Industry Insights September 2022

MarshBerry’s Perspectives for High Performance (PHP)

Insights from our proprietary financial database to help drive your business.

Brokers Are Maintaining Steady Defensive Intervals

The Defensive Interval, or Working Capital Defensive Interval, measures the number of days that a firm could operate and cover its expenses without needing additional capital beyond its working capital.

Having a higher Defensive Interval can help a firm better weather a slowdown or loss of a major account — or take advantage of unexpected opportunities.

MarshBerry has seen that high growth firms often have a defensive interval of three months to over four months. Here is the formula to calculate this metric:

Defensive Interval = ((Average Total Current Assets – Average Total Current Liabilities) / (Total Annual Expenses / 365)).

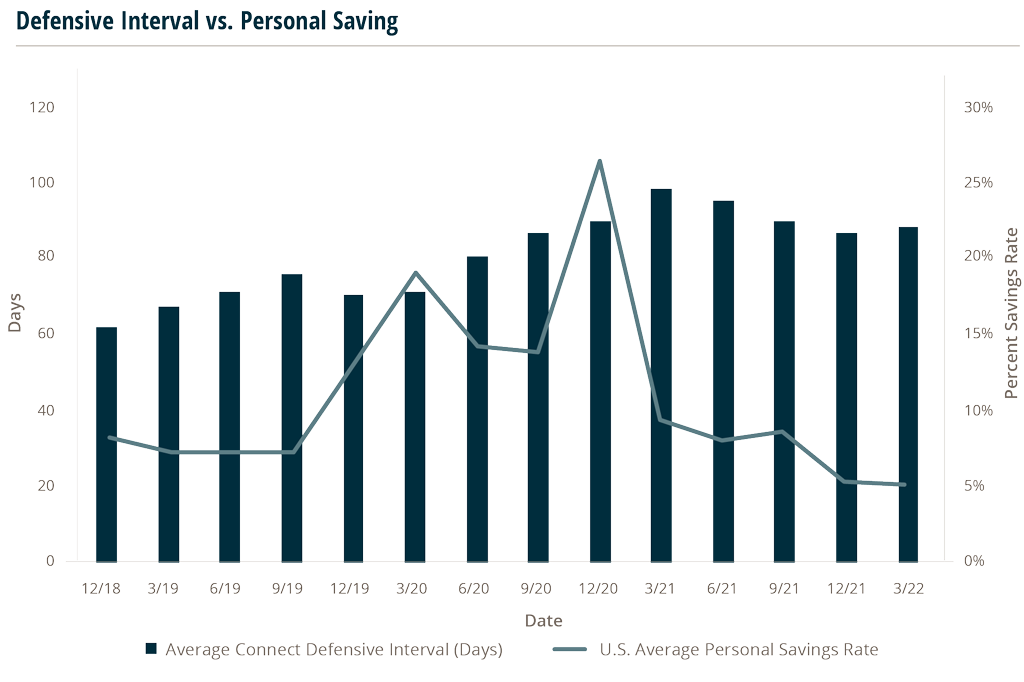

The graph shows the average Defensive Interval of MarshBerry’s Connect executive peer exchange members compared to the U.S. Personal Savings Rate. Both metrics started to increase as COVID-19 cases rose due to a combination of decreased spending and stimulus packages, including Paycheck Protection Program (PPP) loans. More recently, the Defensive Interval appears to be staying above the pre-COVID-19 average while the Personal Savings Rate seems to have leveled out. This may indicate that some insurance brokers are maintaining strong balance sheets while controlling expenses. With inflation rising at record rates these will be useful metrics to monitor moving forward.

In the current volatile and shifting macroeconomic environment, firms should consider reinvesting in their balance sheets so they can be prepared for any unforeseen events and be opportunistic toward potential investments in new producers, technology, or acquisitions.

*Note: The Average Connect Defensive Interval (Days) is showing the average of MarshBerry’s Connect Network Members.

The Hidden Power of Diversity During a Recession

A recession impacts every firm, but the impact is not equal. Diversifying is key to outperforming during a recession. It is known diversification of risk can lead firms through economic hardships, including recessions, but diversification extends further. Having a diverse roster on your team may be just as important.

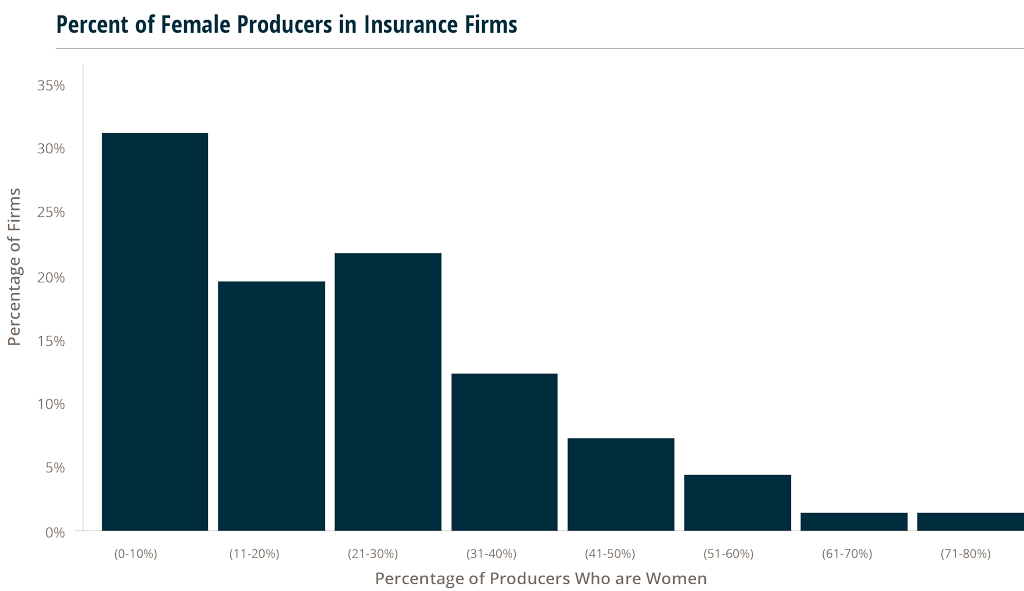

Harnessing the power of a diverse work force can help firms not only survive a pandemic but thrive in one.

From 2007-2009, when the S&P 500 suffered a 35.5% decline, companies with high positivity rates in marginalized employee groups saw a 14.4% gain.5 Men and women experience and react to risk differently. Men are more likely to react to a perceived risk while women generally measure business risk lower. Insurance Business America explains that having a diverse team leads to broader views and a more comprehensive perspective as implications and opportunities of risk are accessed differently. Despite that widely proven phenomenon, insurance firms are lacking in utilizing this tool. According to MarshBerry’s proprietary financial database, Perspectives for High Performance (PHP), one-third of firms have less than 10% of females in producer positions and nearly three quarters have less than 30%. A recession is a big risk for companies; using the potent strength that is currently untapped by many companies can be highly influential in managing that risk.

Research has proven that diverse teams are more effective at solving difficult problems and reaching diverse markets and customer segments.6 This can directly impact profitability, especially in times of recession, when all markets are affected directly. MarshBerry’s PHP data shows that companies with higher diversity ratings have higher EBITDA (as a percentage of revenue), organic growth rates and rates of new business. Each of those metrics are important factors in determining a firm’s success through economic hardship and can be influenced by a company’s diversity strategy. Less than 50% of the largest firms (>$20M revenue) and less than 10% of smaller firms (<$5M revenue) have a formal Diversity, Equity & Inclusion (DE&I) program or strategy, even though the benefits of a diverse team are clear: increased profitability, wider range of thought and increased assessment of risk — all of which a firm must utilize to survive and even grow during a recession.

Creating formal DE&I programs, fair recruiting practices, and analytical promotion processes are all ways to continue diversifying your team to create a recession ready battle strategy.

5 https://www.greatplacetowork.com/resources/blog/workplace-diversity-might-be-the-key-to-surviving-recession

6 https://hbr.org/2016/11/why-diverse-teams-are-smarter