Focused Insights: Global M&A Trends Are Mixed, While Insurance Brokerage Deals And Values Hold Steady Vol II, Issue 5

In this Section

Global merger and acquisition (M&A) activity is declining in the shadow of an economic environment that is seeing a rising cost of capital, a slowing economy and a possible recession. Since the record-breaking number of global M&A transactions of 2021, deal values have decreased in nearly all major industries through the first quarter of 2023. But the insurance brokerage M&A space is bucking that trend.

Global M&A deal volume and values at a crossroads

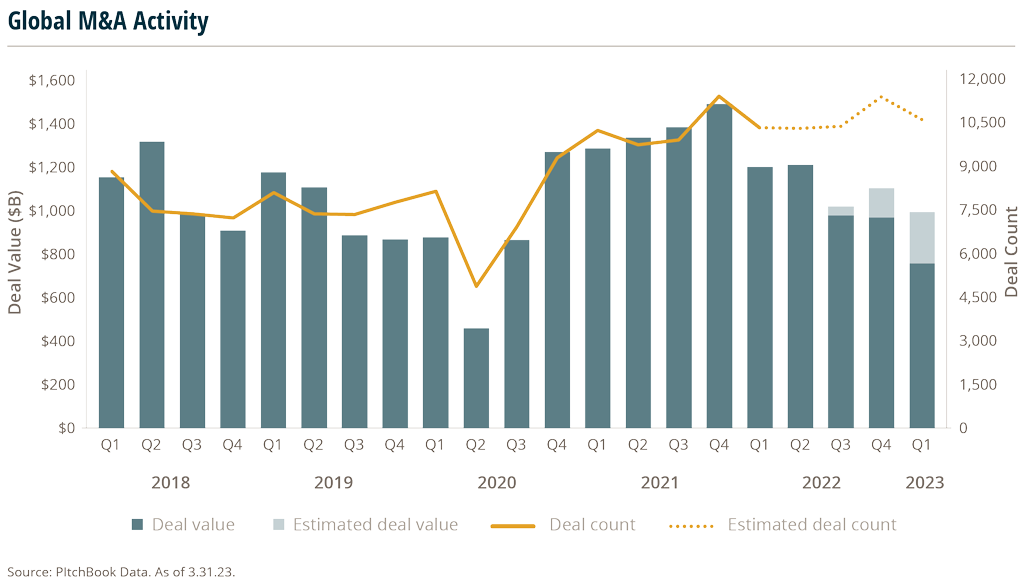

Global M&A deal volume rose slightly over the last five quarters, with deal counts for 2022 still being finalized and projected to slightly exceed 2021’s total number of deals by 3% (42,431 deals vs. 41,321 deals). This trend continued into 2023, with announced collective global deal counts in Q1 2023 estimated to exceed those in Q1 2022 by 3% (10,652 deals vs. 10,336 deals).1

However, global M&A deal valuations are headed in a different direction. Since the high-water mark of Q4 2021, which saw nearly $1.49 trillion in collective deal value across 11,420 total transactions – the global M&A market hasn’t exceeded $1.21 trillion in value since Q2 2022.

Q1 2023 is projected to deliver the lowest global M&A deal value total since the pandemic – and down 33% from the high-water mark set in Q4 2021.1

Pressured by the global economic headwinds of high inflation, high interest rates, and tighter credit markets – acquirers are showing signs of being more selective and putting downward pressure on valuations. The market conditions may also be pushing some companies into distressed situations, forcing their hands to seek partners at discounted valuations.

Additionally, there are some indications that the buyer crowd is thinning. Some buyers have publicly declared their desire to sit on the sidelines and watch economic conditions unfold, leveling the supply and demand playing field a bit. This has naturally led to deeper valuation scrutiny.

Insurance brokerage M&A deal volume and values aren’t slowing as much as other industries

The U.S. insurance brokerage M&A sector comprises only about 2% of the global M&A market. However, this market share has doubled since 2012 (when it accounted for only 1% of total transactions).

The global M&A market, as reported by Pitchbook, is broken down into seven sectors: business products & services (B2B), consumer products & services (B2C), energy, financial services, health care, IT and materials & resources. Insurance brokerage represents a sub-sector of financial services.

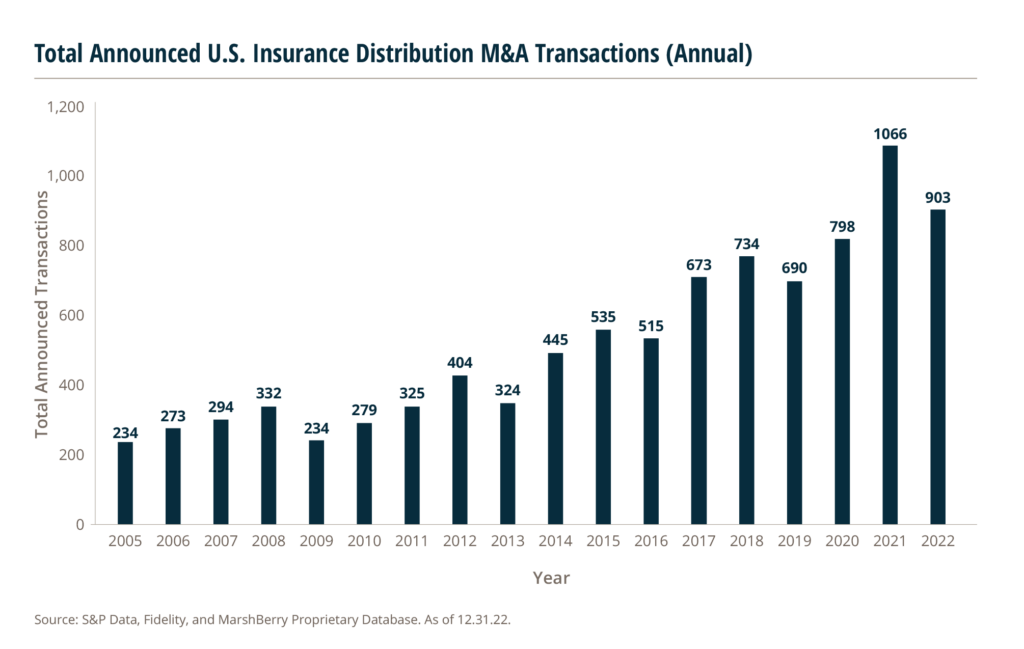

In 2022, the 903 announced insurance brokerage transactions represented a 112% increase since 2012. Comparatively, the collective global M&A market in 2022 only saw a 41% increase in total deals since 2012.

That number is buoyed by the IT and health care sectors which saw 96% and 65% deal volume growth, respectively, over the 10-year span. But other sectors have declined compared to 2012, such as the energy sector (down 3%) and the materials & resources sector (down 12%).2

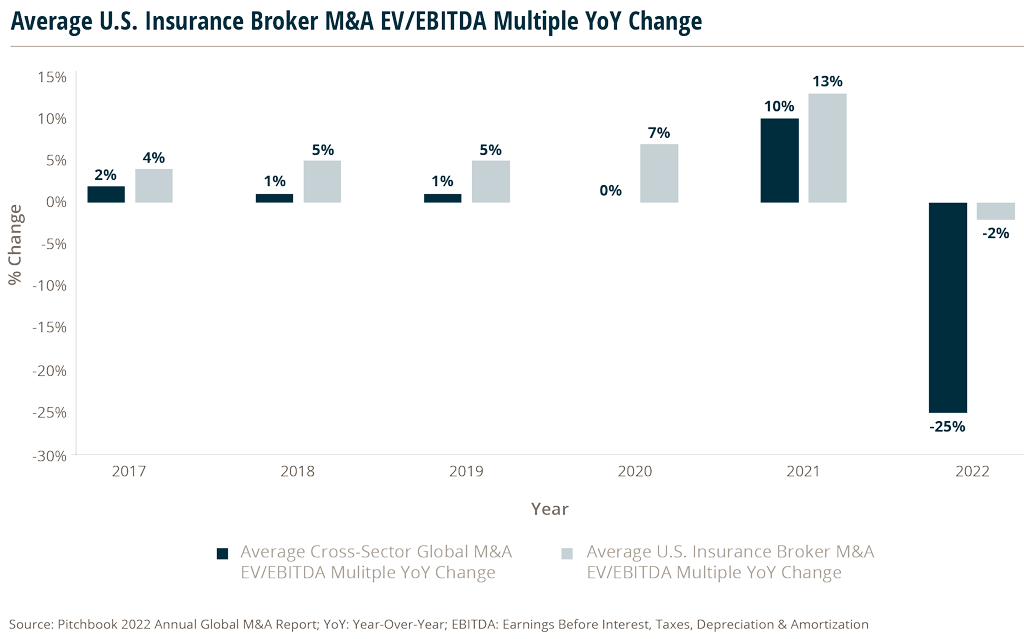

Collective global M&A deal valuations, as measured by the Enterprise Value (EV) to Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) ratio, have displayed some year-over-year (YoY) volatility. YoY changes in this multiple for average collective global M&A had been relatively flat from 2017-2020. But in the record-breaking year of 2021, multiples spiked, only to plummet in 2022. Each sector has been affected differently by the global economic factors of supply and demand, supply chain issues, industry regulations and geopolitical events.

In comparison, the U.S. insurance brokerage industry has remained consistently positive in its YoY EV/EBITDA multiple growth, even increasing 7% in 2020’s COVID year, while the collective index dropped 3%. In 2021, while all industries saw a surge in EV/EBITDA multiples, the insurance brokerage industry outperformed the collective index (13% vs. 10%). In 2022, insurance brokerage displayed great resiliency with an immaterial decline in multiple values of 2%, as the collective index dropped 25%.

M&A activity in Q1 2023 for insurance brokerage started the year off strong for both volume and valuations – showing continued resistance to the surrounding economic factors.

Publicly traded insurance broker Brown & Brown, Inc. (BRO) recently noted in its Q1 2023 earnings call that M&A volume was somewhat slower for the industry, but that high-quality companies are still trading at similar multiples seen in 2022. BRO CEO, President & Director J. Powell Brown stated: “As it relates to the overall M&A market, the level of deals primarily from financial backers has slowed. That does not mean high-quality businesses don’t trade at similar multiples to what we’ve seen over the past year.”3

Why are insurance brokerage M&A values growing?

The rapid consolidation of the insurance brokerage industry has been driven by extreme market competition and strategic expansion goals. Firms are looking for ways to access new markets, gain operational efficiencies and to enhance service capabilities.

As the global economy grows, and as risks increase due to environmental changes, technology advancement and social impacts, so does the need for insurance protection. These factors continue to create opportunities for insurers to expand into new markets and attract more customers.

As insurance brokers look to expand their reach and their capabilities in order to stay competitive, one of the fastest ways is through partnerships with other firms. That may mean acquiring other companies (and not necessarily other insurance brokers) or by accepting investments from other firms.

As the complexity of the insurance landscape increases, it becomes difficult for smaller firms to stay competitive on their own. They either need to develop unique offerings and become specialists, or they can merge with, or acquire, other agencies to gain access to new products and services – or become acquired themselves.

Lastly, as the insurance industry has proven for decades, it is a resilient industry that continues to be a good investment. Over the last several years, this reputation has attracted interest and investments by private equity (PE) firms, creating an even more competitive marketplace for insurance agencies.

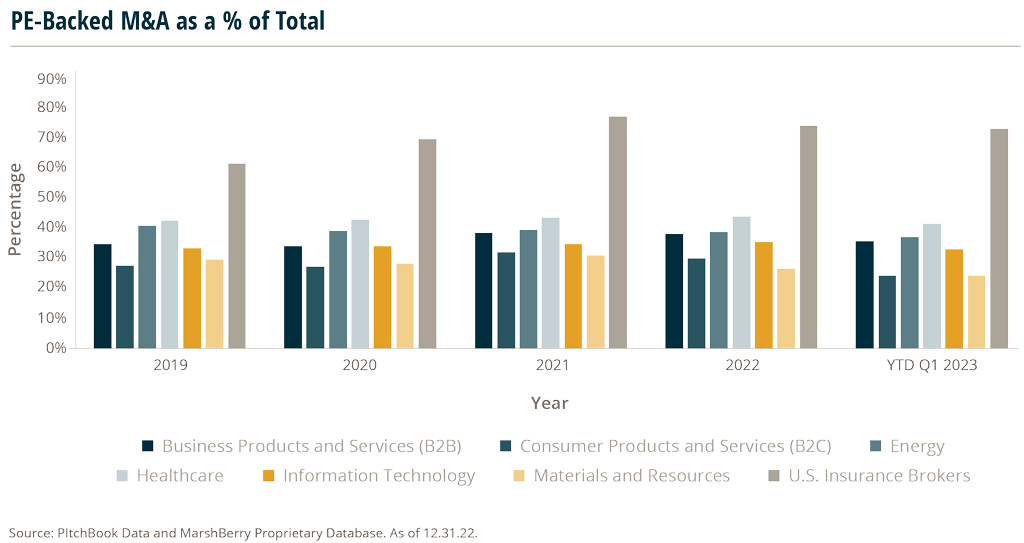

PE-backed buyers have consistently accounted for over 70% of insurance brokerage transactions for the past three years. This is nearly double the percentage of PE-backed acquisitions within other sectors. Insurance brokerage deals involving PE buyers have increased at a Compound Annual Growth Rate (CAGR) of 11.1% since 2018.

PE-backed buyers have recognized the growth potential in insurance brokerages, as well as the substantial number of small and medium-sized firms operating independently. These represent an opportunity to consolidate fragmented entities into larger, more efficient organizations, that can expand their client base, cross-sell additional insurance products, and explore new markets. And with the predictable, recurring revenue model, due to the renewal nature of insurance – this industry is a stable, longer-term investment for PE firms looking to diversify during turbulent times.

The role of specialty insurance in M&A volume and values

Another factor driving M&A activity and higher valuations in the insurance brokerage space is the acquisition of specialty distributors by large brokerage firms. Many of these firms have a retail and specialty division, the latter of which is made up of programs, managing general agents (MGAs), managing general underwriters (MGUs), general binding facilities and wholesale brokerage talent. Furthermore, some of the more progressive firms have made investments in alternative risk solutions, such as captive managers. This type of specialty rollup strategy has fueled M&A activity in the delegated authority segment and has caused comparably sized well-run specialty firms to be valued at a premium vs. their retail broker counterparts.

How can firms better compete in a tough market?

While there are challenges in the current environment, insurance brokerages can take proactive steps to maximize their organic growth, boost their competitiveness, and improve their attractiveness in a more selective M&A environment. Here are some strategies that firms of all sizes should consider:

- Commit to an aggressive talent reinvestment plan that includes hiring and promoting colleagues internally.

- Reassess your capital structure to build capacity and liquidity for growth.

- Re-think your risk tolerance as it relates to debt and leverage.

- Find leadership that can clearly articulate and execute on the vision of the agency/brokerage.

- Build a meaningful client value proposition that is most likely supported by technology, which translates into higher quality experiences.

- Invest in technology upgrades.

During these uncertain times, the insurance brokerage industry continues to show strength and resiliency, while the collective global M&A market appears to be softening. Insurance brokerage firms are in a key position to continue to reinforce and improve their value propositions in this interesting economic environment.

Sources:

1 https://pitchbook.com/news/articles/mergers-acquisitions-deals-valuations-Q1-2023

2 https://files.pitchbook.com/website/files/pdf/Q1_2023_Global_MA_Report.pdf

3 https://finance.yahoo.comnews/brown-brown-inc-nyse-bro-125634906.html