U.S. Macroeconomic Indicators Vol II, Issue 1

Market Trends and Current Statistics

Here are key U.S. macroeconomic indicators that are likely to impact brokerages within the insurance industry.

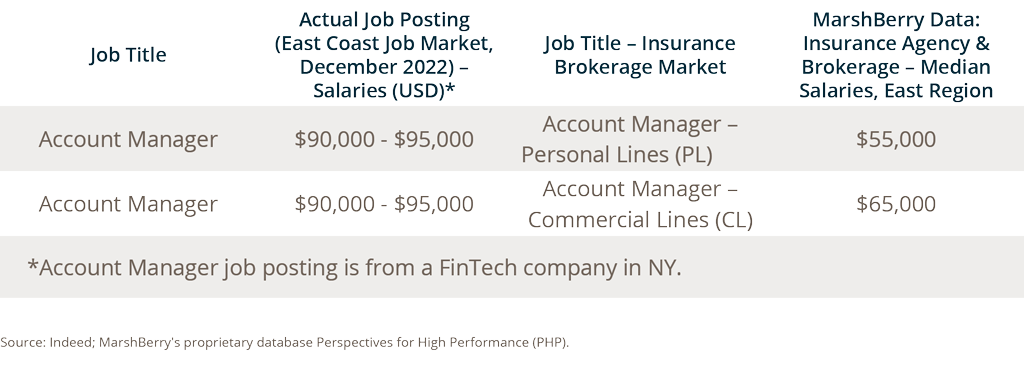

New Salary Transparency Laws Present New Challenges For Hiring And Retention

There are an increasing number of salary transparency laws in the U.S., where companies are required to list salary ranges on job postings. This is part of a trend towards equitable workplaces where people in comparable roles are paid similar wages, across different industries. As equity and inclusion become more important, these laws are likely to spread to more states. This shift could potentially impact hiring and retention as employees gain insight into colleagues’ salaries and pay offered by other industries and companies.

Salary transparency laws have spread in many U.S. states including in Colorado, Maryland, Connecticut, California, and Washington. Each jurisdiction has different terms regarding which companies are covered. On November 1, 2022, New York City started requiring employers with four or more employees to post salary ranges on job opportunities. California’s new salary transparency law went into effect on January 1, 2023, and applies to companies with over 15 workers.

Experts believe that companies may want to consider long-term strategies around navigating this new trend and shift in legislation. Dave Carhart, VP of advisory services at Lattice, a provider of performance and compensation management services, stated, “Once people work at companies where salary transparency is the norm, it will seem odd, or secretive, for companies not to share it, even if there’s not a legal requirement to do so.”

1 in 20

Number of Employees That Would Quit If They Learned That They’re Making Less Than Their Coworkers

Salary Transparency Laws May Make Hiring More Competitive For Insurance Brokers.

The increased visibility into salaries or more competitive packages in other industries could increase competition in recruiting talent for insurance brokerages. This could also increase job switching as employees can see when there are more lucrative opportunities. About 1 in 20 employees said they would quit if they learned that they’re making less than their coworkers, based on a ResumeBuilder. com survey of 1,200 U.S. workers in November 2022.

For example, according to Indeed, a FinTech company with over 50 employees in New York currently has an account manager job posting offering a salary range of $90,000-$95,000. This compares to a $65,000 median salary plus bonus in the East region for account manager roles at commercial lines insurance brokers.1 While the required experience and job description of different account manager roles may vary widely across industries and companies, the FinTech job posting in the example has similar required qualifications and is fairly close in terms of the job description to the typical account manager role in MarshBerry data.

“With salaries for new employees becoming more transparent, it could force the hand of many businesses to raise salaries for all employees,” said Ben Johnston, chief operating officer of Kapitus, which provides financing to small and medium-sized businesses.

How can insurance brokers navigate these shifts and hire top candidates?

Despite changes to salary visibility in recruiting, there are other factors that play into candidates’ decisions for accepting roles with companies. Insurance agents and brokers can improve their chances to recruit and retain the best talent by creating a more meaningful candidate experience.

While the trend towards salary transparency will likely see greater adoption in the U.S., firms can start acting now. Working with a professional talent acquisition agency that has the knowledge and experience to scout the right candidates for the insurance industry may ensure that insurance brokerage firms remain competitive and are able to hire the right talent as hiring becomes more challenging.

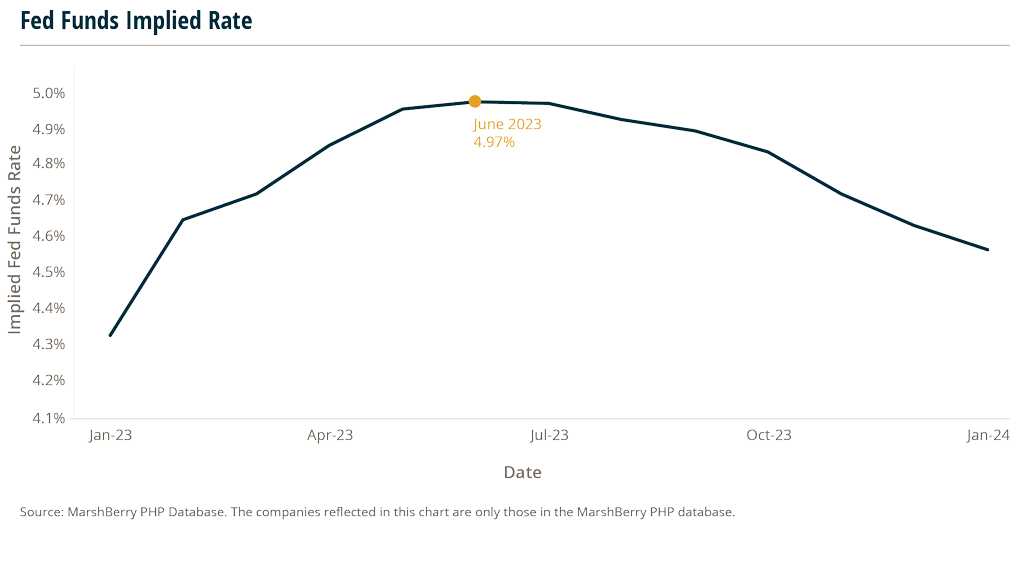

The Federal Reserve’s Impact On the Economy and Potential Recession

After a volatile year in 2022 for the U.S. economy and financial markets, many economists and strategists at major investment banks are predicting that 2023 will likely see both the Fed pivot and the U.S. experience a recession this year. A Fed pivot happens when the central bank changes its policy from tightening to loosening (or the reverse). In addition to cutting rates (or increasing), many consider moderating rate hikes or pausing rate hikes also pivoting.

Many financial institutions predict a Fed pivot in 2023.

Based on outlooks by economists at 23 large financial institutions, most predict that the Fed will raise interest rates in the first quarter and begin cutting rates in the second half of 2023.1

This follows the fed’s seven increases of its benchmark rate in 2022, up from a range of 0%-0.25% to the current 4.25%-4.5%. In december, the fed’s median forecast indicates that the fed funds rate would hit a “Terminal rate” – meaning the peak rate of the fed’s interest rate cycle – of 5.1% in 2023 and 4.1% in 2024.2

The futures market is also factoring in a pivot by the Fed, even though the Fed has been saying they will keep rates elevated for 2023. The Fed Funds implied rate is indicating a peak in the federal funds rate in mid-2023, with an expected decrease later in the year.3 The markets may be speculating that a Fed pivot will occur in 2023 because of the U.S. entering a recession, which many investors are forecasting.

Recent inflation data has come in better than expected. The November Consumer Price Index (CPI) increased 7.1% vs. a year ago, below economist expectations and below October’s 7.7% increase. While the Fed may want to reach a 2% target for inflation before easing, worse than expected economic conditions may lead the Fed to pivot sooner.

Even though a recession is predicted by many of the financial institutions for this year, most of the economists see a light recession, one that is shallow or mild. These economists surveyed also see the economy and U.S. equity markets improving, with equities finishing the year up slightly, and bonds performing well in 2023.4 These improved financial returns are expected to be boosted by a Fed pivot.

Implications for Insurance Carriers and Brokers.

If a rebound occurs in the equity markets, and the bond markets perform well, insurance carriers may experience improved returns from their investment portfolios. Insurers tend to invest more of their portfolio in fixed income investments. A recovery in overall economic growth in later 2023 would help improve the growth of insurance carriers and insurance brokers, as business investment expands.

- https://www.wsj.com/articles/big-banks-predict-recession-fed-pivot-in-2023-11672618563

- https://www.schwab.com/learn/story/fomc-meeting

- https://www.schwab.com/learn/story/market-perspective

- https://www.wsj.com/articles/big-banks-predict-recession-fed-pivot-in-2023-11672618563

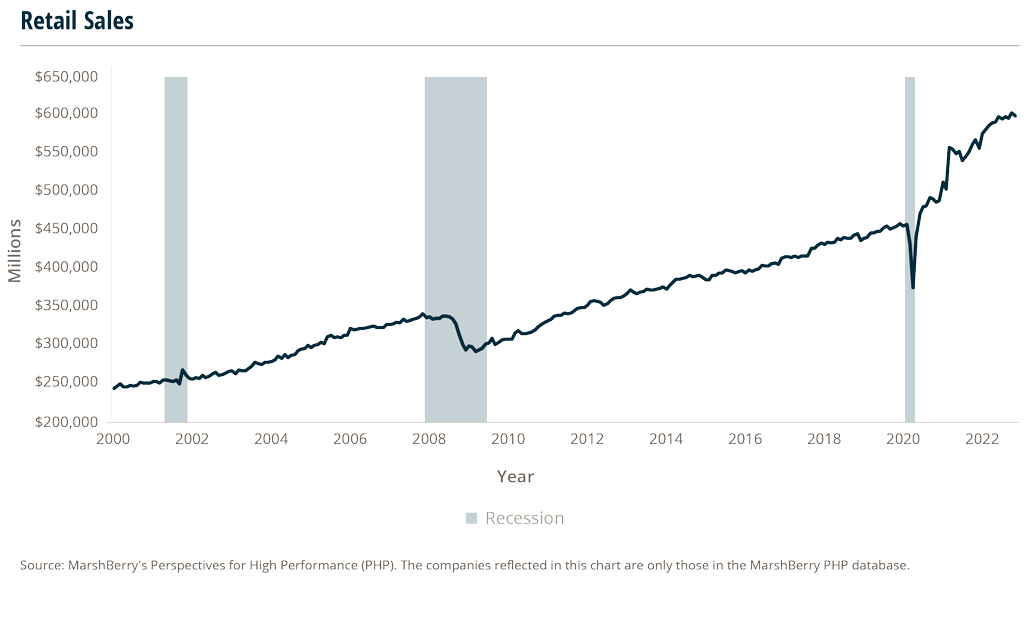

Can Non-Traditional Indicators Predict A Recession?

Clearly defining a recession can be difficult. Many indicators have a lagging effect and are not able to clearly show a recession in advance. Additionally, experts do not agree on a concrete measurement to define a recession, with most utilizing the rule of two consecutive quarters of declining GDP.

Beyond stocks and job data — other, more creative indicators can show the health of the economy and possibly predict a recession.

Because consumer spending makes up such a large portion of GDP, more specific consumer spending trends can also be indicators of an economic turndown.

Former Fed Chairman Alan Greenspan popularized the “men’s underwear sales” indicator.1 Because underpants are the last piece of clothing men think to buy when money is tight, sales drop as they are less likely to spend money in this area.

The “lipstick index” shows purchases of cosmetics are inversely correlated with the health of the economy. From 1929-1933, during the Great Depression, lipstick sales rose. During the 2001 recession, even as retail sales were down, lipstick sales rose, according to Estée Lauder.2 And now, post-COVID, with masks optional, lipstick is making a comeback with 2022 sales up 37% (through October), despite a recession on the horizon.3 When money is tight, splurging on more expensive luxuries is not always an option, hence the uptick in lower cost luxuries such as lipstick, one of the most common products purchased on impulse.

Frozen and store brand foods spike during economic hardships. As people look to cut costs, grocery store name brands offer a simple way to cut costs. In 2009, Kraft saw rises in frozen pizza and boxed mac and cheese purchases as consumers shifted their spending habits towards low-cost alternatives and eating out less.2

In an economic downturn, there are not as many things to celebrate. NPR found that economic indicators derived from the sales of champagne were 90% accurate, citing sales increasing in 1999 prior to the internet bubble burst, in 2007 before the housing bubble burst, and most recently in 2021. What might that mean?4

- https://www.cnbc.com/2022/04/08/recession-signals-these-unusual-indicators-may-be-worth-monitoring.html

- https://www.washingtonpost.com/photography/interactive/2022/how-lipstick-underwear-can-predict-economy/

- https://www.wsj.com/articles/the-lipstick-index-is-back-11669256641

- https://www.npr.org/sections/money/2011/12/14/143704975/what-nail-polish-sales-tell-us-about-the-economy