U.S. Macroeconomic Indicators Vol II, Issue 2

Market Trends and Current Statistics

Here are key U.S. macroeconomic indicators that are likely to impact brokerages within the insurance industry.

Inverse Sides Of Specialty Insurance: Cyber And Workers Compensation

The name gives it away. Specialty insurance is just that, special. Comprised of many different lines that do not fit in other categories and are often times unrelated, specialty insurance lines act independently making the category as a whole difficult to predict. While some lines are currently raising premiums as demand soars, others are falling despite a hardening market.

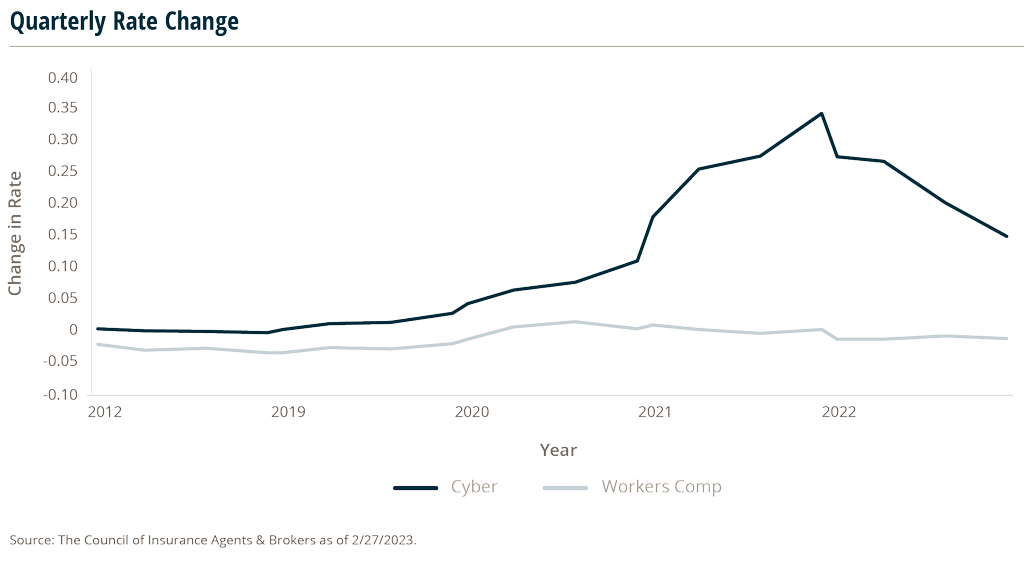

Cyber insurance and workers comp are at the two ends of the spectrum, reacting to current market conditions very differently.

Instability of cyber lines: Increased demand + increased risk = premiums rising

Having one of the most volatile rates, cyber insurance has seen dramatic increases in the past few years. Just in 2022, some premiums rose 79% in Q2, 48% in Q3 and 28% in Q4 year-over-year (YoY).1 This huge increase in premium is attributed to the rise in demand for policies along with an increase in risk and loss ratios, forcing underwriters to increase policy prices and requirements.

In the U.S. cyber insurance costs increased 123% in from 2020-2021 and are projected to continue rising.2

So why is demand for cyber insurance rising? With the average data breach costing firms $9.44M in the U.S., and the frequency and severity of ransomware attacks increasing, companies of all sizes are looking for coverage.3 Not only are firms liable for paying for the recovery of data but also the damages, attacker pay offs and resulting necessity to build back a better security system.

Demand has also increased as remote and hybrid work environments become the new normal. Remote work set-up requires advanced software design due to the lack of hardware infrastructure in many home set ups. With multiple devices set up across different networks, it is hard to block and identify malware and hacking.

The increasing risk of cyber attacks is also placing pressure on underwriters to increase premiums and regulations to offset the claims losses. Loss ratios are already high in cyber policies, coming in at over 65% the past two years.4

Demand for cyber insurance will continue to grow as the sophistication and frequency of attacks increases. Currently only 55% of organizations have cyber insurance and only 19% have coverage over $600,000.5 The rapid changes in technology and its uses for commercial business directly influence the instability of cyber lines. These rapid changes mean renewal and underwriting process will be lengthier and take more resources.

Stability of workers’ compensation lines

Conversely, one of the more stable lines in specialty insurance is workers’ compensation which has seen a slow decrease in premiums. This profitable line is predicted to continue decreasing rates through 2023.

Rates are already down from an average of .97 cents per $100 dollars of payroll in 2022 to .93 cents in 2023.6

While workers’ compensation laws and regulations are different for each state and industry, they have decreased across the board as the line experiences an extended soft period favorable for purchasers. This soft period, ushering in low rates, is adding capacity to a profitable line of business, benefiting insurance brokers and risk holders.

There has been a downward rate in claims frequency leading to lower loss ratios. Underwriting projections are adjusting for this decrease by lowering rates due to 8+ years of consecutive underwriting profitability.7

One reason for lower claims frequency could be the increased implementation of workplace wellness programs.8 These programs are designed to encourage healthy habits to increase the physical and mental wellness of employees. Healthier, happier employees lead to less accidents and less workers’ compensation claims. Other trends such as increased health awareness and working from home could also be affecting claims frequency.

Workers’ compensation will continue to be a favorable line with lower rates, and a safe haven for insurers and insureds. The stability and predictability of workers compensation will allow for simpler renewals and efficient underwriting.

A Resilient Labor Market Keeps Pressure On The Fed And The Insurance Industry

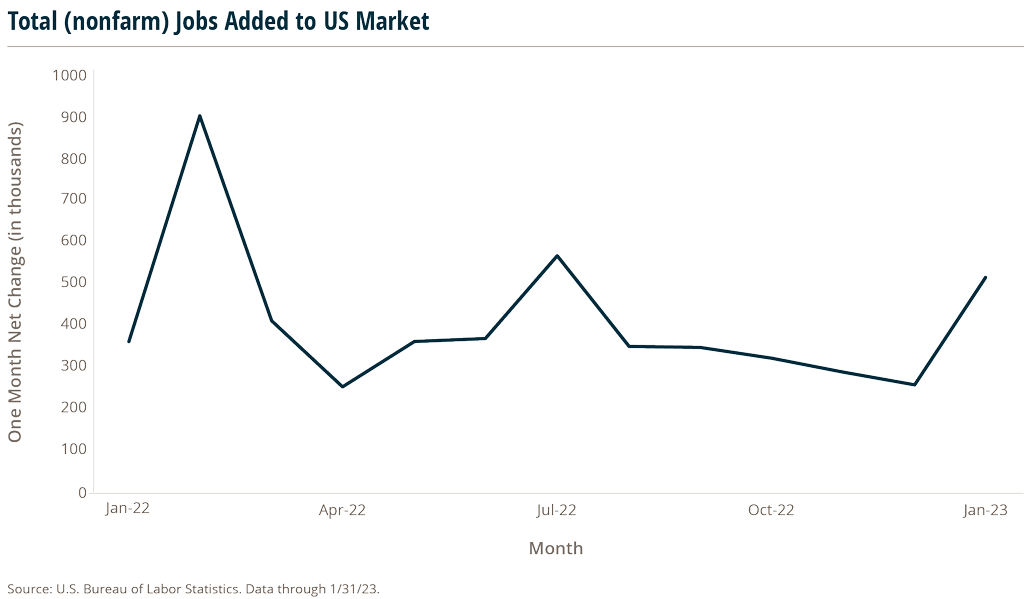

The labor market doesn’t seem to want to cooperate with the Federal Reserve’s (Fed) effort to slow down the economy. Despite continued interest rate hikes by the Fed in 2023, the U.S. added another 517,000 (non-farm) jobs in January – nearly doubling December’s job total of 260,000. With it, unemployment dropped to another historic low of 3.4% – the lowest since 1969.

Why is the job market growing?

It’s a paradoxical circle. Higher wages allows consumers to spend more, driving up demand for goods and services, driving up prices (inflation), driving up profits for companies, driving up the need for (and affordability of) more workers, driving up wages to compete for the shrinking labor pool. This overheated economy isn’t sustainable, and to keep the circle from spinning out of control and collapsing on itself the Fed is balancing the challenges of slowing down the economy, without throwing it into a deep recession.

There are signs that the Fed’s strategy is working. Sort of. Inflation has slowed, with December’s Consumer Price Index coming in at 6.5%, down from November’s 7.1% and June’s high of 9.1%. Wage growth has also started to wane, with average hourly earnings growing 4.4% YoY in January, down from December’s 4.8% growth. But it may not be slowing down fast enough for the Fed to consider any kind of substantial pivot on interest rate hikes.

Which sectors are seeing the most job growth? The least?

Despite recent high-profile layoffs in the tech sector from companies like Google, Amazon and Microsoft, most companies are struggling to fill new or vacated roles and are desperately trying to hold on to the employees they have.

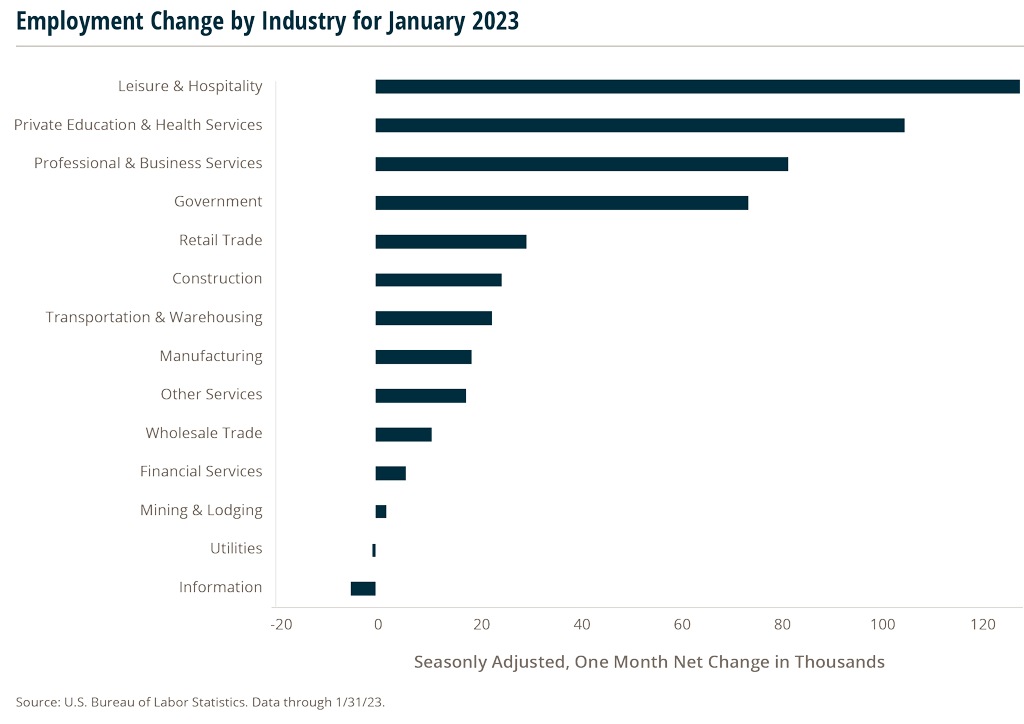

The largest industry to see added jobs in January 2023 was the leisure and hospitality sector – adding 128,000 jobs, most of them in restaurants and bars. This is followed by high growth in private education and health services sectors (105,000 jobs), professional and business services (82,000 jobs) and government (74,000 jobs).9

Sectors that grew the least, or reduced their open roles, include the aforementioned tech sector – identified by the U.S. Bureau of Labor Statistics as “information”– with 5,000 less jobs in January. The utilities sector also lost 700 jobs in January.

How is the insurance industry fairing?

While the “Financial Services” sector saw 6,000 new jobs in January, the sub-sector of “insurance and related activities” reduced the number of jobs available by 5,100.

Still, the overall open roles in finance and insurance is currently at 386,000.10

The overall outlook for the insurance industry in 2023 is positive and firms are projecting even further staffing needs to support it. A Q1 2023 Insurance Labor Market Study by The Jacobson Group and AON plc reveals that 67% of insurance carriers plan to increase staff over the next 12 months. With positive outlooks for revenue growth in 2023, recruiting and employee retention remains the top challenge and key focus for companies in the insurance industry.10

Is The U.S. Headed Towards A Recession Or A Soft Landing? It Depends On Who You Ask.

It’s the question that dominates every economic conversation. As the Fed tries to slow the economy by tightening the gap between inflation and the Federal funds rate – will the result be a recession? Or is there a chance of a soft landing – perhaps missing a recession altogether?

In the Federal Reserve Open Market Committee’s (FOMC) Summary of Economic Projections, released on 12/14/22, the median projection for GDP growth over 2023 was 0.5%. The committee also projected the unemployment rate rising to 4.6%, the personal consumption expenditures (PCE) price index falling to 3.1%, and the Federal funds rate to be in a target range of 5% to 5.25% at the end of the year.11

Six weeks later, after FOMC’s two-day meeting (on 1/31/23-2/1/23) with the Board of Governors of the Federal Reserve System, their outlook shifted somewhat. The committee now expects GDP to grow at a somewhat faster rate in 2023, with unemployment remaining a bit lower than projected in December and PCE price inflation forecast to be 2.3% in 2023. The Fed still viewed the possibility of a recession in 2023, resulting from sluggish growth in private domestic spending and tight financial conditions.12

However, many economists in business, finance and academia have different outlooks from the Federal Reserve Board. For instance, responses in the Wall Street Journal’s January 2023 Economic Survey show economists on average expect the Federal funds rate’s midpoint to register near 5% in June before falling to 4.7% by the end of the year. These economists expect GDP to hardly grow in 2023 with an average response less than 0.2% for the year with a contraction in GDP in the second quarter. Average expectations are for unemployment to rise to 4.7% while PCE price inflation falls to 2.9% by the end of 2023. The survey results put the probability of a recession sometime in 2023 at 61%.13

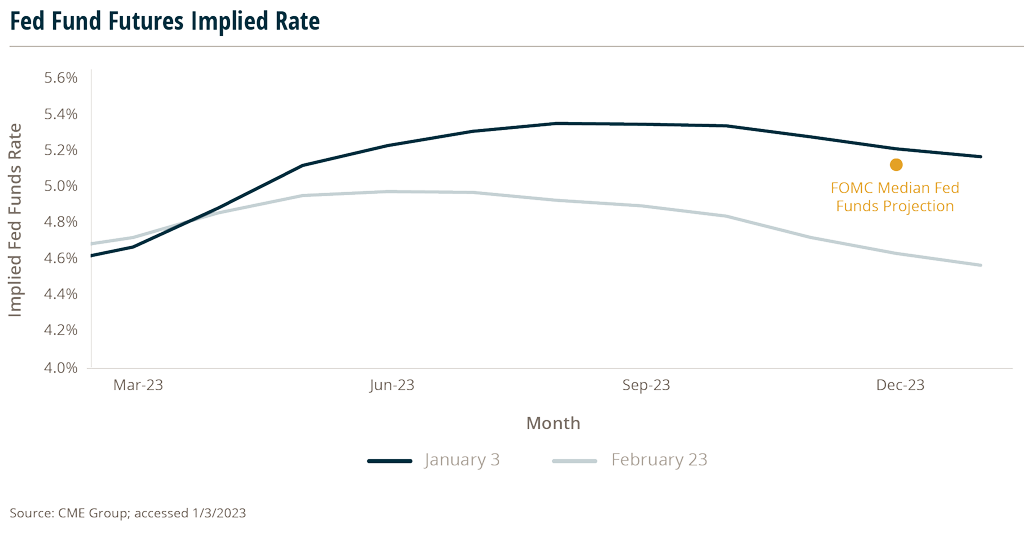

Markets have also shown disagreement with Fed statements, though economic releases in the first couple months of the year have moved expectations closer to the Fed’s published expectations.

At the beginning of January, Fed Funds futures showed markets expected the Fed funds rate to peak just below 5% in June before falling to 4.6% at the end of the year. However, following several reports showing continued strength in the labor market and persistent inflation, Fed Funds futures peaked just below 5.4% in August before falling to 5.2%, slightly above the FOMC’s most recent guidance, by the end of the year.14

1 https://www.wsj.com/articles/quarterly-cyber-insurance-update-february-2023-62141c19

2 https://arcticwolf.com/resources/blog/real-causes-cyber-insurance-rate-increase/

3 https://www.ibm.com/reports/data-breach

5 https://networkassured.com/security/cybersecurity-insurance-statistics/

6 https://www.thehartford.com/workers-compensation/rates-drop

9 https://www.bls.gov/charts/employment-situation/employment-by-industry-monthly-changes.htm

11 https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20221214.pdf

12 https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20230201.pdf

13 https://www.wsj.com/articles/economic-forecasting-survey-archive-11617814998

14 https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.settlements.html