Public Broker Performance Vol II, Issue 4

MarshBerry Broker Index

Get the latest performance and insights on the public broker composite.

MarshBerry Broker Composite Index And Earnings Update

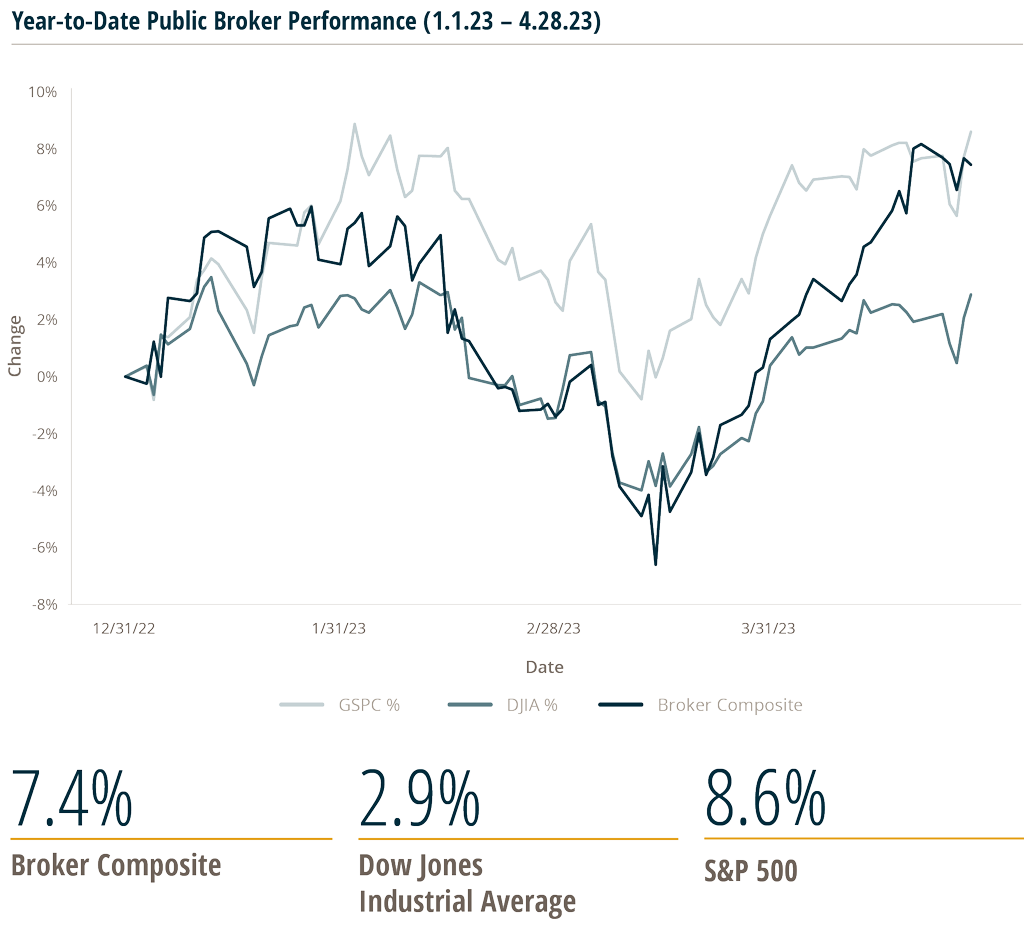

During the period from January 1, 2023, through April 28, 2023, six public brokers, as measured by MarshBerry’s Broker Index, outperformed the Dow Jones Industrial Average (DJIA), highlighting the strong fundamentals of the insurance brokerage industry. However, the S&P 500 outperformed both the brokers group and the DJIA during this time.

The following publicly traded insurance brokers are included in the Broker Index: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP).

Insurance brokers reported overall positive earnings results for Q1 2023, which were attributed to a combination of improving new business, strong retention, and continued insurance rate increases. These companies were also optimistic around meeting 2023 growth targets. Organic growth figures reported in Q1 2023 were comparable to slightly higher than those seen in the prior Q4 2022. Most brokers reported organic growth rates in a range of 7%-13%; compared to 5%-12% in Q4 2022.

- MMC reported organic revenue growth of 9% for first quarter 2023 vs. 7% organic growth in Q4 2022 and 8% organic growth in Q3 2022.

- BRO reported impressive organic growth of 12.6% in Q1 2023 driven by 33.8% growth in national programs. This compares to BRO’s organic growth of 7.8% in Q4 2022 and 6.7% in Q3 2022.

- AJG posted for its combined Brokerage and Risk Management segments 9.7% organic growth in Q1 2023, vs. 11.7% organic growth in Q4 2022 and 8.4% in Q3 2022.

- WTW posted 8% organic growth in Q1 2023, above the organic growth rates of 5% in Q4 2022 and 6% in Q3 2022.

- AON reported organic revenue growth of 7% in Q1 2023, up from 5% in Q4 2022 and Q3 2022. The firm noted continued strong retention and net new business generation.

- BRP once again reported organic growth that was far above the public broker group average, with Q1 2023 organic growth of 23% (vs. Q1 2022’s 16%); and Q4 2022 organic growth of 26%. This was the highest Q1 organic growth since BRP’s IPO, driven by strength across the business. While BRP sees global economic conditions continuing to be challenging, the company sees its business as very resilient and well positioned.

M&A Activity

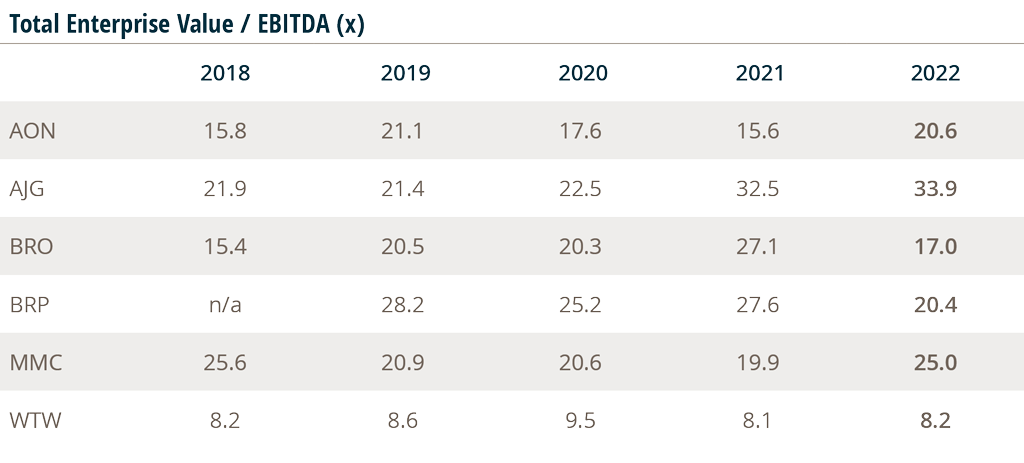

BRO noted that M&A volume was somewhat slower for the industry, but that high-quality companies are still trading at similar multiples seen in 2022. BRO CEO, President & Director J. Powell Brown noted on the Q1 2023 earnings call: “As it relates to the overall M&A market, the level of deals primarily from financial backers has slowed. That does not mean high-quality businesses don’t trade at similar multiples to what we’ve seen over the past year.”

AJG had another active quarter in Q1 2023, with 10 new tuck-in brokerage mergers completed, accounting for about $69 million of annual revenue. The company also has about 40 term sheets signed or being prepared, which is over $350 million in annual revenue.

In contrast, BRP CEO Trevor Baldwin said on the Q1 2023 earnings call that “we do not currently expect to execute any material partnerships in 2023 as we remain committed to deleveraging and continue to expect the market to soften over the balance of 2023, a trend we are starting to see.”

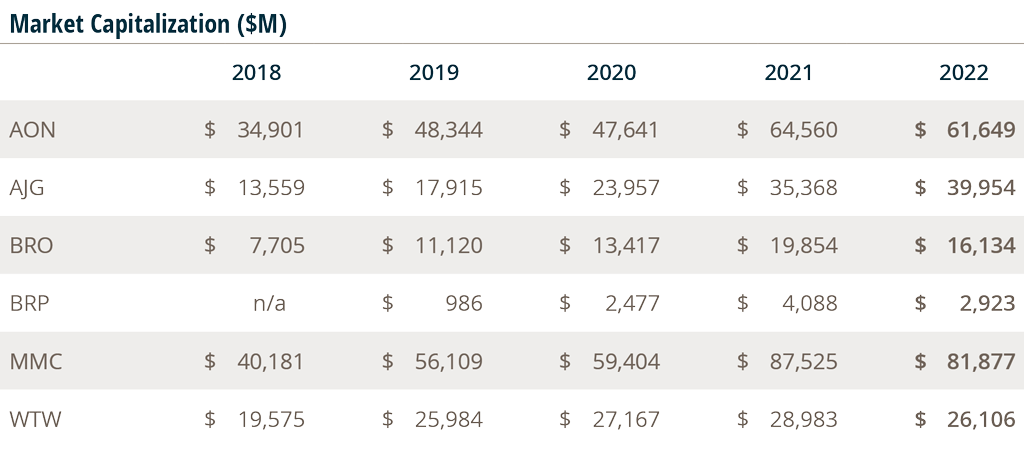

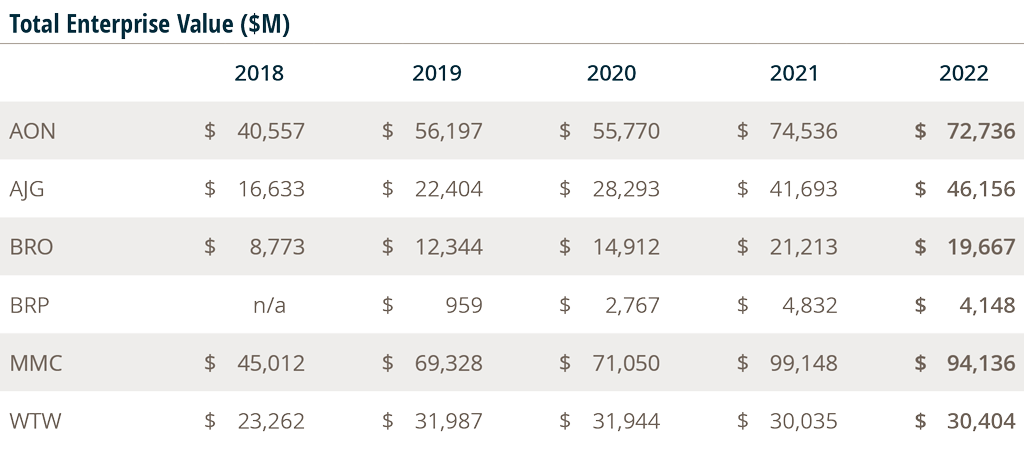

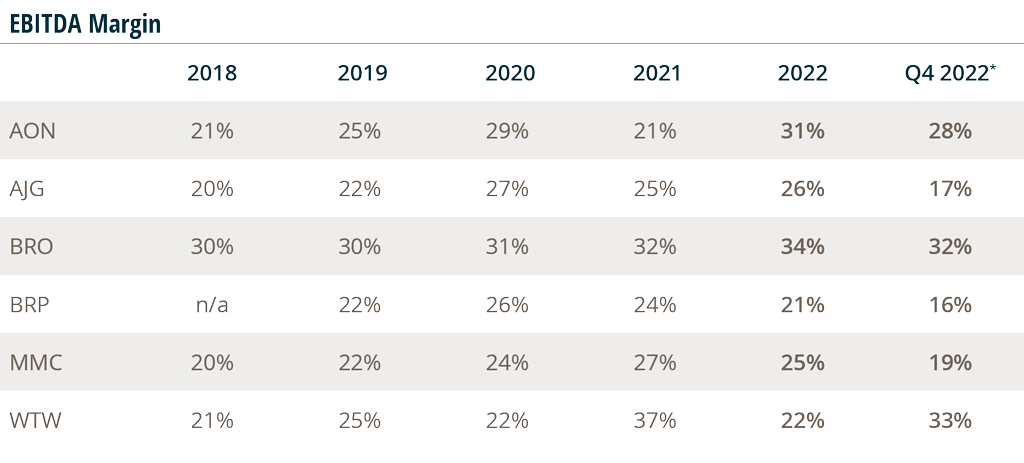

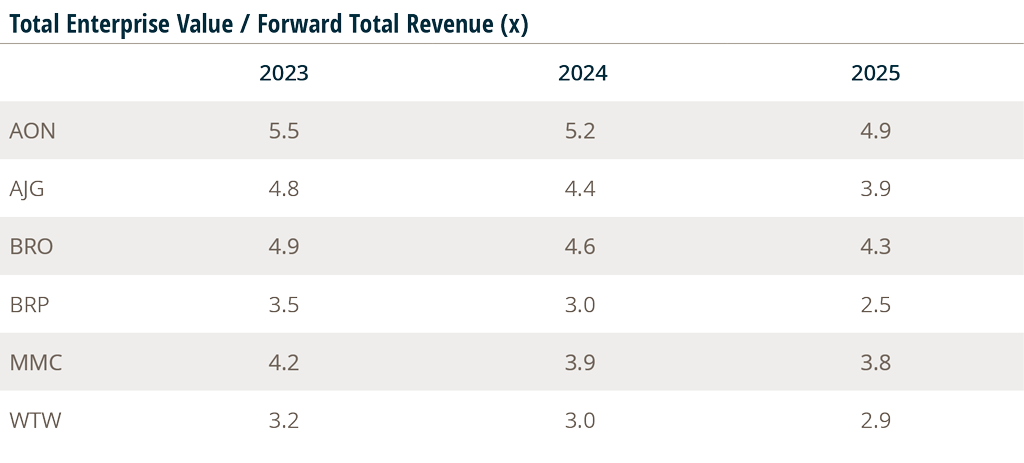

Public Broker Comps

The MarshBerry Broker Index is a composite of market data on the following companies, sourced from Yahoo Finance: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only. This information is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy.

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.