M&A Market Update Vol II, Issue 2

In this Section

The Latest Deals and Insights

Who’s buying? Who’s selling? And why should you care? Phil Trem, MarshBerry’s President of Financial Advisory, highlights the current M&A market and provides a look at transactions in February 2023.

For Potential Sellers – What Matters Most Is Growth

A year ago, inflation was on everyone’s mind, sparking plenty of talk about what the Fed may or may not do. The conversations in the insurance brokerage space were more about the impact the rising Federal funds rate might have on mergers & acquisitions (M&A) activity due to the higher cost of capital. But in the end, 2022 delivered the second most transactions on record, as well-capitalized buyers continued their pursuit for quality targets.

In 2023, the talk has shifted towards “recession or soft landing” as inflation continues and the Fed keeps pace with interest rate hikes. There is no shortage of opinions for how the 2023 U.S. economy will shake out. In fact, if you get 10 economists in a room, you’ll get 10 different opinions. But again, for the insurance brokerage industry the question still lingers – what impact might the higher cost or availability of debt capital have on M&A in 2023?

One acquirer, BRP Group, Inc. (BRP), indicated during its recent Q4 2022 earning call that it would be more focused on organic growth versus acquisitions in 2023. CEO Trevor Baldwin stated, “The reality is the cost of capital is up meaningfully. And as a result, a lot of the larger, higher-performing businesses are choosing not to come to market and transact in that type of a backdrop, the type of assets that we would typically be most interested and excited about.”1

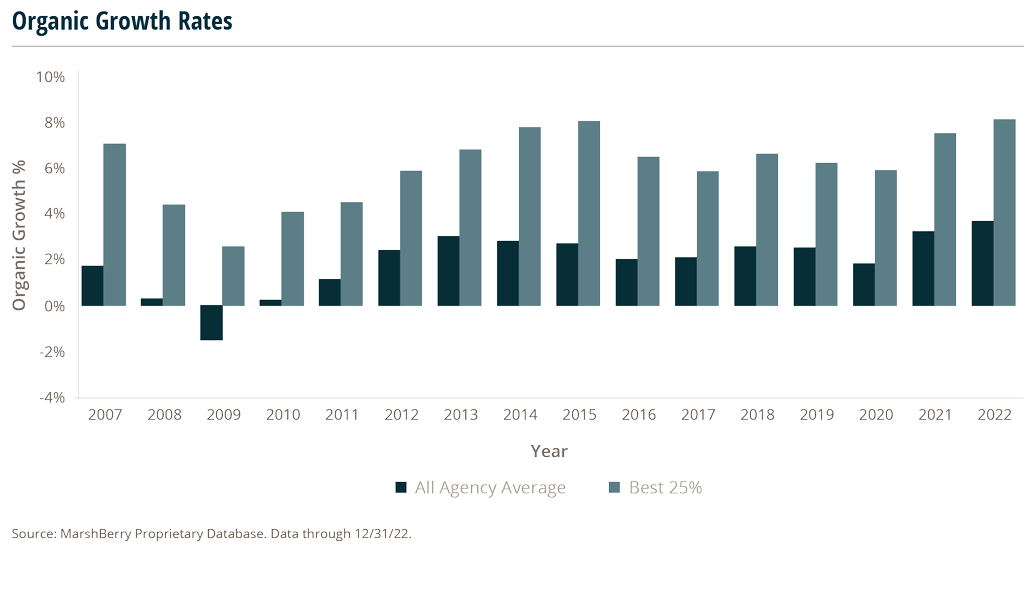

Of course, this is simply one firm’s position and not necessarily the sentiment of the industry as a whole. But the key to this statement is the reference to “higher-performing businesses” and “the type of assets we would typically be most interested and excited about.” Performance is king. In this environment, it doesn’t matter how large or small you are. If you aren’t significantly growing (organically), you aren’t going to attract the interest of potential partners.

A focus on organic growth

It’s never too late to focus on organic growth. But for many firms, this may be the year to significantly ramp up your organic growth strategy.

Being average isn’t going to be good enough as buyers are taking a more conservative approach in their M&A strategy and looking for those quality firms that can clearly add value and help them grow.

Acquirers are looking for companies that show greater growth potential than themselves. If the average buyer is growing at 8%-10%, why would they be interested in a firm that grows less than that?

Insurance Brokerage M&A Market Update

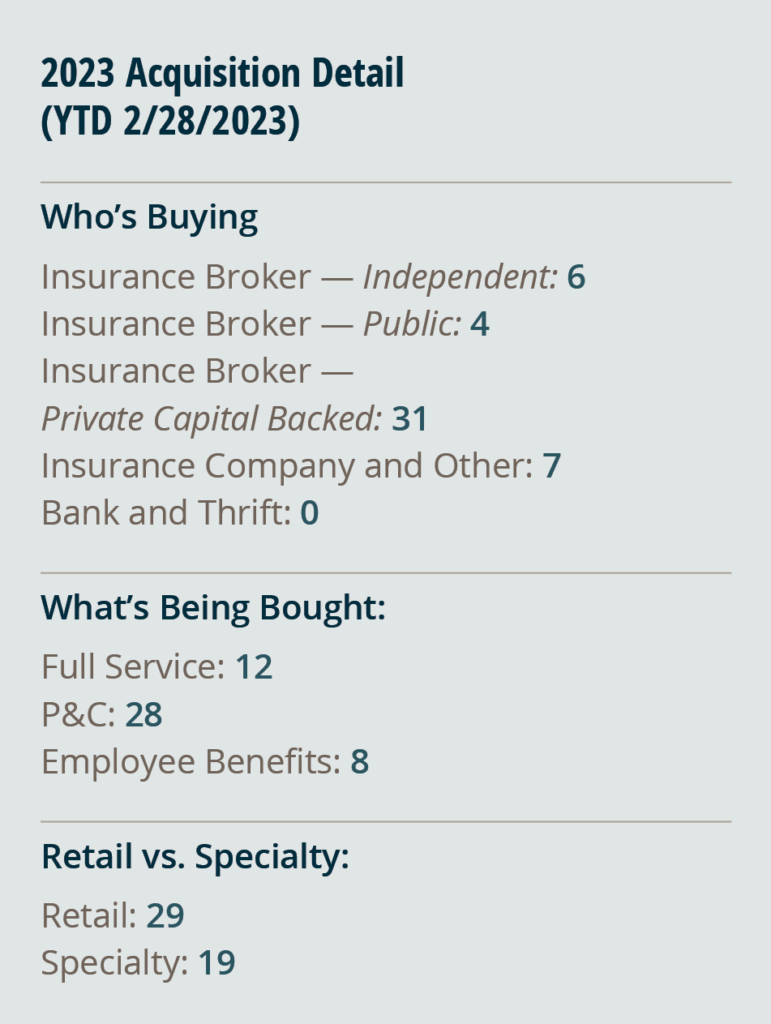

As of February 28, 2023, there have been 48 announced M&A transactions in the U.S. Activity through February is similar to the start of 2022, which saw 51 transactions announced through this time last year.

Private Capital backed buyers have accounted for 31 of the 48 transactions (64.6%) through February, which is consistent with proportion of announced transactions over the last 5 years. Total deals by these buyers increase at a Compound Annual Growth Rate (CAGR) of 26.9% since 2018. Announced transactions by Independent Agencies have continued to decline since 2021. On average, 23.1% of total deals were done by Independent Agencies from 2018-2021 compared to 12.6% in 2022 and 12.5% to start 2023. High valuations and availability of capital could be two of the main drivers for this section of buyer’s decline in deal activity.

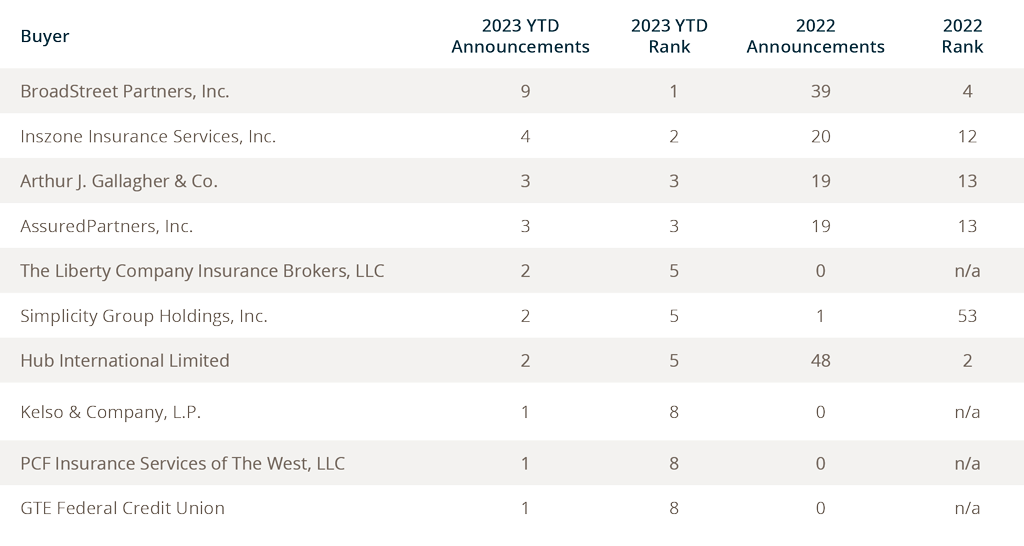

Strong deal activity from the marketplace’s most active acquirers has remained constant to begin 2023. Ten buyers have accounted for 58.3% of all announced transactions observed, while the top three (BroadStreet Partners, Inc., Arthur J. Gallagher & Co., and Hub International Limited) account for 33.3% of the 48 total transactions.

2023 M&A Outlook

2023 has gotten off to a similar M&A start to the previous two years. A slow, methodical and deliberate pace. Despite some buyers projecting they may slow down their acquisition strategy, there are still plenty of well capitalized buyers who are active in the M&A market. The difference will be how targets are evaluated and compared to each other. For acquirers, “quality” and “significant organic growth” will be the key characteristics evaluated when deals get valued.

MarshBerry remains cautiously optimistic but it’s likely going to be another strong M&A year with plenty of demand. The question you need to ask is how can you become the higher-performing growth firm that shines brighter than the competition? Whether thinking about selling now, later, or never, today seems like a great time to start focusing on enhancing the growth capabilities of your firm.

Deal Spotlight

MarshBerry International advises consolidation deal for Coöperatie Licent

Closing within the first quarter of 2023, MarshBerry International advised on a consolidation deal, merging 16 Dutch intermediary firms and existing cooperative MGA into the Licent Cooperative.

Backed by Dutch private equity investment company, Gilde Equity Management, the group now has more than thirty branches with approximately 300 employees spread throughout Eastern and Northern Netherlands. The deal allows the 16 merging offices and additional partnering offices to operate under their own name with the support of the larger group to exceed growth expectations and reap the benefits of mutual support. The group is organized into clusters based on region and culture, to maximize synergies, allowing branches to collaborate with those they harmonize with the best.

MarshBerry International successfully strategized the initial plan, brought the group to market and facilitated the sale and implementation of the new company. “MarshBerry has been working in this industry for 42 years, doing broker formations like this in the U.S. for a long time,” said Michel Schaft, Managing Director for MarshBerry International. “While this is a European deal, the principles are the same. We brought deep experience to the table, including experience in broker formation, and helped develop the plan that made Licent the ‘hunter’ rather than the ‘hunted’.”

This groundbreaking deal offers an alternative to the more traditional takeover by a large office or private investor, allowing firms autonomy while also being strengthened by the partnership. With the merging companies, Licent now ranks in the Top 25 of insurance brokers in the Dutch market.2

2 https://www.amweb.nl/139117/licent-kantoren-gaan-samen-in-uniek-bedrijf

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co., LLC. 28601 Chagrin Blvd., Suite 400, Woodmere, Ohio 44122 (440.354.3230)

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2022 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.