Focused Insights: A Recession Like No Other Vol II, Issue 1

Is the Impending Recession Just a Sheep in Wolf’s Clothing?

In the 1967 film The Graduate, a guest at a cocktail party repeats one word of advice for Benjamin Braddock, the eponymous hero played by Dustin Hoffman: “Plastics.” The subtext, of course, is that the plastics industry is a rock-solid bet for a young grad still undecided of their next steps. But the famous scene would have aged just as well had the immortal word been “insurance.”

Plenty of industries describe themselves “recession-proof” but the insurance sector may have the strongest claim to that distinction.

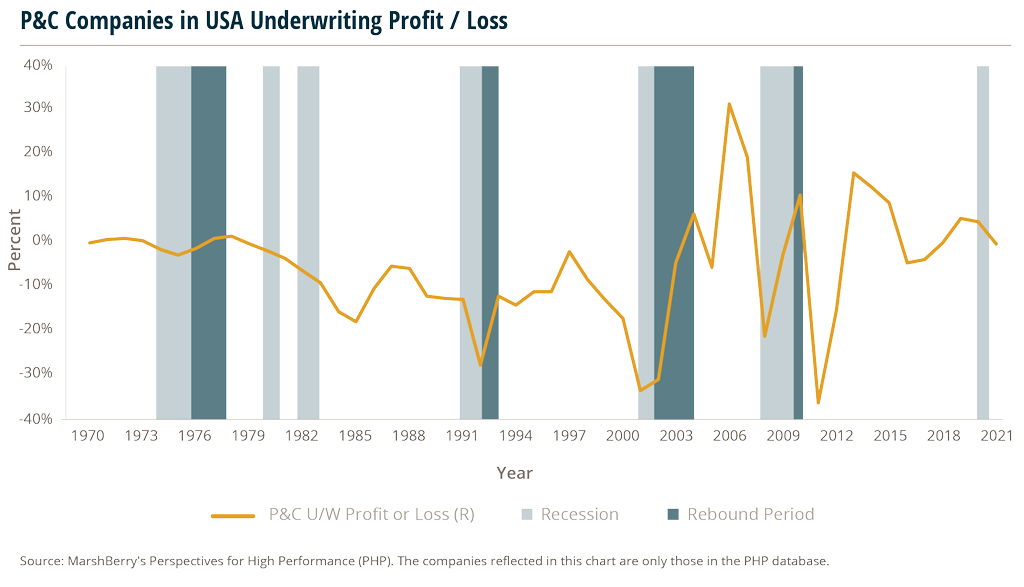

Yes, insurers aren’t immune to recessions. They tend to sustain underwriting losses and see their profits slump like everyone else. Carriers may also experience lower returns from their investment portfolios in slowdowns compared to higher growth periods.

But the lasting damage from macro-economic downturns tends to be minor for Property & Casualty (P&C) insurers, with rebound tendencies immediately following a downturn. Insurance isn’t a discretionary purchase for many businesses and individuals, but an eternal necessity. Whatever the economic weather, businesses still need to buy property and liability insurance, and individuals must purchase health, auto, homeowners and natural disaster insurance. In fact, Acts of God such as hurricanes, tornados and floods are the sector’s real bogeymen. Insurers won’t have any fond memories of 2005, the year of Hurricane Katrina, or of the destructive tornado season of 2011.1

The perennial need for insurance becomes the industry’s trusty armor during recessions. Typically, net written premiums soar2, and insurers pick up where they left off after a downturn. And even if demand for financial protection is soft, insurers don’t live or die by their annual balance sheet. Many carriers are major investors with long-term investment horizons who can withstand short-term hits.

The issue is particularly pertinent these days. By many accounts, though certainly not all, the U.S. is standing on the brink of a recession as the Federal Reserve (Fed) raises interest rates to tame inflation, causing businesses to rein in spending. But there are signs that this recession, should it hit, will be a relatively mild beast — meaning carriers should be confident about weathering any slowdown.

A couple of leading economic indicators point towards upside potential for the world’s financial guarantors — suggesting that we may be facing a recession like no other.

What’s the argument for a recession?

First, let’s be clear: There remain important players who are skeptical we’re even facing a recession. Goldman Sachs’s top economist, for example, said there’s a “very plausible” path for the U.S. to avoid a recession. The bank put the probability of one at only 35% in the next 12 months.3

But that is well below Wall Street consensus, and few would deny that a measure of economic gloom is baked into the near future. Take a look at the Treasury Yield Curve, a historically reliable bellwether of our long-term economic fortunes.

In a typical economy, the longer the term of the U.S. Treasury note, the higher the interest rate, or yield, that it pays to the note holder, and vice versa. But now, the yield curve is inverted. Investors are worried about the near-term future and are seeking higher interest rates on two-year Treasury notes than for 10-year bonds.

That strongly suggests that we could be in the eye of the storm in just a matter of months. An inverted yield curve has been the harbinger of every recession over the past 60 years, except for 1966, when the U.S. economy merely experienced a slowdown.

Yes, but today’s economy isn’t so simple.

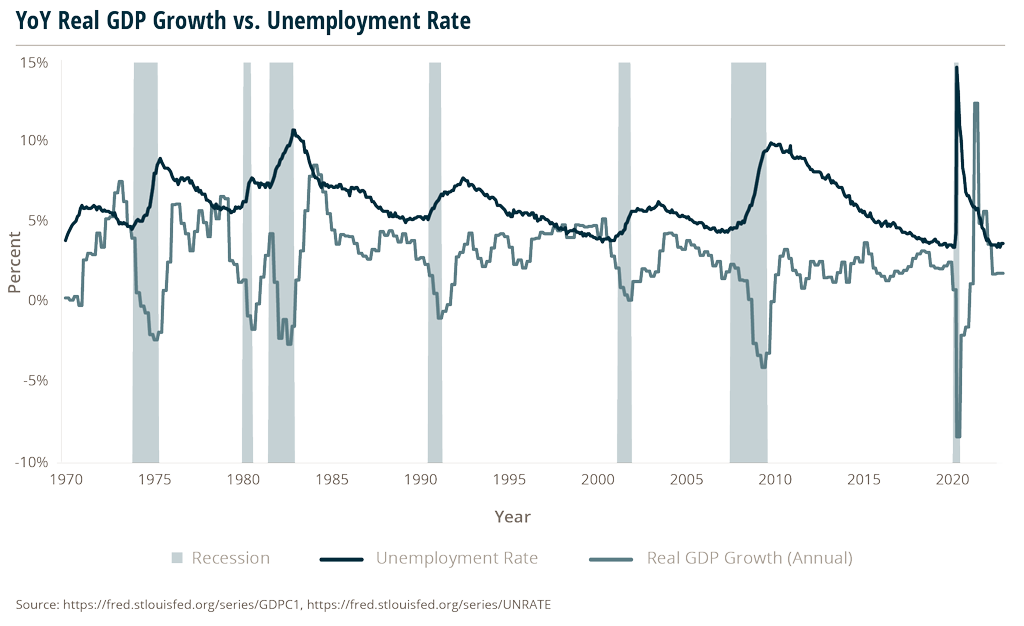

Look closer and you can see why this recession may unfold like no other. Why? For one thing, study the correlation between gross domestic product (GDP), the measure of the nation’s economic output, and employment. In every U.S. recession since World War II, GDP growth rate goes down, while unemployment goes up.

During the Iran-Energy Crisis of 1981-1982, real GDP fell by 2.6%, while unemployment rose to 10.8%, the highest since the Great Depression. During the Great Recession of 2008-2009, GDP decreased by 4.0% while unemployment reached 10%. In the short, deep COVID-19 recession, GDP fell by 9.6% while unemployment peaked at 14.7%.4,5

The relationship between the two indicators is one of tight inverse proportion because they feed off each other. Companies lay off workers when they’re feeling less confident about the future, which has a knock-on effect on consumer sentiment and spending. As consumers cut back, it impacts companies’ profits, leading to further redundancies, and so on.

This time around, there has been a decoupling of GDP and unemployment movements. Consumer sentiment is understandably pessimistic given the inflationary environment and other ongoing global macroeconomic factors. But — unemployment is at a 40-year low, and there are more jobs than bodies to fill them. At the last count, there were nearly 11 million open positions in the U.S., with around six million Americans unemployed.6 In fact, the double whammy of retiring Baby Boomers and the COVID-19 pandemic has precipitated a labor force participation crisis. Most companies aren’t laying off workers. Instead, they’re desperate to hire.

Companies are also cash rich. Businesses are coming off months of healthy demand for goods and services thanks to the billions of dollars in fiscal stimulus pumped into the economy during the pandemic. Companies in various sectors have recorded double-digit profit growth in recent quarters and filled their coffers.7 In fact, U.S. firms are sitting on close to $4 trillion in cash, which is a hefty downturn buffer. An average firm may not have to face the tough choice of firing workers or cutting back on investment. And a high-performing company may even have the money to weather a prolonged economic storm and continue to grow.

Not only will this type of financial protection break the usual cycle of previous recessions (i.e., lower consumer spending, high unemployment), but it means that the prospect of a “jobless recovery,” whereby GDP bounces back and unemployment rises, is very slim. This recession will probably be the opposite of most recessions, with output decreasing and companies hiring. That is why some pundits are already labeling it a “jobful downturn.”

What does it mean for the insurance industry?

The record shows how this industry can successfully weather stormy times. Since 1985, the U.S. insurance industry has enjoyed growth in net written premiums every single year, apart from the 2007-2009 period of the Great Recession. Premiums even continued to grow during the slowdowns caused by the Gulf War in 1990-1991, the September 11 attacks of 2001, and the COVID-19 pandemic.

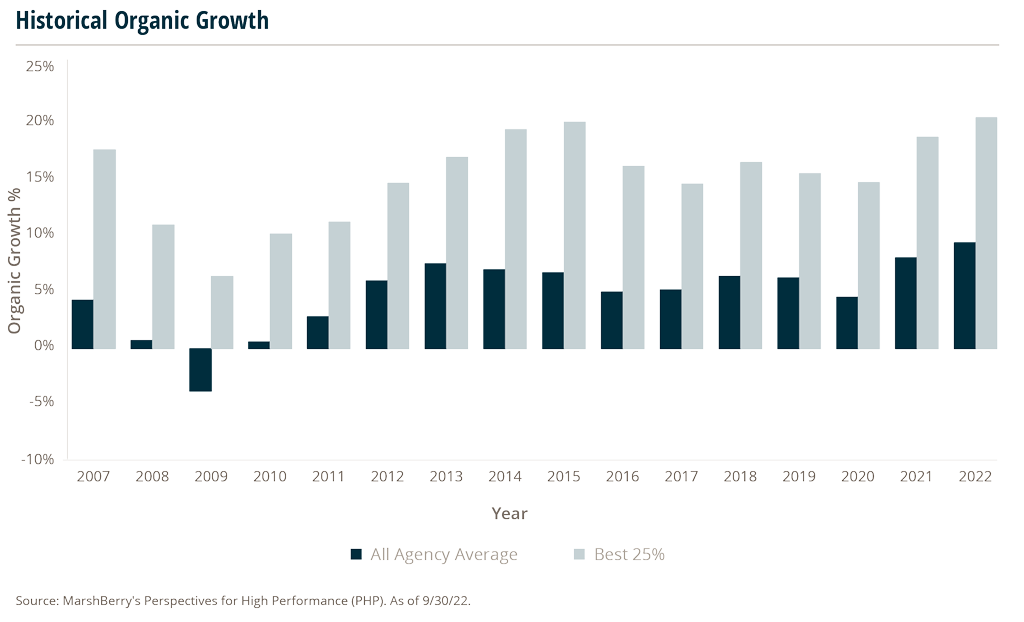

The steep but short COVID-19 slowdown in 2020 is a good example of the sector’s resilience. A year later, brokerages and agencies reporting to MarshBerry’s proprietary financial database Perspectives for High Performance (PHP) saw, on average, a nice lift in organic growth, from 4.6% in 2020 to 8.3% in 2021. This increase in organic growth was likely driven by such factors as higher premiums and increases in asset prices. The Best 25% of firms fared even better. They not only grew more than the average firm in 2021 but they saw less of a drop in organic growth levels during the pandemic-related slowdown vs. in the prior recession in 2009.8

Since the millennium P&C insurers have recorded healthy underwriting profits in the years following losses allowing them to break even. The industry’s performance has been bolstered by net investment gains that have consistently been in the $20-30 billion range every year since 2000.9

The insurance industry can take this kind of recession in stride. Jobful downturns mean fewer claims and pay-outs, which limits their underwriting losses. Businesses also have plenty of cash on hand to beef up their protection once calmer economic waters prevail.

8 in 10

Number of Business Leaders Expecting a Recession

2 in 3

Number of Business Leaders That Have a Positive Outlook On the Economy

13%

Percentage of the Public That Have a Positive Outlook On the Economy

Public sentiment matches up with the idea that this could be a recession like no other. Nearly eight in 10 business leaders are expecting a recession and most are feeling the acute effects of inflation, supply chain disruption and the war in Ukraine, according to AON’s Executive Risk Survey, released in October 2022. Despite this, according to the Survey, two out of three business leaders have a positive outlook on the economy, compared to only 13% of the public. And although the sales of cappuccinos are an unscientific method of gauging the severity of a recession, Starbucks is reporting a sales boom, even as its prices continue to soar.10

Say it softly, but this recession won’t be anything like 1981, 2008, or even 2020. As long as carriers manage their long-term investments astutely, they may have nothing to fear from the next few quarters.

2. https://www.verisk.com/siteassets/media/downloads/insuranceresultsreport2021q2.pdf

4. https://fred.stlouisfed.org/series/GDPC1

5. https://fred.stlouisfed.org/series/UNRATE

6. https://www.bls.gov/news.release/pdf/empsit.pdf

8. https://www.marshberry.com/resource/top-performing-agencies-brokerages-show-resiliency-in-downturns/

10. https://finance.yahoo.com/news/recession-talk-could-be-overblown-morning-brief-103035628.html