M&A Market Update Vol II, Issue 5

In this Section

The Latest Deals and Insights

Who’s buying? Who’s selling? And why should you care? Phil Trem, MarshBerry’s President of Financial Advisory, highlights the current M&A market and provides a look at transactions in June 2023.

High Demand For Insurance Brokerages Keeps Valuations Strong

As private capital-backed buyers kick the tires of potential targets and become more stringent in their due diligence process, they are starting to ask the question “Why are valuations for insurance brokerages still so high?” In this struggling economic environment, it’s a good question. The answer is – demand.

There continues to be significant demand for both insurance coverage and for the insurance brokerage firms who can provide that coverage. Showing once again, even during the most volatile times, the important role insurance plays in keeping businesses and individuals moving forward.

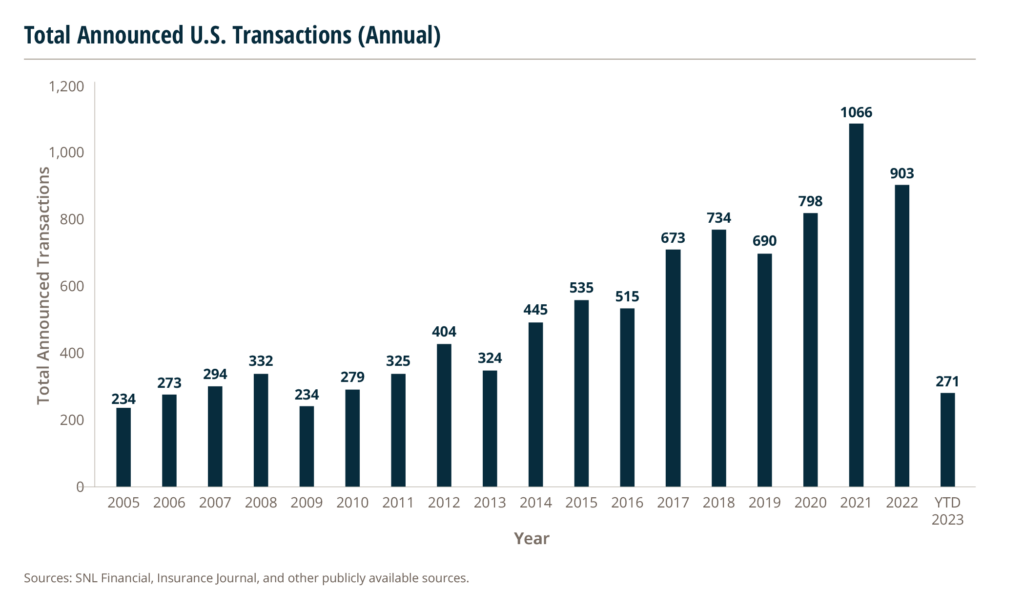

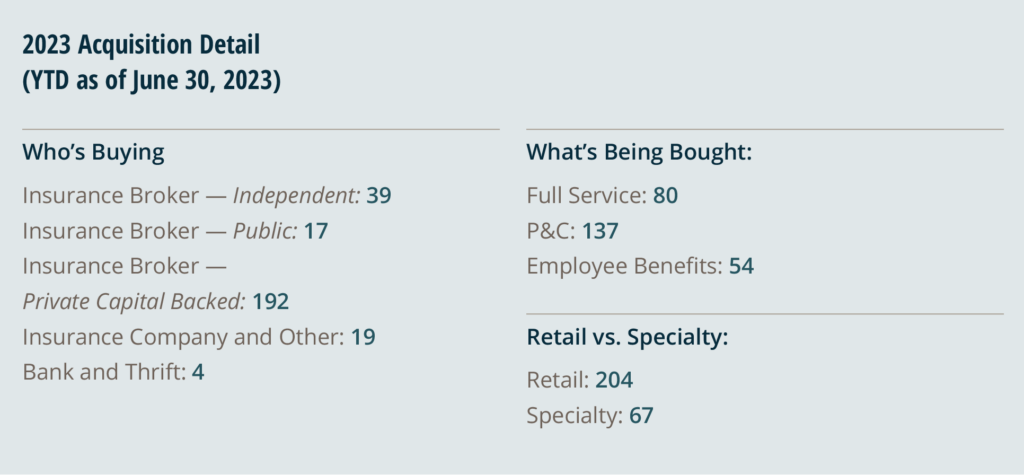

Through June 30, 2023, there have been 271 announced merger & acquisition (M&A) transactions in the U.S.

Private capital-backed buyers have accounted for 192 of the 271 transactions (70.8%) through June, which is consistent with the proportion of announced transactions over the last 5 years. Total deals by these buyers increased at a compound annual growth rate (CAGR) of 11.1% from 2018 to 2022, with a marked increase after the onset of the pandemic.

Deals involving specialty distributors as targets accounted for 67 transactions (or 25.0%) of the total 271 deals in 2023 – a six percentage point increase in transaction share over 2022. Specialty firm deals have increased by a CAGR of 22% from 2018 through 2022, a trend that is anticipated to continue as traditional retail brokers expand into the wholesale and delegated authority space.

Independent agencies accounted for 14.4% of the total year-to-date (YTD) transactions – down from 17.2% in 2022. High valuations, coupled with limited availability of capital, are likely contributing to this decline in overall share of transactions.

Deal activity from the marketplace’s most active acquirers has remained strong in 2023. Ten buyers have accounted for 49.1% of all announced transactions, while the top four (BroadStreet Partners, Hub International, Inszone and Risk Strategies Company) account for 28.0% of the 271 total transactions.

Notable transactions:

- June 1: Breckenridge IS, Inc., announced that it has sold the two entities comprising its Insurance Services Division to Accretive Insurance Solutions. The Insurance Services Division specializes in P&C wholesale brokerage, as well as program administration. Over the last several years, Breckenridge Insurance Services has seen strong growth in a number of market segments.

- June 8: Hub International Limited announced that it has acquired Project Motown Holding Co, an agency platform that owns seven agencies. As a whole, Project Motown has more than 60 employees and specializes in commercial coverage, employee benefits, employer compliance requirements, human resources technology, employee wellness and wealth management services

- June 30: Risk Strategies and Premier Financial Corporation announced that Risk Strategies has acquired First Insurance Group from Premier Financial Corp., (Nasdaq: PFC). Premier Financial Corp is a community banking and financial services holding company based in Defiance, Ohio, while First Insurance Group is one of the largest multiline agencies in Ohio. The agency will continue to operate as First Insurance Group, a division of Risk Strategies.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co., LLC. 28601 Chagrin Blvd., Suite 400, Woodmere, Ohio 44122 (440.354.3230)

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2022 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.