U.S. Macroeconomic Indicators June 2022

In this Section

Market Trends and Current Statistics.

Key U.S. macroeconomic indicators that are likely to impact firms within the insurance industry.

Consumer Confidence

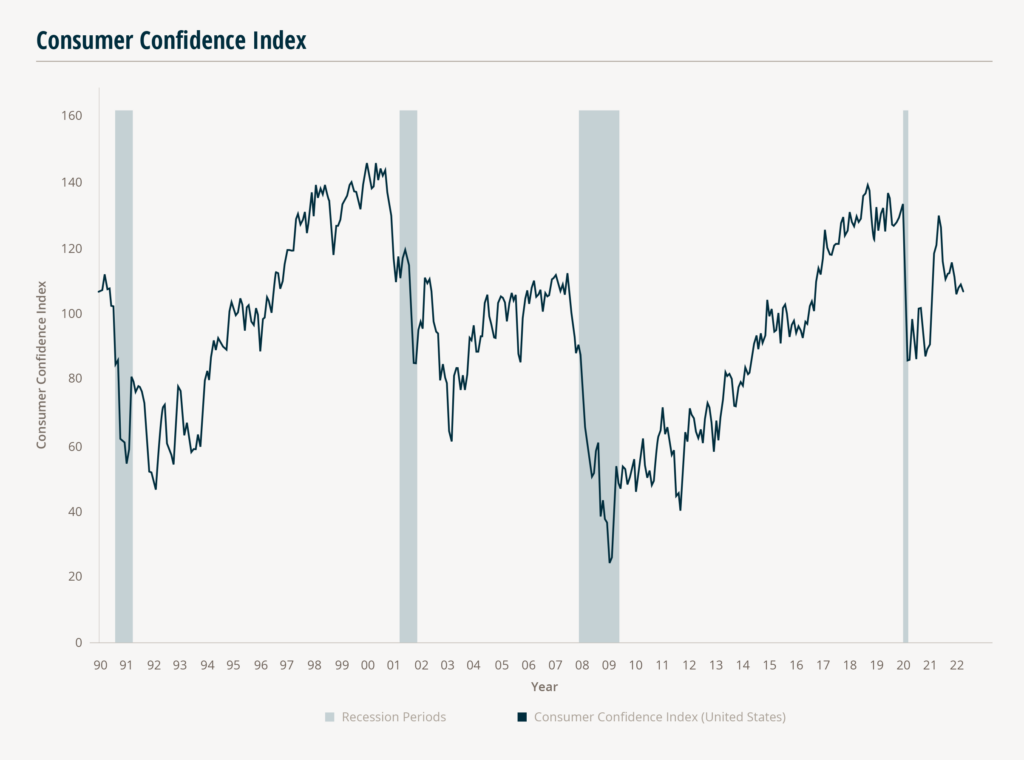

U.S. consumer confidence, as measured by the Conference Board Consumer Confidence Index, fell to a three–month low in May, to 106.4, compared to economists’ expectations for 103.9 and April’s 108.6 figure. The lower May number likely indicates concerns around continued rising inflation and higher borrowing costs. The Conference Board’s Expectations Index, which measures consumers’ short–term outlook for income, business, and labor market conditions, also decreased to 77.5 from 79.0. While consumer spending has not seen a dip, MarshBerry will monitor this for indications of a consumer slowdown which would likely impact economic growth.

106.4

Consumer Confidence Index May 2022

The Conference Board’s Confidence Index is forecasting slower growth over the next few quarters driven by rising prices, with more people spending less on discretionary items as they need to spend more on staples. Commerce Department data still shows that U.S. consumer spending, which comprises more than two–thirds of U.S. economic activity, is holding up. Spending increased 0.9% in April for the fourth consecutive month. What is potentially concerning is the personal savings rate dropping to 4.4%, from a downwardly revised 5% in March. The April savings rate is the lowest since September 2008. But the personal savings rate is also potentially distorted by the government bolstering the economy through the pandemic, and a decline has been expected by economists.

4.4%

Personal Savings Rate

Separately, The University of Michigan’s Consumer Sentiment Index, a monthly index of consumer sentiment, fell to 58.4 in May from 65.2 in April, the lowest level since August 2011. Thirty–eight percent of all households in the survey noted inflation was a concern, a frequency not seen since 2008, with rising prices cited as the main reason for declining living standards over the past year. While consumers generally see wage gains over the next year, about 49% of consumers see their incomes rising less than prices in the same period.

https://news.umich.edu/pessimism-on-inflation-overshadows-optimism-on-personal-finances/.

The PCE Price Index

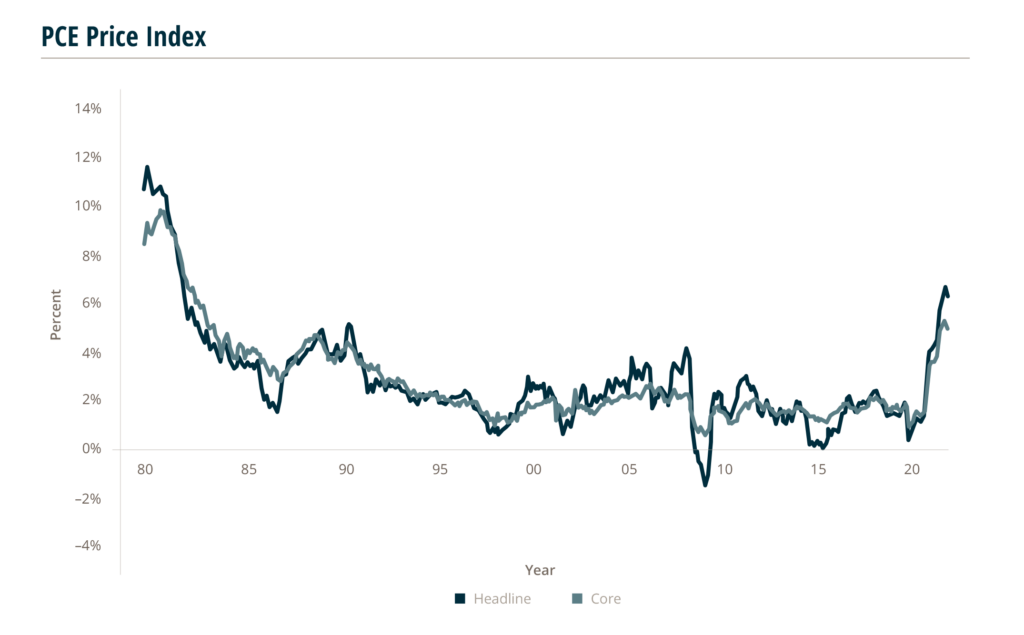

The Personal Consumption Expenditures Price Index (PCEPI) recorded April price increases of 6.3% over the previous twelve months. This is a slight decrease from March levels. Removing food and energy components, referred to as core inflation, the index recorded a 4.9% increase from the year before.

Inflation is registering at levels last seen in the 1980s. The previous time the index registered above 6.3% was January 1982 and core PCEPI inflation last registered above 4.9% in September 1983. Increases in April were across the board, with prices for energy goods and services leading the way with a 30.4% increase. While April was the first sign of inflation slowing at the headline level, core PCE price inflation had peaked in February. Food was the only line item in the Bureau of Economic Analysis’ (BEA) published results that showed faster growth from March’s levels with all other published categories slowing between March and April.

The PCEPI is the preferred measure of consumer inflation for the Federal Reserve. It is produced by the BEA and measures inflation through surveys of what businesses are selling, as opposed to a survey of what households are buying, which is what the Consumer Price Index (CPI) measures.

Manufacturing PMI

Manufacturing grew in May, as the Manufacturing Purchasing Managers’ Index (PMI) registered 56.1 percent, 0.7 percentage points higher than the April reading of 55.4%. A Manufacturing PMI above 48.7% generally indicates an expansion of the overall economy. This is the 24th consecutive month the overall economy grew following the slowing in April and May 2020. The average over the last 12 months is a PMI of 58.8%, and May’s 56.1% is the second lowest in that time period (April 2022 being the lowest). Four of the five subindexes that directly factor into the Manufacturing PMI were in growth territory.

Timothy R. Fiore, Chair of the Institute for Supply Management Manufacturing Business Survey Committee, stated, “The U.S. manufacturing sector remains in a demand–driven, supply chain–constrained environment. Despite the Employment Index contracting in May, companies improved their progress on addressing moderate-term labor shortages at all tiers of the supply chain.” He continued, “All of the six biggest manufacturing industries—Machinery; Computer & Electronic Products; Food, Beverage & Tobacco Products; Transportation Equipment; Petroleum & Coal Products; and Chemical Products measured moderate-to-strong growth in May.”

The Federal Reserve

On June 15, the Federal Reserve (Fed) announced it was raising the federal funds rate ¾ points to a target range of 1.5–1.75% from its previous range of 0.75–1.0%. This is the first time the Fed has raised the target range by ¾ of a percent since 1994 and is a departure from the half percentage point increase that previous guidance from the Fed had indicated. In its statement, the Fed stated it anticipates ongoing increases in the target range will be appropriate as the Committee seeks to reduce inflation. In its published projection materials, assessments of the members of the Federal Open Market Committee had indicated the participants anticipated the target range for the federal funds rate at the end of 2022 will fall somewhere between 3.0% and 4.0%, with a median of 3.4%.

The rate is expected to be even higher in 2023 with a median projection of 3.8%.

This rate increase followed an eventful May, where the Fed had taken a couple measures to combat soaring inflation. On May 4, the Fed announced it was raising the federal funds rate a half point to a target range of 0.75–1.0% from its previous range of 0.25–0.5%.

This was the first time the Fed had raised the target range by more than a quarter percent since 2000.

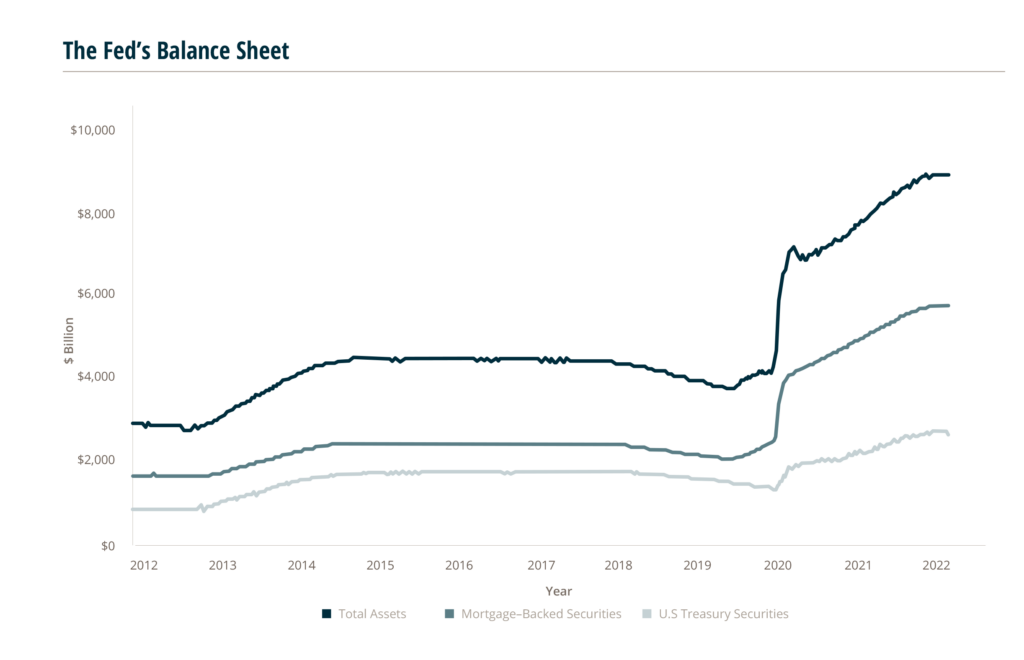

On that same day, the Fed also announced details of its plan to reduce its balance sheet. Over the course of the COVID–19 pandemic, the Fed took measures known as quantitative easing in which it purchased securities—primarily U.S. Treasury securities and mortgage–backed securities—to increase the amount of cash in the economy, resulting in lower interest rates and increased economic activity. In January, the Fed had announced it was planning on reducing the size of its balance sheet—quantitative tightening—and in May it announced the details of its plan.

This “unwinding” of the Fed’s balance sheet is intended to keep the economy from “overheating” and causing unwanted inflation.

Beginning June 1, the Fed began reducing the rate at which they reinvest the principal payments they receive from maturing securities, thereby reducing its balance sheet.