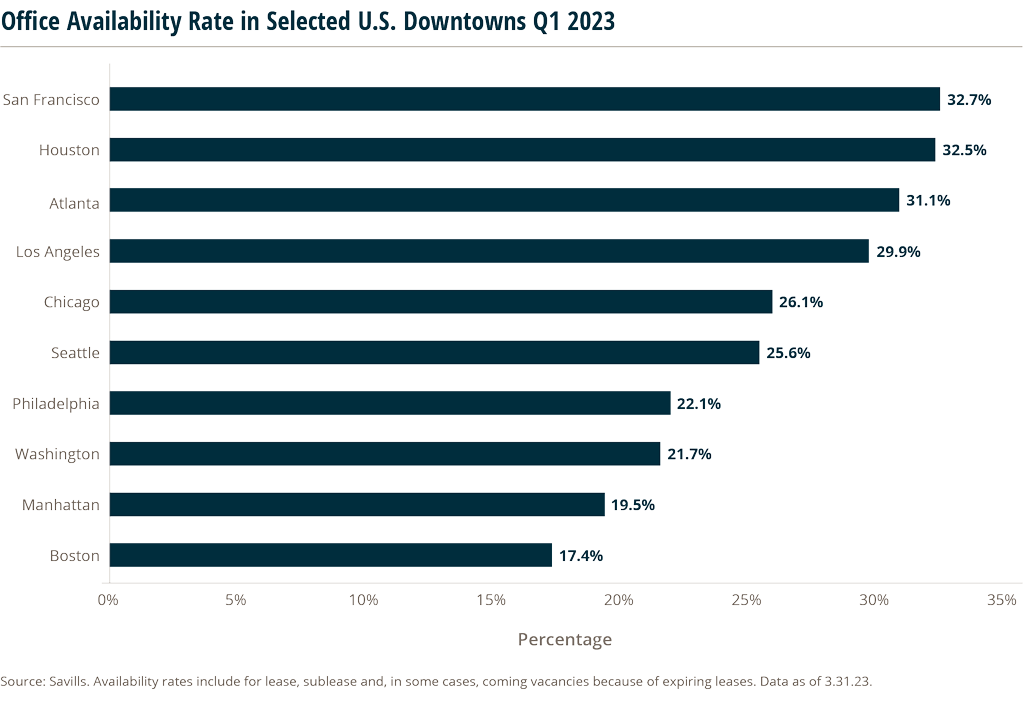

San Francisco, CA, has seen the largest impact so far, with tech companies cutting back on jobs and office space and workers preferring to work from home over a long commute. The city’s homelessness crisis is also concentrated downtown, driving an increase in store closures from rising retail theft. In Q1 2023, square footage leased in the city was down by more than two-thirds from Q1 2019 levels.

In New York, NY, it’s estimated that only about half of office workers are back at their desks – and buildings are struggling with the loss of tenants in the need for upgrades. In the meantime, newly built office towers are adding to the current supply, creating competition for older properties. In Atlanta, GA, 31% of office space is available for lease as of Q1 2023, and nearly 30% of Atlanta’s office space has debt maturing between now and 2025.

European cities have other issues

While London faces similar office vacancy issues as U.S. cities do, it also faces an issue where hundreds of buildings could become obsolete because they don’t meet UK environmental regulations.

Properties are graded on energy performance, from A to G. By 2030, it will be illegal to rent commercial buildings ranked below B, and owners will need to choose between expensive upgrades or empty offices.

One of Sweden’s main problems is the amount of debt property companies took on while rates were low. Much of the financing came from short-term and floating-rate bonds, so yields and costs will likely soar as landlords face $42B of bonds due over the next five years, including about 33% of which are due in 2024.

It took six years for commercial real estate prices to recover after the 2008 financial crisis (which was focused on issues in residential real estate), and now some analysts say this current correction could take 10 years or more. The question now is how much will the correction ripple through and impact the banking sector and the broader economy?

Insurance Carriers Continue Big Investments In Tech

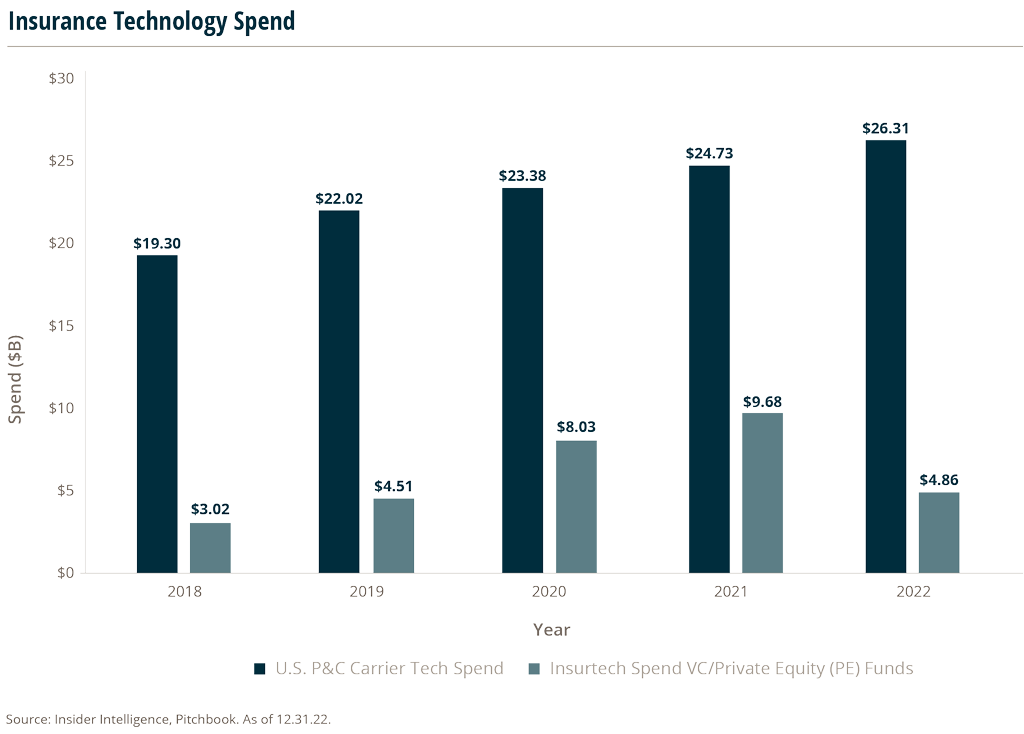

Recent headlines have focused on a decline in venture capital funding in the insurtech industry. But this does not equate to shrinking tech investment in insurance. While the threat of a potential economic slowdown looms, insurance industry leaders continue to allocate sizable funds to tech. Insurance brokerage firms can also benefit from continued investment to help boost efficiencies and improve organic growth.

In Q1 2023 venture capital (VC) activity, $1.1 billion was invested in the insurtech space across 115 deals, a decrease of 9.9% in deal value from Q4 2022. This deal value was the lowest since Q2 2018.9

Although insurtech investments appear challenged due to poorly performing public offerings, the challenging economic environment, and higher competition, some of the largest P&C (Property & Casualty) carriers are continuing to spend hundreds of millions or more each year on technology to remain competitive, grow revenue, and improve margins. In fact, technology investments in the P&C space are up ~36% from 2018, with an estimated $26 billion of direct investment in 2022 from U.S. P&C carriers.10

Several of the largest carriers in the industry are actively investing in their digital capabilities. For example, in Chubb’s 2022 annual report (released in 2023), the company noted continued investments in digital technology, including investments in robotics, artificial intelligence and machine learning, to gain insights into underwriting and claims while improving efficiencies. The company projected $500 million in run-rate cost savings in 2023 in its 2021 annual report.11 Chubb also noted that it is investing hundreds of millions of dollars in transformation efforts.

Travelers is another large carrier that is heavily investing in technology. In its 2022 annual report, Travelers continued to show its commitment to innovation, stating: “Over the past five years we have meaningfully increased our overall technology spend…increasing our spending on strategic initiatives by nearly 70% since 2017 while holding routine but necessary expenditures about flat.”12 The company also noted its ongoing investments of “well over $1 billion annually on technology” in its 2021 annual report.13

Despite the difficult road the insurtech industry has traveled over the past few years, it is likely that the technological evolution of the insurance industry will only accelerate from here. Brokers need to continue to stay current on developments in technology and adopt solutions that enables them to stay competitive – even relevant.

Sources:

1 https://www.failory.com/cemetery/toys-r-us

2 https://www.cnn.com/2018/10/16/business/sears-amazon-cause-of-problems/index.html

3 https://www.netguru.com/blog/largest-brick-and-mortar-retailers-us

4 https://www.amazon.com/find-your-store/b/?node=17608448011

7 https://www.politico.com/news/2023/06/05/mortage-interest-rates-property-values-00094969

8 https://www.greenstreet.com/insights/CPPI

9 https://pitchbook.com/news/reports/q1-2023-insurtech-report

10 https://www.insiderintelligence.com/content/spotlight-us-pc-insurance-technology-spend-forecast-2022

11 https://s201.q4cdn.com/471466897/files/doc_financials/2022/ar/2021-Chubb-Annual-Report.pdf

12 https://s26.q4cdn.com/410417801/files/doc_financials/2022/ar/B/Travelers-2022-Annual-Report-pdf.pdf

13 https://s26.q4cdn.com/410417801/files/doc_financials/2021/ar/Travelers-2021-Annual-Report.pdf