U.S. Macroeconomic Indicators Vol II, Issue 4

Market Trends and Current Statistics

Here are key U.S. macroeconomic indicators that are likely to impact brokerages within the insurance industry.

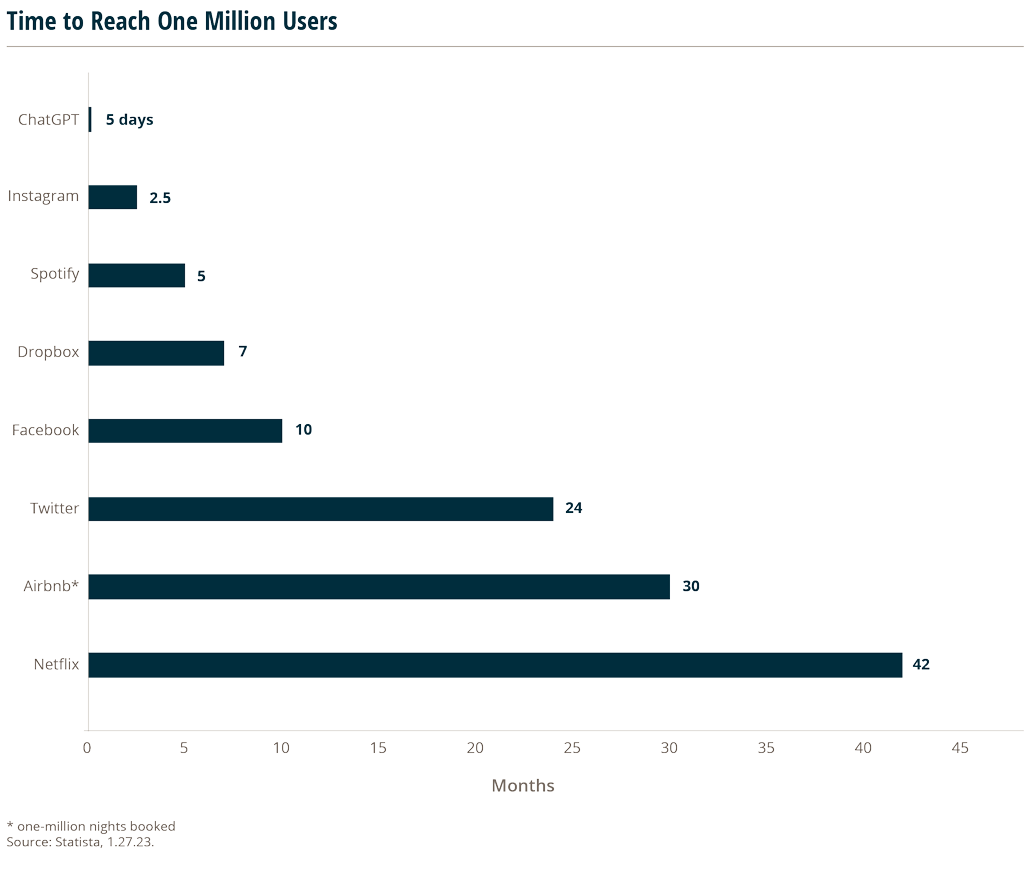

ChatGPT and the insurance industry

ChatGPT is an artificial intelligence chatbot that launched in November 2022. Its main purpose is to create human-like text and it’s been used in industries like healthcare, education, and even religion. Now ChatGPT is gaining momentum in the insurance industry. During the Insurtech Insights Europe conference, the chatbot demonstrated how it can answer basic insurance questions, keep insurers informed of emerging trends, and delve into customer needs. Swiss insurance firm Zurich has started experimenting with the technology to uncover efficiencies in areas like data analysis, the claims process, and fraud.1

While its popularity skyrocketed, ChatGPT has its fair share of criticism. The technology doesn’t have enough expertise to draft complex or technical documents, such as policy wordings.2 Some point to its lack of humanity as problematic, particularly in professions where empathy is necessary, which includes insurance. Italy has gone as far as banning the technology, with regulators citing their concern that there “appears to be no legal basis underpinning the massive collection and processing of personal data in order to ‘train’ the algorithms on which the platform relies.”3 Other critics indicate the tool’s ethical challenges, such as its tendency to take on biases or prejudices, depending on how it’s programed.4

ChatGPT isn’t the only option for this type of technology. Competitors like Jasper, YouChat, or Chatsonic aren’t receiving the same buzz, but have similar features.5 Jasper, for example, is designed purely for businesses and can support functions like marketing, sales, and internal communications.6

There is most likely a future for ChatGPT in business, including insurance, but merely as an additional tool, not as a replacement for human-owned functions (meaning jobs like underwriting are safe).

And since, at least for the time being, experts have cautioned users to double check its results7, the technology will require more testing and investigation before it gains widespread use.

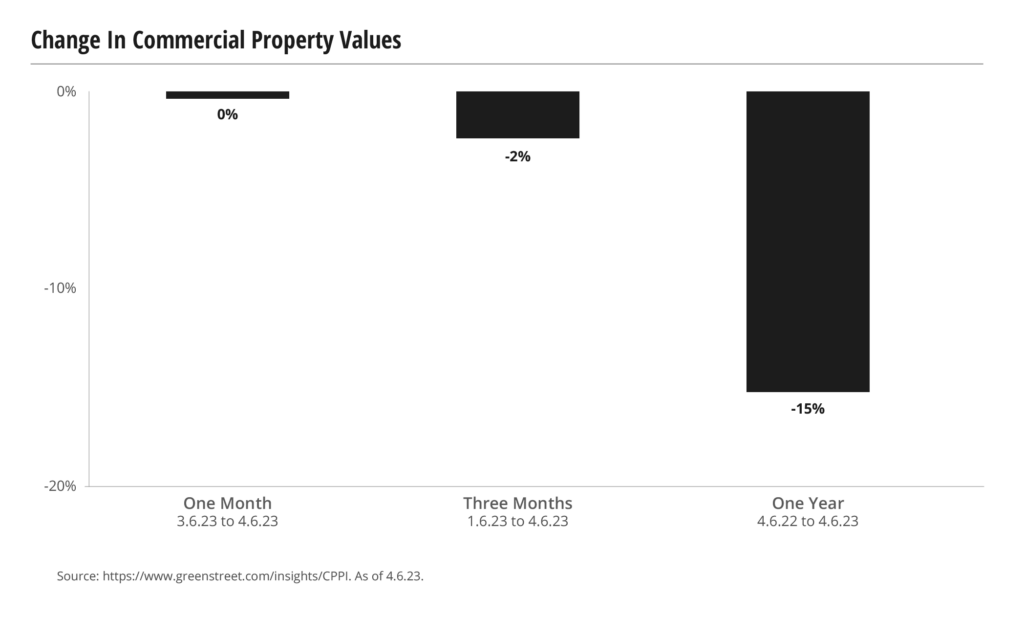

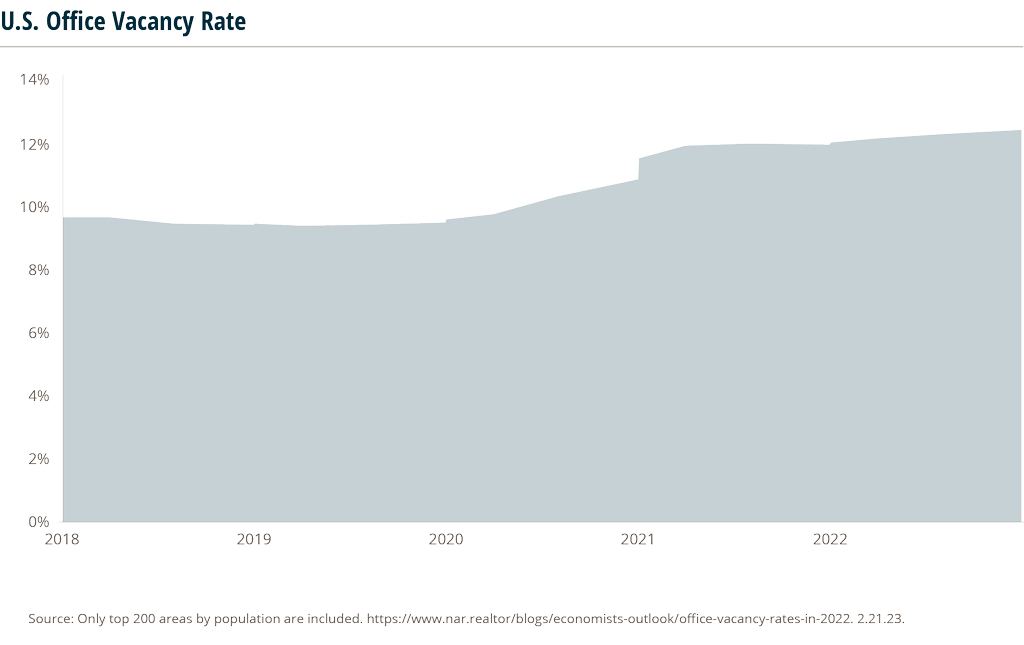

Risk in the commercial real estate market

Have high rise office spaces fallen victim to the internet? As work-from-home remains popular, commercial real estate struggles to stay profitable due to demand decline and economic turmoil.

Morgan Stanley projects commercial property prices could fall nearly 40%, dropping dangerously close to 2008 crisis level prices.8 This is partially due to trillions of dollars of commercial mortgage debt maturing in a potentially high-rate environment over the next few years, coupled with office and retail property valuations continuing to fall from pre-pandemic values. In addition, credit dependent industries, such as mortgage lenders and real estate investors, have felt the pinch of the Fed’s tightening monetary policy.

The effects of a downturn in commercial property real estate could be far reaching, affecting more than developers and real estate holders. The $20 trillion industry supports 15.1 million jobs, generates $831.8 billion dollars in personal earnings and contributes $2.3 trillion to U.S. GDP annually, making it extremely influential to the greater economy.9

Additionally, banks have a high amount of exposure to commercial real estate, meaning the health of the market has a large impact on the performance of banks and the greater economy.

Because of the tumultuous times, asset valuations are varying widely. With credit becoming scarce, a gap is growing between buyers’ and sellers’ expectations. Sellers are demanding sky high 2021 prices, while buyers are questioning the stability and valuation of investments, giving low ball offers. With increased uncertainty, asset valuations will continue to vary, leading to problems balancing books and debt ratios.

While industrial, retail and hotel real estate may be safe from the economic strains, office buildings are the most vulnerable, with the highest vacancy ratings.

This comes as almost a quarter of office building loans require refinancing within the next year.Recent banking crises have added worry to analyst predictions. JPMorgan Chase bank analyst Kabir Caprihan recently warned that 21% of office loans are destined to go bad, causing lenders to lose an average of 41% of the loan principal on the failures. Producing potential write downs of 8.6%, banks could lose $38 billion on office mortgages.10 But without a clear understanding of the future of the economy and cultural trends, the number of failed projects and valuation decline are only speculative.

The impact of recent banking failures on insurance m&a

As the dust continues to settle on the Silicon Valley Bank (SVB) and other bank collapses in March, some insights into what and why it happened, and possible implications, are coming into focus.

What happened to SVB?

SVB’s niche business model of working with the venture capital-backed, tech start-up community, set up the convergence of the following sequence of events – which ultimately brought down the bank. If any of these events didn’t occur, there is a possibility that SVB would have survived.

- Because of SVB’s lack of loans to its VC-backed, cash-rich customer base, it found itself with an excess of deposited cash available for the bank to use in other investments, such as bonds.

- SVB uses half of its assets ($91B) to invest in treasury bonds and U.S. government agency mortgage-backed securities, during a time when longer term rates were attractive. (Note, banks on average only invest about 25% of their assets in such bonds.11)

- The Federal Reserve raised interest rates to fight inflation, reducing the market value of SVB’s existing long-term bond holdings and resulting in large unrealized losses for the bank.

- After SVB announced that it needed to raise an additional $2B to shore up its balance sheet, depositors panicked and started to electronically withdraw their savings in mass, to the tune of $42B (aka, a run on the bank), putting SVB into a negative cash balance of nearly $1B, forcing regulators to shut it down.12

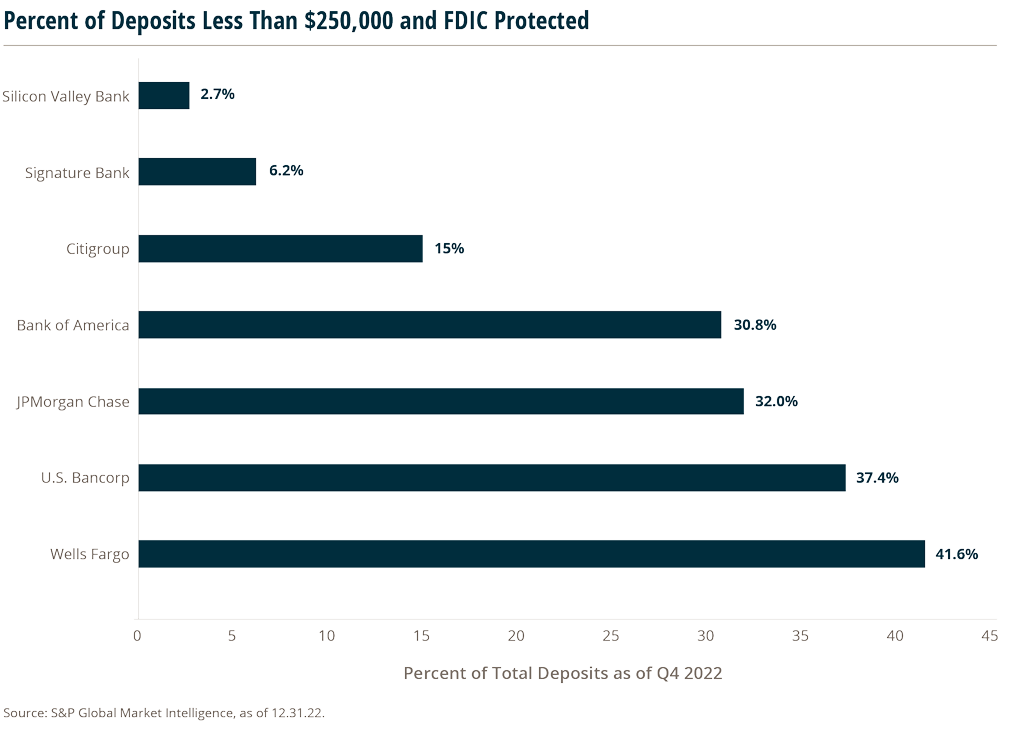

- Since 97% of SVB’s deposits were mostly institutional and exceeded $250K, they weren’t fully FDIC insured – which led the Federal government to step in and protect depositors to prevent widespread panic in the banking sector.13

The average percentage of uninsured deposits at large U.S. banks at the end of 2022 was 45.9% of total domestic deposits.

SVB and Signature Bank represented the highest and 4th highest, respectively, for the proportion of uninsured deposits at an individual bank – leaving them highly exposed to the risk of a bank run.14

For comparison, here are some major U.S. banks’ share of deposits with less than $250,000 as a percentage of total deposits in Q4 2022 – compared to SVB and Signature Bank.

Possible impacts on insurance M&A

With a clearer background story of SVB’s path to disaster and subsequent government intervention – there has been a calming around concerns that the broader banking institution is in trouble. However, the ripple effect could impact the insurance brokerage M&A landscape in several ways.

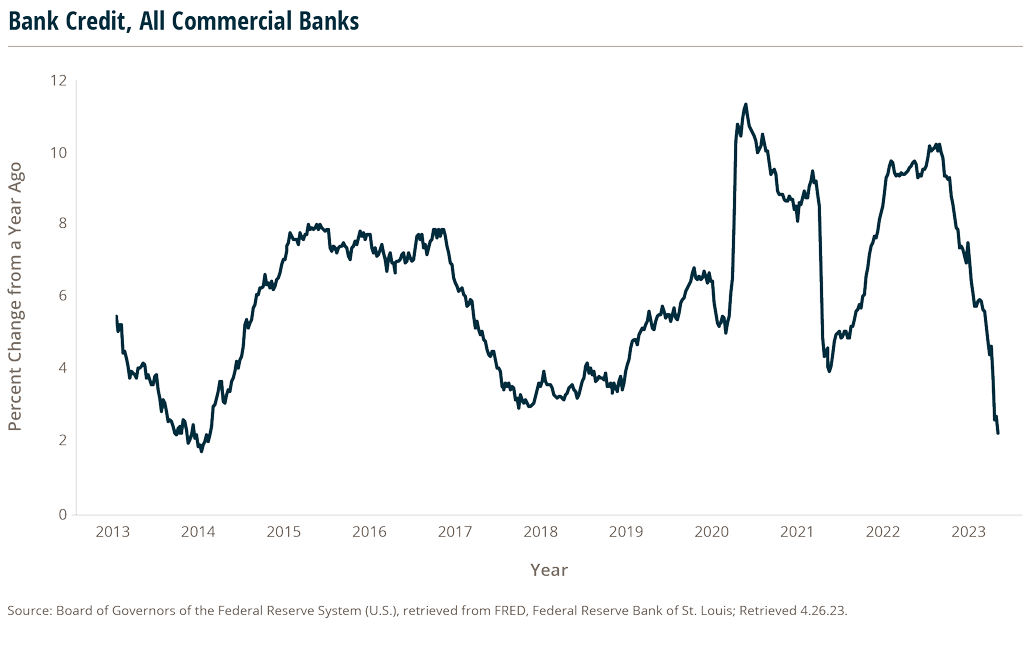

- There most likely will be some tightening of credit supply by U.S. banks, who are seeking to improve their lending standards to preserve capital and build better liquidity.

- With access to debt capital becoming more scarce or too expensive, some M&A acquirers may need to shift to equity capital strategies to make deals.

- For those acquirers who still have access to dry powder – there may be a shift in perceived valuations, whereas buyers look to leverage the macroeconomic uncertainty, forcing sellers to be more willing to entertain bids they previously might have declined.

- The venture capital-backed insurtech industry, already challenged by global funding pullback and falling valuations, may find access to capital even more difficult and/or more expensive. The result may be distressed sales and additional failures for insurtechs in 2023 – particularly for early-stage ventures.

Sources:

1 https://www.insiderintelligence.com/content/zurich-chatgpt-insurance-sector-eyes-ai-benefits

3 https://www.cnbc.com/2023/04/04/italy-has-banned-chatgpt-heres-what-other-countries-are-doing.html

5 https://mashable.com/article/chatgpt-alternatives-ai-chatbot

7 https://next.ergo.com/en/AI-Robotics/2023/ChatGPT-insurance-industry-digital-morning-Generative-AI

10 https://www.cnbc.com/2023/04/09/the-coming-commercial-real-estate-crash-that-may-never-happen.html

11 https://www.oaktreecapital.com/insights/memo/lessons-from-silicon-valley-bank

13 https://www.statista.com/chart/29478/share-of-fdic-protected-deposits-at-selected-banks/