M&A Market Update Vol II, Issue 4

The Latest Deals and Insights

Who’s buying? Who’s selling? And why should you care? Phil Trem, MarshBerry’s President of Financial Advisory, highlights the current M&A market and provides a look at transactions in April 2023.

Mixed Economic Signals Don’t Deter Big Deals Amongst Big Players

Mixed economic signals continue to draw the ire of the Federal Reserve (Fed). Despite the first real signs of an economic slowdown – with Q1 2023 reports showing a slower-than-expected growth and a dropping inflation rate – the Fed decided to raise interest rates by another quarter point on May 3.

In Q1, real GDP growth slowed to an annualized pace of 1.1% (following 2.6% and 3.2% of the previous two quarters) but a 3.7% increase in consumer spending continued to keep it in positive territory.1 Job growth also slowed in March, with increased layoffs and the lowest number of open jobs in two years. However, April saw a resurgence as unemployment dropped to 3.4% (down from 3.6% in February).2

Mixed economic signals indeed.

Large partnerships continue despite economic noise

While concerns around rising interest rates’ impact on the cost and/or availability of capital continue to be themes on the merger & acquisition (M&A) front, a couple of blockbuster deals hit the headlines of the insurance brokerage news channels.

Leading global insurance brokerage Hub International Limited (HUB) recently announced an agreement with Leonard Green & Partners (LGP), wherein LGP will provide HUB with a substantial minority investment. HUB’s current enterprise valuation is at $23 billion on $3.7 billion in revenue. HUB President and CEO, Marc Cohen stated: “Despite the headwinds of the pandemic, interest rate hikes, and a global economic downturn, HUB has demonstrated its ability to persevere and excel. In the last 4 1/2 years we’ve delivered a 2.5 times ROI.” The transaction is expected to close in Q3 2023.3

MarshBerry is proud to have provided market research assistance to HUB as part of this transaction.

Also making a large splash was a partnership deal between one of Canada’s largest independent insurance brokerages – Westland Insurance Group (Westland) – and BroadStreet Partners Inc. (BroadStreet), owned by Ontario Teachers’ Pension Plan. BroadStreet will take a $1.1 billion majority stake in Westland, giving Westland the long-term capital needed to continue expanding across Canada’s commercial insurance market.

James Lyons, President and CEO of Westland stated: “Ontario Teachers’, through its financial partnership with BroadStreet, invests in select, high performing, and entrepreneurial insurance brokers with superior management teams, which makes them a great fit for this partnership. The investment is a signal of confidence in Westland’s long-term potential, growth strategy, and future vision.”

M&A Market Update

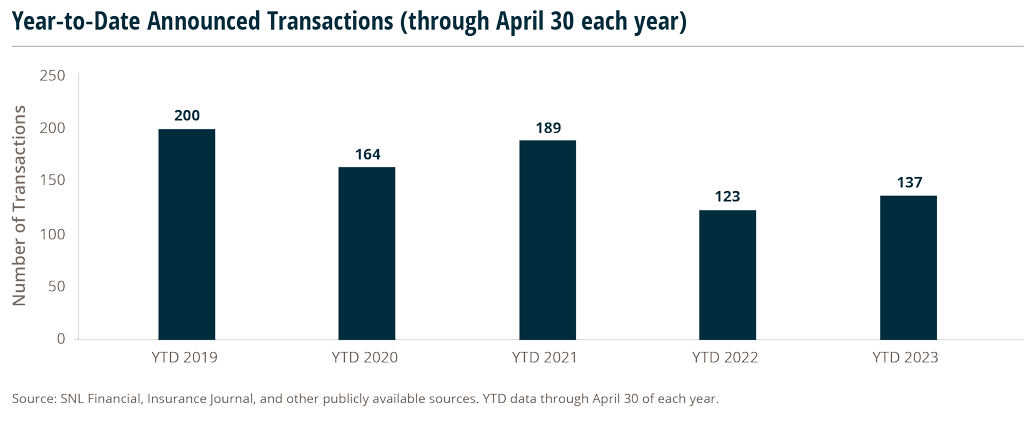

As of April 30, 2023, there have been 137 announced M&A transactions in the United States. This volume of deal announcements represents a 11% increase compared to 2022, which saw 123 transactions announced through this time last year.

Private capital-backed buyers have accounted for 110 of the 137 transactions (80.3%) through April, consistent with trends for the last five years. Total deals by these buyers increased at a CAGR of 26.9% since 2018. The percentage of announced transactions by independent agencies have continued to decline since 2021. On average, 23.1% of total deals were done by this group from 2018 to 2021, compared to 12.6% in 2022 and 9.5% to start 2023. High valuations, coupled with limited availability of capital, are likely contributing to this decline in share of deal activity.

Deal activity from the marketplace’s most active acquirers has remained strong in 2023. Ten buyers accounted for 50.5% of all announced transactions observed, while the top three (BroadStreet Partners, Risk Strategies and Hub International Limited) accounted for 25.5% of the 137 total transactions.

Deal Spotlight

MarshBerry advises RHP General Agency in sell side deal to Risk Placement Services

May 15, 2023: RHP General Agency (RHP) has agreed to be acquired by Risk Placement Services (RPS), a subsidiary of Arthur J. Gallagher (AJG).

RHP is a Texas-based Managing General Agency specializing in providing residential property insurance to homeowners in Texas and Arizona. RHP was previously owned by an affiliated insurance company, Southern Vanguard Insurance Services (SVIC, AM Best rated A-).

MarshBerry was engaged to assist RHP in finding a strategic partner to accelerate growth through the expansion of its distribution network, to build out new products and geographies, and to expand with new/existing markets (primary and reinsurance).

Operating in a challenging property environment, RHP was sought after in the marketplace by buyers for their talented management team, creative product design, and disciplined underwriting approach. Despite a rising rate environment where capacity has been extremely hard to come by for most, RHP has fared well on this front. By leveraging a state-of-the-art technology platform, RHP is able to achieve superior levels of profitability while enhancing the customer experience for insureds and brokers alike. Additionally, by effectively utilizing data analytics, RHP is able to monitor its risk exposures across its insurance portfolio in real-time. RHP’s vast distribution channel comprises over 600 broker partners, which provides for meaningful cross-selling opportunities as RHP is integrated into the RPS platform.

RPS acquired RHP for its consistent track record of producing profitable underwriting within the property insurance segment. By partnering with RHP’s seasoned leadership team, RPS hopes to leverage and grow RHP’s integrated platform that provides full control of the insurance value chain from insurance distribution to underwriting and claims management. Further, RHP’s relationship with SVIC represents a distinct competitive advantage for the company in this challenging market environment.

MarshBerry’s George Bucur, Managing Director, and Tobias Milchereit, Vice President, were trusted advisors to RHP and leveraged their expertise in the specialty insurance market to help RHP find the right strategic partner to enter the next chapter of their growth story.

Sources:

2 https://www.nytimes.com/live/2023/05/05/business/jobs-report-economy-april