Industry Insights Vol II, Issue 6

Industry Insights

Insights from MarshBerry proprietary data and market intelligence to help drive your business.

Could Investing In Onboarding And Training Result In Better Retention?

Talent acquisition continues to be the number one challenge for insurance brokerages, with over half of firms looking for talent. But it may be just as important for companies to look at strategies for talent retention.

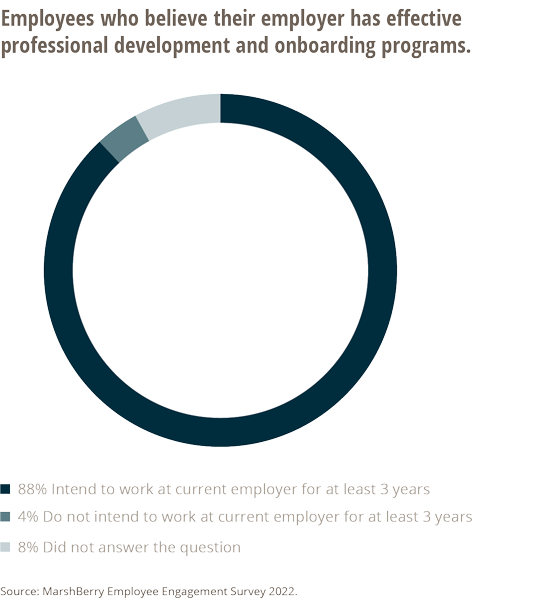

Based on data from MarshBerry’s Employee Engagement Survey, firms with strong onboarding and training practices also have happier employees who are more likely to remain long-term. The survey asked respondents to agree or disagree with the following statements:

This organization does a good job of orienting new employees.

This organization supports my professional training and development.

The survey also asked respondents to agree or disagree with the statement:

I intend to work here for at least three more years.

The results? 88% of respondents who agreed their employer does a good job at employee orientation and supporting professional development – intend to work at their company for at least three more years.

Employees who are more satisfied with an employer’s onboarding process and focus on training and professional development are also more likely to stay with the company long-term.

Better onboarding and professional development are important for insurance brokerages as part of an overall attractive culture. Furthermore, training and onboarding can have a substantial impact on the success of both new hires and existing talent. Creating an inviting, nurturing environment for a new team member is vital to their success and the agency’s growth. Mentorship, as well as a solid educational plan, helps solidify the employee experience.

Wealth Is Shifting In Generations, Gender, And Ethnic Groups

Wealth in the U.S. is shifting – with women, racial minorities, and younger generations gaining ground in investing, business ownership and earning potential. And where there’s wealth, there’s power and influence. This change is affecting consumer habits, investing trends, business strategies and even hiring practices.

One major element of this shift is known as the Great Wealth Transfer, when a massive amount of money will transfer from the Baby Boomer generation to Generation X and Millennials.

An estimated $84 trillion will be handed down to younger consumers over the next ten years.1 Women are the largest beneficiaries of the transfer, as baby boomers are leaving more of their nest egg to women than past generations.2

The economy is bracing for the Great Wealth Transfer, as many of the recipients, regardless of race or gender, have less experience in managing high net levels of wealth. This will lead to opportunities for wealth advisors, businesses and communities. However, it also comes with additional risks as 70% of women select a new financial advisor after the death of a partner. Financial advisors may see some loss of business or changes in how advisors are selected.3

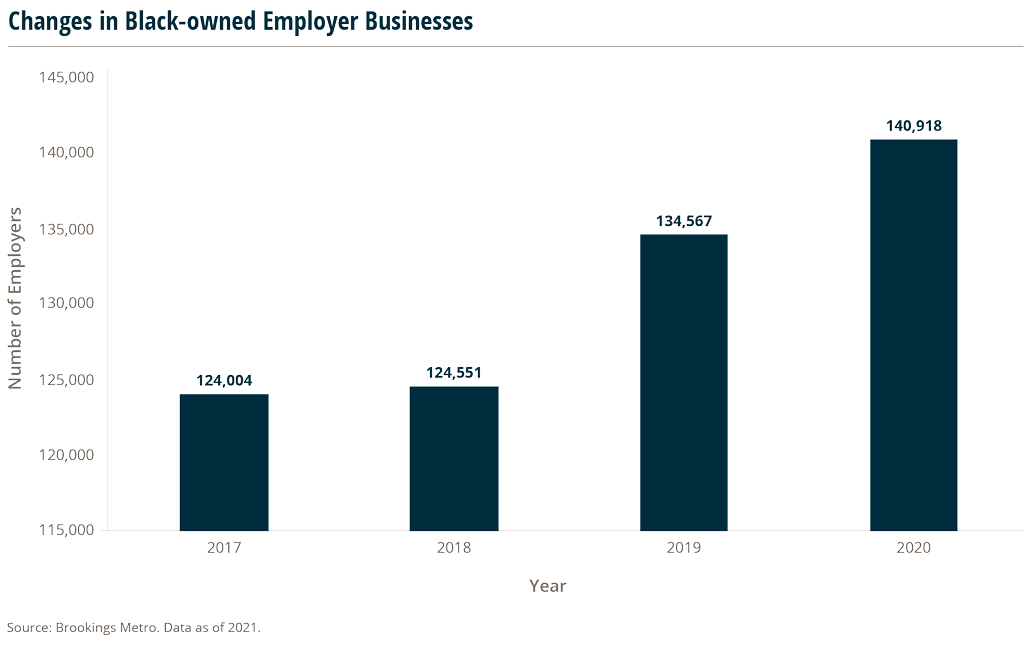

In Black households, spending has grown faster than spending in white households, so the profile of an average consumer has changed.4 Black-owned businesses have increased faster than White-owned businesses, with Black-women-owned businesses increasing by 18.14% between 2017 and 2020 — more than all women-owned businesses (9.06%).5 These businesses tend to perform most strongly in the Southeast, which might encourage relocation for better business opportunities.5

These changes are also impacting unexpected industries. Real estate, for example, reports that more single women own homes than single men.6 In addition, Black Americans are three times more likely than White Americans to choose brands that support social causes, which may influence positive changes in communities and launch charitable initiatives.4

As the Great Wealth Transfer unfolds, additional economic conditions, political changes, and even extreme weather may contribute to further shifts in wealth distribution that financial advisors must prepare to address.

In This Hard Market, Pif Numbers Are Dropping

“Policies in force” (or PIF) is a term commonly used in the insurance industry to refer to the active insurance policies that an insurance company currently has in effect. Insurance companies often have a large number of policies issued to different policyholders, covering various types of risks such as auto insurance, home insurance, life insurance, health insurance and business insurance.

Insurers regularly monitor their PIF to help them make informed business decisions, such as pricing policies, assessing risk levels, allocating resources, and managing their overall operations.

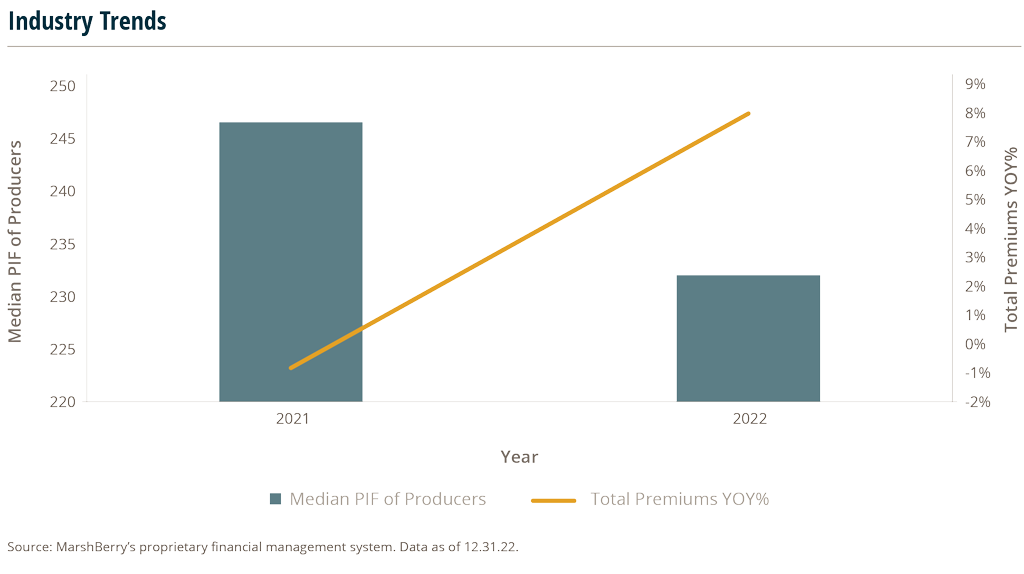

In a hard market, the price per policy typically becomes more expensive due to increased rate changes. As a result, there may be a decrease in PIF as clients look for better pricing or they decline renewals. Even then, firms may see rising revenue with rate increases – but without additional new business coming in, PIF levels start to drop.

From an industry perspective, total premium dollars grew nearly 8% from 2021 to 2022, whereas the number of policies in force decreased nearly 19%. This caused the average premium per policy to increase by over 30% in 2022.

When the soft market returns, and rates eventually drop, brokerages will likely notice a dip in revenue due to the significant decrease in PIF. To get ahead of that, ramping up new business efforts on high quality premium accounts could lessen this dip and allow for a more competitive advantage. This may also be a good time to join an agency network to gain access to new carriers, market intelligence, like-minded industry professionals and new growth strategies. Providing a high standard of service, building relationships and leaning on mentors is always key, but will become even more necessary when rates drop.

Sources:

1 https://www.kiplinger.com/retirement/great-wealth-transfer-gen-x-should-prepare

2 https://www.morganstanley.com/articles/female-invest-women-and-wealth