U.S. Macroeconomic Indicators Vol II, Issue 5

Market Trends and Current Statistics

Here are key U.S. macroeconomic indicators that are likely to impact brokerages within the insurance industry.

Bank Alternatives: Other Places To Keep Your Money

With the failures of First Republic, Silicon Valley Bank, and Signature Bank making headlines, many consumers are seeking alternatives to traditional savings and checking accounts. Other than your mattress, where can you store your money that’s not a conventional bank but still earns interest? New options seemingly surface daily.

- Some are choosing options available through their investment firm – keeping their retirement, checking, and 529 accounts at one institution. Schwab Bank offers checking and savings account options, alongside their brokerage account offerings, and has become the 12th-largest U.S. bank with assets reaching $300 billion.1 Schwab Value Advantage Money Fund – Investor Shares features a seven-day yield (without waivers) interest rate of 4.94% (as of 6/13/23).2

Tech giant Apple now offers interest-bearing savings accounts with a high-yield APY of 4.15% (as of 05/10/23) which is 10x that of the national traditional bank average.3

- Online banks, such as Ally Bank, are growing in popularity due to their lower or zero fees, higher interest rates on savings accounts, and superior web experience.

- Credit unions also offer multiple benefits, including lower fees, loan options, and higher rated customer service.4 While they operate a lot like banks, credit unions are considered not-for-profit and are owned by their members.

- Cashless transaction apps like Venmo, PayPal, and Google Pay are also popular choices due to their user-friendly platforms and strong security features. General transactions on these apps aren’t FDIC-insured, but some offer products through a partner bank that does receive FDIC protection. PayPal Savings, for example, allows users to make deposits and earn interest.

- While not a true bank alternative, cryptocurrency is gaining steam as an investment option. Visa currently has over 50 crypto wallet partners that can connect to over 70 million merchants.5 Mastercard is also entering the crypto space with their Start Path Crypto program. This program helps crypto startups gain customers and enhance their products. While some have earned millions investing in crypto, there are critics. Warren Buffett referred to Bitcoin as a worthless “gambling token.” Chief strategist of Euro Pacific Capital, Peter Schiff, believes “the Bitcoin bubble will pop before the dollar bubble.”

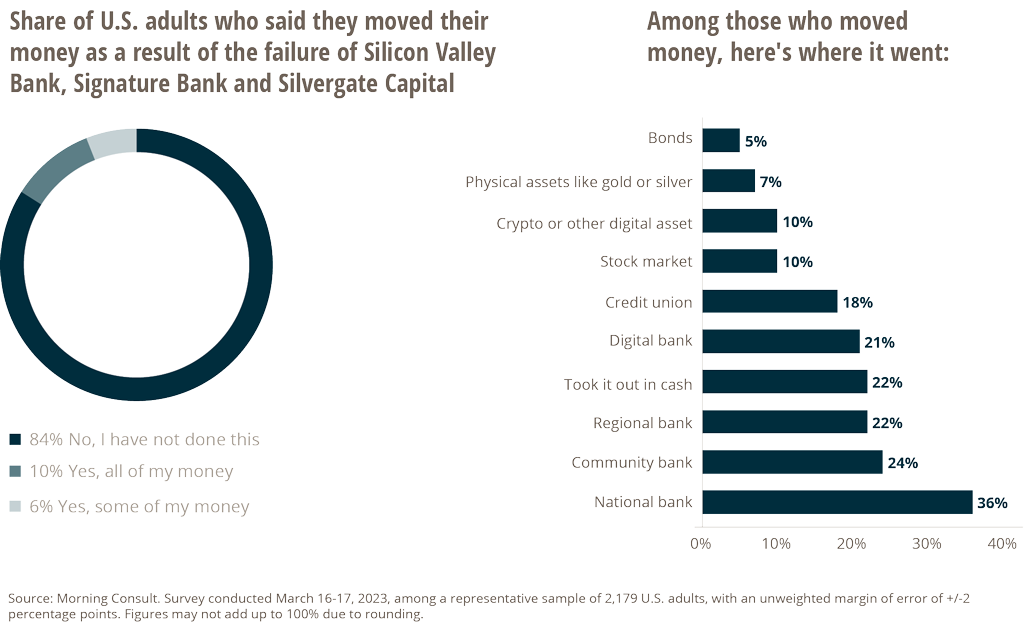

According to a survey of U.S. adults who moved their money due to bank failures, a majority moved their money to another bank, not an alternative location, demonstrating that banks are still a popular choice.

The recent failures of large-scale banks may encourage government action in the form of new regulations or penalties for bank executives. Economists are warning that the banking crisis could make a recession more likely, but there are also reports that consumer spending is up. Spending typically increases in the summer months, so there could be good news on the horizon.

Rising Demand For Gig Economy Related Policies

The rise of the gig economy, referring to the growing trend of temporary or freelance work, has significantly impacted labor markets and work standards. The gig economy is characterized by nontraditional work arrangements and increased autonomy, leaving workers with more control over their time and work allocation. Common examples include driving for delivery services such as DoorDash or ride share platforms such as Uber, but extend to the skilled labor force with “handy man” gigs on Task Rabbit and graphic design requests on platforms such as Fiverr.

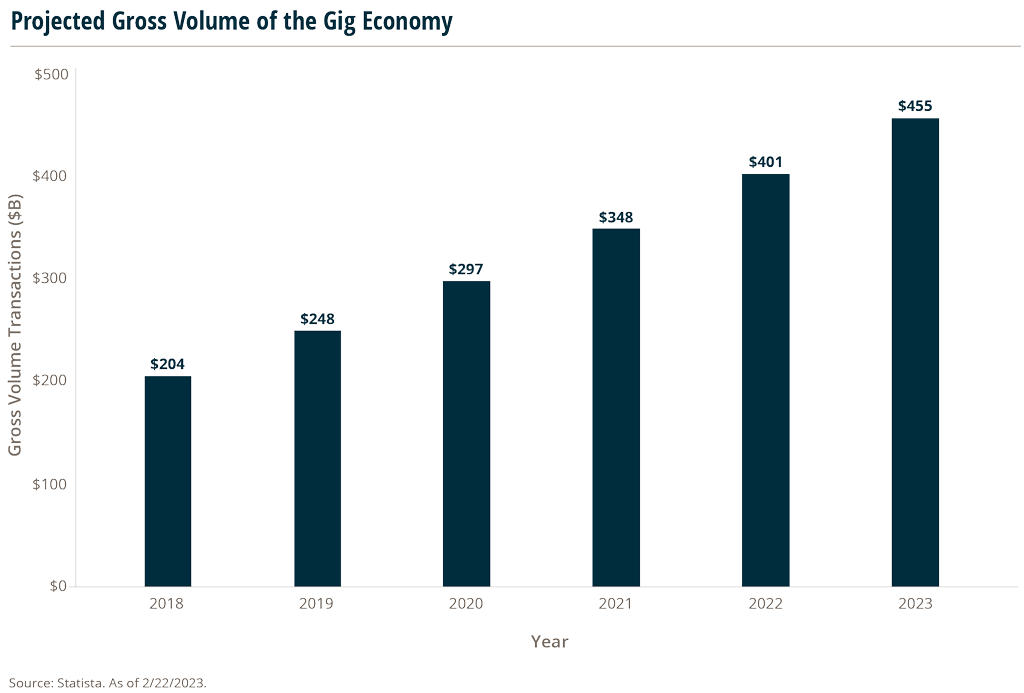

As technology advances change the workplace, the gig economy has quickly gained speed – growing three times faster than the total U.S. workforce.

By 2027 it is predicted that over 50% of the U.S. workforce will have taken part in the gig economy.6

The accelerated adoption of the gig economy has led to some growing pains. On the one hand, it has provided more flexibility and autonomy for workers who prefer non-traditional work arrangements. On the other hand, it has also contributed to income insecurity and inequality and raised issues with workers’ rights, as many gig-based jobs do not offer the same benefits or job security as traditional employment.

In response to these challenges, new insurance products are emerging that cater specifically to the needs of gig economy workers. These policies offer protection from the increased risks and uncertainties faced by gig workers and reflect the changing nature of work.

- Short-term disability insurance: Because they are self-employed through short-term contracts, disability insurance provides income replacement in the case individuals are unable to work.

- Liability insurance: Because many gig workers operate their own business, policies might be needed to protect them against claims of damage or injury to others.

- Pay-as-you-go insurance: Also known as usage-based insurance, this is based on the actual usage or risk of a particular activity or asset where premiums vary. This can be beneficial for gig workers whose workload and client numbers vary, leading to a need for adaptable liability policies. This is also an affordable way to get coverage for those who do not have the same financial stability or predictability as traditional employees.

- Cyber insurance: Gig workers who handle sensitive data, such as personal or financial information, may need cyber insurance to protect against data breaches or other cybersecurity threats.

As the industry grows and matures, identifying and mitigating associated risks will also grow in popularity and necessity. The current gig economy generates $204B in gross volume6, opening new avenues for brokers to explore, ripe with new markets and product offerings.

The Public Health Emergency On Covid-19 Has Expired, But Its Impact Still Lingers

On May 11, the U.S. COVID-19 public health emergency expired. Coverage for COVID-19 treatments, vaccines, and tests have been reduced and services like telehealth visits may see increased out-of-pocket costs. A major impact will be the availability of coronavirus tests — both at-home tests and those performed by medical experts, causing delays in COVID-19 diagnoses and data collection. However, according to Dr. Nirav Shah, the CDC’s Principal Deputy Director, “Our ability to detect and monitor disease threats should be better in the future than it has been in the past. And that ability to detect and monitor should be built into our baseline and not contingent upon emergency declarations.”

Potential change to remote work policies

Remote work may be affected by the expiration of the COVID-19 public health emergency – as some companies are already reducing remote options because they feel there’s less need for flexibility.

COVID-19 changed how offices function in general, including socially distanced desks, endless supplies of hand sanitizer, and a surge in Zoom calls. But post-pandemic, some companies are modifying how they use their offices or even selling office spaces altogether.

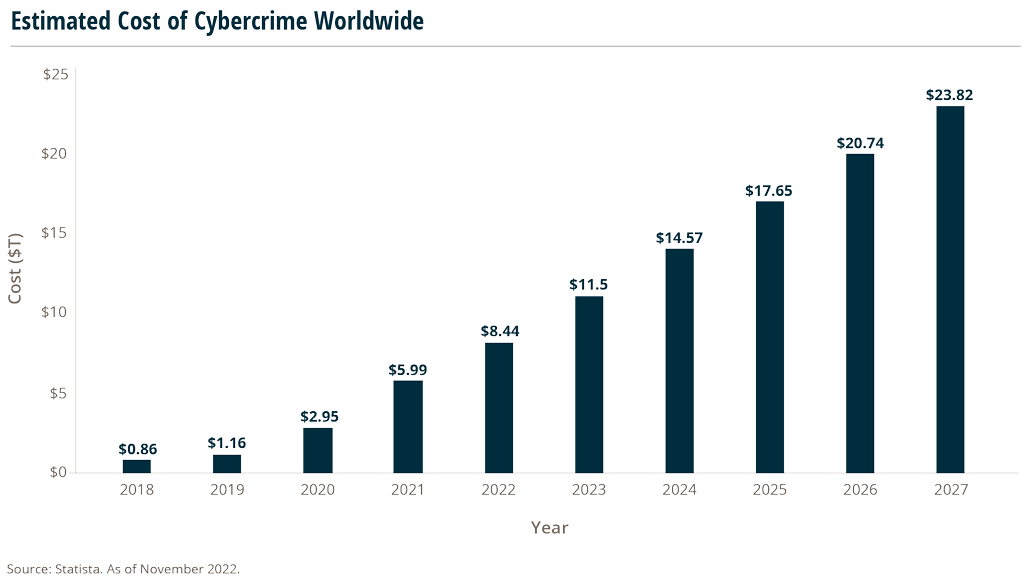

A rise in cybercrime

Another ongoing impact from the pandemic is cybercrime. With the rise in remote work and telehealth visits, cyber fraud and threats have increased over the past two years.7

The insurance industry in particular has been hit hard with 82% of the largest carriers having been targeted by cyber criminals.8 Improving overall cyber security practices and the availability of insurance coverage will continue to be a priority for businesses in 2023.

2 https://www.schwab.com/money-market-funds

4 https://www.palisadesfcu.org/blog/benefits-of-joining-a-credit-union

5 https://www.coinbase.com/learn/crypto-basics/can-crypto-really-replace-your-bank

6 https://teamstage.io/gig-economy-statistics/

7 https://www.jdsupra.com/legalnews/end-of-an-era-covid-19-public-health

8 https://www.techrepublic.com/article/insurance-industry-being-ravaged-by-high-rate-of-cyberattacks/