Public Broker Performance Vol III, Issue 1

MarshBerry Broker Index

Get the latest performance and insights on the public broker composite.

MarshBerry Broker Composite Index: Market Update and Q4 2023 Earnings

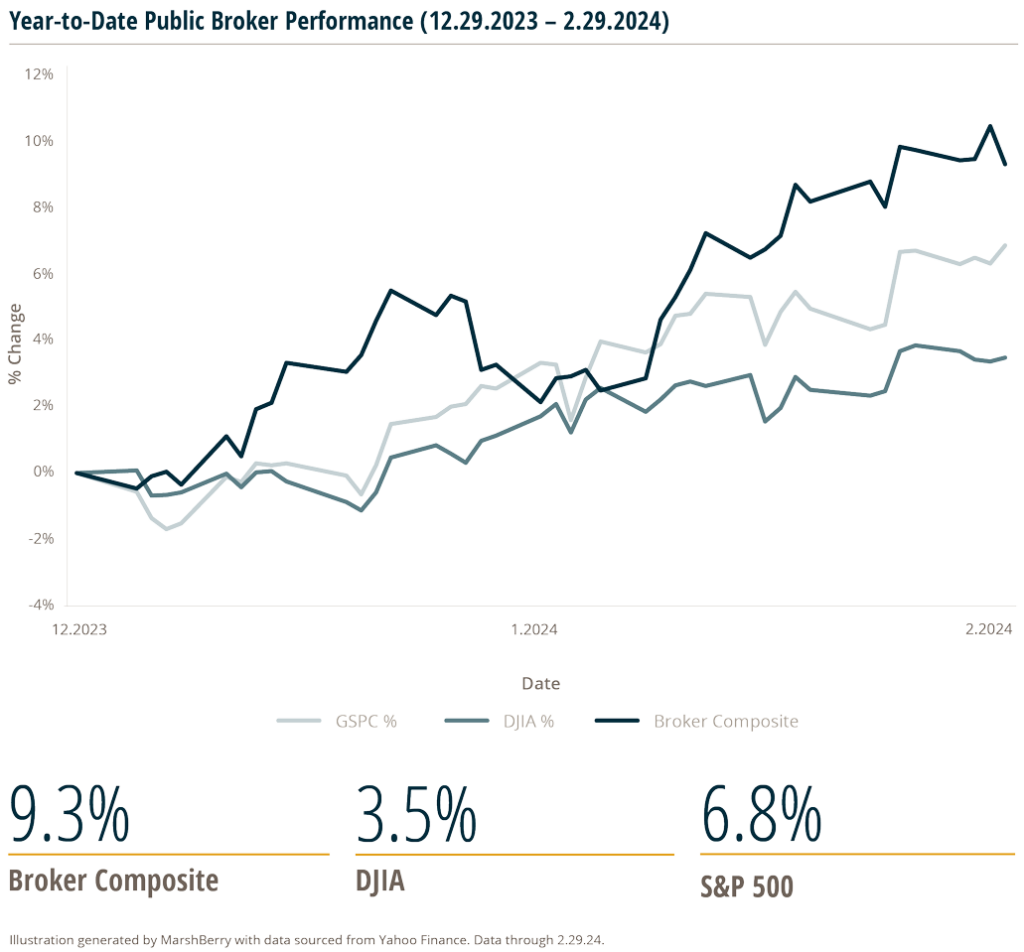

During the period from January 1, 2024, through February 29, 2024, six public brokers, as measured by MarshBerry’s Broker Index, outperformed the Dow Jones Industrial Average (DJIA) and S&P 500, highlighting the strong fundamentals and growth prospects of the insurance brokerage industry. The following publicly traded insurance brokers are included in the MarshBerry Broker Index: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP). These brokers outperformed both the DJIA and the S&P 500 (GSPC) index year-to-date through February 29, 2024.

Q4 2023 Earnings Results

Overall, Q4 2023 earnings results from insurance brokers showed strong performances. Management teams were positive in meeting targets for Q1 2024 and further into 2024. Organic growth figures reported in Q4 2023 were generally comparable to those seen in Q3 Most brokers reported organic growth rates in a range of 6%–16%.

- MMC reported Q4 2023 organic growth of 7%, compared to 10% in Q3 2023.

- BRO posted organic growth of 7.7% in Q4 2023, below the 9.6% seen in Q3 2023.

- AJG: For AJG’s combined brokerage and risk management segments, AJG posted 8.1% organic growth in Q4 2023, compared to the firm’s 10.5% organic growth in Q3 2023.

- WTW posted 6% organic growth in Q4 2023, below its 9% organic growth in Q3 2023.

- AON had organic revenue growth of 7% in Q4 2023, above the 6% in Q3 2023.

- BRP’s organic growth in Q4 2023 was 15%, below BRP’s Q3 2023 organic growth of 19%.

- RYAN reported Q4 2023 organic growth of 16%, above Q3 2023’s organic growth of 14.7%

The Macroeconomic Environment and Continued Organic Growth

Most of the public brokers had a strong end to 2023 and are confident in their continued growth in 2024, driven by new business wins, rate increases and M&A strategies.

John Doyle, MMC President and CEO, said: “Our performance reflects execution of a well-defined strategy, which includes building a culture that attracts and retains top talent, strengthening our capabilities through organic and inorganic investment, positioning ourselves in segments and geographies with attractive growth and margin profiles, leveraging data, insights, and innovation to support clients and managing uncertainty and finding new opportunities and delivering the power of Marsh McLennan’s perspective to help clients thrive.”

RYAN Chairman & CEO Patrick G. Ryan spoke of secular growth drivers in the Excess and Surplus Lines (E&S) space, stating: “We believe the E&S market will keep growing and consistently outpace growth in the admitted market, overshadowing any cyclical shifts in certain lines with respect to submission flow and pricing. This is further aided by changes in distribution trends, with a growing number of wholesale-only E&S carriers in the marketplace.”

WTW noted that its specialty businesses continue to experience high growth, with improved client retention and new business wins. Its focus on specialization in its Risk & Broking segment also continued to be a key driver of organic growth.

Mergers & Acquisitions Activity

M&A remains a top priority for RYAN, and its pipeline remains robust, with both tuck-ins and potential large deals. The firm expects to have double-digit organic growth in 2024, driven by organic and acquisition strategies, as well as secular growth factors. While RYAN is seeing hard market pricing conditions continuing in 2024 in most of its lines, the company expects the flow of business into the non-admitted market to be a greater driver of growth than rate.

During Q4 2023, AJG completed 14 mergers, totaling $410 million of estimated annualized revenue. AJG is following its active Q4 2023 for M&A activity with a strong start to 2024, with four brokerage mergers closed in January for about $30 million of annualized revenue. AJG also had approximately 40 term sheets signed or being prepared, representing around $350 million of annualized revenue. Chairman & CEO J. Patrick Gallagher noted, “As we sit here today, we are very well positioned. 2023 was a great new business year, and I believe we will continue to win new clients while retaining our existing customers.”

BRP CEO & Director Trevor L. Baldwin spoke of BRP’s future M&A activity: “And after we pay the last of the large earnouts in the first quarter of 2025, I think we would expect that M&A

becomes a more prevalent part of our story again. But importantly, we’ll be more episodic in nature than it was in the first few years of our life as a public company.”

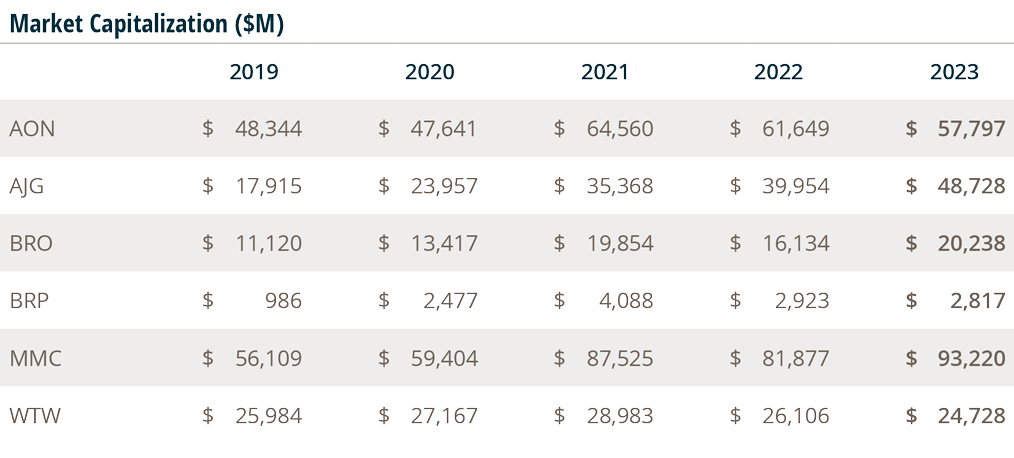

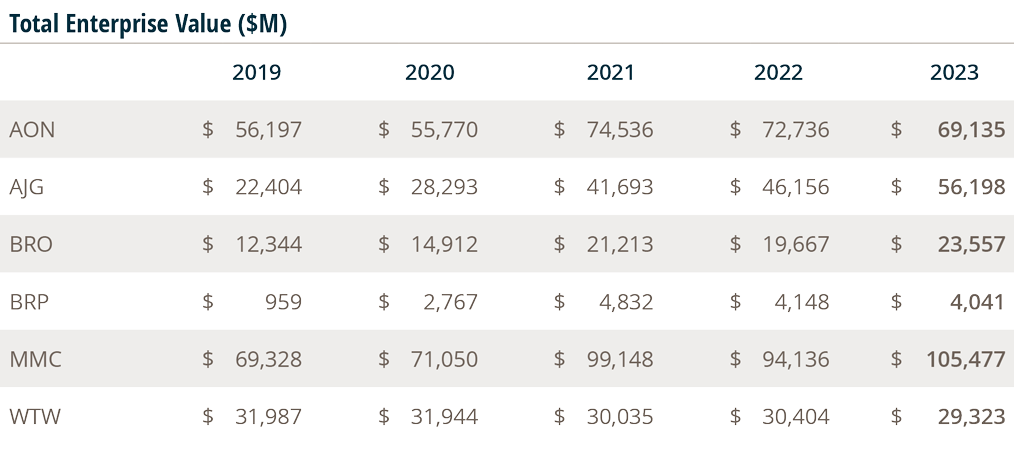

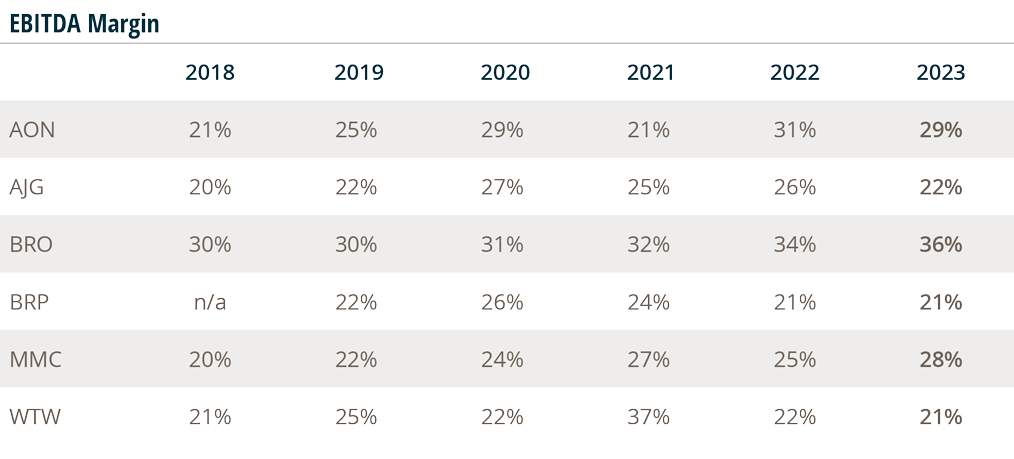

Public Broker Comps

Source: S&P Global Market Intelligence, Company Reports, FactSet, 3/1/24. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization. AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BRP = Baldwin Risk Partners; MMC = Marsh & McLennan Companies, Inc.; WTW = Willis Towers Watson Public Limited Company.