Focused Insights: Achieving “Real” Organic Growth Through True Value Creation Vol III, Issue 1

In this Section

Organic growth is a deceiving, slippery slope. Especially in good times. Insurance brokerages have notoriously leaned on their organic growth as measures of their success, using it to fuel their belief that their strategic moves and decisions have paid off. But how much of that growth is coming purely from new business versus rate and exposure growth in their existing book of business?

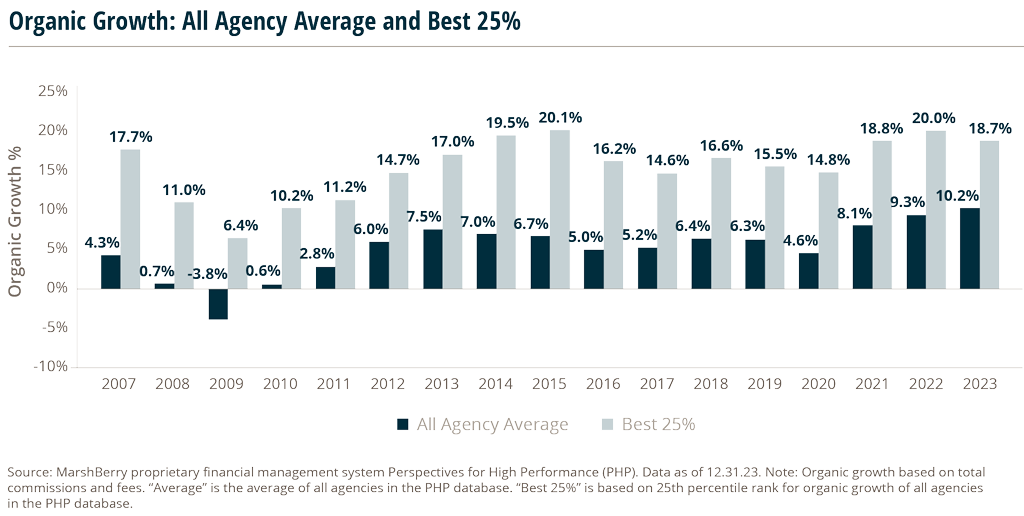

According to MarshBerry’s proprietary financial management system, Perspectives for High Performance (PHP), in 2023 the average firm achieved sales velocity (new business as a percentage of prior commission income) of 14.3% and an organic growth rate of 10.2% indicating around 4.1% leakage). But MarshBerry analysis shows that approximately seven percentage points of that 10.2% organic growth was driven by premium rate increases and exposure base growth in the existing book of business — leaving only 3.2% as “real” organic growth (10.2% minus 7%).

The reality is — many firms are naïvely sitting complacent, enjoying the fruits of a hard rate environment and economic growth that deserves most of the credit for their organic growth success. Only when this hard market tide retreats will we see which firms are truly prepared (and dressed) to face the world versus those who are swimming naked.

Peak Performers vs. Average Firms

Peak performers in this industry refuse to accept the external environment as an excuse for success or failure. Those firms that are driving double-digit organic growth have accepted one critical truth: success is defined by achieving results regardless of the cycle.

Case in point — while average firms saw organic growth of 10.2% in 2023, peak performers (the Best 25%) grew an average of 18.7%. This is where organic growth differentiation exists. These peak performers achieved outsized sales velocity (23.3%) and superior retention (leakage of only 4.6%). As a result, these firms on average are achieving “real” growth of approximately 11.7% (18.7% less the seven points related to the help from rate and exposure growth). Such firms are making strategic decisions that create more value for their firm by driving meaningful, sustainable, organic growth achieved by superior new business production and retention. These firms are driving “real” organic growth.

“Real” Predictable, Profitable, Organic Growth

Real organic growth is something that many don’t consider or even calculate. Just like calculating the “real” interest rate on an investment, you must consider the rate of inflation on the purchasing power of that investment. If you’re receiving 6% interest on your investment, but inflation is 4% — your real interest rate is 2%.

The same is true for calculating real organic growth. You must consider the impact that inflation and rate increases are having on your organic growth. Without this consideration, you’re simply sitting flat or worse, shrinking.

That’s why the mantra for peak performers is “predictable, profitable, organic growth.” These organic growth leaders have executed a plan to drive results in good times and in bad. And many are doing so by implementing a process to become a true value creation advisor.

Keys To Being a True Value Creation Advisor

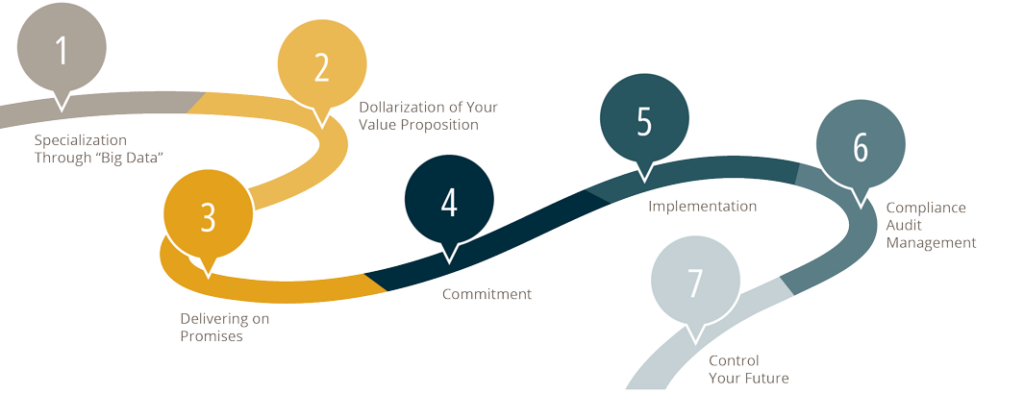

How can you put your firm in a position to control your future by achieving predictable, profitable organic growth in and out of cycle? While not an easy feat, you can achieve it if you establish a vision, develop a process, embrace consistency and make your vision come to life as your brand. The insurance brokerage industry has graduated from selling price — to selling features and benefits. However, the leaders in the industry have now gone beyond selling features and benefits — to selling outcomes. Why? Because the CEOs of your clients and prospects have the world’s shortest, three-word job description: maximize shareholder value.

If you don’t make such a transformation to helping them achieve this goal, your brokerage will be forever perceived as a vendor. The roadmap to becoming a true value creation advisory firm includes the following seven key areas of focus.

1. Specialization Through “Big Data”

Big data, specialization and predictive modeling are key to connecting risk mitigation strategies with value creation. While “big data” continues to be a buzz word, and generally relates to large pools of data, data is something insurance brokers already have within their business management system and other disparate systems. What makes it big in this case? You have it and you can use it to create, support and promote specialization. Specialization through your big data is accomplished by creating practice groups and industry verticals.

A practice group represents two or more individuals that have a unique level of skill in an area that generally cuts across industry verticals, such as captives, Directors & Officers (D&O) liability, claims management, loss control, safety, pharmacy and compliance.

Establishing expertise within one or more industry verticals is also a key ingredient to specialization. Many brokerages have industry vertical specialization but don’t know it, don’t track it, and don’t promote it. The fact is — if you write one non-profit you are a generalist. But if you write two, you are an expert. Use the power of your diverse client base and the data you capture and maintain to drive industry vertical expertise within your firm.

2. Dollarization of Your Value Proposition

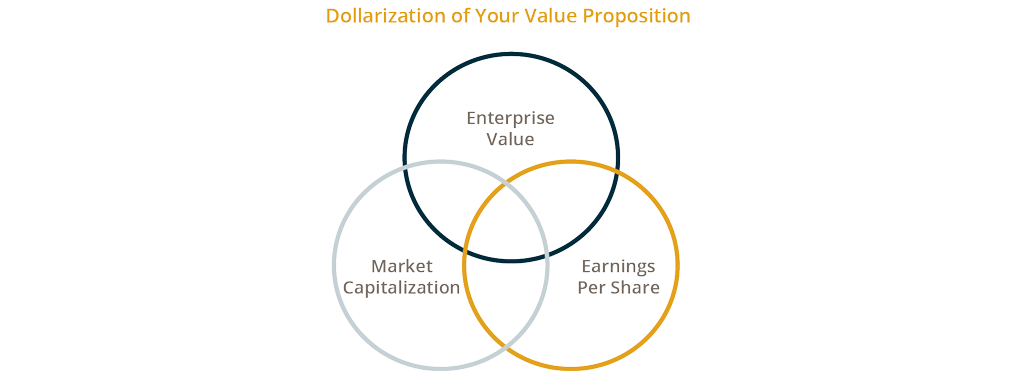

Dollarizing your value proposition to insureds is not about the cost savings — it’s about your ability to create value. It is about your ability to help the CEO do their job — maximize shareholder value.

There once was a time when the market would perceive you as unique because of a best-in-breed, value-added service platform. Today, insureds see a revolving door of producers claiming that their proprietary process and infrastructure yields a superior ability to reduce the long-term frequency and severity of claims to lower both long-term premium and ancillary costs associated with absenteeism, safety, compliance, employee morale and employee turnover. But these virtues are no longer unique in the eyes of the insured.

Peak performers have these virtues and a way to dollarize their value proposition. Dollarizing your value proposition is truly unique, as most firms have not built the process to quantify the value of the relationship with the insured. As a value creation advisor, you need to illustrate how the implementation of the solutions that you bring to bear can have a predictive impact on the insured that goes beyond the cost of risk. The dollarization of your value proposition to the insured should be measured by factors that speak to the responsibilities of the CEO directly related to increasing shareholder value (enterprise value, market capitalization and earnings per share).

If your client is in an industry where the average enterprise value is 10 times EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), a program to reduce the cost of risk by $1M will add approximately $10M to the value of their business.

This measure is different as it speaks directly to the job description of the CEO and can put you in the position to be a true trusted advisor.

3. Delivering on Promises

Once the roadmap to dollarization has been established, it is important that you deliver on your promise to achieve the action items that support the plan. The best roadmap delivers on promises through a structured service timeline, stewardship report and compliance audit management system that holds the staff of the company accountable to the insured. In today’s environment, your ability to deliver sets you apart far more than your ability to promise. Provide your clients with the following:

- Service Timeline: This is a contract with the insured that outlines the results of a detailed risk assessment, the strategic objectives of the risk mitigation program, services that will be provided, critical activities, deliverable deadlines, individuals responsible for fulfillment, mutual accountability and important measurement milestones.

- Stewardship Report: Deliver a periodic report card that provides an update on the progress toward achieving commitments captured within the service timeline.

- Compliance Audit Management Process: This is your activity tracking, reporting and accountability process that governs the service program to ensure that promises made are promises kept.

Those organizations that embrace the reality that predictable results (mitigation of risk, client satisfaction and retention) stem from properly managing the process — will likely be the leaders in the industry.

4. Commitment

To drive cultural change, commitment must come from the top. The CEOs of tomorrow’s brokerages are inspiring and requiring their teams to embrace a formalized dollarization plan, service timeline, stewardship, and compliance audit management process as the very process by which they can maximize retention and drive new business in the coming decade. Those leaders are proclaiming that a new day has dawned where the organization can drive real growth by executing a plan to provide predictable, auditable, and superior service to clients that produce superior outcomes defined as an increase in shareholder value.

But be prepared for a battle when it comes to producer acceptance of this new order. Inevitably, implementation will be plagued by a web of excuses created by legacy producers attempting to coax management to give up the mantra.

However, peak performers destroy complacency, eliminate excuses and embrace change. Leadership may also choose to implement a hammer to enforce adaptation. The hammer is simple — producers who do not comply with the non-optional behaviors required of the plan do not get paid on the account, or the commission paid to the producer on the account is at a lower rate.

Non-optional behaviors include:

- All accounts above a certain threshold must be on a dollarization plan.

- Accounts must be on a service timeline.

- Accounts must receive an annual stewardship presentation.

- The annual stewardship presentation must include a report card holding the firm and the insured accountable.

- The stewardship report card must be signed by the insured.

- A service plan for the coming year must be developed collaboratively by the producer and insured.

Peak performers are not allowing behaviors critical to account retention and new account acquisition to be left to chance.

5. Implementation

Once an institutional commitment is made to embrace client communication and accountability, the company must define an implementation process.

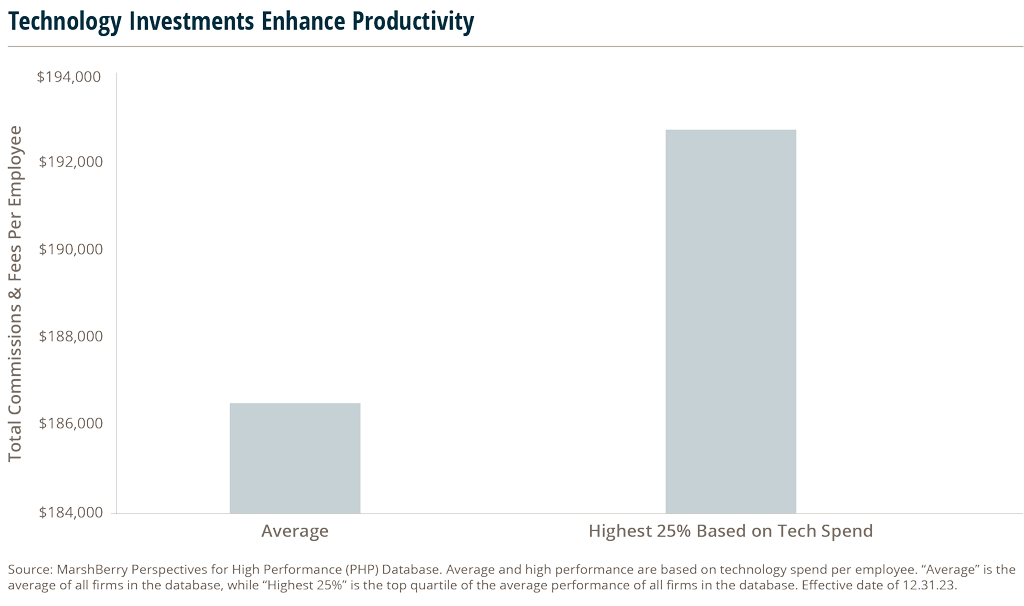

The first step is buying, or building, the technology necessary to administer such initiatives, training company personnel, overseeing the process and holding staff accountable. Organic growth and employee productivity are directly correlated with how much is spent on technology per employee. Invest the time and the capital in technology to help drive the mission and productivity.

Next, a cultural change should occur that visibly shifts the responsibility of delivering on client promises from the producer to an account executive. Producers remain as the primary relationship manager, are active in critical client meetings and keep abreast of issues — but rely on account executives to proactively manage all day-to-day activity.

Many firms call their “hunters” Account Executives (AEs) or worse yet, call their “farmers” producers, which is at the core of the problem. Peak performing firms define an AE as a highly professional service person that is proactive, external, relationship-driven, and very solid technically. These are the best farmers but NOT the best hunters. AEs generally have new business goals, but the goals are typically 25–50% of the minimum new business goal required of producers, a title reserved for only those that can, and do, hunt. The industry is plagued by AEs masquerading as, and being paid like, producers. These non-producing producers (sometimes still called “servicing producers”) restrict growth and virtually eliminate the ability to maintain margin while reinvesting in the next generation. The term “servicing producer” (or a non-performing producer that still retains the producer title) is fortunately an antiquated word that only a few survivors still extol.

Most non-producing producers, however, do not make good AEs. In high-performing firms, the AE layer enables management to give non-producing producers three options:

The days of having non-producing producers that are really shepherds over a flock of renewals, are long gone in those firms that can perpetuate, which is almost exclusively defined as firms driving predictable, profitable organic growth.

6. Compliance Audit Management

The insurance distribution industry has become very skilled in building a process to make promises but has failed to build a process to ensure delivery so that accountability and stewardship is an opportunity, not a risk.

Accountability to the insured is only realistic if implementation involves a compliance audit management system. Only then can producers and service personnel be equipped to proactively resolve delinquent service commitments and embrace accountability to the insured, which may remove any doubt as to the value the firm brings to the table.

In its simplest form, compliance audit management is a process to run ad hoc exception reports that outline upcoming service commitments and delinquent service commitments. Executive leadership in peak performing firms need to be in the position to run and review compliance audit reports on a weekly basis, manage a process to resolve delinquencies and proactively prepare for coming deadlines. Compliance audit reports are important to enabling a firm to resolve late items before an account is in jeopardy of being lost.

A well-oiled compliance audit management system enables firms to manage compliance audit scores by employee, account, niche segment, branch and book of business. Employees should be stackranked by their compliance audit score, posted, trended over time and held accountable through performance reviews and by performance-weighted bonus incentives. Audit data should drive future activity and future commitments, helping firms be more proactive in their service delivery.

7. Control Your Future

Becoming an industry vertical specialist — supported by practice groups that perform detailed risk assessments, dollarize the value proposition, and implement a risk mitigation service program captured in a signed service timeline — was once a revolutionary concept. It is rapidly becoming the price of admission.

Without a compliance audit management process, stewardship means scampering around prior to renewal trying to pull together activities on the back end only to identify failed promises that could have been addressed but were identified too late.

The importance of a value-added service timeline and stewardship reporting system is clear as it:

- Yields transparency and disclosure.

- Offers compensation justification.

- Becomes a proactive retention strategy.

- Becomes a cornerstone of new business differentiation.

- Identifies cross-selling opportunities.

- Establishes meaningful and consistent communication.

- Enables humility and voluntary accountability.

- Solidifies the road map to dollarization.

Are you a true value creation advisor to your clients?

Your goal is to be on top of the pyramid as a strategic resource and trusted advisor for your clients. Your focus should be on the “why” as opposed to the “what” and “how.” Instead of talking to the CEO about the price of insurance, coverage, value-added services or even the cost of risk — show them how your solutions can help drive shareholder value, market capitalization and the earnings per share of their company.

Today’s peak performing firms capture their “big data” that is necessary to correlate risk-related issues for their clients, while embracing dollarization and leveraging compliance auditing to ensure that promises made, are promises kept. Insureds expect service, but demand results. Become the insurance broker that leaves no promise to chance. Build the system, hold yourself accountable and control your destiny by helping your clients maximize shareholder value. That’s where “real” organic growth lives.