Focused Insights: How Can Brokers Adapt And Thrive In This Hard Market? Vol II, Issue 3

The insurance industry is well into a hard market of rising premiums and reduced capacity. Meanwhile, many insurance brokers have never experienced working through a hard market. How are firms preparing their producers to adapt to this new environment?

What is a hard market?

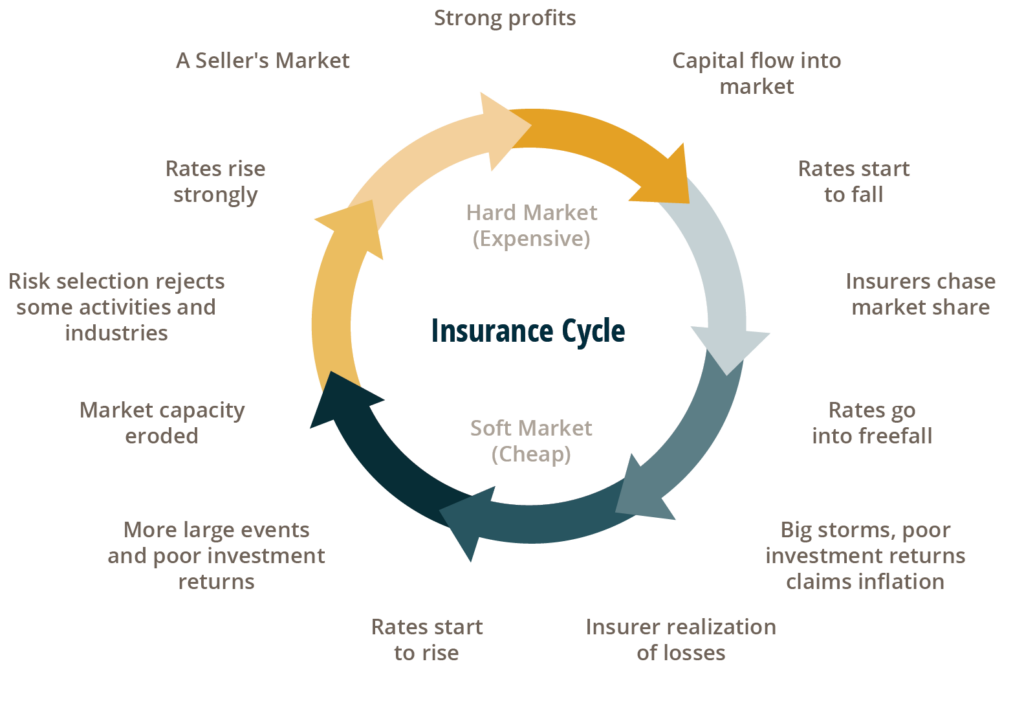

The cyclical nature of the insurance market means the market will swing on a pendulum from soft to hard market and back again. It is continuously changing, adapting to current market conditions, social trends and loss projections. Identifying the exact timing of a hard or soft market shift is difficult – especially when you are in the midst of it.

There is not a single definition of a hard market, just like there is no term for markets caught in-between a hard and soft market. It’s more of a scale.

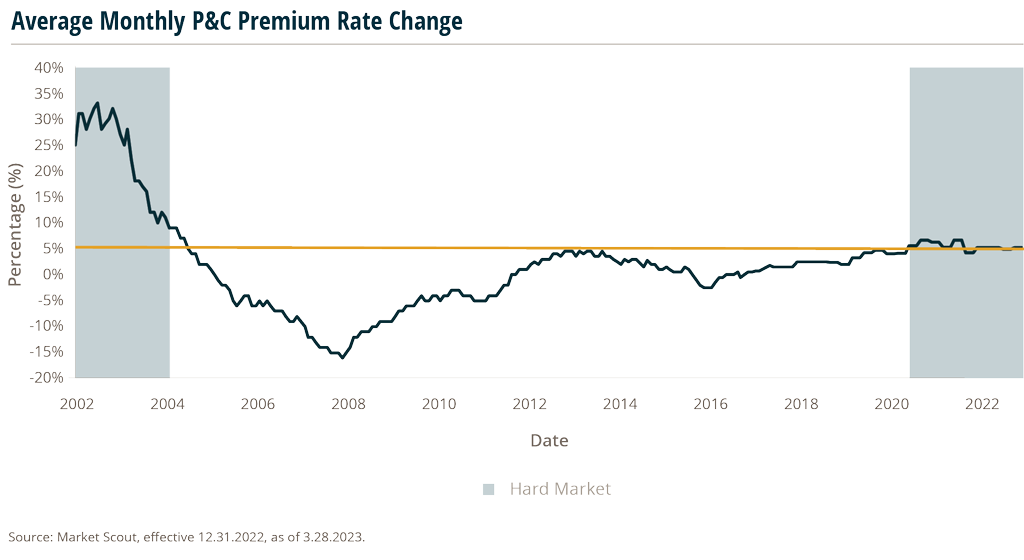

MarshBerry defines a hard market as a period where product premium rates increase by over 5% for two or more years. Experientially, a hard market period is characterized by increased premium rates, restricted coverage, and lower capacity – caused by an increase in demand and decrease in supply of policies.

For brokers this means they may receive higher commissions from increased premiums, but might experience more stringent and time-consuming underwriting and difficult renewal periods. Carriers reduce their willingness to compete with one another and instead focus on analyzing their existing books of business and reducing their current risk profile.

Traditionally, a period of rate hardening is preceded by increased underwriting losses or falling investment returns. Causes could additionally include an increase in frequency or severity of losses or regulatory intervention, all posing threats to profits.

The last hard market occurred from 2001-2004 when Property & Casualty (P&C) rates increased an average of 20.08% over a three-month period, hitting a high of 33% in 2002.1 This period was partially caused by the dot com bubble and fall out from catastrophic events such as 9/11, causing major losses for carriers.2 Before that the previous hard market was in 1983-1987, caused by regulatory policy changes.

Current hard market: a convergence of factors

Many pressures, from geopolitical instability to turbulent economic markets, are causing the current hard market and continued hardening of rates. These are a few of the most significant pressures.

- Economic instability. Market volatility has created uncertainty around investment income. The continuation of elevated inflation is also leading to higher claims payouts, undercutting profits. And with the Federal Reserve’s interest rate increases, the equity markets may see a decline in future earnings growth for U.S. companies.

- COVID-19. The impact of the pandemic is still being felt in the financial world. Companies have endured an extended period of low interest rates, leading to a lower return on investments. This caused an increased reliance on underwriting profits that were also hurt by increased claims related to the pandemic, which were not forecasted.

- Social inflation. The rising costs of claims payout and litigation beyond that of inflation is known as social inflation. This measures the increase in perceived value by jurors and claims holders which has increased dramatically over the past two years, pushing claims above what was expected.

- Increase in catastrophic weather events. Over the past decade extreme weather related events have become more frequent and more severe. The ever-evolving nature of these events makes them hard to predict causing increased underwriting losses.

- Geopolitical unrest. With increased tensions globally and nationally, many businesses face uncertainty, leading to higher risk exposure. This coupled with continued supply chain disruptions is changing the risk profile for many businesses exacerbating the need for higher premiums to cover unexpected losses.

- Carrier profitability has fallen. These effects are having a direct impact on underwriting policies and the need for reduced risk exposure. As losses pile up, combined ratios in P&C are increasing to higher levels, finishing 2022 at 105.8.3 Combined ratio, which measures the difference between claims and expenses paid and premiums, represents the profitability of a company. A combined ratio over 100 indicates an underwriting loss. 2022’s hard market comes after a barely profitable market in 2021 with combined ratio of 99.5.

- Hardening reinsurance market conditions may continue into 2023. Recent factors such as high inflation, an above-average catastrophe year in 2022 including Hurricane Ian, and volatile financial markets drove price increases and led to a challenging reinsurance renewal cycle in January 2023.4 The shifts in the reinsurance market, with supply decreasing as reinsurers cut their property-catastrophe and other exposures, are driving higher pricing and increased constraints for buyers. The increase in reinsurance rates is also pressuring commercial insurers to raise their rates even further.

How is this hard market different?

Increased premiums, tightened capacity, and less policies written are the traditional hard market indicators.

However, while premiums are rising in this current market, the number of policies is not declining, in fact – they are growing.

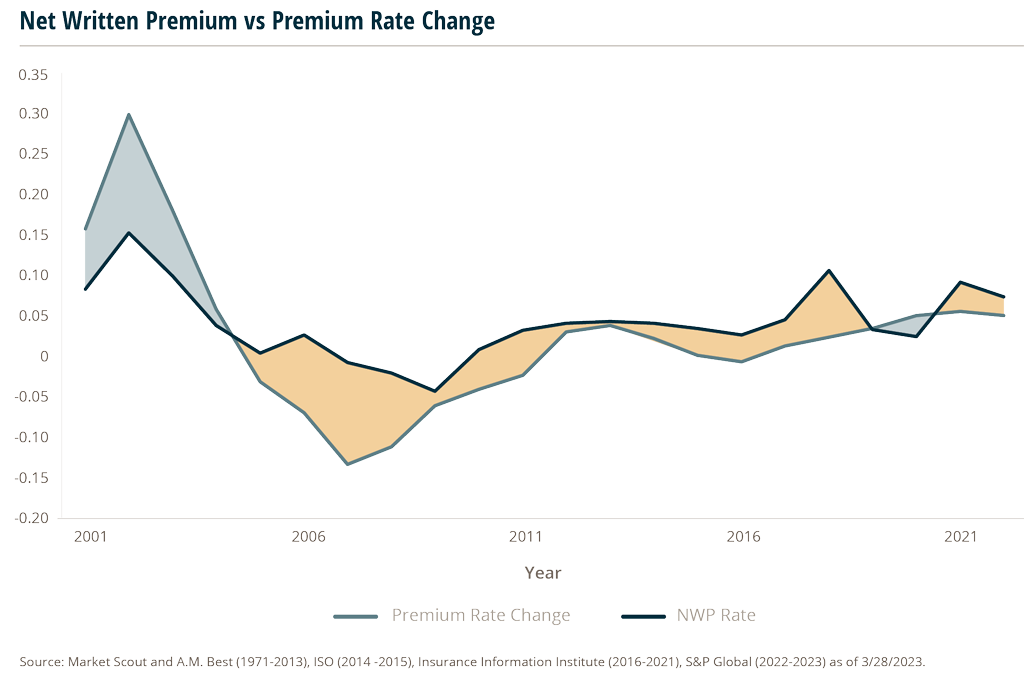

Net Written Premium (NWP) represents general growth and contraction within the industry caused by a number of factors including product rate changes and policy quantity growth.

As shown in the NWP vs. Premium Rate Change chart, the difference between “NWP growth rate” and “premium rate change” in theory represent the amount of growth (or contraction) due to changes in the number of policies written.

The yellow areas indicate periods of lower policy rate changes with growth primarily attributed to a growing insurable base. A growing insurable base could mean more policies are written, new types of policies are written (such as Cyber) or larger coverages are written for policies.

Conversely, the blue areas represent periods where overall growth appears to be primarily driven by rising premium rates, typical of a hard market where number of policies declines, and policy rates increase.

The current market conditions present a uniquely strong position. Currently there is a hard market with lasting rate increases of over 5%. But since the pandemic, the NWP has not decreased below rate changes. This is good news for insurance brokers and carriers as they can enjoy excess commission from increased profits while also benefiting from an increased insurable base.

How can brokers thrive in this current hard market?

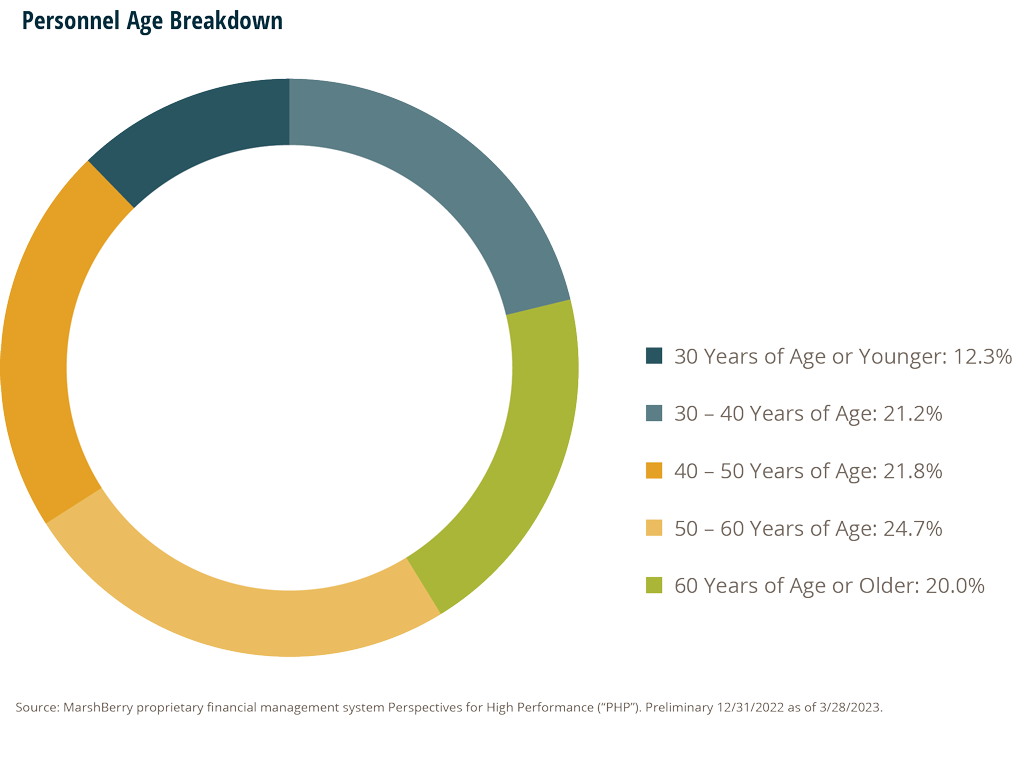

Because of the previously extended soft market, many brokers have not experienced a hard market making this is new territory for them. It has been 19 years since the last hard market, which ended around 2004.

If the average producer started their career out of college – any producer aged 41 or younger has no experience working in a hard market environment – which is approximately 34% of producers.

For this group, it could be valuable to provide new sales training processes and tactics needed to understand this environment for producing revenue.

Producers must adapt to the new challenges with effective strategies, as well as find ways to differentiate themselves during this hard market. Here are some suggestions:

- Allow more time and effort for policy renewals. Because of stricter underwriting, new and renewing policies may undergo harsher underwriting checks with stringent requirements. The need for reduced risk will place additional responsibilities on all parties: carriers and underwriters to assess and predict risk, producers to advise clients on risk reduction strategies, and clients to consider what coverage and risk balance they are willing to purchase.

- Increase technology adoption. By relying on automation technology to auto renew more generalized, smaller accounts, producers can dedicate more time to complex renewals and new business. This reliance increases efficiencies in policy creation and renewal process, allowing them more time to provide value to other areas.

- Increase perceived value as a broker. As insurance coverage becomes more expensive, many clients will see a decreased value in the policies they are holding. Coupled with a decrease in the availability of policy options, clients may not feel they are getting the same perceived value out of their broker as they did during periods of a soft market. This is where producers must step in to enhance their value proposition. By focusing on risk prevention and other specialty services, they can add value beyond that of coverage. Providing a general overview of a client’s position and current risk profile along with long-term planning can add to their importance, leading to increased retention of current clients and attraction of new ones.

- Increase training and mentorships for the next generation. The effects of a hard market can dramatically affect the role and responsibilities of a broker, so it is important that seasoned professionals that have been through complete insurance cycles mentor and coach “newer” producers. Creating formalized training and mentoring programs can assist in the adjustment as brokers endure this phase of the insurance cycle.

- Do not be afraid of change. The market is constantly changing so producers must adapt. Keeping up with the latest forecasting and trends can put them at an advantage, allowing them to change tactics as policy availability and prices change.

What’s next for this hard market?

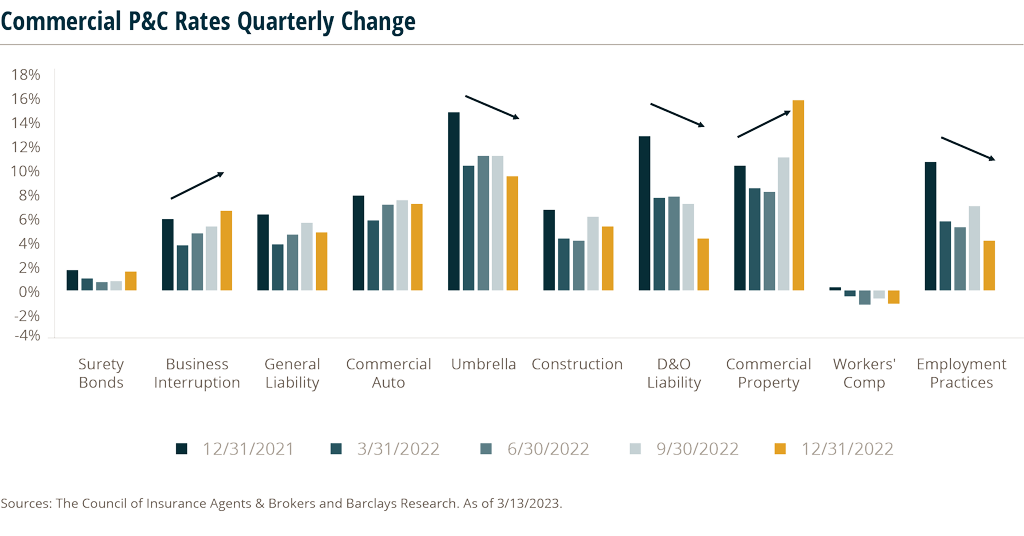

Over the past four quarters, some insurance lines are beginning to show signs of softening while others remain firmly in a hard market. There appears to be a divide growing between different types of policies – some hardening and raising rates, while others are starting to soften as rates fall. Overall rates are still elevated, but this division could mark an interesting turn in the P&C market.

But the outlook isn’t negative. With increased rates and a smaller than expected decrease in new policies and lost business, the insurance market is showing considerable strength. Brokers that are adapting to the changes in the market environment will stay competitive and possibly thrive.

Sources:

1 https://www.marketscout.com/barometer

2 https://www.insurancejournal.com/magazines/mag-features/2002/04/29/19097.htm

3 https://www.iii.org/insuranceindustryblog/category/industry-financials/

4 https://www.reinsurancene.ws/hard-market-to-increase-volatility-for-primary-insurers-goldman-sachs/