Focused Insights: The Digital Transformation of Insurance Distribution: How Can Brokers Keep Up? Vol II, Issue 2

While insurtechs are facing headwinds, it’s likely that the digital transformation of the insurance industry will accelerate from here. What should insurance brokerages do to keep up?

There is no doubt that insurtech companies are facing a challenging economic climate, with continued high inflation, potential further interest rate increases and a higher cost of capital for potential investment partners.

However, despite these challenging market dynamics, it is believed that the technological evolution of the insurance industry will accelerate from here. Why? Because the industry is slowly shaking off historical impediments such as carriers’ legacy technology infrastructure and limitations of widely adopted agency management systems.

History has shown that we often overestimate the short-term impact of new technology and underestimate its long-term effect. As public markets cratered when the dot.com bubble burst, not many people expected that a few of those firms would dominate global markets two decades later. The first iPhone was released in 2007. Only 15 years later, this technology has not only shifted individual communication and commerce, but also had a massive impact on how businesses operate.

Thus, brokers need to do more to keep up with recent developments in insurtech and adopt emerging new technology in order to remain competitive. While many brokers are still hesitating, carriers have demonstrated their willingness to double down and make strategic acquisitions in the technology space to achieve their long-term strategic goals.

While there is no doubt that the digital transformation will have significant long-term implications for insurance, it also provides companies with unique opportunities. By deploying emerging technology solutions, companies can gain an edge in an otherwise very competitive market.

Here are three key trends in the technological evolution of the insurance market that brokers should keep an eye on:

1. Automation. Technology can help streamline insurance processes including sales, quote, bind, issuance, aspects of servicing and the renewal process. While a fully automated platform may be only suitable for more transactional business, there are efficiencies to be gained from automation that go far beyond that.

“Automation and data platforms level the playing field for agents and brokers. Carriers have long been using similar tools to increase productivity and profitability in small commercial, but in a lot of ways what they did to help themselves moved the burden to the agents and brokers. Today, platforms designed for agents and brokers are closing that gap and realigning the channel.”

Talage CEO Adam Kiefer. (Talage is an insurtech focused on developing digital distribution software solutions for commercial insurance that transforms the quoting process for agents and insurance companies.)

What is the potential impact on the industry and insurance brokers?

- Automation can help create efficiencies and enhance profitability by streamlining certain processes along the distribution value chain. By automating manual and repetitive tasks, brokers can focus on activities such as risk management and service to improve the customer experience, which could lead to higher retention rates.

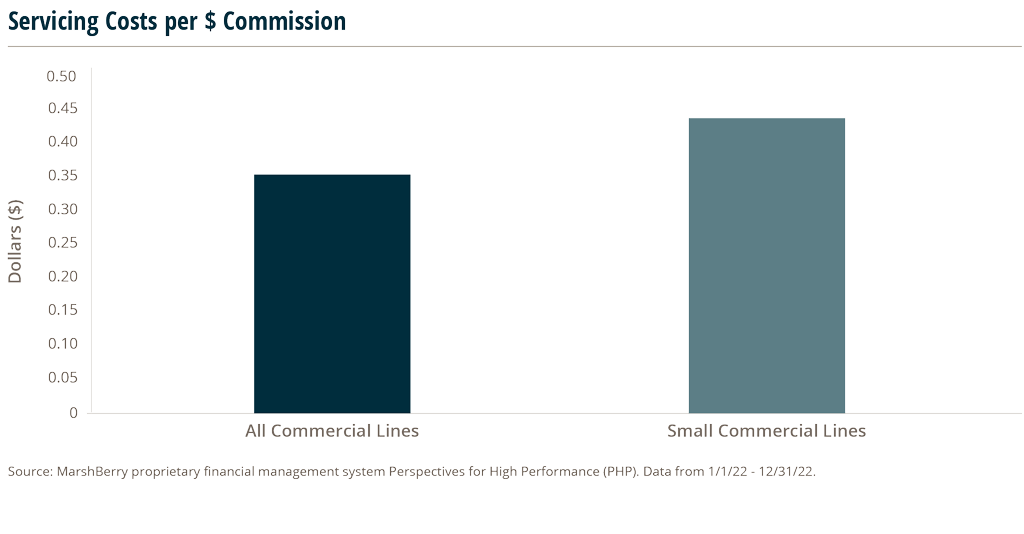

Based on MarshBerry’s proprietary database, small commercial business is on average 30% less profitable when compared to the entire commercial lines book, which demonstrates the need to improve existing processes to enhance profitability in this market segment. We argue that by adopting a technology-enabled platform, brokers could move down-market and achieve a high level of profitability that may even exceed that of their mid-to-large commercial lines segments.

2. Data analytics. Data analytics involves the analysis of insurance-related data to create insights that inform business decisions. Many large brokers have increased their investments into their analytics capabilities, which starts with the consistent collection of relevant data across all businesses. This is often complicated by the fact that businesses run on different systems.

What is the potential impact on insurance brokers?

- Advanced use of data analytics can help brokers make more informed decisions when it comes to underwriting / pricing of insurance policies. There is currently a significant discrepancy in the market when it comes to the usage of external data sources. As the ability to generate insights from data increases, firms with access to more relevant, high-quality data will have a competitive advantage.

- The demand for brokers to act as risk managers will only increase in the future. Brokers can help clients gain more visibility into their loss performance and identify areas of improvement, which is more relevant than ever given we are in a hard market cycle. The increased usage of alternative insurance solutions will also increase clients’ demand for more sophisticated analytics tools.

- A more digital world will result in a shift in how certain individuals and businesses shop for insurance. While the usage of new distribution channels could represent a growth opportunity for brokers, keeping track of and optimizing customer acquisition costs will require the implementation of new tools.

3. Artificial intelligence and predictive analytics. Artificial intelligence (AI) involves the use of algorithms and computers to work on tasks, such as speech recognition, complex decision-making, and image analysis. Predictive analytics uses historical data to forecast future events and identify trends that help inform strategic decisions.

What is the potential impact on the industry and insurance brokers?

- The wider adoption of connected devices across industries will increase the complexity of data analytics (e.g., unstructured data).

- Real-time monitoring will provide the ability to identify new market opportunities as they arise.

- The amount of available data is growing significantly and is expected to double within the next three years. The sheer amount of data will increase the importance of cloud native technology infrastructure that provides speed, flexibility and scalability.

- The insights gained through the analysis of customer data can be used by brokers to offer more personalized and tailored services to clients.

- The combination of data and artificial intelligence will enable the industry to advance predictive analytics in order to prevent losses (e.g., automobile accidents).

Five ideas to stay competitive in a technology-driven world

While the insurance brokerage industry is in its early innings of what is likely to be a transformational change from distribution over placement, to underwriting for certain classes of business – the time to act is now if you want to avoid falling behind the curve. Here are five ways for agencies and brokerages to get started:

- Identify technology needs and stay informed. The best place to start with any digital transformation is to first identify key areas where technology can make a meaningful difference within your business. Staying on top of this ever-evolving technological landscape is always a challenge. However, staying up-to-speed allows brokers to remain in control and stay ahead of their competition.

- Be balanced. Despite the flashiness of technology, a personalized client experience still has a lot of value. Continue to focus on providing a personalized customer experience and quality service. Having access to a broker is still highly valued by clients and can complement a technology-based distribution strategy.

- Adopt automation. Using technology to automate manual and repetitive tasks allows brokers to focus on risk management and service which could lead to an improved customer experience.

- Diversify your product offering. Technology may enable you to diversify your revenue base and increase your wallet share by allowing you to sell third-party insurance products on your platform (or launch your own).

- Don’t go at it alone. While remaining independent, the resources of a larger group can benefit your firm and in return your customers. Joining an executive peer exchange allows firms to stay current with the latest, emerging industry trends.

The digital transformation of the insurance industry is here. Those that are embracing it stand to gain significant advantages in how their business fits into the future state of insurance distribution. Where will you fit into that future state?