Industry Insights Vol II, Issue 3

MarshBerry’s Perspectives for High Performance (PHP)

Insights from our proprietary financial database to help drive your business.

Spend More, Grow More: How Increasing Service Staff Pay Leads To Greater Organic Growth

Strong organizations value high service standards and performance, and they are willing to pay for it. To help producers write more new business, and at the same time increase your margin, consider hiring better, more expensive and more professional people.

Firms that hire service personnel that are more professional, and less clerical in nature, pay more. A lot more. In fact, the firms that are in the Top 25% of book size handled pay, on average, about 50% higher than the Bottom 25%. But, while the average wage per employee is greater, the overall cost (as a percentage of book handled) is less. In addition, the workload that the staff pulls off the backs of producers enables them to write more new business.

The result? Greater organic growth.

Unfortunately, many firms try to hire on the cheap and are possibly hurting productivity.

Total Commissions & Fees per Service Person measures the productivity of service staff by depicting the relationship between a firm’s income and the amount of business the service staff maintains. The metric conveys even more meaningful insight when compared to organic growth and service staff compensation.

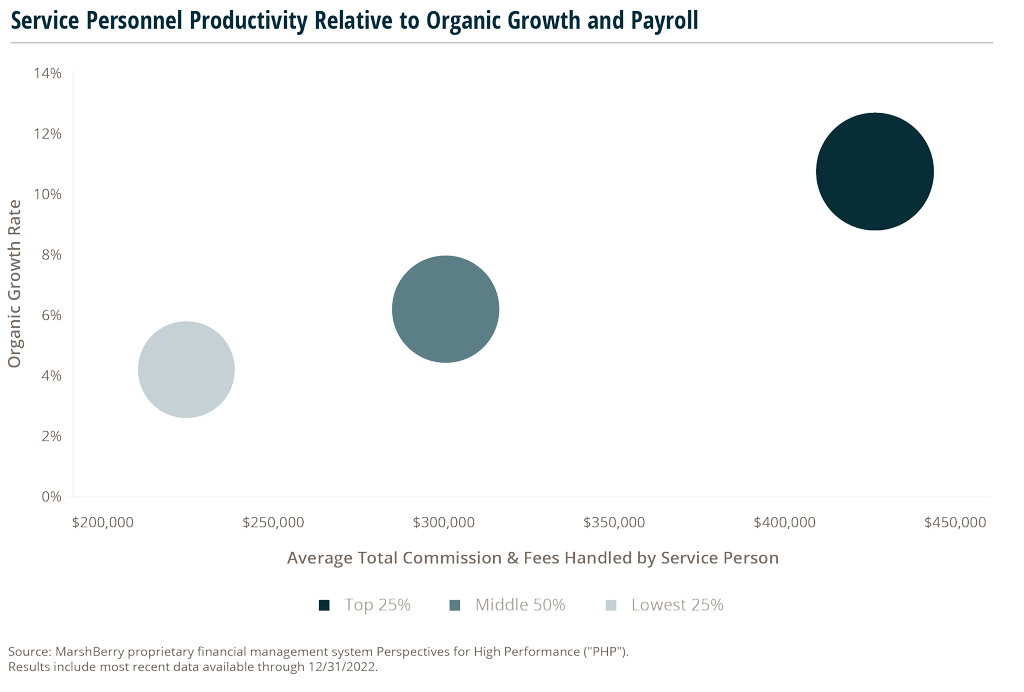

This graph compares total commissions & fees per service person to organic growth based on average service personnel payroll. The size of each bubble is determined by average service personnel payroll (the bigger the bubble, the larger the service pay).

The data shows a direct positive correlation between average service personnel pay and productivity of the service staff, as well as organic growth of the agency.

The data also illustrates that staff efficiency improves as service payroll increases. While it may seem counterintuitive to increase efficiency by increasing costs, raising service staff payroll (either through pay increases or new hires) will reduce the need for producers to service accounts. Instead, producers will be able to focus on writing new business and driving organic growth for your agency. Producers or owners who are effectively delegating their servicing load should see higher than average performance in total commissions and fees per production person.

The Correlation Between Lower Facility Costs And The Number Of Remote Employees

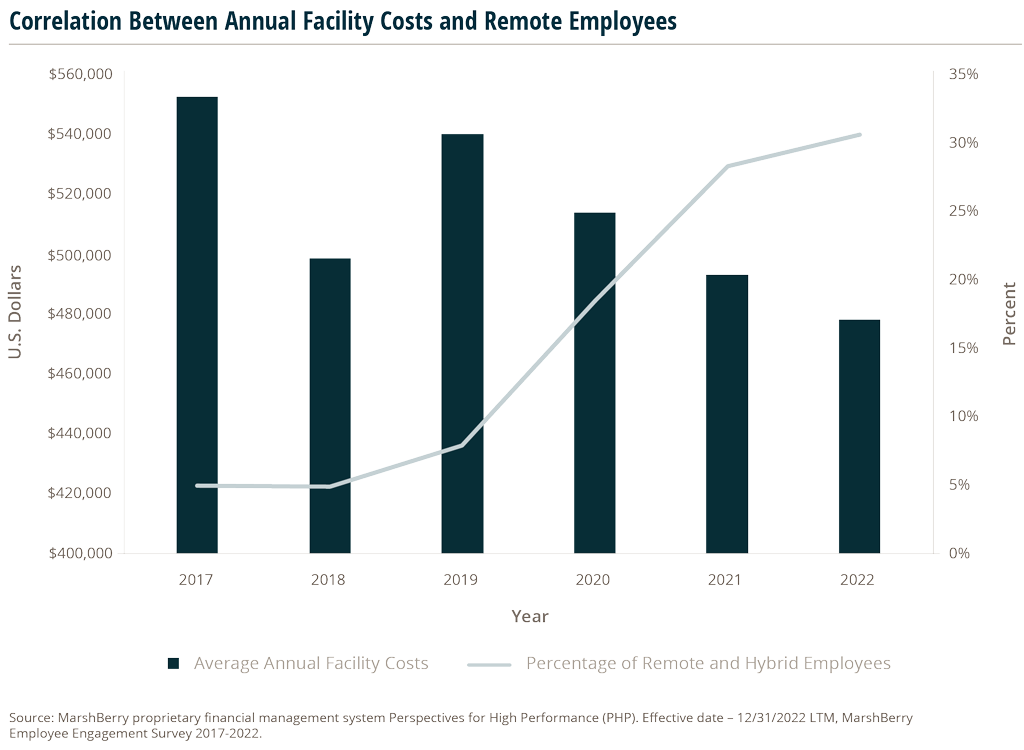

Is there a direct correlation between the decrease in facility costs for insurance brokerages and the number of fully remote and hybrid employees since COVID-19? Based on MarshBerry’s proprietary database, Perspectives for High Performance, the average annual facility costs have dropped steadily since 2019, with an overall decrease in facility costs of 13% since 2017.

On the other hand, the percentage of insurance brokerage employees working remotely has drastically increased since 2019. According to MarshBerry’s annual Employee Engagement Survey, prior to 2019, less than 8% of respondents worked remotely. 2022 survey results showed that over 30% of respondents are now working remotely or in a hybrid format.

Many firms are likely reaping the benefits of lower facility costs with the rising number of fully remote or hybrid workers.

While it may not be a top cost-saving strategy for all firms, this insight into the peripheral benefit of remote and hybrid work arrangements may provide additional value for the argument of remote working. Brokerages could also improve employee satisfaction by giving workers the option of remote or hybrid working. FlexJobs’ 2022 survey found that 32% of respondents want a hybrid work environment, while 65% prefer to work remotely full-time.1

While some firms may question a possible impact to productivity from a more remote workforce, according to Forbes, “A study using employee monitoring software confirmed that the shift in remote work during COVID improved productivity by 5%.”2 Embracing flexible work arrangements could potentially benefit your brokerage.

Sources:

2 Forbes: “Workers Are Less Productive Working Remotely (At Least That’s What Their Bosses Think)” by Dr. Gleb Tsipursky