Focused Insights: Specialty Insurance M&A Market Update: Demand Is Up, But Supply Is Down. Vol II, Issue 4

In this Section

- A Solid Start For Specialty Insurance M&A In Q1 2023 – But Will It Continue?

- The Continued Hard Market Is Driving Many Insureds To Look To Place Insurance With Specialty Providers

- Specialty Brokers Are Consolidating At A Greater Rate Than Retail

- Deal Highlight: Warburg Pincus

- Specialty Market Outlook For The Second Half Of 2023

As the macroeconomic environment continues to deliver new challenges, the merger & acquisition (M&A) sector for specialty insurance brokers and agents shows resiliency in the first quarter of 2023. Specialty firms continue to be highly sought after by the buyer community and are consolidating at an outsized rate when compared to their retail broker counterparts. Valuations in the sector continue to be buoyed by certain tailwinds, such as an ongoing hard market, a shortage in the supply of specialty firms, and higher organic growth rates, all of which continue to hold buyer interest. However, there may be headwinds from higher interest rates that impact the cost of capital for buyers, particularly those that are highly leveraged, and capacity providers who may be struggling to achieve acceptable returns on equity.

A solid start for specialty insurance M&A in Q1 2023 – but will it continue?

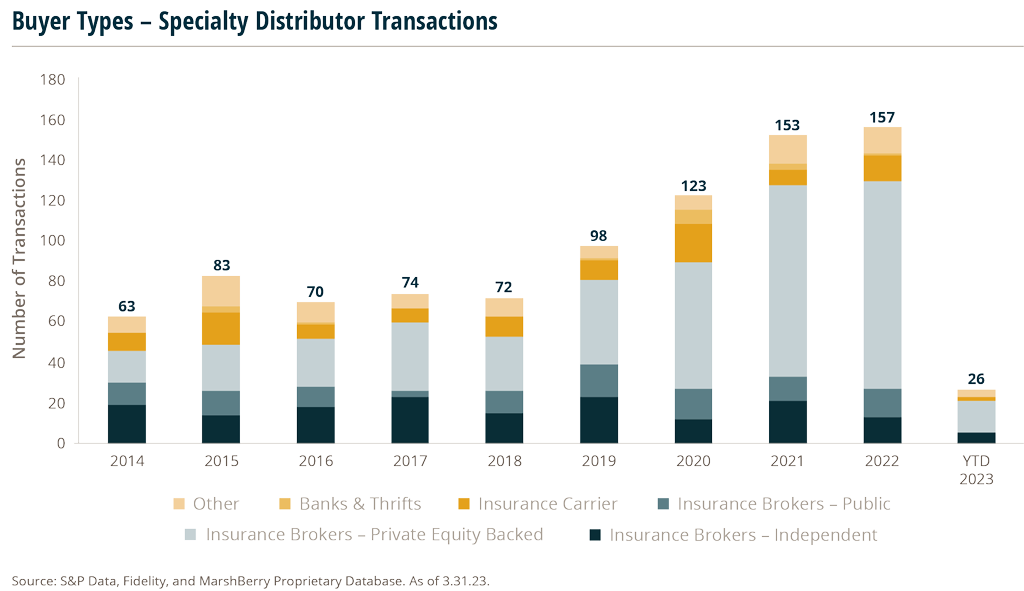

As of March 31, 2023, there have been 26 announced specialty insurance distribution M&A transactions in the U.S. – an 8% increase in total deals compared to this time in 2022, which ended Q1 with 24 announced transactions.

While Q1 2022 was ultimately credited with 50 transactions by year’s end as deal announcements came in post-quarter – it’s important to note that Q1 2023 (or 2023 as a whole) is not expected to match last year’s record numbers. George Bucur, Managing Director & Specialty Practice Co-Head at MarshBerry stated:

“Buyers are still clamoring for opportunities, but the pipeline of sellers is thin, and expectations are that deal counts will trend lower.”

Of the 26 announced specialty transactions in Q1 2023, private capital-backed buyers accounted for 14 of them, which is consistent with proportion of announced transactions over the last three years. Total deals by these buyers increased at a Compound Annual Growth Rate (CAGR) of 28% since 2020. Q1 2023 announced transactions by independent agencies are seeing a slight increase as a percentage of total transactions since 2021. On average, 11% of deals were done by independent agencies from 2018–2021 compared to 8% in 2022 and 23% to start 2023.

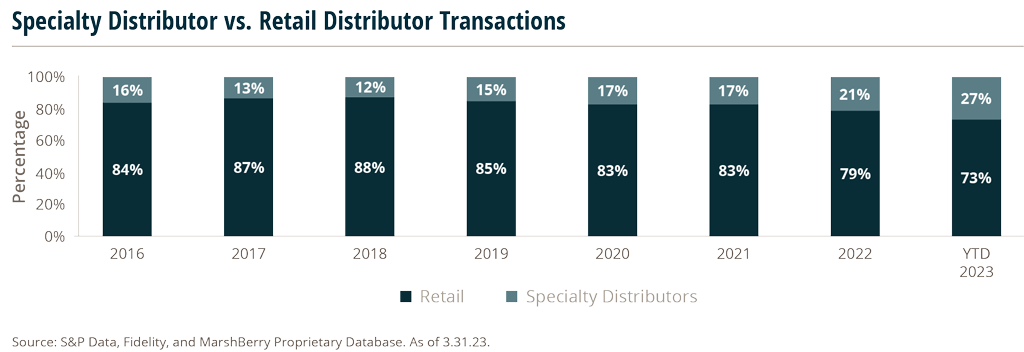

Specialty firms drove a meaningful amount of deal activity, comprising 27% of the total 98 overall firm transactions during the first quarter of this year. To put it in perspective, MarshBerry estimates that specialty firm counts only make up 5-10% of the distribution marketplace, but they are driving well over 25% of the transaction activity. This loudly speaks to the continued interest of buyers.

The continued hard market is driving many insureds to look to place insurance with specialty providers

Specialty firms, specifically in the surplus lines arena, are in most instances, still experiencing rate increases, continuing the hard/firm rate environment that kicked off in early 2019. This trend seemed to accelerate with surplus lines premiums increasing by approximately 25% in 2021 and 2022, respectively. While premium growth is expected to remain positive in 2023, it may not match the rates achieved in the last few years. Premiums will be supported by risks becoming more complex, heightened natural catastrophes, wartime conflict, and admitted markets constricting underwriting standards, which pushes products previously placed in the admitted marketplace into the surplus lines arena. Furthermore, carriers generally have been experiencing lackluster underwriting results, specifically in light of the recent volatile financial markets. Collectively, these two primary income sources of carriers are adversely impacting overall returns, potentially supporting future rate increases.

Although the current hard rate environment is protracted and carriers continue to increase rates, such increases have become harder to achieve as more competition has entered the market, putting pressure on prices. As a result, equilibrium – defined as loss-free accounts renewing at expiring rates, with no increase or decrease – has not been achieved yet. Gerard Vecchio, Managing Director & Specialty Practice Co-Head at MarshBerry noted:

“We forecast that certain Excess & Surplus lines will see further rate increases in the 5%+ range for accounts without losses. There are potentially much higher increases for loss prone accounts.”

Driving these continued rate increases are higher current loss costs and increased claims activity contributing to carriers’ needs to secure higher premiums for the risks they are insuring.

Specialty brokers are consolidating at a greater rate than retail

There are thematic trends that make acquisitions of specialty brokers increasingly more appealing, allowing them to consolidate at a greater rate. In both 2021 and 2022, MarshBerry estimates that nearly 8% of specialty firms were involved in transactions, compared to about 2% of retail firms, in each respective year. This means specialty firms consolidated at a rate of over 4x vs. retail brokers. This trend is expected to continue because of the higher propensity for growth of specialty brokers and their ability to drive more value to the end user, making them more appealing to buyers.

The specialty market is growing at a much quicker rate than their retail admitted counterparts. Specifically, specialty premiums as a percentage of the overall Property & Casualty (P&C) market grew over 90% during the last 10 years, going from 9.2% in 2012 to an estimated 18% in 2022.

Specialty firms are likely directly benefiting from the overall market growth and as a result are growing at superior rates compared to their retail broker counterparts.

Large brokers are pursuing specialty firms for their attractive operating structures, which can be highly leveraged for growth. They are looking to specialty distributors to take advantage of concentrations of premium in the retail divisions of these brokers. By partnering with niche focused specialty distributors, large brokers are capturing more revenue by funneling premium concentrations to the wholesale brokers or delegated authority affiliates (i.e., Managing General Agents or MGAs). This often results in more clout with carrier partners, optimal commission structures, enhanced profit shares and contingent arrangements, and/or the creation of proprietary products. Another benefit is controlling more of the client’s (the insured in this case) experience and therefore mitigating retention issues.

Deal Highlight: Warburg Pincus

On December 1, 2022, Warburg Pincus, a leading global growth investor, acquired K2 Insurance Services (K2), a leading independent specialty insurance program manager. This transaction is projected to close in Q2 2023 and supports K2’s growth strategy, which includes M&A and organic growth. K2 is also focused on offering best-in-class services to clients. Through its MGAs, K2 markets, underwrites, and services over $1 billion each year in niche commercial and personal insurance premiums.

Warburg Pincus was impressed with K2’s history of acquiring and growing specialty MGAs and program administrators. The investor sees significant growth potential in K2. Michael Martin, Managing Director, Head of Financial Services, Warburg Pincus commented: “K2 is truly a differentiated platform, offering a full suite of services to a diversified portfolio of programs that are supported by deep carrier relationships. K2’s management team has extensive industry experience and a demonstrated track record of growing insurance businesses.”

MarshBerry served as a financial advisor to Warburg Pincus throughout the transaction.

Specialty Market Outlook for the second half of 2023

Despite recent challenges at financial institutions, rising interest rates and the impact on the availability of debt and equity capital, specialty firms are still in demand, as buyers want to capture more revenue and faster growth through specialty firm acquisitions. But supply remains short and will be the main roadblock for significant deal volume.

Because of these dynamics, MarshBerry sees high-performing specialty firms continuing to command historically high valuation multiples – while valuations for average and underperforming firms are starting to plateau or even decline in some areas.