Public Broker Performance September 2022

In this Section

MarshBerry’s Broker’s Index

Get the latest performance and insights on the public broker composite.

MarshBerry Broker Index August Update

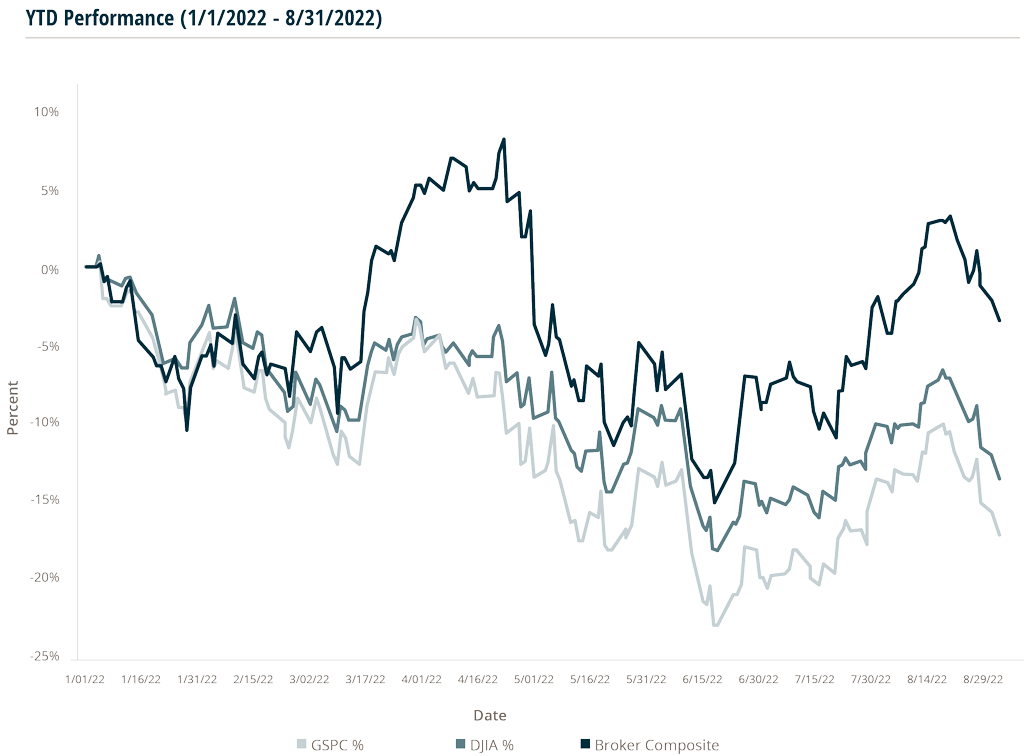

At the conclusion of the second quarter earnings season, six publicly traded insurance brokers: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW), and BRP Group, Inc. (BRP), saw their share prices outperforming the broader stock market through August.

While the major indices have seen double digit declines year-to-date, MarshBerry’s Broker Composite Index again outperformed benchmark indices through August 31, 2022, highlighting the solid fundamentals and growth of the insurance brokerage industry. Through August 31, the S&P 500 decreased by -13.9% and the Dow Jones Industrial Average (DJIA) decreased by -17.5%, while the public broker composite declined by a much smaller -3.4%.

While insurance brokers reported generally strong second quarter results, which were attributed to a combination of improving new business, strong retention and continued insurance rate increases, they also noted

concerns about the macroeconomic environment.

Currently there are more signs of economic slowdown and uncertainty that may impact the growth of insurance brokers and carriers, including the August Purchasing Managers Output Index figure coming in at the weakest since 2009 (ex-the early 2020 pandemic) and U.S. GDP declining for two quarters. On August 26, Fed Chairman Jerome Powell spoke about using “tools forcefully” to manage inflation, that may cause “some pain” to the U.S. economy.

Stocks rallied for several weeks prior to the Fed’s statements on August 26, fueled partly by expectations that the Fed appeared to signal more caution about the pace and size of future Fed Fund rate increases at its last meeting in July. Although the August 26 remarks sparked a broad sell-off in equities, the shares of the public brokers were less affected. This may have been helped by the confidence around meeting organic growth targets that many brokers signaled on their second quarter earnings calls, despite concerns, including continued high inflation, federal fund rate increases, and geopolitical tensions.

Furthermore, several of the public brokers tend to have larger recurring revenue bases and businesses that are relatively noncyclical, supporting relatively stable growth during downturns. For example, WTW CEO Carl A. Hess said on WTW’s 2Q22 earnings call:

“We estimate that about 80% of our revenue base is recurring, often built upon nondiscretionary solutions and services.”

WTW CEO, Carl A. Hess

WTW also sees the business as less sensitive to economic downturns. In 2020, when U.S. GDP declined by 2%, WTW posted organic revenue growth of 2%; in 2008-2009’s recession, WTW’s predecessor posted organic revenue growth of 2% to 4%.

Overall, the shares of the public insurance brokers appear well positioned for the rest of the third quarter.

– 3.4%

Broker Composite

– 13.9%

Dow Jones Industrial Average

– 17.5%

S&P 500

Source: Yahoo Finance, August 31, 2022.

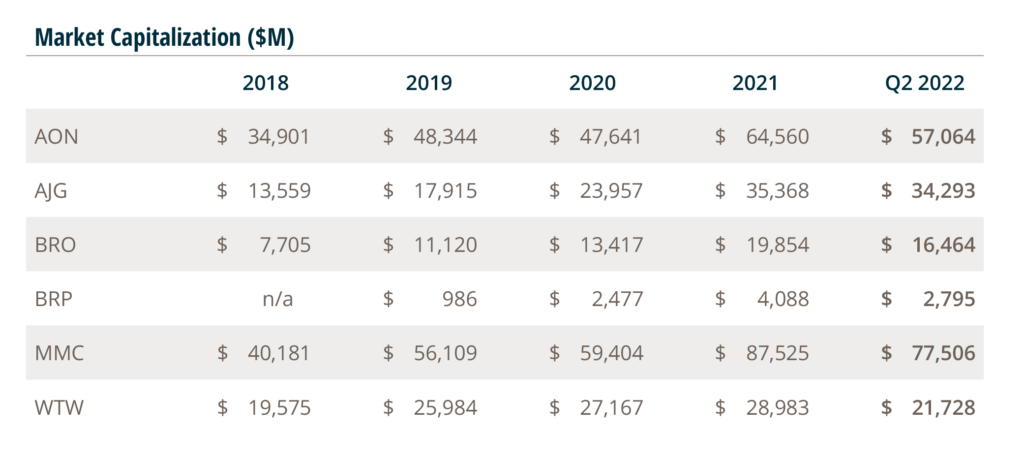

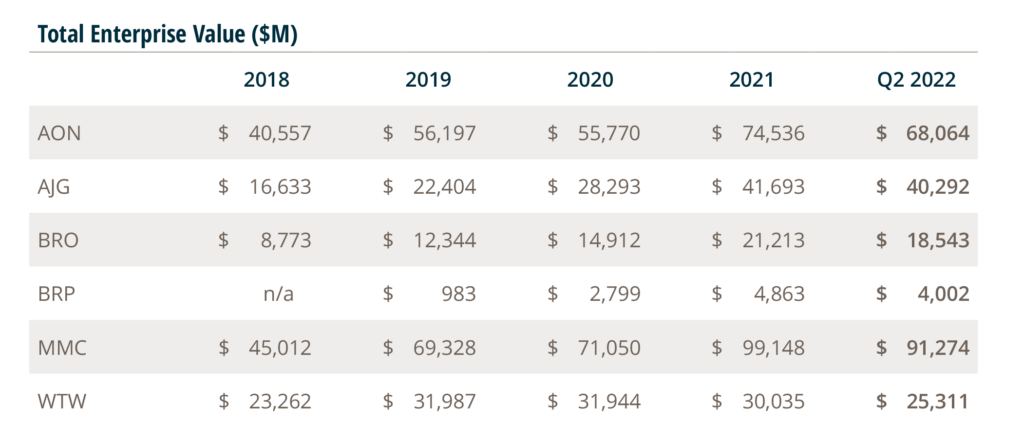

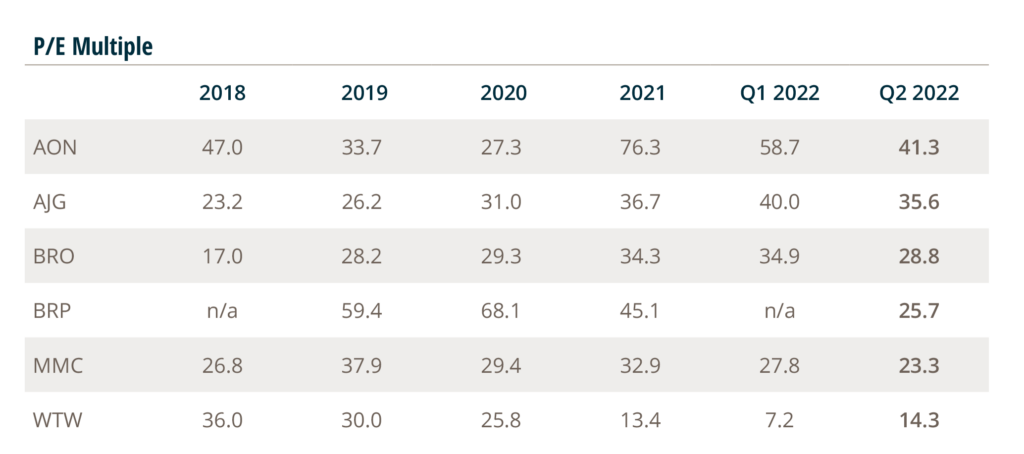

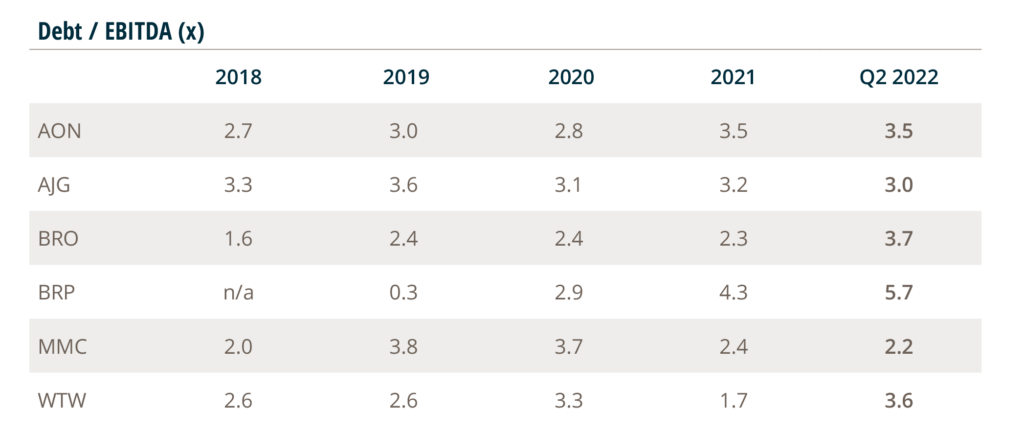

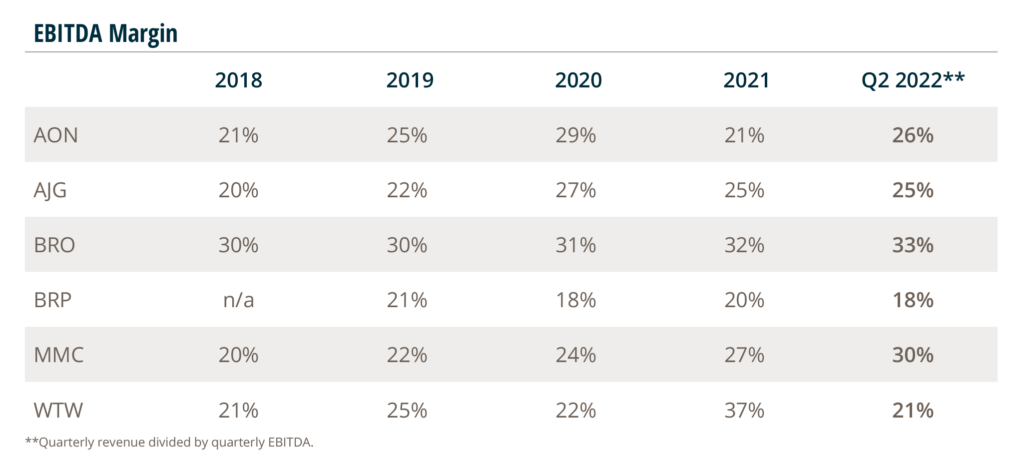

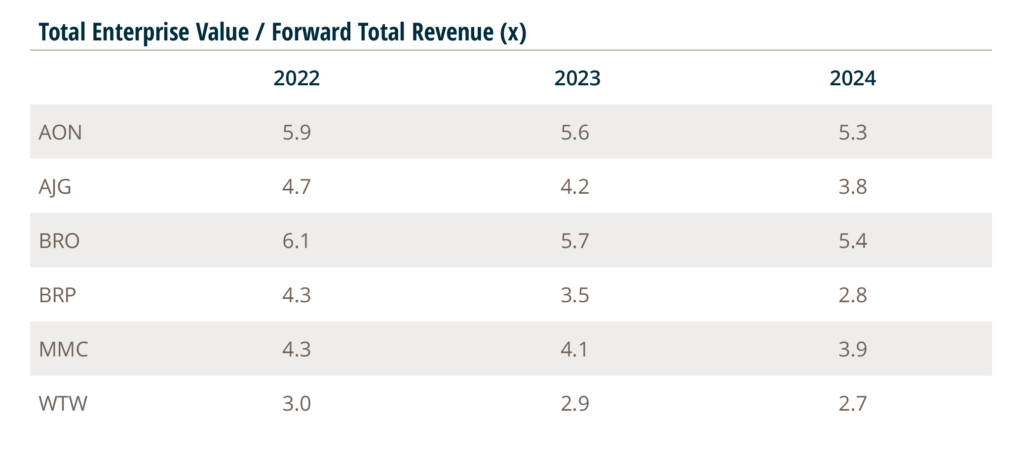

Public Broker Comps

Source: S&P Global Market Intelligence, Company Reports, FactSet, 8/22/22. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization. AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BRP = Baldwin Risk Partners; MMC = Marsh & McLennan Companies, Inc.; WTW = Willis Towers Watson Public Limited Company. 2022.

Source: Yahoo Finance of 8/31/22 at close. BRP, BRO, AON, AJG, MMC, WTW. This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an off er to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.