Focused Insights: Adapting to Climate Change, Catastrophes, and How Risks Are Mitigated October 2022

Hurricane Ian is the latest reminder that weather-related catastrophes are here to stay, and that the Property & Casualty insurance industry needs to do more than simply mitigate risk. It needs to adapt.

Adapting to Climate Change, Catastrophes, and How Risks Are Mitigated

The historical success of the insurance industry is based on its ability to assess, manage, and mitigate risks for its clients. Without the insurance industry’s ability to underwrite those risks for businesses and individuals, the global economy would be unable to function.

Since the first recorded form of insurance, over 3,000 years ago when Chinese traders would divide their shipments among multiple ships to limit any losses due to treacherous waters, this industry has faced risks and solved for them. Through treacherous waters, wars, disasters, depressions, recessions, and pandemics, insurance has been there to mitigate the amount of risk businesses and individuals are burdened with to help them survive and thrive.

This latest risk, climate change-induced, natural catastrophes, could be the most challenging risk ever for individuals, businesses, and the insurance industry itself. Solving it may require something more than simply the mitigation of risk. It may require adaptation.

Hurricane Ian may be the catalyst that forces the insurance industry to adapt

The term “natural catastrophe” in the insurance industry refers to any natural or man-made disaster that is unusually severe and costs more than $25 million in insured property losses, or results in over 10 deaths, over 50 people injured, and/or more than 2,000 filed claims.

Hurricane Ian will surpass all of those requirements and is projected to be the most devastating and the most expensive natural catastrophe in Florida’s history. It is expected to surpass 1992’s Hurricane Andrew’s $26.5 billion in losses. Hurricane Katrina, which hit New Orleans in 2005, currently holds the U.S. record for cost at $108 billion (or $163 billion adjusted for inflation).

For Hurricane Ian, the difference this time might be that the cost will be shared disproportionally with individuals and business, rather than just with insurers, as many Florida residents within the impacted areas already lack sufficient insurance.

For the Property & Casualty (P&C) industry, will Hurricane Ian be the straw that broke the camel’s back? Or will it be the catalyst the insurance industry needs to reinvent the way it mitigates risk and adapts to a changing weather-related, insurance environment?

The number and severity of natural disasters is increasing

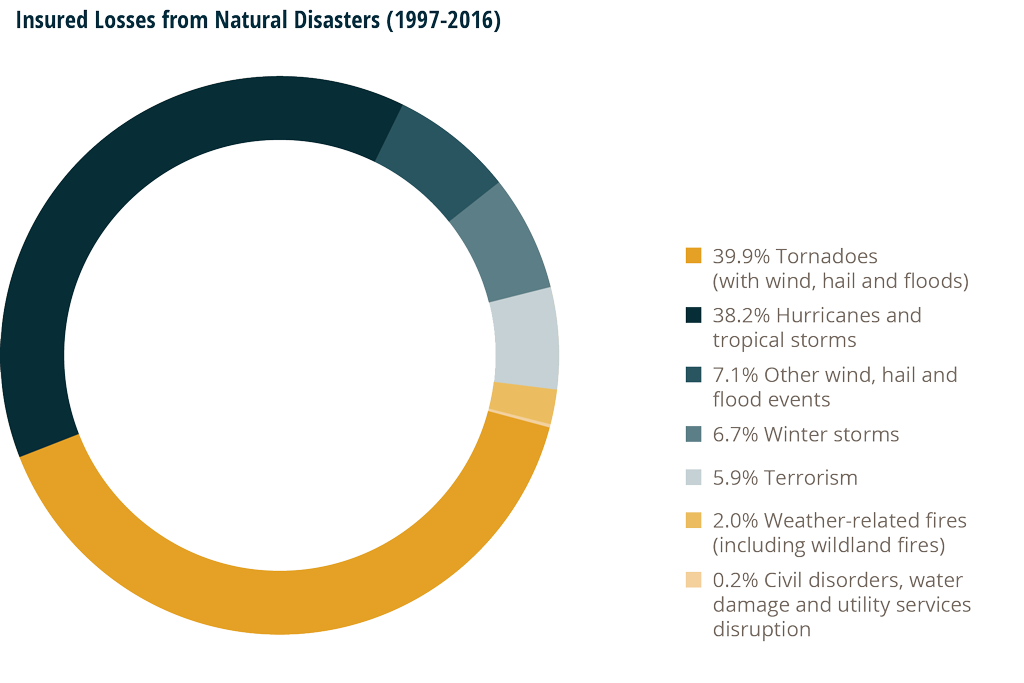

Data on natural catastrophes from 1997 to 2016 shows that hurricanes and tropical storms were responsible for 38.2% of all catastrophe insured losses, adjusted for inflation, in the U.S. This is second only to tornado-related natural disasters. Tornado-related events (including wind, hail, and floods associated with tornadoes) were responsible for 39.9% of total catastrophe losses during this timeframe.1

Natural disasters like hurricanes, tornadoes, floods, and wildfires have always been a part of living on this planet. They aren’t new, but they are becoming more frequent and more catastrophic.

Rising global average temperature is associated with widespread changes in weather patterns. Scientific studies indicate that extreme weather events such as heat waves and large storms are likely to become more frequent or more intense with human induced climate change.

EPA.gov

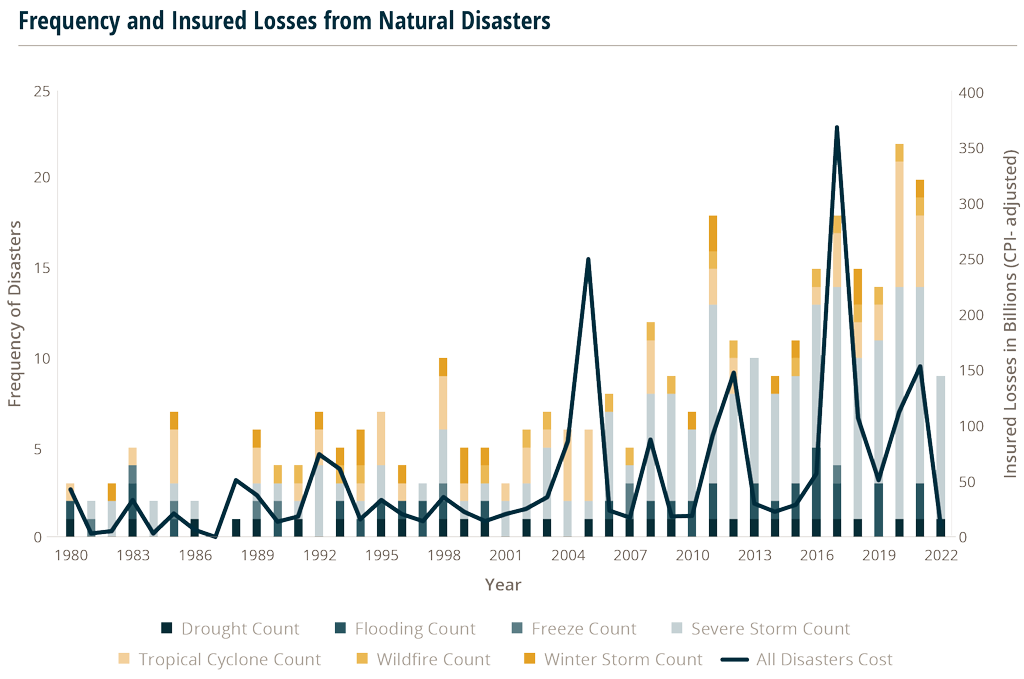

From 1980 to 1989 there was an average of 3.1 natural disasters per year in the U.S. with an average annual cost of $20.2 billion in insured losses. Over the last ten years (2011-2021) the U.S. has averaged 14.8 natural disasters per year, with an average annual cost of $105.8 billion. In 2020 alone, there were 22 natural disasters. And in 2021, there were 20 natural disasters.2

There is a rapid upward trend, in both number of disasters and increased cost, that can’t be discounted or ignored.

So, what is causing the increase in natural disasters? Many scientific studies and experts point to climate change as the physical force contributing to more frequent and extreme weather events.

The impact that natural catastrophes are having on P&C insurers

Insured losses are clearly the primary impact that climate change and the increased volume of natural catastrophes are having on insurers. But we are also starting to see disruptions in the insurance markets in terms of the affordability and availability of coverage.

In Florida, even before Hurricane Ian, five property insurers declared insolvency in 2022, forcing customers to find property insurance in an already depleted market or pushed to Florida’s state-backed government insurer — Citizens Property Insurance Corp. The non-profit insurer surpassed one million policies this year, bringing their risk exposure to $346 billion, with only $13.4 billion available to pay claims.3

The reinsurance market in Florida is compounding the problem, with capacity shrinking as leading reinsurers pull back or avoid Florida entirely. Swiss Re and Munich Re, two of the largest reinsurers, have reduced their capacity by 50% this year, along with RenaissanceRe Holdings who also steadily reduced its exposure in the Florida market and raised its rates.4

The next several months will determine the true impact Hurricane Ian will have on the Florida insurance market.

Similar conditions exist in California after two straight years where historic wildfires (in 2017 and 2018) ravaged the state — causing $9 billion and $12 billion, respectively, in financial losses.5 As a result of the California wildfires in 2018, Merced Property & Casualty Company was unable to pay out all claims and was pushed into insolvency.6

Today, California has seen shrinking capacity for coverage in wildfire high-risk areas, with insurers like American International Group and Chubb, either reducing or eliminating conventional homeowner’s coverage. The result has been a surge in Excess and Surplus (E&S) policies written in California to fill the gap left by traditional insurers who have left the market.

What other potential risks might insurers being facing?

In some of these high-risk geographies, where the cost of claims is outpacing the revenue of premiums collected, insurers are starting to raise premiums or exit certain markets altogether. In either case, this puts additional strain on the financial health of insurance companies. Insurance company profitability comes from their conservative investment approach. But any decrease in premium intake, due to market exits or market insurability, will impact their investment strategies.

A 2019 Deloitte study on climate risk also revealed that many regulators are becoming increasingly concerned that current insurer risk models were not up to the challenge of capturing and testing climate-related risks.7

Furthermore, regulators were concerned that the insurance industry is not responding correctly or quickly enough to the risks of climate change. With losses piling up, insurers can’t simply avoid operating in high-risk geographies or insurance categories to protect their book of business and investment portfolios.

Since most risk assessments and rate-setting revolve around existing catastrophe models and historic data, there are concerns that if these catastrophes become more frequent, more powerful, and even more widespread, current modeling and data starts to become unreliable, less effective, and even more costly.

Climate change isn’t the only factor contributing to rise in property losses

While climate change is quickly blamed for the steady increase in insured property losses, other factors may be contributing to the frequency of losses and rising dollar amounts.

Approximately 30% of land in the contiguous U.S. is considered “disaster hotspots.” These are areas that are at high risk for flooding, high winds, and drought. They are also highly desirable for their ocean or mountain views or proximity to cities. Conversely, there are also many undesirable locations because of the high risks and thus populated for their affordability. These “disaster hotspots” are home to nearly 60% of all buildings in this country. It is also noted that about 1.5 million building are in hotspots that are at risk for two or more disasters.8

Insurance losses are also impacted by the rise in more expensive residential and commercial properties being built in high-risk areas.

Part of the problem is local governments choosing tax revenue over building restrictions in high-risk areas. Municipalities continue to approve the building of waterfront homes and businesses in flood-prone areas, while endorsing minimal hazard-resistant building codes for homes in hurricane and tornado-prone areas.

A Federal Emergency Management Agency (FEMA) study estimates that the U.S. could avoid $1.6 billion (or more) per year in damages from catastrophic weather events if local municipalities adhered to modern building codes. The FEMA report states that approximately 65% of U.S. counties, cities, and towns haven’t adopted modern building codes. In addition, the state of Florida alone could avoid $1 billion per year in property losses if modern building codes were enabled and enforced to protect against wind and flooding.9

Are there opportunities for solutions?

In the short-term, there may need to be a shift towards specialty insurers, like E&S insurance, to solve for the availability and affordability challenges in high-risk areas. But with the growing risks that climate change may bring, so will the growing demands that insurers do more than just transfer those risks.

Customers, shareholders, and regulators are going to be looking for sophisticated, proactive risk mitigation strategies. It’s no longer about avoiding disaster. It’s about planning for the inevitable disaster, and taking the proactive steps to reduce exposure, losses, and long-term impact.

Insurance can play a pivotal role in raising awareness of the impact of climate change, with the intent to influence policy, regulations, and human behavior.

Can insurance help influence better regulations and enforcement of modern building codes? Can there be more strict underwriting policies that are more closely aligned with higher standards for disaster preparedness for buildings? Can insurers work closer with local and state government agencies and building associations to discourage development in high-risk zones?

Let’s improve risk modeling by working with climate science experts and incorporating advanced predictive analytics. Or work with engineers to invest in new technologies that improve building materials that support increased exposure to extreme weather conditions.

“Adaptation” is the act of “changing to suit new conditions”

Climate change is a global problem and global responsibility. And while it may not be entirely solvable, the challenges it has created (property destruction, insurance affordability, and accessibility) may be adaptable. Are there opportunities for the insurance industry to solve the adaption challenge?

It will take collective and collaborative efforts across the board to affect change and adapt to these new conditions. But if any industry has the ability to influence change — it’s the insurance industry. Insurance has been at the forefront of facing challenging risks since the beginning of time. It makes sense that insurance will have to be part of any solution to adapt to climate change and the catastrophes it brings.

- Source: Insurance Information Institute (https://www.iii.org/article/spotlight-on-catastrophes-insurance-issues)

- Source: National Centers for Environmental Information (NOAA) (https://www.ncei.noaa.gov/access/billions/summary-stats)

- Source: ABC Action News (https://www.abcactionnews.com/news/price-of-paradise/citizens-property-insurance-hits-a-million-policies-but-is-there-enough-funding-if-a-storm-hits).

- Source: S&P Global (https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/florida-property-insurers-wrestle-with-lower-capacity-higher-reinsurance-costs-70510577).

- Source: California Department of Insurance (http://www.insurance.ca.gov/0400-news/0100-press-releases/2019/release041-19.cfm).

- Source: Insurance Journal (https://www.insurancejournal.com/news/west/2018/12/02/510765.htm)

- Source: Deloitte (https://www2.deloitte.com/content/dam/Deloitte/us/Documents/financial-services/us-fsi-climate-risk-regulators-sharpen-their-focus.pdf)

- Source: NPR.og (https://www.npr.org/2021/06/23/1009062465/more-than-half-of-u-s-buildings-are-in-places-prone-to-disaster-study-finds)

- Source: ValuePenguin.com (https://www.valuepenguin.com/modern-building-codes-study)