Industry Insights Vol II, Issue 4

MarshBerry’s Perspectives for High Performance (PHP)

Insights from our proprietary financial database to help drive your business.

Emerging Lines Of Business: The Rapid Growth Of Cyber And Pet Insurance

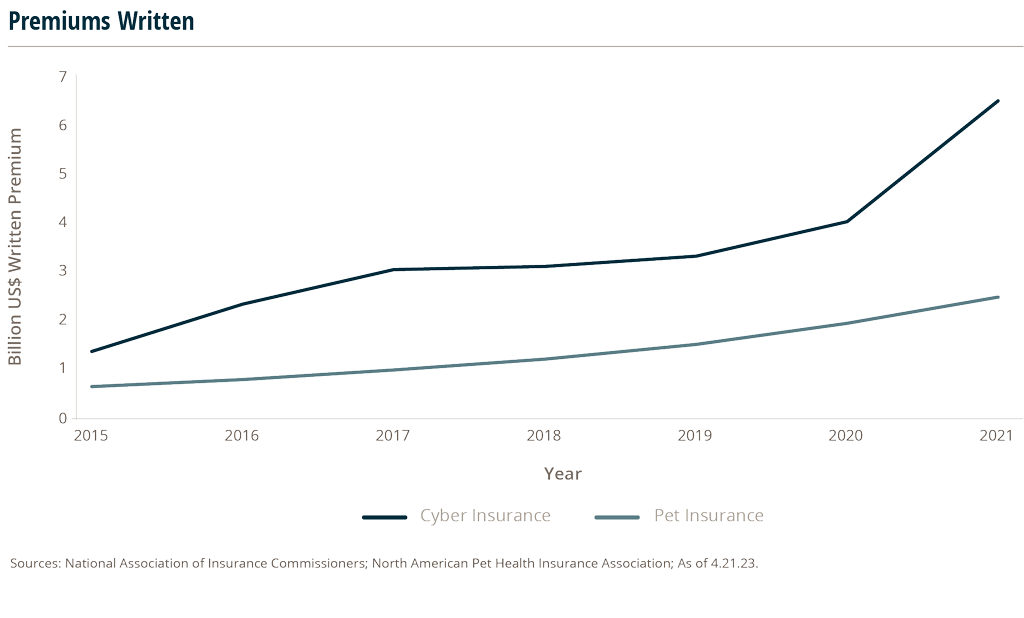

Over the course of the last decade, several lines of business have emerged in insurance that have grown from niche to high-demand products. Two of the more trendy lines – Cyber insurance and pet insurance – have shown impressive growth since 2015.

Cyber insurance has risen from a total direct written premium volume of $1.4 billion reported to NAIC in 2015 to $6.5 billion in 2021, a compounded annual growth rate of 29.1%. While there had been general awareness for solid cyber security practices – the steep increase in reliance on technology in all industries as a result of the COVID-19, and the increase in the severity and frequency of cyberattacks has resulted in a surge in demand for coverage.1

In 2021, direct written premium volume for cyber insurance rose 61% from 2020 levels and premium rate increases peaked at a reported average of 34.3% in the 4th quarter of 2021.

Another product that has seen a surge in demand in recent years is pet insurance. A movement across many industries in recent years has been that of pet products following trends in human markets. U.S. consumers have increasingly treated their furry companions as family members and have become willing to spend more on them.

Total gross written premium volume for pet insurance in the U.S. reached $2.5 billion in 2021, up from $499.8 million in 2013, which results in a compounded annual growth rate of 22.4%.2

North American Pet Health Insurance Association (NAPHIA)

While it functions in a way similar to health insurance, pet insurance is classified as a P&C line of business and is regulated as such. While the total number of pets insured has been climbing along with total written premiums, the NAPHIA estimates just less of 2.5% of pets in the U.S. are covered by insurance, leaving plenty of opportunity for growth. Additionally, while pet insurance is being purchased as personal lines policies, it has also increasingly become offered as an employee benefit as companies have sought created routes to attract and retain talent.

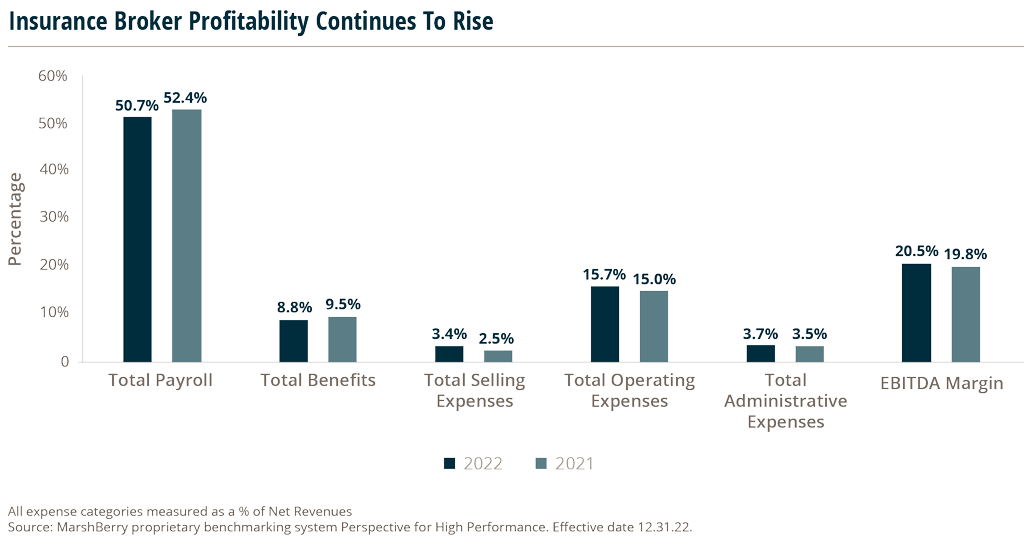

Insurance Broker Profitability Is Close To All-time Highs

Amidst 2022’s challenging global macroeconomic environment that included Federal Reserve (Fed) interest rate hikes, continued high inflation, and a slowing economy, insurance brokers still managed to achieve EBITDA (earnings before interest, taxes, depreciation, and amortization) margins near all-time highs.

Based on MarshBerry data, for the average firm, 2022 EBITDA margin improved 70 basis points over the prior year to 20.5%. In fact, over the past 25 years, agency profitability has nearly doubled.

Insurance brokers have been successful at managing compensation expenses, one of their largest expenses. Despite a tight labor market in 2022, the average broker was able to rein in compensation costs, with both payroll and benefits expenses declining over the past year as a percent of net revenue. Executive and service payroll saw slight decreases, while production and support payroll were close to flat.

Although the data shows that some other expense line items increased, this was not enough to offset improved compensation expenses and strong top-line growth. One area that saw an increase was selling expenses, which increased as business travel returned to pre-pandemic levels. Operating and administrative expenses saw a slight uptick as well. Changes were slight but broad-based across all operating expenses, indicating rising costs possibly due to inflation.

It will be interesting to see if insurance brokers are able to sustain these strong margins in the face of continued inflation and an ongoing tight labor market. March 2023 jobs data indicated that the labor market may be cooling – with 236,000 jobs added, the smallest in two years. However, the unemployment rate ticked down to 3.5%, from February’s 3.6%.3 It remains to be seen whether the labor market will cool even further this year in the face of a potential recession. That could give brokers even more wiggle room around their compensation expenses.

Sources:

1 https://www.ciab.com/download/33125/?tmstv=1682103589

2 https://naphia.org/industry-data/section-1-gross-written-premium/

3 https://www.wsj.com/articles/march-jobs-report-unemployment-rate-economy-growth-2023-3338931f