Industry Insights October 2022

MarshBerry’s Perspectives for High Performance (PHP)

Insights from our proprietary financial database to help drive your business.

Slowing GDP Growth May Impact Contingents and Overrides in 2022

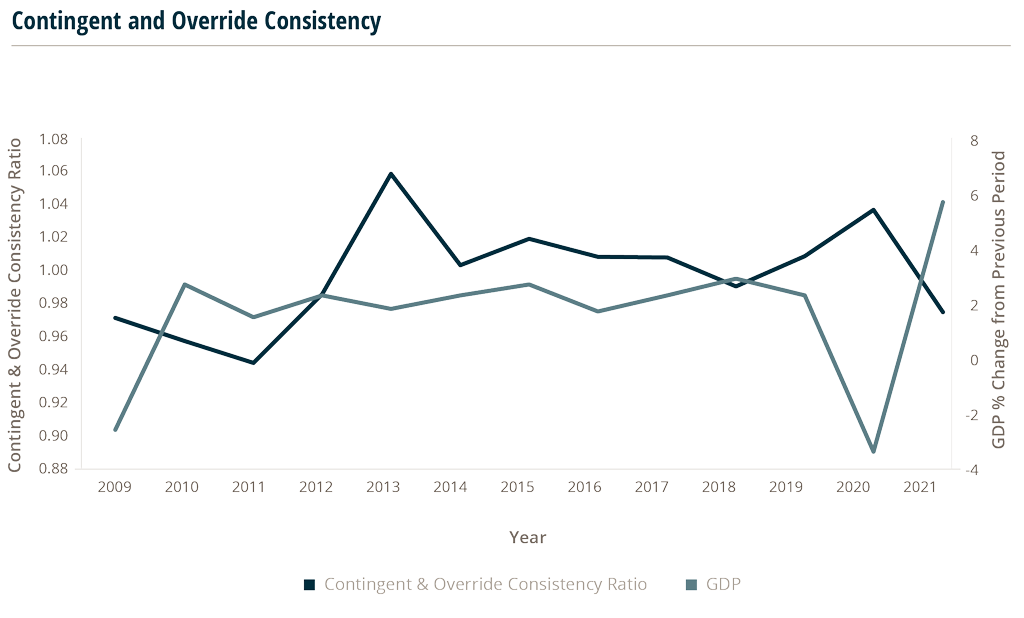

The Contingent and Override Consistency Ratio shows the change in contingent income and override earnings over a two-year period. This is calculated by taking the contingents and overrides as a percentage of P&C and Life & Health (L&H) commissions for the current year divided by the contingent and override income’s percentage of P&C and L&H commissions for the past two years. Contingent payments include bonus commissions and profit sharing from companies.

The median Contingent and Override Consistency Ratio in PHP is highlighted here from 2009-2021. If this ratio is greater than 1.0, then contingents and overrides are up from the prior year as a percentage of P&C and L&H commissions. If the ratio is less than 1.0, then contingents and overrides are down from the prior year as a percentage of P&C and L&H commissions.

Since 2013 this ratio has only fallen below 1.0 twice, in 2018 and 2021. The U.S. economy experienced the longest recorded period of economic expansion from June 2009 to February 2020. While more factors than economic growth contribute to the total contingents and overrides a firm can earn, a decade of continued economic growth certainly creates a more favorable environment.

While economic growth returned in the second half of 2020 and continued through 2021, the first half of 2022 has seen two quarters of negative annualized GDP growth, and forecasters are becoming more pessimistic about the year ahead.

The favorable economic environment of the previous decade is gone, and while that does not mean a firm cannot successfully maintain its contingent and override income — 2021 was a reminder that those bonuses are not guaranteed.

Recession Rebound: Stability in the Insurance Industry

The insurance industry has weathered more than a few recessionary periods. Historically, the insurance industry tends to ride out recessions better than other industries, rebounding faster and more efficiently. P&C insurance is not an elastic good and therefore is not affected as heavily by the market. Limits, coverages, and retentions may be influenced by prices driven by supply and demand, but customers are largely still required to transfer risk by purchasing some form of insurance. The importance of insurance has become embedded in our society, and it has become a beacon of security. No matter the economic outlook, people will protect their assets. This can become even more true and evident after a recession where people do not want to lose more, explaining why the industry tends to see quick rebounds after most recessions.

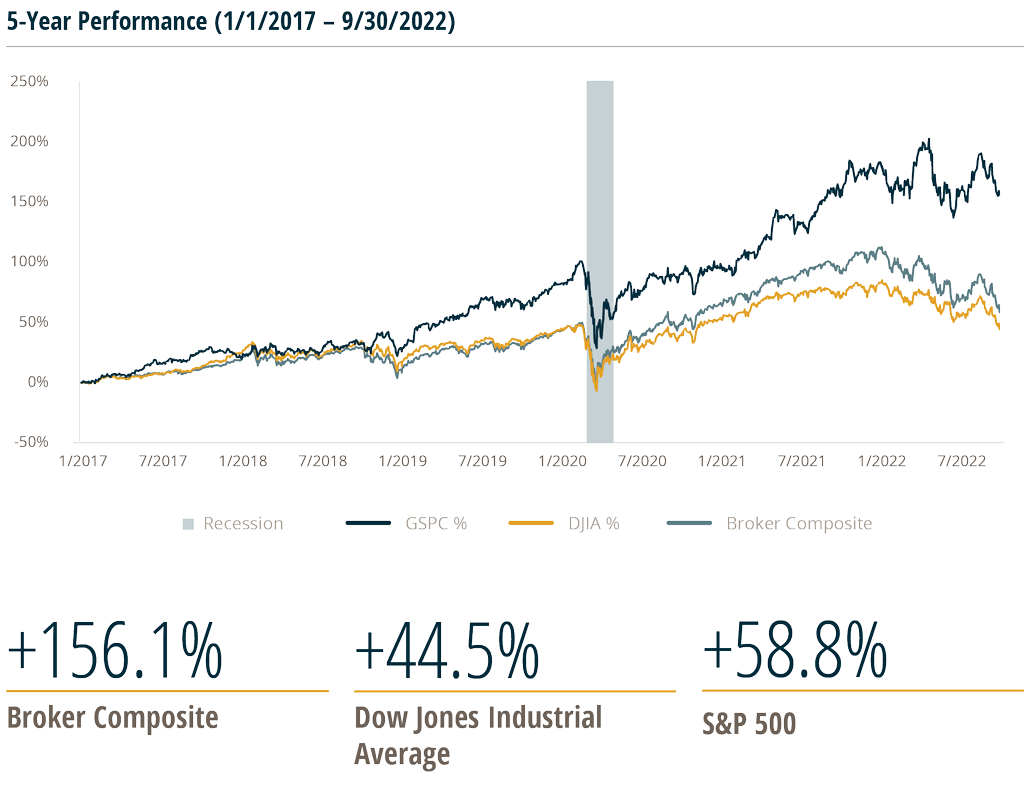

An example of this can be seen following the brief 2020 recession. In comparing MarshBerry’s public broker stock composite’s performance to major indices such as the Dow Jones Industrial Average or S&P 500, the public brokers index saw a quicker recovery and higher returns following the 2020 recession.

The MarshBerry Broker Index is a composite of market data sourced from Yahoo Finance on the following companies: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only. This information is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy.

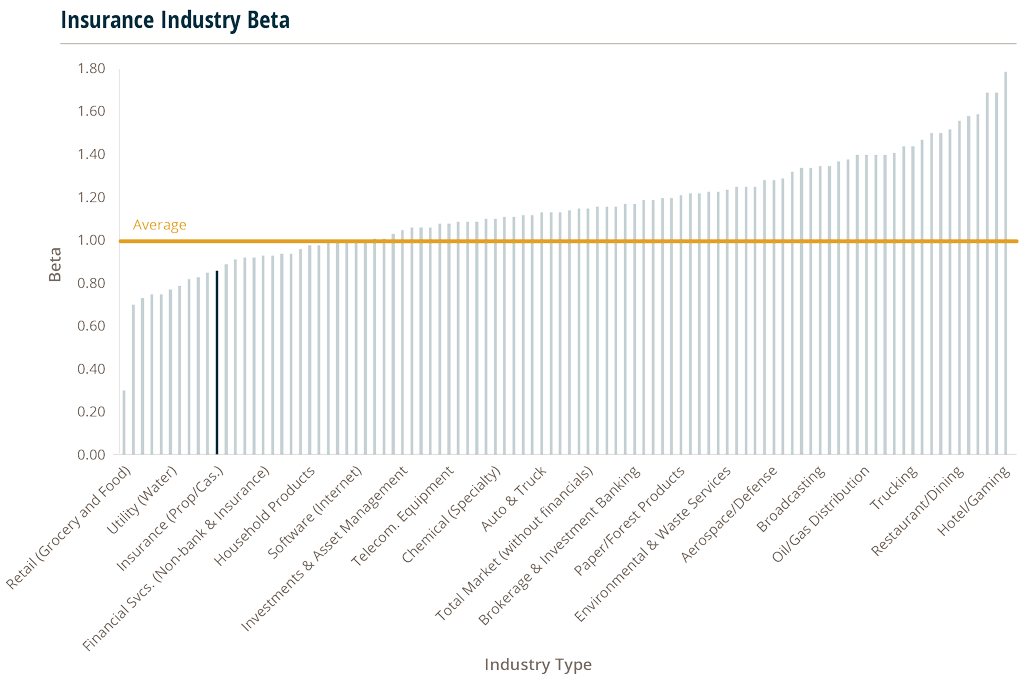

A stock’s beta measures volatility relative to the overall market and indicates how much the stock is expected to fluctuate based on current market trends. Industries with betas over 1.0 are more volatile than the market as a whole, while those under 1.0 are less volatile than the larger market (or a large index like the S&P 500). A beta of one means the industry will likely track to the market. P&C insurance ranks low on the spectrum at 0.86, coming in below other industries such as real estate, investment management, and computer services.