U.S. Macroeconomic Indicators Vol III, Issue 1

Market Trends and Current Statistics

Here are key U.S. macroeconomic indicators that are likely to impact brokerages within the insurance industry.

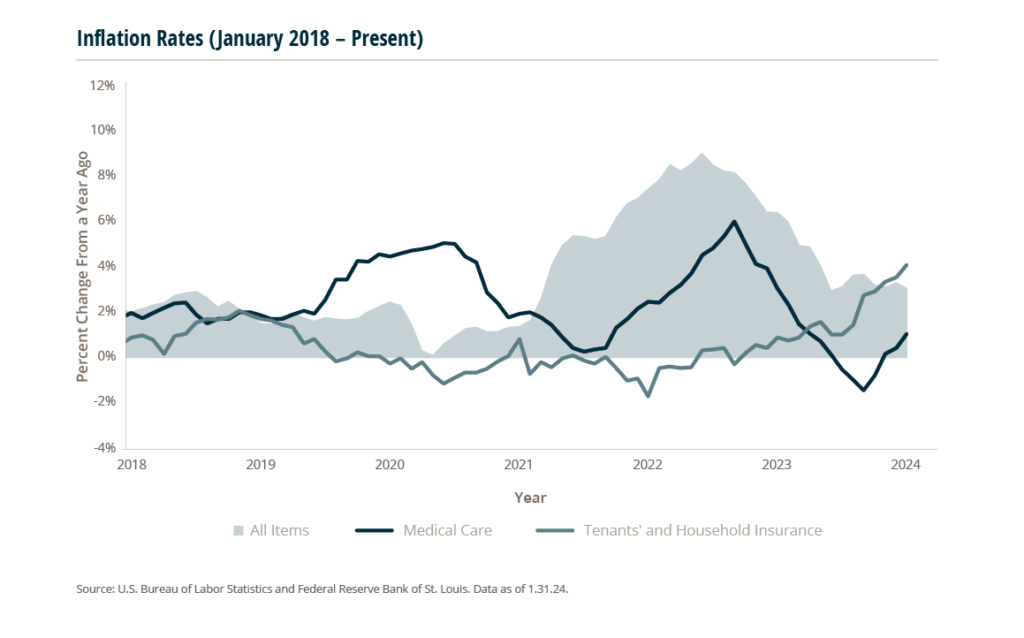

State of Inflation: Higher Than Expected CPI Numbers Delays Fed Interest Rate Cuts

In 2023, inflation cooled from historical highs in 2022. This was encouraging for economists and market participants, who were hopeful for the possibility of several Federal Reserve (Fed) rate cuts in 2024. However, the January 2024 Consumer Price Index (CPI) rose 3.1% year-over-year, above Wall Street’s projections of 2.9%, raising investor concerns around the timing of the Fed’s much anticipated rate cuts.1

Inflation improved broadly from the June 2022 high of 9.1% but is still above the Fed’s 2% target level.2 As of January’s CPI report, several categories are still seeing higher costs:

While the normalization of supply chains has largely helped bring down costs of general goods, service-related costs remain elevated due to wage growth.

Current inflation figures will likely keep the Fed on track with holding rates steady at its next meeting in March 2024. According to Fed-Funds futures, traders now project that the Fed will start cutting rates at its June 12 meeting, instead of its May 1 meeting, which was the prior expectation before the January inflation report. Historically, the Fed tends to ease about six months after its last hike, according to data compiled by Bloomberg going back to 1980. Based on the last hike on July 27, 2023, this current pause is set to be longer than average.4

Impact of Future Fed Rate Cuts on Insurance Brokers

Overall, more encouraging inflation data or weaker growth and jobs reports may influence the Fed’s interest rate decisions. U.S. January retail sales and manufacturing data came in weaker than expected, backing the case for Fed rate cuts. However, jobless claims for the week ended February 3, 2024, decreased for the first time in three weeks, indicating some strength in the labor market. Even if interest rates decrease to 4.6% in late 2024 and potentially below 4.0% in 2025 (forecasted by the Federal Open Market Committee),5 interest rates will be roughly in line with levels seen pre-Great Recession. These will still be below levels seen leading up to 2021. While these rates are an improvement from the current levels, they will still impact the cost of capital and potentially influence merger and acquisition (M&A) strategies of insurance brokers.

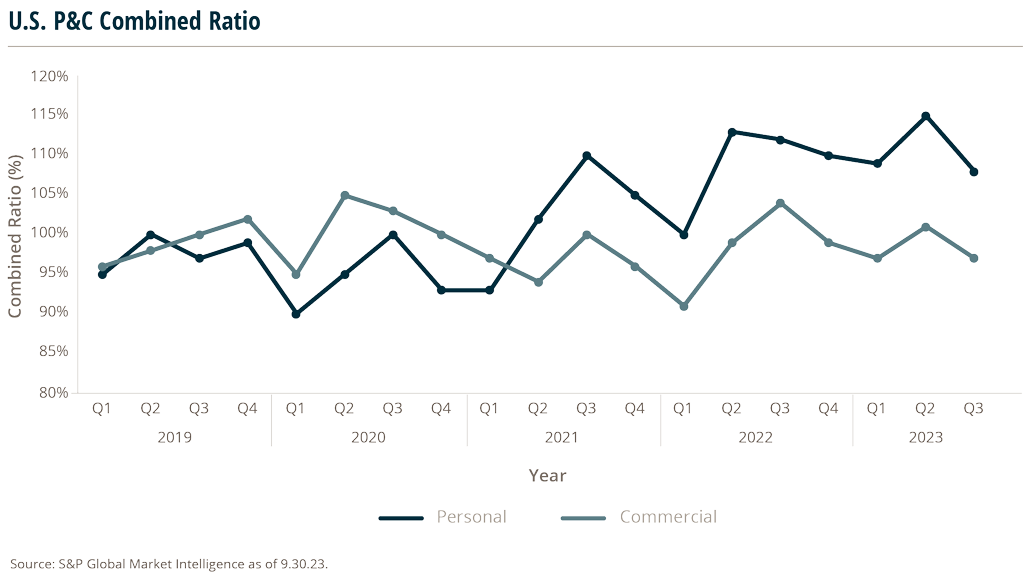

2023 Combined Ratio Worsens for P&C Insurers

The U.S. Property & Casualty (P&C) industry is poised to post another underwriting loss for 2023, with the net combined ratio forecast to worsen to 103.9%, from 102.4% in 2022, according to a report from the Insurance Information Institute (Triple-I) and Milliman.6

For reference, a combined ratio below 100% is generally considered to be good, but the ideal ratio varies depending on the industry and the company’s specific circumstances. Combined ratio is a measure of underwriting profitability, not overall profitability, so it’s a useful tool for comparing the performance of different insurance companies. Other factors should be considered, such as the type of insurance written and the competitive landscape.

Commercial Lines Continued to Outperform Personal Lines

Commercial lines are forecasting a net combined ratio at 97.7%, while personal lines are forecasted at 109.9%. Jason B. Kurtz, FCAS, MAAA, a principal and consulting actuary at Milliman highlighted that commercial lines in total had underwriting gains in 2022, while personal lines had underwriting losses. He said, “We forecast relatively strong commercial auto premium growth of 9% in 2023, 9% in 2024 and 7% in 2025. Underwriting losses have returned and there will be a continued need for rate to improve the combined ratio results.”7

Personal lines, specifically the homeowners’ line of business, are experiencing reduced coverage as providers pull back from disaster-prone areas, such as California. Personal auto insurance also had some challenges, including higher cost for repairs, higher used-car prices, and supply chain and labor market issues.

The first half of 2023 signaled the trouble, when the P&C industry recorded a $24.5 billion net underwriting loss, nearly matching the $26.5 billion in total losses recorded for all of 2022.

Driving this loss were factors such as natural catastrophes, inflationary pressures, and rising interest rates. As demonstrated in the chart below, the combined ratio for both personal and commercial lines rose in Q2 before leveling out in Q3.

However, the outlook for 2024 is more positive with strong premium growth and easing inflation pressures predicted. The end of 2023 signaled improvements to come, in particular, Travelers reported a record profit in the 2023 fourth quarter.8 After a year of record-breaking losses, insurers now see potential for profitability in the coming year, due to rate increases and easing inflationary pressures. Insurance executives say premiums will likely increase in the “low double digit” percentages for home insurance renewals this year, and in the mid-teens for drivers renewing policies through June.

A contributing factor to these improvements is the recent approvals by state regulators to increase rates. Since insurance is regulated on a state level, insurance companies must gain rate approval on a state-by-state basis. Allstate received regulatory approval to raise auto insurance rates in California, New York and New Jersey. Regulators approved insurance rate increases for American Family Insurance, Farmers Insurance, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA by more than 20% across multiple states. Some states, including Texas and Ohio, saw increases over 30%.9

In addition, homeowners’ premiums received regulator approved increases, such as a 16.8% increase granted to Travelers Insurance, a 15.5% rate hike for Farmers, and a 5.8% increase for Allstate, all in Texas. Minnesota and California also experienced large increases and Arkansas even approved a 23% increase for State Farm Fire and Casualty rates.10

The balance between creating rates that are fair to policy holders, but high enough for insurers to stay in the state, will lead to interesting changes in 2024.

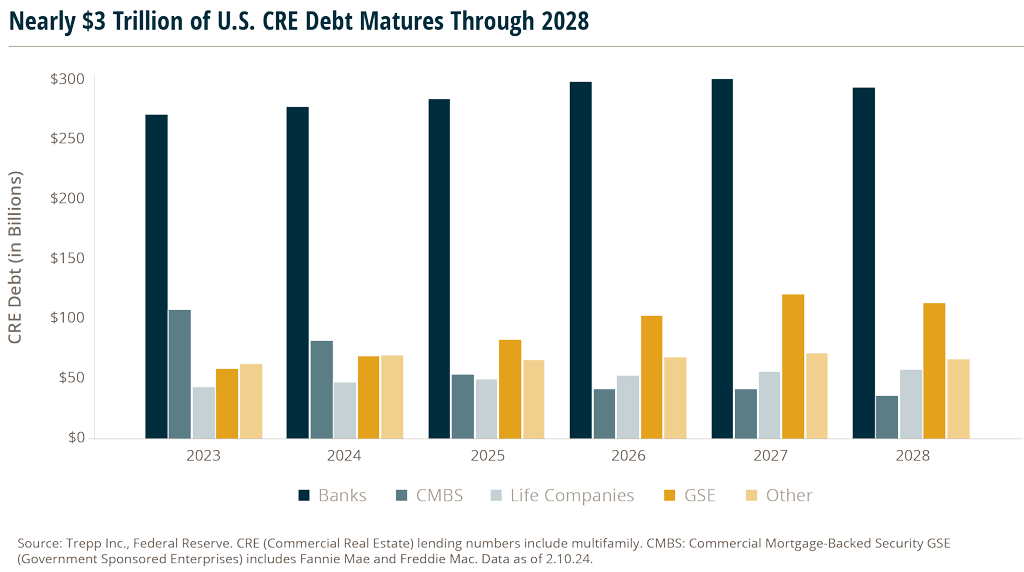

Commercial Real Estate Is a Potential Economic Headwind

The commercial real estate market is seen as a potential risk to the U.S. economy in 2024 by economists and U.S. regulators, as the sector may see greater defaults by owners facing refinancing higher rates.

About $1.2 trillion of commercial mortgages are set to mature in 2024 and 2025, which is about 25% of all outstanding commercial mortgages and the highest recorded level since 2008.11

Banks are the largest holder of these commercial mortgages. Concerns are around borrowers needing to refinance mortgages at much higher rates because of Fed rate hikes over the last few years.

The Commercial Real Estate (CRE) sector has been impacted by high interest rates, rising vacancy rates, decreased demand for office space and other large commercial spaces, and the possibility of an economic slowdown. New lending rates for commercial real estate are projected to be much higher than existing mortgage rates, posing risks for lender losses on commercial-property loans. This could impact many small- and medium-sized banks with exposure to the U.S. commercial real estate market. Banks will have about $560 billion in commercial real estate maturities by year end 2025, according to data company Trepp.

$560 billion

Amount banks will have in commercial real estate maturities by year end 2025

Impact of CRE Debt on Banks

Because of recent signs of stickier inflation and a more robust economy, the Fed may decide to cut rates at a slower pace than previously expected, increasing risks of write downs at smaller lenders and regional banks. “CRE is the largest loan category among almost one-half of U.S. banks, and more than one-quarter of U.S. banks have CRE loan portfolios that are large relative to the capital they hold,” noted the Financial Stability Oversight Council in its annual report.

Recent developments at regional bank New York Community Bancorp (NYCB) are raising concerns that other lenders could face sizeable losses linked to CRE loans. NYCB saw its share price drop sharply after its earnings release showed unexpected losses on real estate loans for office and apartment buildings. The decrease in value of the firm’s real estate loans led NYCB to cut its dividend and set aside more reserves to protect against future potential losses. Moody’s downgraded the bank’s credit grade to junk, due to the bank’s “financial, risk-management and governance challenges.”12

Insurance Industry Exposure to CRE Debt

While U.S. banks have the most exposure to CRE debt, at about 60% of CRE mortgage debt, the insurance industry has some exposure. This is concentrated in life insurance firms, due to their longer-tailed lines. However, Fitch Ratings said that the ratings of U.S. life insurers are not currently at risk from CRE exposure because of their “stable investment portfolios comprised of high-quality, diversified exposures, conservative underwriting, strong liquidity and effective asset-liability management (ALM).”13

- https://www.wsj.com/economy/consumers/what-to-watch-in-the-cpi-report-will-inflation-fall-below-3-ffc5859a

- https://www.crfb.org/blogs/2022-inflation-hit-41-year-record

- https://www.cnbc.com/2024/02/13/cpi-inflation-january-2024-consumer-prices-rose-0point3percent-in-january-more-than-expected-as-the-annual-rate-moved-to-3point1percent.html

- https://www.bloomberg.com/news/articles/2024-01-17/fed-rate-cut-wagers-for-march-may-lean-too-heavily-on-history

- https://www.bloomberg.com/news/articles/2024-02-05/powell-tells-60-minutes-fed-likely-to-wait-beyond-march-to-cut

- https://www.businessinsurance.com/article/20240131/NEWS06/912362448/Propertycasualty-underwriting-loss-expected-for-2023

- https://www.reinsurancene.ws/inflation-cat-losses-to-drive-2023-underwriting-loss-for-pc-industry/

- https://www.wsj.com/finance/insurance-companies-profits-stock-ebae7fd1

- https://www.wsj.com/finance/insurance-companies-profits-stock-ebae7fd1

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/texas-approves-36-double-digit-homeowners-insurance-rate-hikesin-q3-23-78123059

- https://www.reuters.com/markets/us/bracing-commercial-real-estate-reckoning-mcgeever-2024-02-01

- https://www.nytimes.com/2024/02/06/business/banks-real-estate-fears.html

- https://www.fitchratings.com/research/insurance/us-life-insurers-to-withstand-commercial-real-estate-deterioration-03-10-2023