Public Broker Performance Vol II, Issue 1

In this Section

MarshBerry Broker Index

Get the latest performance and insights on the public broker composite.

MarshBerry Broker Index January Update

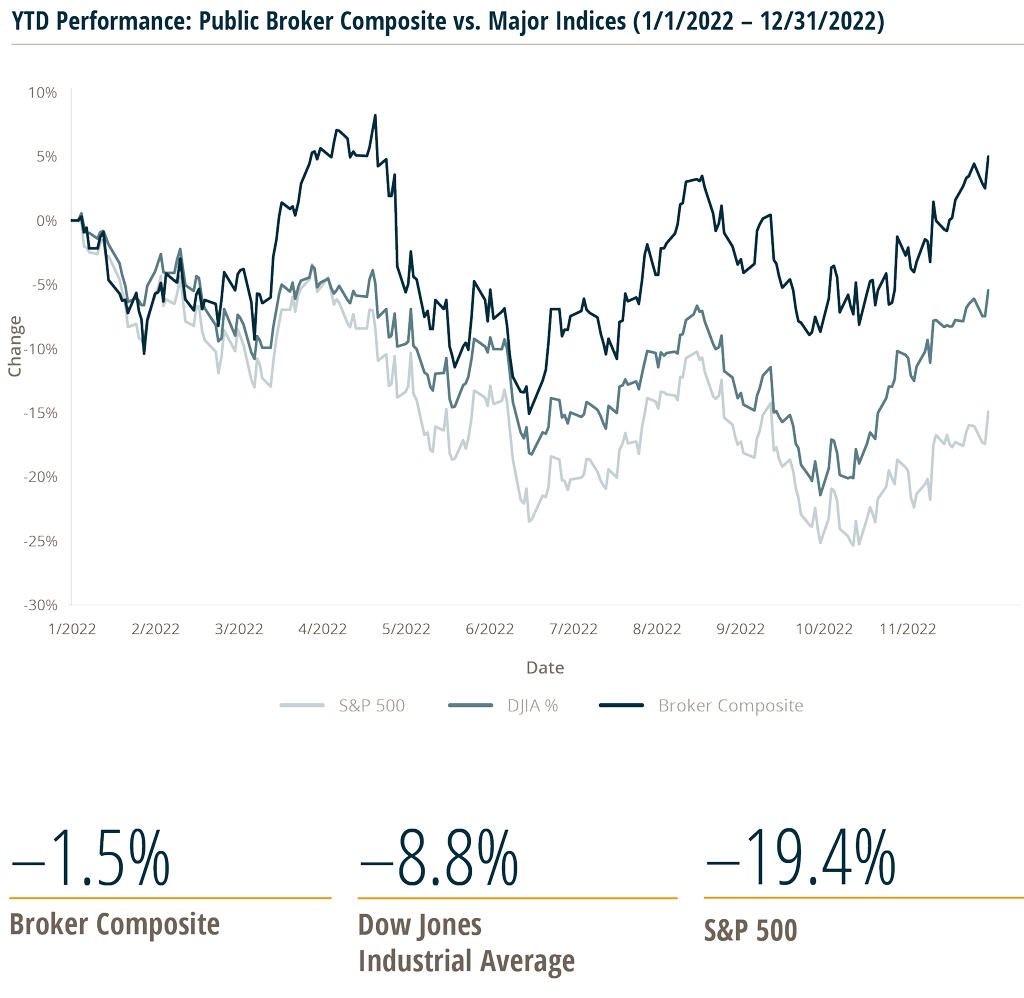

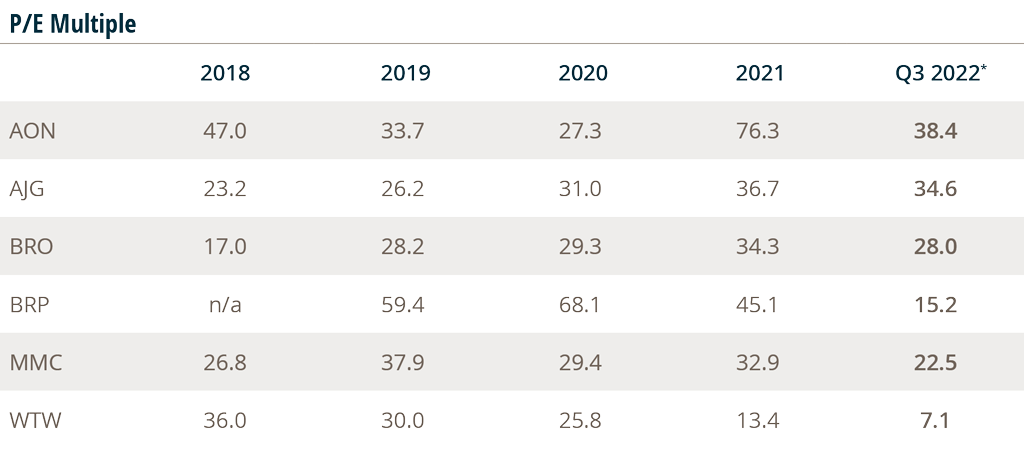

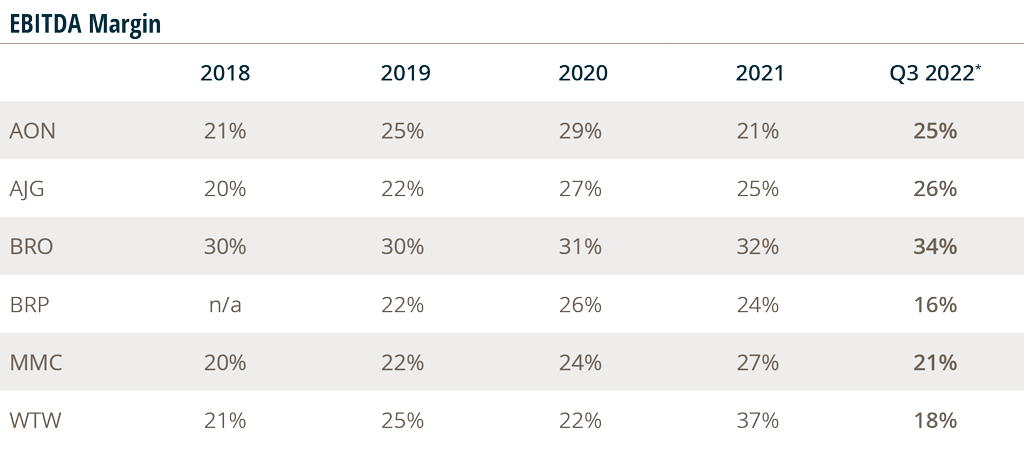

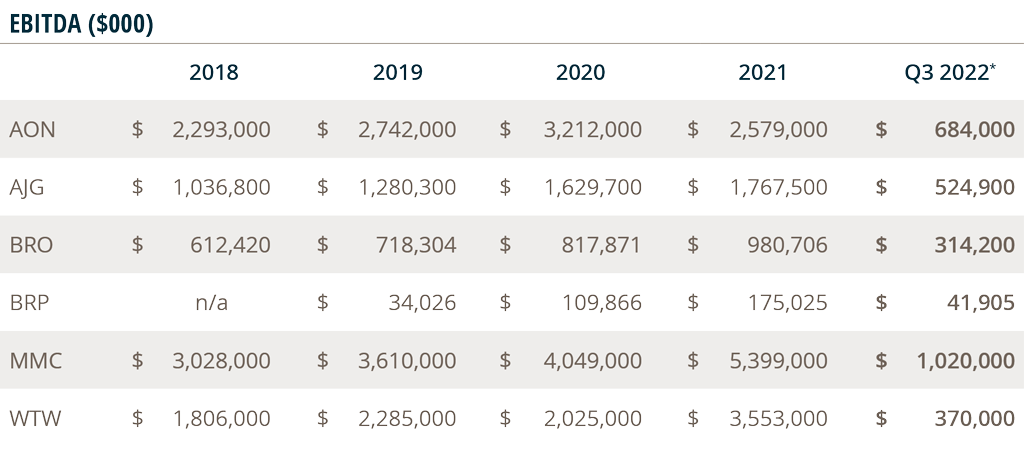

During 2022 six publicly traded insurance brokers: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP), saw their share prices outperform the broader stock market indices for the full year.

As the major indices continued to see greater declines year-to-date, the broker composite index outperformed benchmark indices through December 30, 2022. Through December 30, 2022, the S&P 500 decreased by -19.4% and the DJIA decreased by -8.8%, while the public broker composite decreased by -1.5%.

The S&P 500 began the month of December with a year-to-date performance of -14.9% (through November 30, 2022). The broker composite index was up 5.0% for the same period. At the end of November, equities saw broad gains when Federal Reserve (Fed) Chairman Jerome Powell stated that the Fed may slow the pace of its aggressive rate hikes starting in December. “The time for moderating the pace of rate increases may come as soon as the December meeting,” said Powell. However, equities ultimately had a difficult month in December, with the S&P 500 decreasing by 5.9% and the Dow Jones Industrial average losing 4.2% in December.1

Public insurance brokers remain resilient

Shares of the public insurance brokers continued to outperform the broader indices through 2022. The public brokers tend to be more recession-resistant, as businesses and people need to maintain insurance coverage even in challenging or slowing economic climates. Furthermore, higher inflation has contributed to revenue growth at insurance brokers, as premiums rise.

While the public insurance brokers cited growing macroeconomic concerns, they reported overall positive results in their latest Q3 2022 earnings, which were attributed to a combination of improving new business, strong retention and continued insurance rate increases. However, overall organic growth figures reported were slightly lower in Q3 2022 vs. Q2 2022.

The public brokers have larger recurring revenue bases and businesses that are noncyclical, supporting more stable growth during downturns. People always need to buy insurance. As a result, the volatility of the P&C insurance industry is generally less than other industries. We all have witnessed the resilience of this industry in periods of volatility, time and time again. Many to this day still cannot fathom how the average insurance broker only declined 3.8% in commission and fees during the Great Recession trough of 2009.2

Illustration generated by MarshBerry with data sourced from Yahoo Finance – 1/2/23. The MarshBerry Broker Index is a composite of market data sourced from Yahoo Finance on the following companies: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only. This information is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy.

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information. The MarshBerry Broker Index is a composite of market data sourced from Yahoo Finance on the following companies: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only.

Public Broker Comps

1. https://www.spglobal.com/spdji/en/commentary/article/us-equities-market-attributes

2. https://www.marshberry.com/resource/the-ma-valuation-dirty-little-secret/

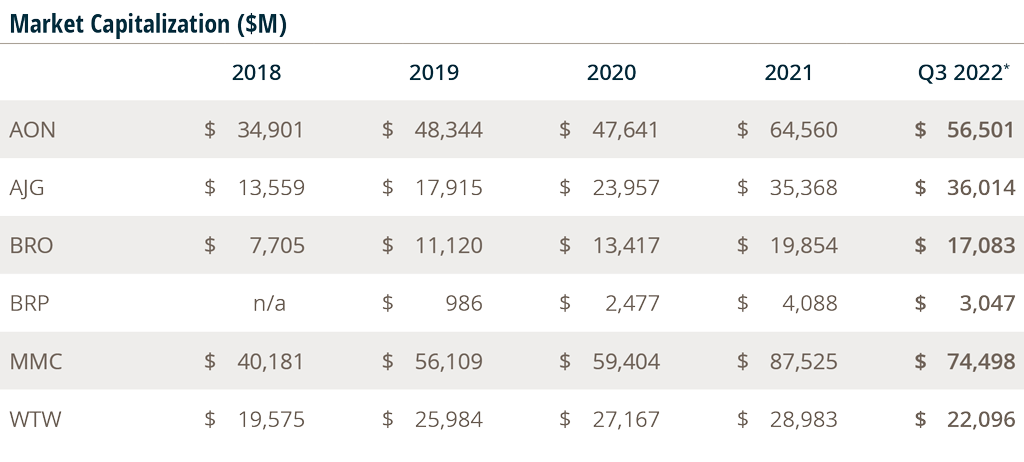

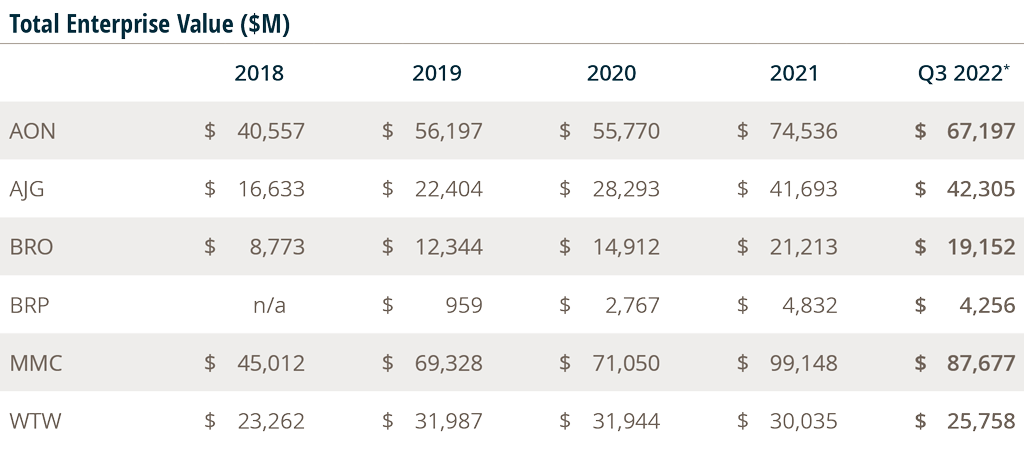

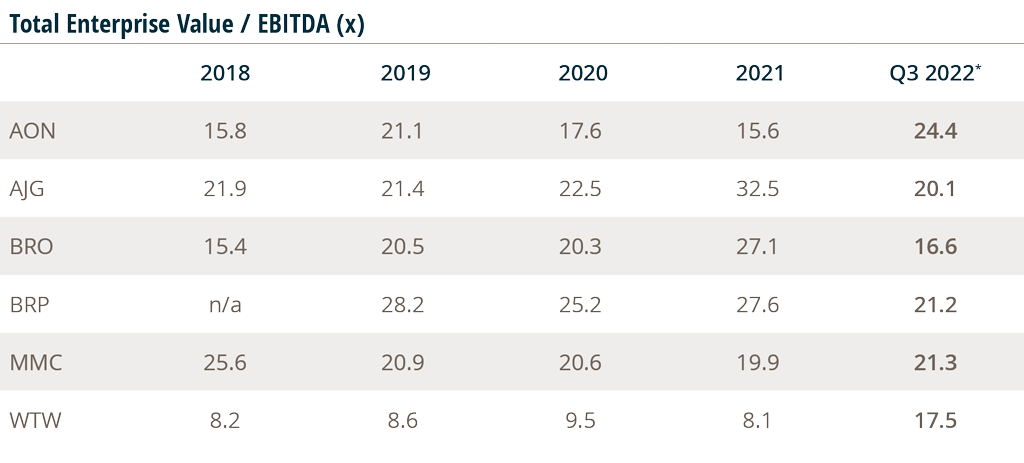

*Results as of Q3 2022

Source: S&P Global Market Intelligence, Company Reports, FactSet, 12/1/22. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization. AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BRP = Baldwin Risk Partners; MMC = Marsh & McLennan Companies, Inc.; WTW = Willis Towers Watson Public Limited Company. 2022.