M&A Market Update September 2022

The Latest Deals and Insights

Who’s buying? Who’s selling? And why should you care? Phil Trem, MarshBerry’s President of Financial Advisory, highlights the current M&A market and provides a look at transactions in August 2022.

M&A Activity Still Robust as Specialty Distribution Transactions Gain Momentum

Despite continued concerns about the U.S. and global economies, rising interest rates to combat inflation, and volatility in the stock market, M&A activity is still robust with 40 transactions announced in August. While still behind year-to-date (YTD) in total compared to 2021, it’s a bit unrealistic to compare 2022 to the record-breaking total of the year prior.

It didn’t help that the 2022 deal count got off to a sluggish start following the year-end blitz of 2021. The rush was based on tax concerns which drove many deals to close in Q4 vs. Q1. However, the rolling 12-month average for transactions is still roughly 60 per month if you include the record-high 183 deals in December 2021.

Even with rising interest rates, buyers still appear poised for aggressive dealmaking — looking to deploy dry powder into attractive investments. But if interest rates continue to rise, and market conditions deteriorate further, it could impact the availability of debt and thus the pace of transactions.

Market Update

As of August 31, 2022, there have been 303 announced M&A transactions in the U.S. The current volume of deal announcements represents a 28.7% decrease compared to this time last year. However, the number of announced transactions is expected to increase as the fourth quarter and year end approaches.

Private Capital backed buyers accounted for 224 of the 303 transactions (73.9%) through August, remaining atop the various buyer classes. This trend is expected to remain consistent throughout the rest of 2022 as dry powder continues to be deployed. Public brokers have remained consistent with last year in terms of total deal count making up 6.9% of total announced transactions.

One trend that continues is the increase in specialty transactions as a percentage of the total number of announced transactions as traditional retail brokers expand into the wholesale and delegated authority space. Specialty firms have been attracting a much broader crowd of buyers. Along with retail firms who are interested in specialty, PE, carriers, and other specialty brokers are all looking to make deals for specialty distributors. Deals involving specialty distributors as targets currently account for 22.8% of the total 303 deals YTD.

Additionally, with the increased interest in specialty distributors, valuations for specialty firms are also continuing to rise. MarshBerry data shows that valuations for specialty brokers, on average, were higher than valuations on retail brokers for the first time in history. This makes sense given the increased level of interest from varying buyer types compared to the limited number of available specialty brokers.

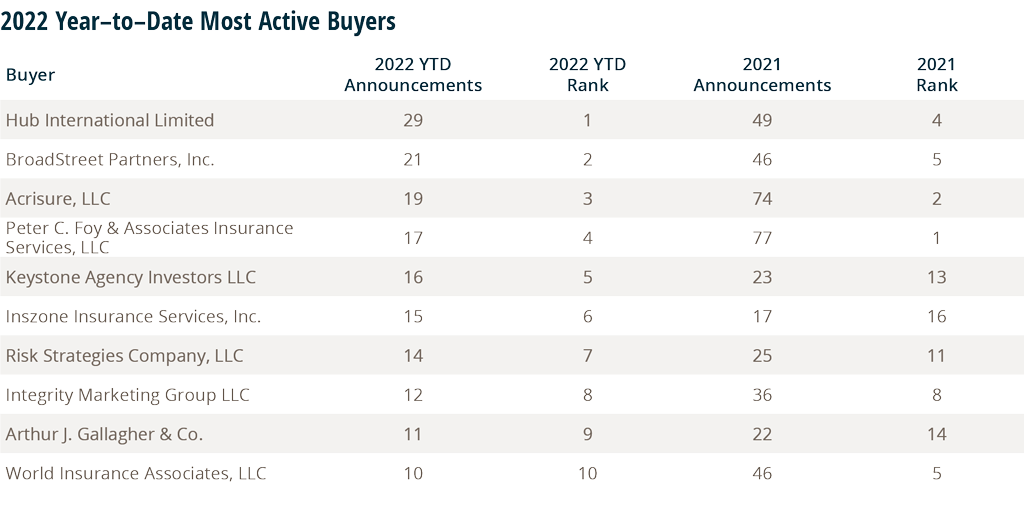

Strong deal activity from the marketplace’s most active acquirers remains constant through August. Ten buyers accounted for 54.1% of all announced transactions observed, while the top three (Hub International Limited, BroadStreet Partners, Inc., and Acrisure, LLC) account for 22.8% of the 303 total transactions.

2022 Acquisition Detail (YTD 8/31/2022)

Who’s Buying:

Insurance Broker — Independent: 26

Insurance Broker — Public: 21

Insurance Broker — Private Capital Backed: 224

Insurance Company and Other: 24

Bank and Thrift: 8

What’s Being Bought:

Full Service: 87

P&C: 157

Employee Benefits: 59

Retail vs. Specialty:

Retail: 223

Wholesale: 34

MGA: 36

Deal Spotlight:

FRP accepts investment by Partners Group as private capital continues to invest in the insurance distribution space

August 10, 2022: Foundation Risk Partners (FRP), a leading retail insurance broker, accepted a controlling stake investment by Partners Group, a leading global private markets firm. FRP’s management team maintains a stake in the firm while its previous private equity sponsor, Warburg Pincus, retains a minority position. This deal is the most recent example supporting the philosophy that firms who optimize efficiencies and position themselves for growth continue to be attractive to private equity-backed buyers.

FRP, which operates 139 offices across 18 U.S. states, offers innovative solutions to businesses and private individuals as they navigate the complex world of commercial insurance, employee benefits, personal insurance, and risk management. FRP’s tremendous growth over the past five years has been driven by their market innovation, integrated communications platform, and commitment to delivering better outcomes for their clients. This new investment will enable FRP to grow more efficiently by integrating acquisitions and broaden their geographic reach. MarshBerry was one of the advisors to FRP in this transaction.

acquirer notify MarshBerry or the public of a prior acquisition. 2022 statistics are preliminary and may change in future publications. Please feel free to send any

announcements to M&A@MarshBerry.com. Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.