Public Broker Performance Vol II, Issue 5

In this Section

MarshBerry Broker Index

Get the latest performance and insights on the public broker composite.

MarshBerry Broker Composite Index May Update

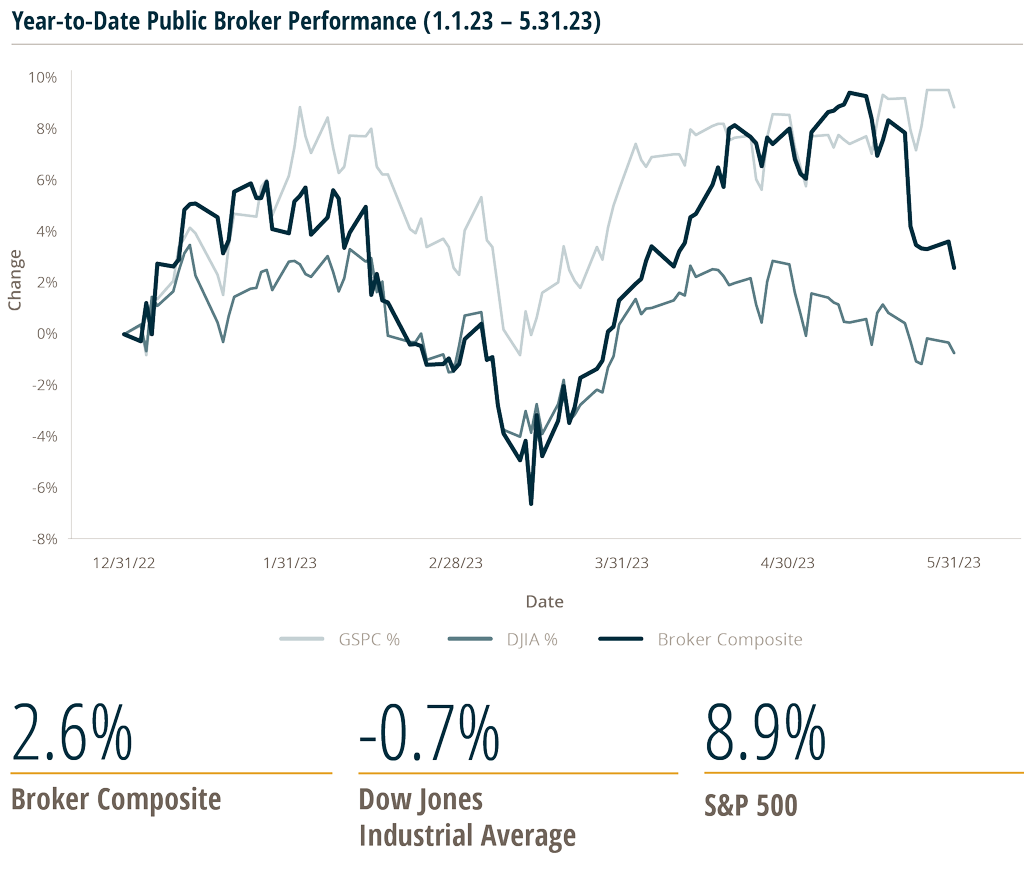

During the period from January 1 to May 31, 2023, six public brokers, as measured by MarshBerry’s Broker Index (MBI), saw a better return vs. the Dow Jones Industrial Average (DJIA). The MBI delivered a 2.6% gain YTD, while the DJIA saw a 0.7% decline. The S&P 500 index outperformed both the MBI and the DJIA, with an 8.9% return for the same period.

The following publicly traded insurance brokers are included in the MBI: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP).

Public brokers continue their steady performance in 2023

The share prices of the public insurance brokers remain stable YTD through May 2023, helped by their strong business models and resilience in many market environments. However, many factors affected the broader stock market, including discussions around the U.S. debt ceiling (with a resolution in late May/early June), regional banking and debt issues, a potential Fed interest rate pause, and optimism around AI.

Public brokers have larger recurring revenue bases and businesses that are noncyclical, supporting more stable growth during downturns. They are also continuing to benefit from higher insurance rates and strong demand, driving rising organic growth rates.

While public insurance brokers cited ongoing macroeconomic concerns on the most recent Q1 2023 earnings reports, they were confident in their continued growth and ability to meet 2023 growth targets. Organic growth figures reported in Q1 2023 were comparable to slightly higher than those seen in the prior Q4 2022. Most brokers reported organic growth rates in a range of 7%-13%; compared to 5%-12% in Q4 2022.

Management at many brokerages generally remained optimistic around their projected results in 2023. AJG Chairman, President and CEO J. Patrick Gallagher stated on the firm’s Q1 2023 earnings conference call: “We also remain optimistic on our customers’ business activity during ’23. We have yet to see any significant shifts in our daily indications of client business activity thus far in April. We are also seeing encouraging employment levels for our benefits clients, suggesting the economic backdrop for ’23 remains broadly favorable.”

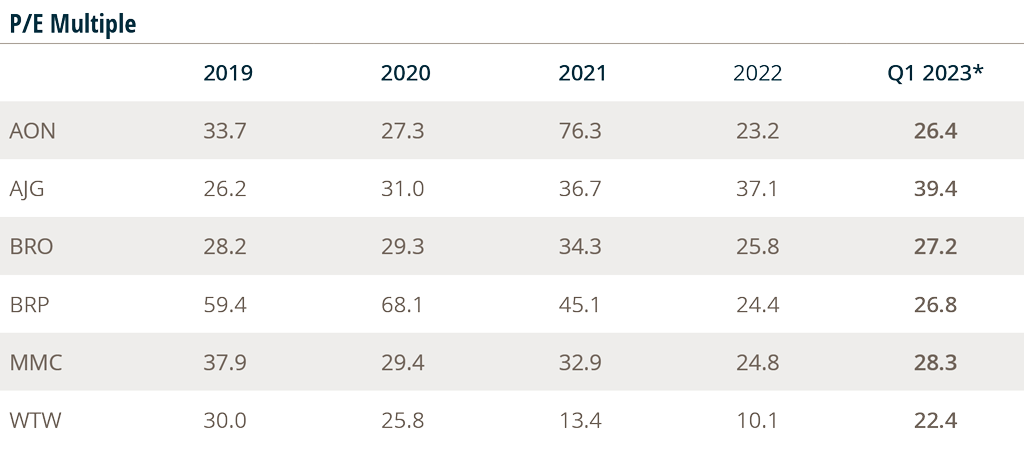

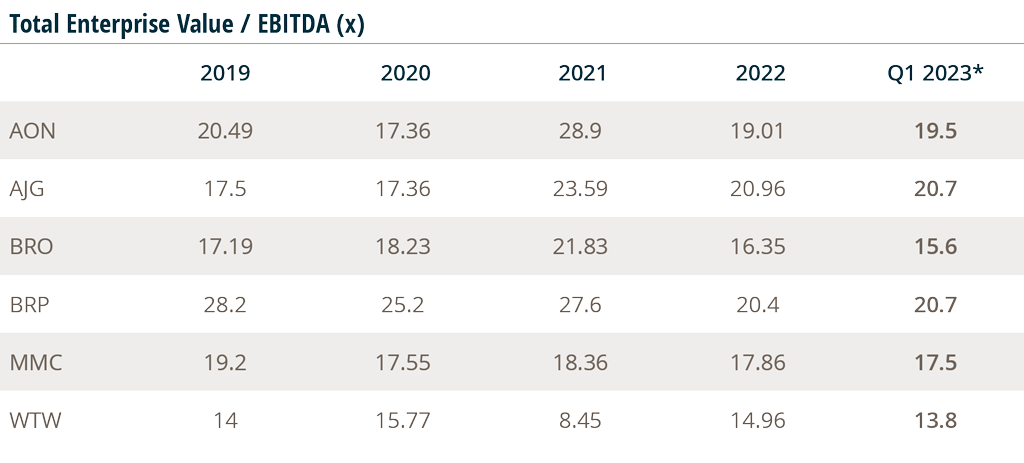

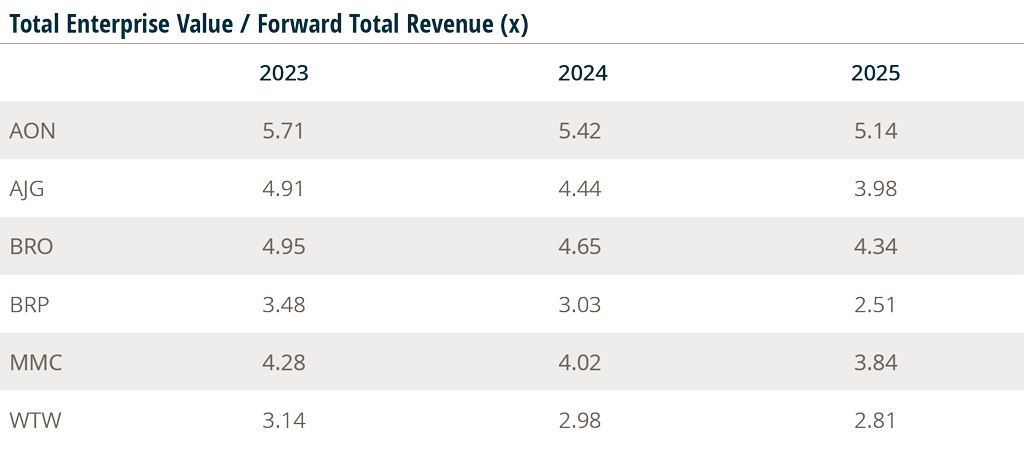

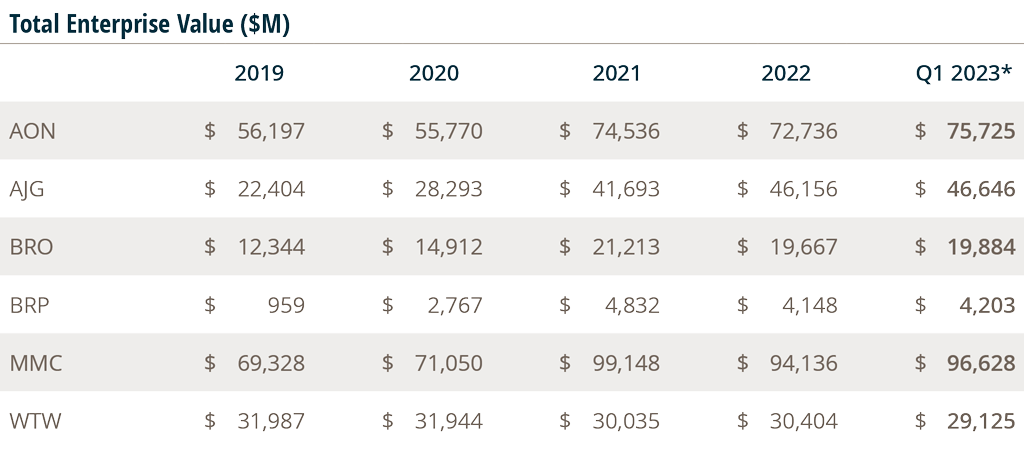

Public Broker Comps

The MarshBerry Broker Index is a composite of market data on the following companies, sourced from Yahoo Finance: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only. This information is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy.

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.