U.S. Macroeconomic Indicators October 2022

Market Trends and Current Statistics

Here are key U.S. macroeconomic indicators that are likely to impact brokerages within the insurance industry.

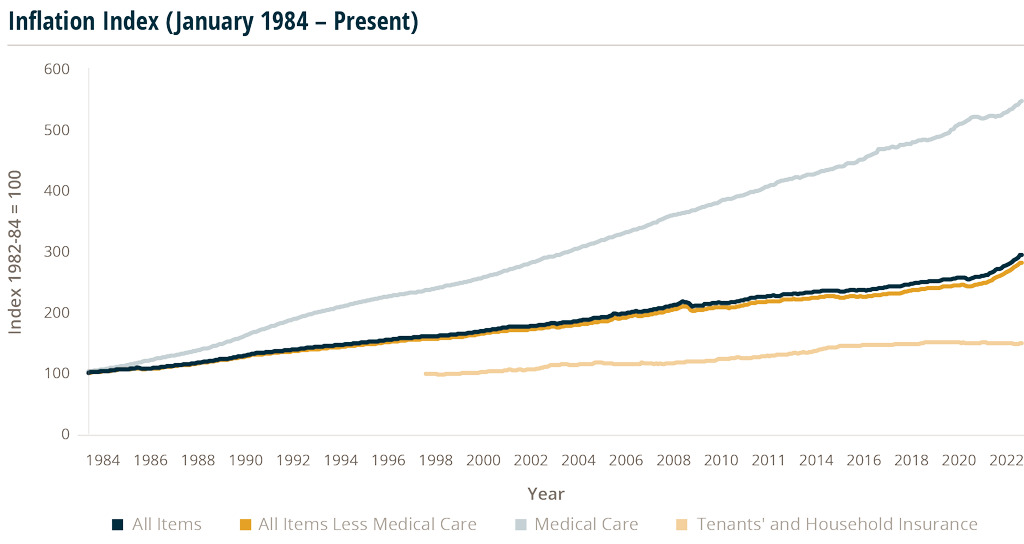

Widespread Price Increases Push Inflation Higher Than Predicted

August consumer prices, as measured by the consumer price index (CPI), rose 8.3% year-over-year and 0.1% from July, according to a report from the Bureau Labor of Statistics. This compares to projections that the prices would increase by 8.1% over last year and fall -0.1% from July. Economists expected inflation to continue its downward trend thanks to plummeting fuel prices, which fell to 10.6% in August, but that has yet to spread to other sectors. The jump in “core” prices, which exclude volatile food and energy costs, was especially worrisome. It outpaced expectations, prices rose 6.3% over last year and 0.6% over the prior month, driven by price increases in rents, new cars, medical care, and other areas. Food prices also spiked in August.

The Producer Price Index (PPI), a gauge of prices received at the wholesale level, declined 0.1%, according to a Bureau of Labor Statistics report. This falls in line with what economists expected. This could be an important predictor of the economy as PPI serves as a leading indicator of the Consumer Price Index (CPI). As producers face inflation, their production costs increase and some of the costs are passed on to consumers. The PPI shows output levels that are not affected by consumer demand. On a year-over-year basis, the PPI increased 8.7% in August, a substantial pullback from the 9.8% increase in July and the lowest annual rise since August 2021. Core PPI increased 5.6% from a year ago, matching the lowest rate since June 2021. The main driver of the decline was the drop in energy prices over the summer.

The Personal Consumption Expenditures (PCE) price index, a widely watched indicator of inflation, rose faster than estimates in the month of August, rising 4.9% year-over-year, up from 4.7% the previous month, based on the release on September 30. The PCE continued to rise even with declining energy prices. PCE is a favored metric of inflation due to its broad level predictability of where prices are going as it adjusts for consumer behavior. Data shows a shift in spending from goods back to services, showing respective gains of 0.3 and 0.6%. Food prices increased 0.8% while energy prices declined 5.5%.

The Fed Continues on its Path of Contractionary Policy

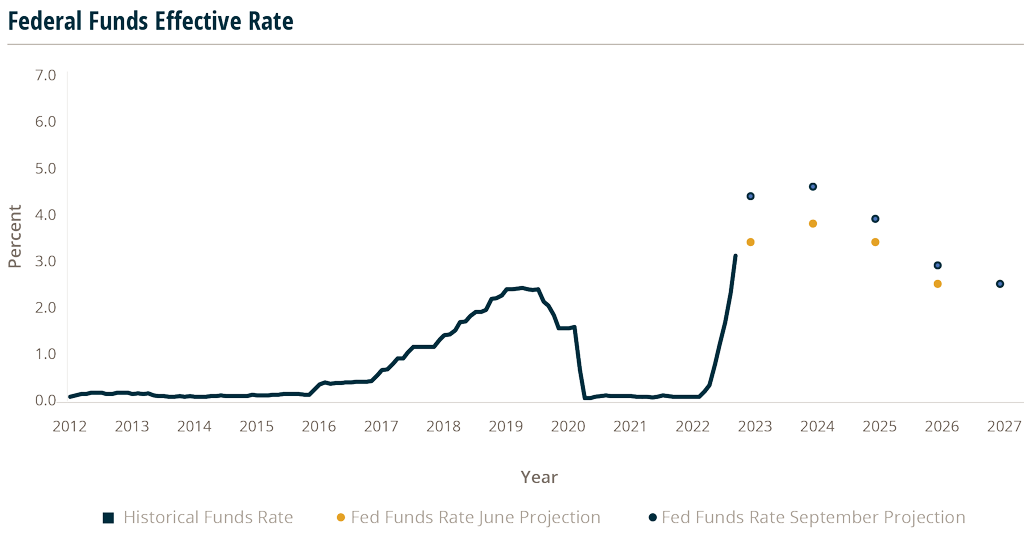

The Federal Reserve (Fed) announced a 0.75 percentage point increase in the Fed Funds rate in its September meeting, the third consecutive increase of that magnitude. The central bank’s goals are to achieve maximum employment and keep inflation at 2% over the longer run. It points to elevated inflation levels combined with low unemployment and robust job gains as support for its continued increases of the Fed Funds target range. The Committee also noted it will continue to reduce its asset holdings according to the plan it outlined back in May.

In June’s Fed Protection Materials, the median of the central bank Committee’s projections for the Fed Funds rate was 3.4% by the end of 2022, implying a target range of 3.25%-3.5%, and 3.8% by 2023. The Fed’s September edition of its Projection Materials shows the projected Fed Funds rate rising to 4.4% by the end of 2022 and 4.6% in 2023. With September’s rate increase bringing the target Fed Funds range to 3%-3.25%, this implies Fed officials expect to raise the Fed Funds rate 1.50 percentage points over the remainder of 2022 with only two meetings remaining.

The Fed Funds rate has an impact both on short and long-term interest rates. Although longterm rates are affected by several factors, including economic outlook, inflation expectations, rate expectations; and global demand and supply, the Fed Funds rate is a crucial driver in affecting its level and direction. In turn, long-term rates affect consumer and business borrowing costs. Increasing business borrowing costs from rising interest rates may put downward pressure on a firm’s value.

Source: Board of Governors of the Federal Reserve System (US), retrieved from FRED 9/1/22.

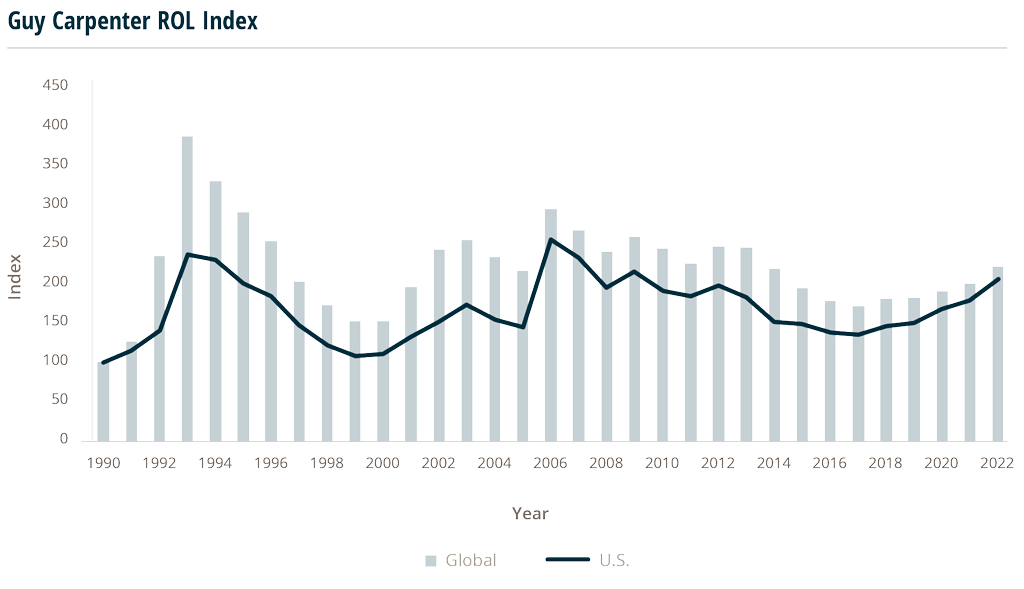

Hurricane Ian Could Push Reinsurance Prices Higher

Hurricane Ian, which hit Florida as a Category 4 storm, is projected to incur insured losses estimated between $25 billion to $35 billion, but some analysts say this could be as high as $45 billion to $60 billion. Analysts are comparing Hurricane Ian’s potential losses to 1992’s Category 5 storm Hurricane Andrew because both had paths that affected highly populated areas. Hurricane Andrew resulted in $15.5 billion in insurance claims or $30 billion in today’s prices. The event could bring more challenges for Florida property carriers who are heavily reliant on reinsurers, as this could lead to even higher rate hikes from reinsurers beyond what’s currently planned.

Hurricane Ian could lead to more pressure on Florida specialists as reinsurers will likely further raise prices for coverage. AM Best commented that: “In a hardened reinsurance market where capacity and the cost of coverage has been significantly altered, Hurricane Ian could add to the capital pressure faced by those insurers that are thinly capitalized and have not been able to secure appropriate reinsurance.”

These further reinsurance price increases would come after recent massive price increases in June, up to 50%, which hurt some Florida property insurers, and caused some bankruptcies.

Even prior to Hurricane Ian’s arrival, ratings agency Moody’s survey of reinsurance buyers indicated that most see reinsurance rates to increase in 2023, with property rates in the U.S. market to see more severe increases. Many reinsurers want to recoup losses from the Ukraine war, the pandemic, and natural events such as hurricanes and wildfires.

AM Best found that premiums assumed by reinsurers and losses paid have soared. The analysis found that premiums assumed by U.S.- based reinsurers for the Florida market have grown by two-thirds in the last three years and losses have increased fourfold, “even without significant hurricane activity.” Losses paid topped $1 billion in 2021 — ten times more than the 2012 number.

$1 Billion

Losses paid in 2021 — ten times more than 2012

Reinsurance recoverables, and ceded premiums for the Florida insurers, were 5.7 times greater than policyholder surplus in 2021 compared with an industry average of just 0.5 times. The ceded premium amounted to more than $7 billion in 2021. Depending on the final loss tally from Hurricane Ian, the recoverables, and ceded premiums have more room to rise, particularly given unknowns around economic and social inflation.

The Guy Carpenter U.S. Property Catastrophe Rate-On-Line (ROL) Index increased by almost 15% for January 2022 through July 2022 renewals, which was the largest jump in this Index of reinsurance pricing and rates-on-line since 2006.

The U.S. Buck Stops Here: How the Strong U.S. Dollar Could Slow Growth and Impact Insurance Brokers

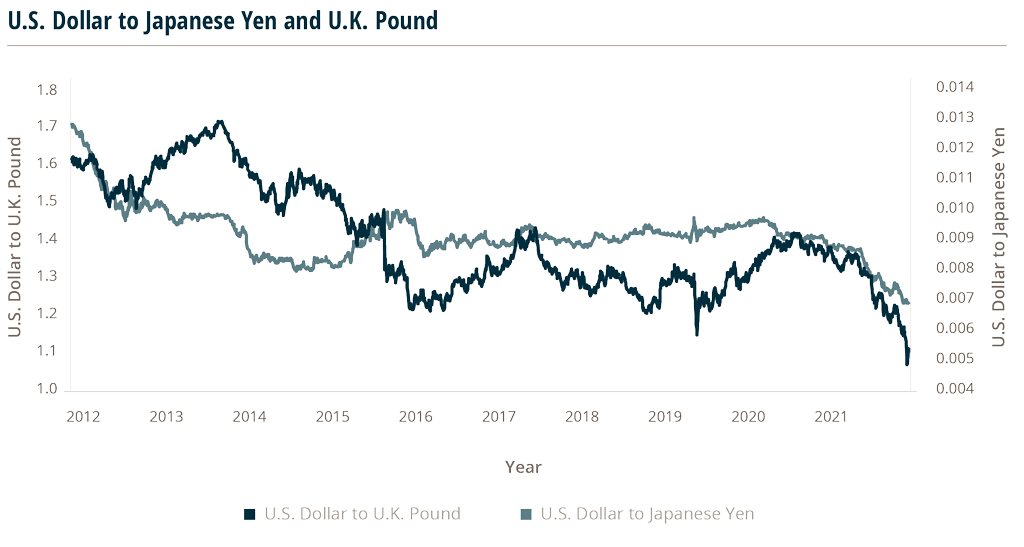

As of September 29, 2022, the U.S. dollar is at a record high compared to other major global currencies. The dollar has strengthened this year relative to other currencies, largely due to the Fed’s aggressive rate hikes, investors seeking safety in dollar denominated assets given rising global economic and political volatility, and the stronger performance of the U.S. economy vs. other countries.

A strong U.S. dollar may help companies and individuals who are purchasing (or importing) goods or services from foreign countries, in foreign currencies. However, it may not be so good for everyone else, including companies with overseas revenue. Just like inflation impacts the cost of U.S. products for Americans, so does it impact the cost of U.S. goods internationally. And when foreign currency loses value against the U.S. dollar, it compounds the problem for other countries’ economies.

Several global currencies reached record lows against the dollar in September. The Japanese yen reached a 24-year low, while the British pound fell to its lowest-ever level vs. the U.S. dollar on September 26. The U.K. pound dropped after its government announced a spending plan, including large tax cuts, that sparked fears of higher inflation. A few months earlier, the euro fell to parity with the dollar for the first time in almost 20 years.

Some governments have intervened to support their currencies. On September 22, 2022, the Bank of Japan intervened for the first time since 1998, spending $19.4 billion to prop up the yen, on concerns that the drop in the yen could impact economic stability. Other countries are also stepping in: China’s central bank ordered state-owned banks to buy yuan and sell dollars to support the Chinese currency. The yuan lost over 11% in 2022 vs. the dollar and is set for the largest yearly loss since 1994.

Beyond contributing to economic instability in foreign countries, the record strong U.S. dollar could also be detrimental to U.S. gross domestic product (GDP), as U.S. goods become more expensive abroad, reducing U.S. exports.

As exports decrease and imports increase, the trade imbalance and U.S. economic growth slows. Furthermore, a stronger U.S. dollar contributes to higher inflation, which in turn encourages a continued hawkish monetary stance from the Federal Reserve. This is also contributing to slower growth.

The impact a strong U.S. dollar may have on the insurance industry

For example, Marsh & McLennan (MMC) noted on its 2Q22 earnings call that “foreign exchange was a headwind of $0.03 to our adjusted EPS due to the strength of the U.S. dollar…Year-to-date, foreign exchange represents a $0.07 headwind.” Furthermore, European and U.K. reinsurers could also have larger loss burdens because of their weakening currencies (some up to 20%+) against the U.S. dollar, which may contribute to their challenges around losses related to Hurricane Ian and other natural disaster events.

U.S. companies, including public insurance brokers and carriers with exposure overseas, will see their profits negatively impacted because of the strong dollar.