Public Broker Performance October 2022

In this Section

MarshBerry Broker Index

Get the latest performance and insights on the public broker composite.

MarshBerry Broker Index October Update

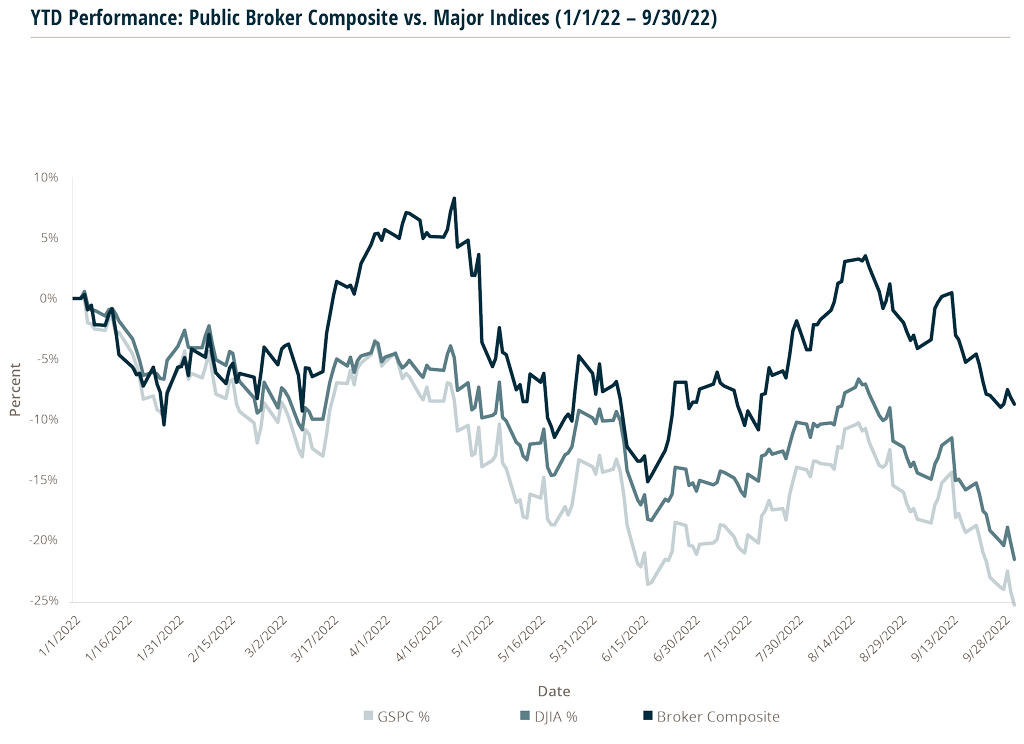

During this volatile period in equities, six publicly traded insurance brokers: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW), and BRP Group, Inc. (BRP), saw lower declines in their share prices compared to the broader stock market indices through September.

As the major indices continued to see deeper declines year-to-date, the broker composite index continued to outperform benchmark indices year-to-date September 30, 2022. Through September 30, the S&P 500 decreased by -25.2% and the DJIA decreased by -21.5%, while the public broker composite declined a much smaller -8.7%.

September was a challenging month for equities, and the S&P 500 declined -9.3% that month, the biggest September drop since 2002’s -11% and below the historical average September performance of -1.0%. Investors remain concerned about a potential recession and the Federal Reserve’s aggressive monetary policy to fight inflation. During its September meeting, the Fed announced a third 0.75 percentage point increase, with an intent to get inflation to around 2 percent over the longer run. Inflation data came in worse than expected in August, with the consumer price index (CPI) increasing 8.3% year over year, above economist projections for an 8% rise.

During the two-day (Sept 20-21) Federal Reserve meeting, Fed Reserve Chairman Jerome Powell made hawkish statements about monetary policy. He commented: “We have seen some supply side healing, but inflation has not really come down.” On September 27, Federal Reserve Bank of Minneapolis President Neel Khashkari echoed that sentiment, saying that the U.S. central bank needs to tighten monetary policy until underlying inflation is declining. Investors reacted to concerns that inflation is still too high, and that the central banks will continue to tighten to bring inflation down.

Third quarter earnings season for the public insurance brokers begins in late October, with MMC’s third quarter report on October These reports will give more insight into how much public brokers are being impacted by current macroeconomic challenges. The public brokers tend to have larger recurring revenue bases and businesses that are noncyclical, supporting more stable growth during downturns.

Going into the last quarter of the year, the shares of the public insurance brokers will continue to be monitored for their relative outperformance for the rest of 2022.

-8.7%

Broker Composite

-21.5%

Dow Jones

-25.2%

S&P 500

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information. The MarshBerry Broker Index is a composite of market data sourced from Yahoo Finance on the following companies: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only.

Public Broker Comps

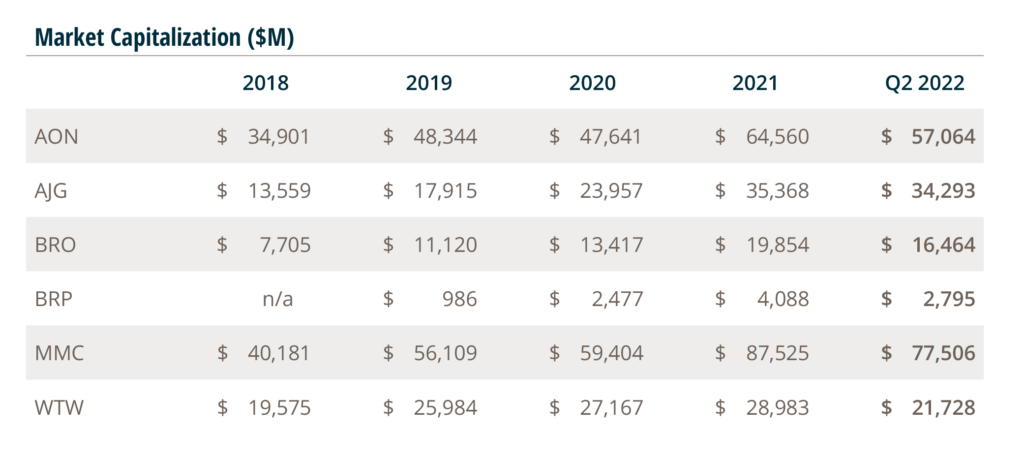

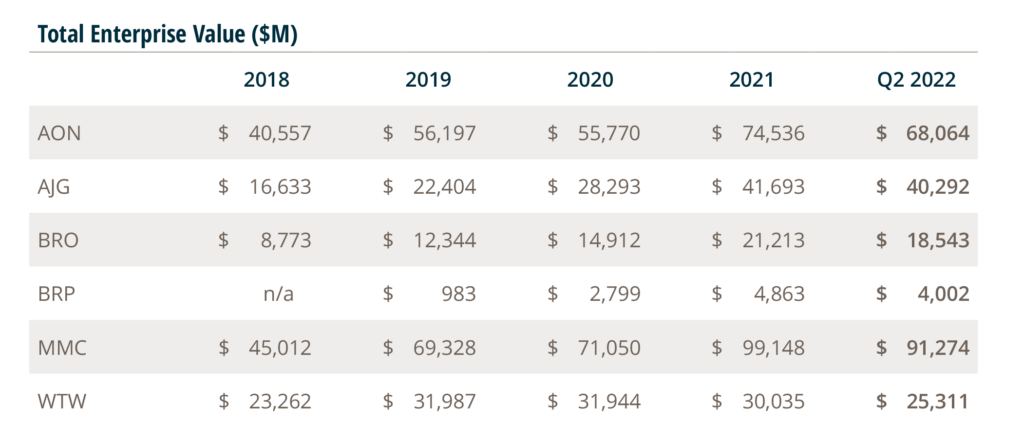

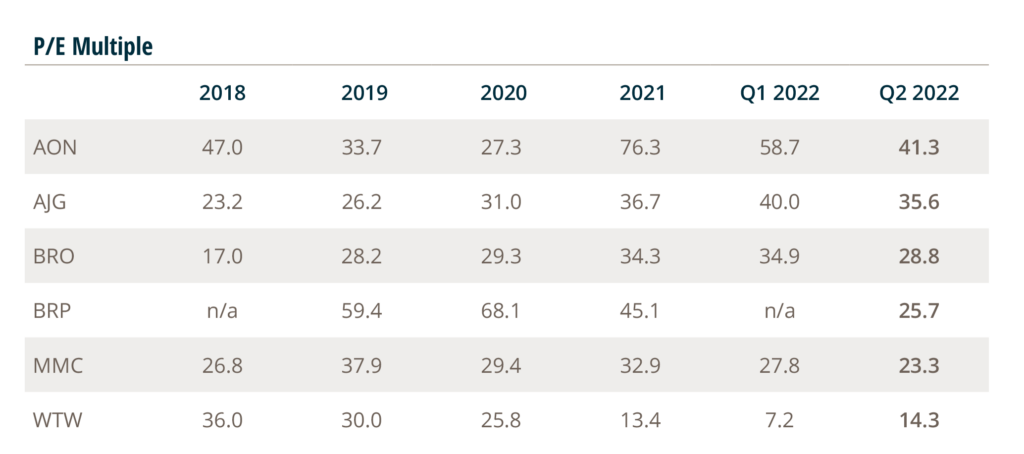

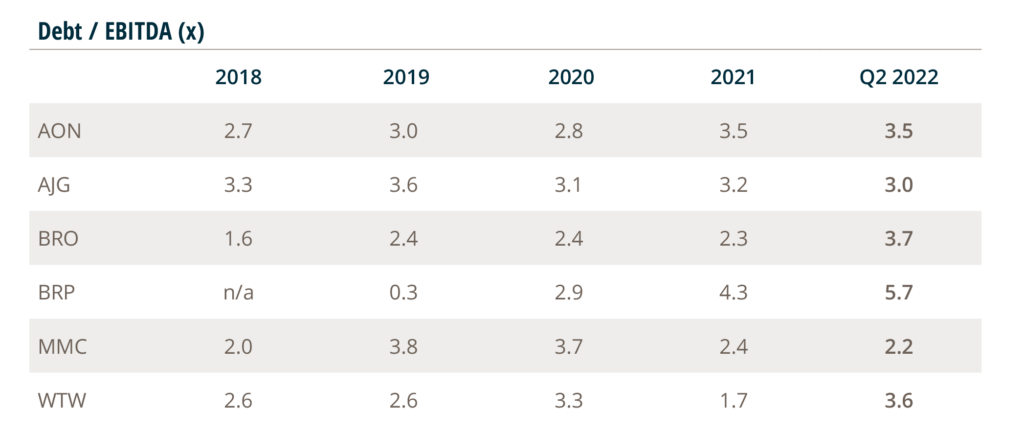

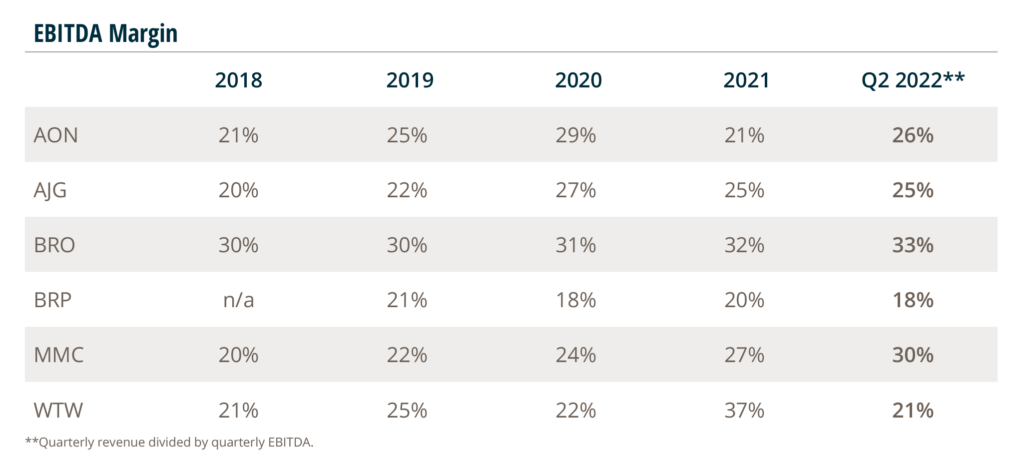

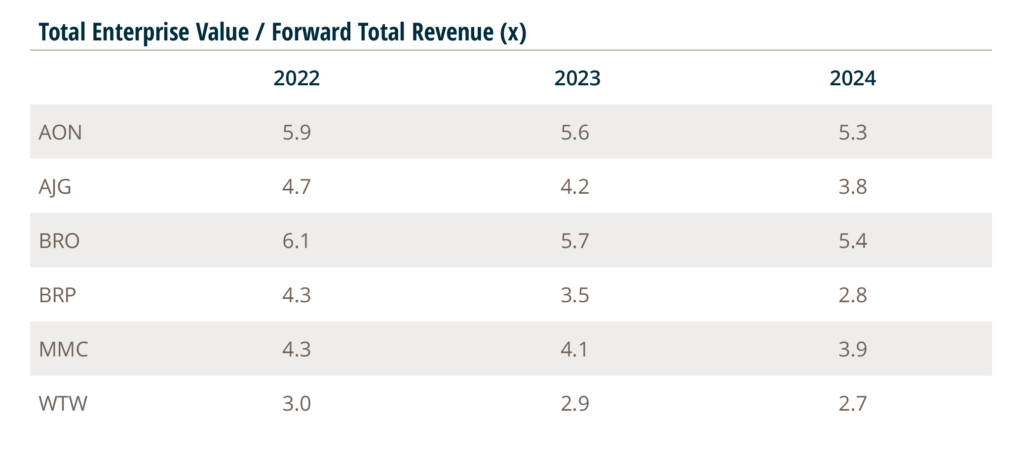

Source: S&P Global Market Intelligence, Company Reports, FactSet, 8/22/22. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization. AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BRP = Baldwin Risk Partners; MMC = Marsh & McLennan Companies, Inc.; WTW = Willis Towers Watson Public Limited Company. 2022.

Source: S&P Global Market Intelligence, Company Reports, FactSet, 8/22/22. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization. AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BRP = Baldwin Risk Partners; MMC = Marsh & McLennan Companies, Inc.; WTW = Willis Towers Watson Public Limited Company. 2022.