Industry Insights June 2022

MarshBerry’s Perspectives for High Performance (PHP)

Insights from our proprietary financial database to help drive your business

Employers with an Effective Talent Retention Strategy will Stand Out from the Competition

In the current labor market, employers are experiencing unprecedented competition for talent. Over the past year, unemployment has recovered to near–historic lows, while the rate of job quits in the U.S. has risen to its highest point since U.S. Bureau of Labor Statistics began tracking it in 2000.

As a result, companies must take measures to ensure their firms stand out from competitors if they want to attract and retain the best talent.

While this of course includes the paycheck, it is becoming clear that it goes beyond just that, with employees increasingly looking at the company culture, benefits, flexibility, upskilling, and work–life balance when deciding whether to accept or stay in a position.

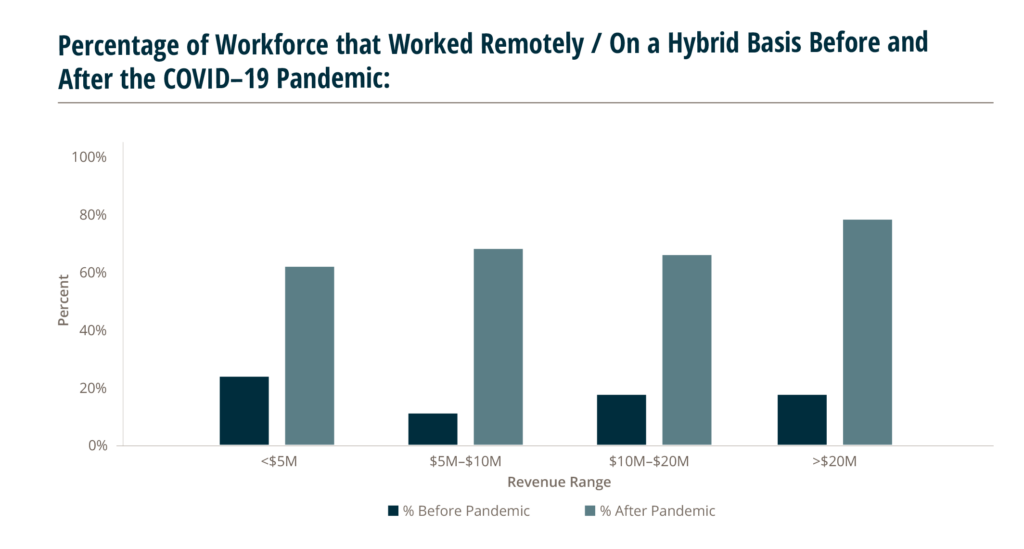

The past couple years have seen a dramatic shift in where employees do their work.

According to MarshBerry’s 2022 Insurance Agency & Brokerage Compensation Survey, respondents indicate that on average, nearly 70% of their employees now work on a hybrid or remote basis, compared to less than 20% prior to the pandemic, with the vast majority of survey respondents indicating that they had a remote work policy that is either based on performance or manager discretion or is available to everyone with a role that can be done remotely.

Employees overall have shifted their attitudes post–pandemic. Many value flexibility, learning and development opportunities, and mentorship. Numerous polls have found that many are willing to walk away if their employer starts requiring in-person full–time work. In addition, recent data projections by job search service Ladders estimate that 25% of all professional jobs in North America will be remote by the end of 2023. An employer that offers hybrid or flexible work options may be able to better retain top talent. These factors are important for brokers to manage and consider when developing a retention plan and strategy.

Top-performing firms tend to spend more per employee

Generally, there is a correlation between productivity and compensation.

There is often a misconception that high–performing firms seek to minimize service staff compensation at all costs, but that is not necessarily the case.

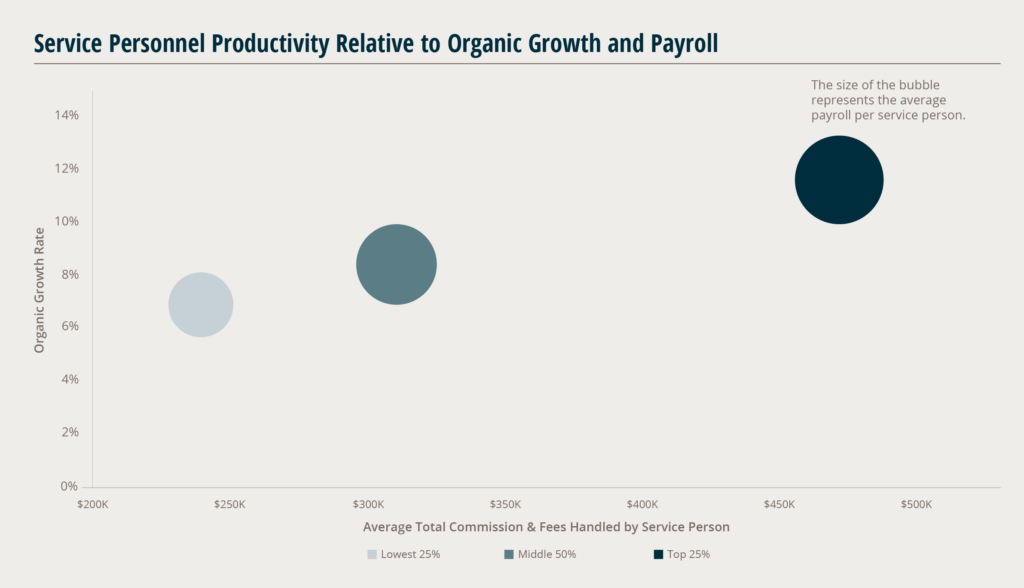

In fact, in MarshBerry’s experience, these top– performing firms often spend more per employee but receive outsized returns in terms of productivity and growth. In MarshBerry’s 2022 Insurance Agency & Brokerage Compensation Study, firms were segmented into three groups based on service personnel productivity, measured by commissions & fees handled: the top 25%, the middle 50%, and the lowest 25%. The Study found that top–performing firms spend more per employee — 36% more than those in the lowest 25% group.

However, they also receive significantly more in returns: their average productivity is 85% higher than the lowest 25%, and their organic growth rate is 104% higher. Thus, it pays to recruit high–caliber staff who may command a premium in the labor market but can significantly outperform more average peers.

36%

More is Spent on Employees in Top 25% Firms than in the Lowest 25% Firms.

85%

Higher Productivity Rate in Top 25% Firms than in the Lowest 25% Firms.

104%

Higher Organic Growth Rate in Top 25% firms than in the Lowest 25% Firms.

In the long run, this also benefits profitability, as fewer people are needed to support the same amount of revenue.