M&A Market Update Vol II, Issue 3

The Latest Deals and Insights

Who’s buying? Who’s selling? And why should you care? Phil Trem, MarshBerry’s President of Financial Advisory, highlights the current M&A market and provides a look at transactions in March 2023.

M&A Activity For Insurance Distribution Continues Rolling After A Strong Q1

It’s a quarter of the way into a year that has been projected to see an “economic slowdown” – perhaps even a recession – and yet the indicators and markets don’t seem to be aware of the plan. Even as the Federal Reserve (Fed) continues to push the agenda with another 0.25% increase to the Federal Funds Rate in March, there is no clear sign that inflation, hiring trends or the financial markets intend to slow down.

Even the recent bank collapses of Silicon Valley Bank and Signature Bank in early March seems to be receding from investor memories quicker than anticipated, with the major U.S. markets ending Q1 2023 in positive territory. At the close of March, the S&P 500 rose 7%, the Nasdaq was up nearly 17% and the Dow Jones just finish above water at 0.4% for the quarter.1

So much for an economic slowdown.

A nice start for insurance distribution M&A in 2023

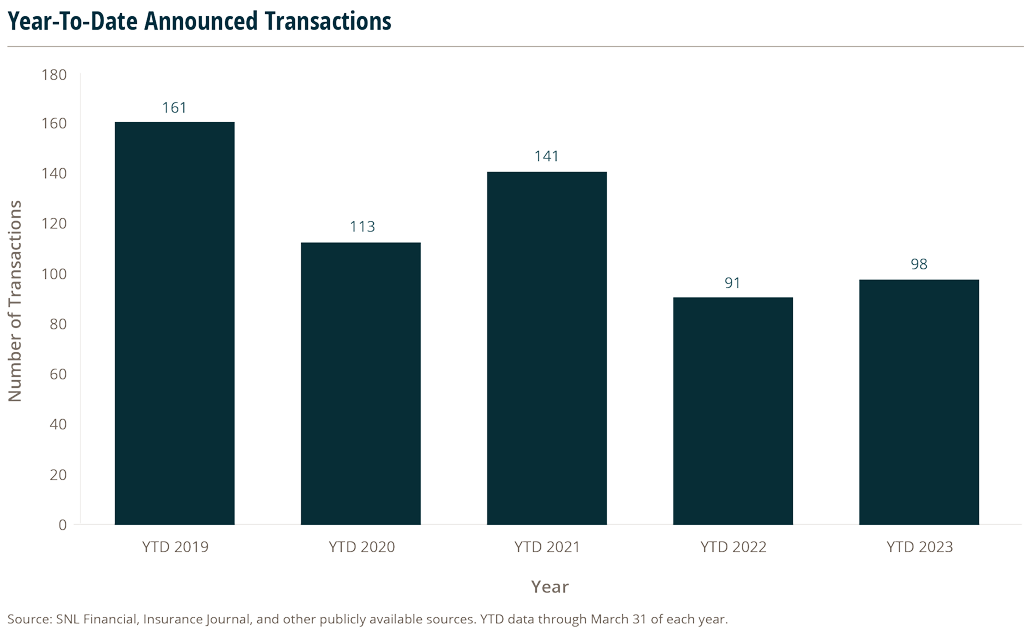

As of March 31, 2023, there have been 98 announced insurance distribution merger & acquisition (M&A) transactions in the U.S. – a 7% increase in total deals compared to this time in 2022, which ended Q1 with 91 announced transactions.

Private capital-backed buyers have accounted for 73 of the 98 transactions (74.5%) through March, which is consistent with the proportion of announced transactions over the last five years. Total deals by these buyers increased at a Compound Annual Growth Rate (CAGR) of 26.9% since 2018. Announced transactions by independent agencies have continued to decline as a percentage of total transactions since 2021. On average, 23.1% of deals were done by independent agencies from 2018-2021 compared to 12.6% in 2022 and 12.2% to start 2023. High valuations and availability of capital could be the main drivers for the decline in independent agency share in deal activity.

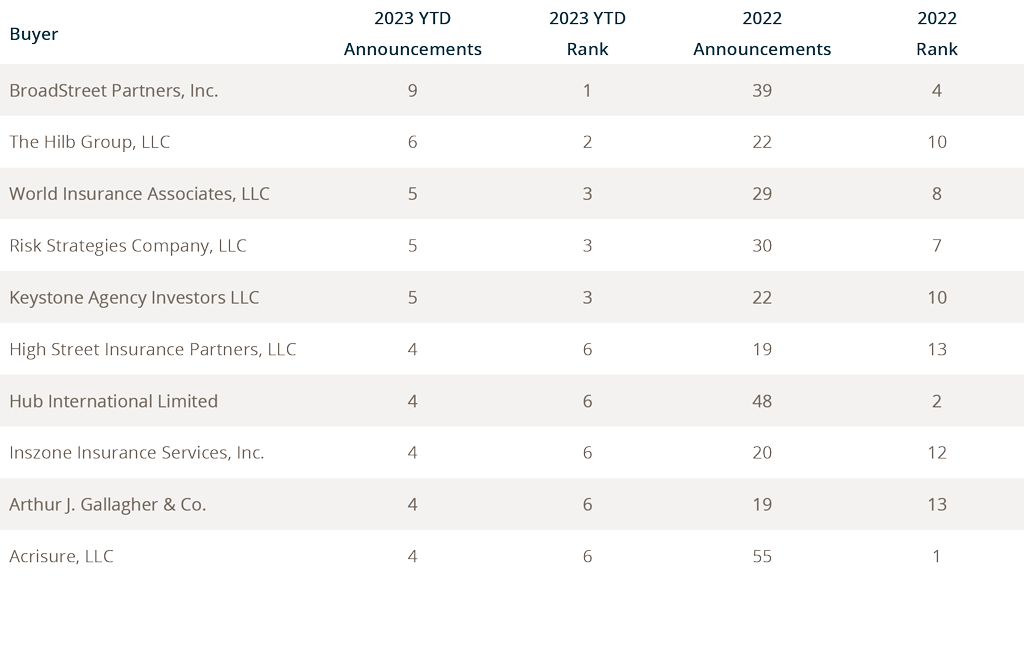

Strong deal activity from the marketplace’s most active acquirers has remained constant to begin 2022. Ten buyers have accounted for 51% of all announced transactions observed, while the top three account for 21.4% of the 98 total transactions.

Are valuations starting to plateau?

Insurance distribution M&A seems to take the economic environment with a grain of salt, understanding that at the end of the day – everyone still needs insurance. That’s not to say this industry is immune to the impact of economic factors, or that they are ignored. It’s just that adjustments can be made, and this industry has a long history of resiliency. One of those adjustments may be in the form of valuations starting to plateau for average firms.

Buyers are looking at potential targets who they believe can make them better and help give them a competitive advantage. Proven growth is still the biggest differentiator for buyers, and they are looking for agencies who already have the right tools and capabilities, but just need a partner to help them grow even more.

Because of this, the valuations for premium quality firms are higher than they’ve ever been – while valuations for average firms are starting to plateau or even decline in some areas. With the continued rate increases, firms that are showing organic growth below industry averages will likely struggle to find valuations that the industry has benefited from over the past 36 months.

While we remain cautiously optimistic that this will be another strong year for M&A activity – the industry will continue to watch the economic conditions unfold in 2023 – and make adjustments as needed.

Deal Spotlight:

MarshBerry advises Wilson, Washburn & Forster Insurance in sell side deal to Alera Group

In March of 2023, Wilson, Washburn & Forster Insurance (WWF) agreed to be acquired by national insurance and wealth service firm Alera Group, Inc. (Alera).

Miami-based WWF, a long-standing client of MarshBerry and Connect Network member, is a full-service P&C insurance agency founded in 1961. They offer a wide range of traditional and specialized insurance products serving clients in industries such as aviation, marine, manufacturing, medical, technology, food and hospitality, nonprofits and others.

Alera provides P&C insurance, retirement planning and wealth services, and employee benefits to clients around the country.

Alera was attracted to WWF because of their strong client base, their ability to train and foster highly productive producers, and their year-over-year consistency for growth and profitability. The addition of WWF to their family of companies gives Alera a strong and established P&C presence in South Florida.

WWF originally came to MarshBerry nearly 15 years ago to become a member of Connect, MarshBerry’s peer exchange network, as a way to learn and drive growth through shared data, ideas and best practices. Over that time, WWF’s leadership and producers have engaged with other MarshBerry consultative offerings such as producer training, strategic planning, and perpetuation planning. MarshBerry was the primary consultant in the Alera brokerage formation.

WWF selected Alera to partner with, from a pool of several interested acquirers, because of the natural fit and cultural styles the two firms shared.

Sources:

1 https://www.spglobal.com/spdji/en/commentary/article/us-equities-market-attributes/

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co., LLC. 28601 Chagrin Blvd., Suite 400, Woodmere, Ohio 44122 (440.354.3230)

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2022 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.