Public Broker Performance June 2022

MarshBerry’s Broker’s Index

The latest performance and insights on the public broker composite.

MarshBerry Broker Index Remains Resilient

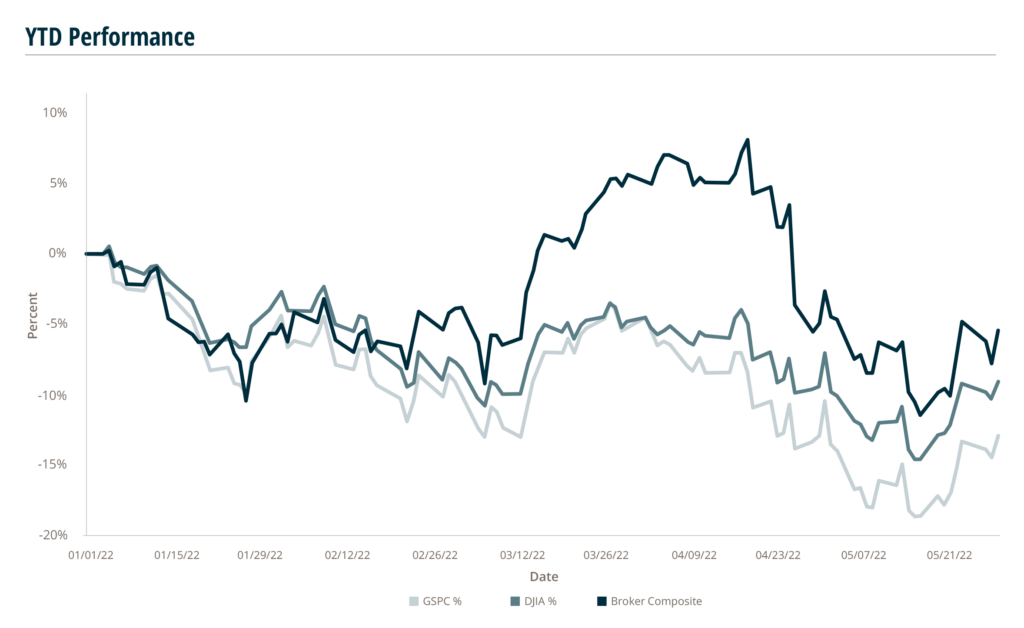

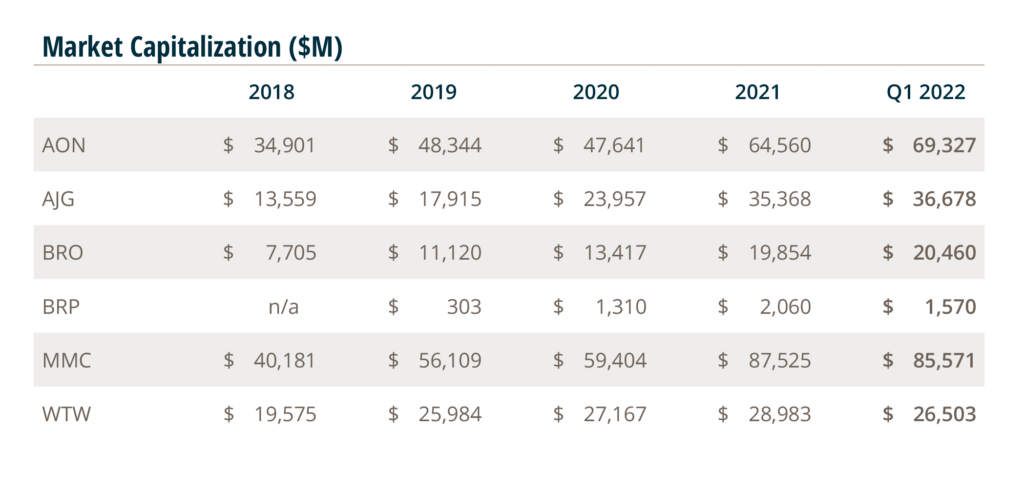

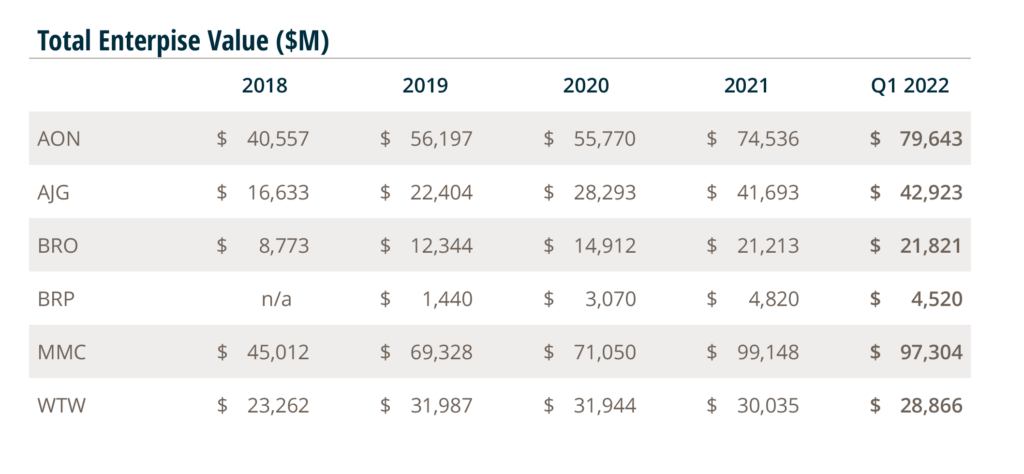

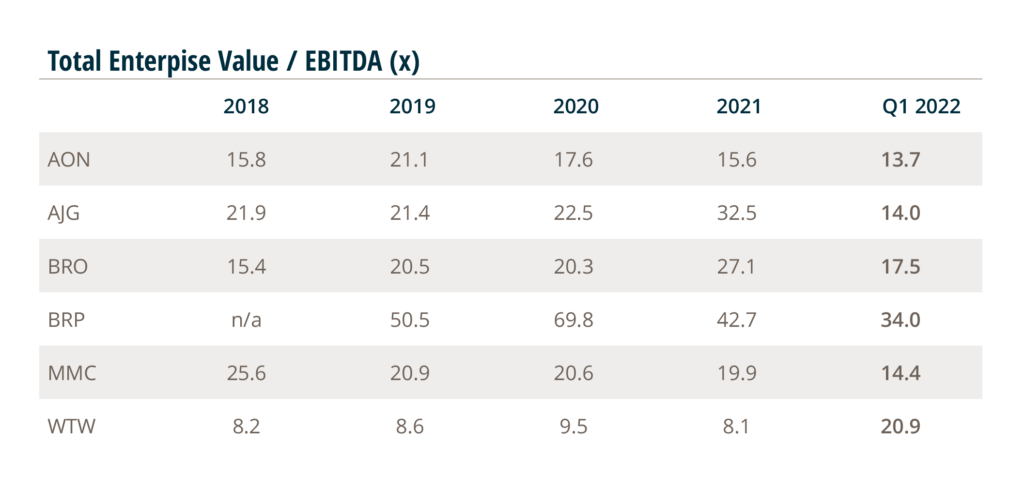

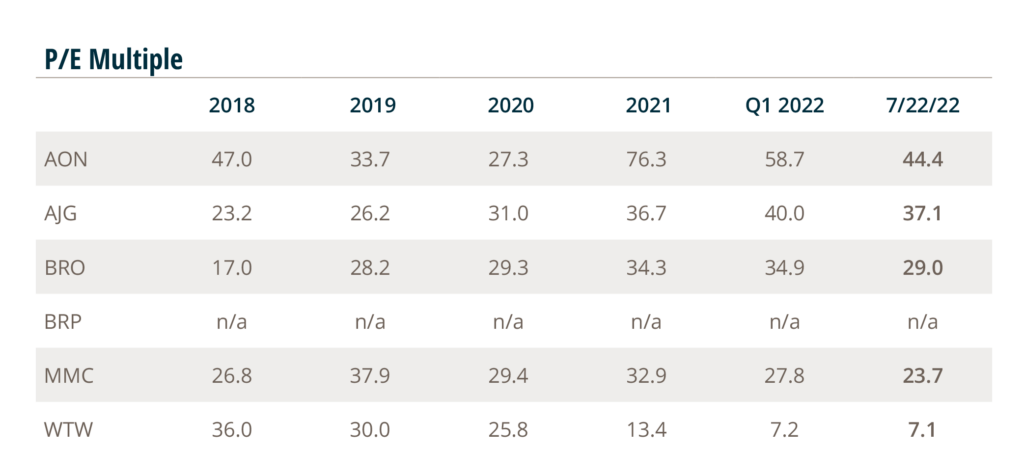

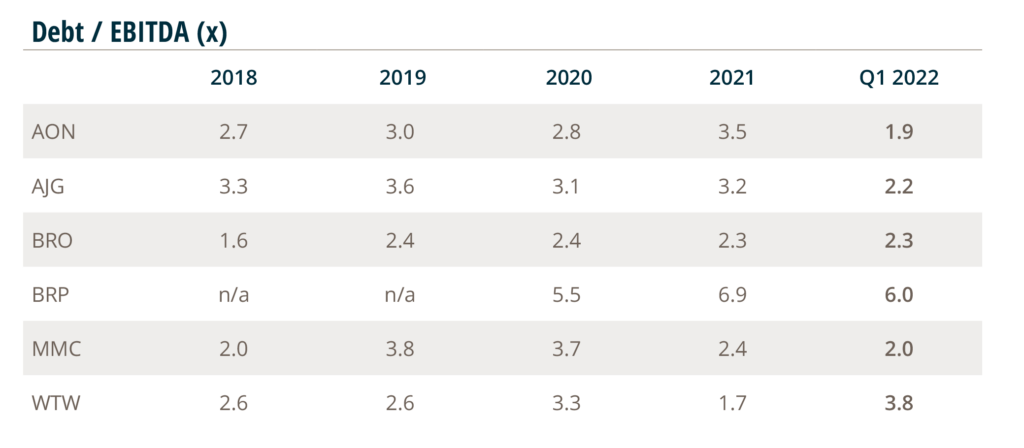

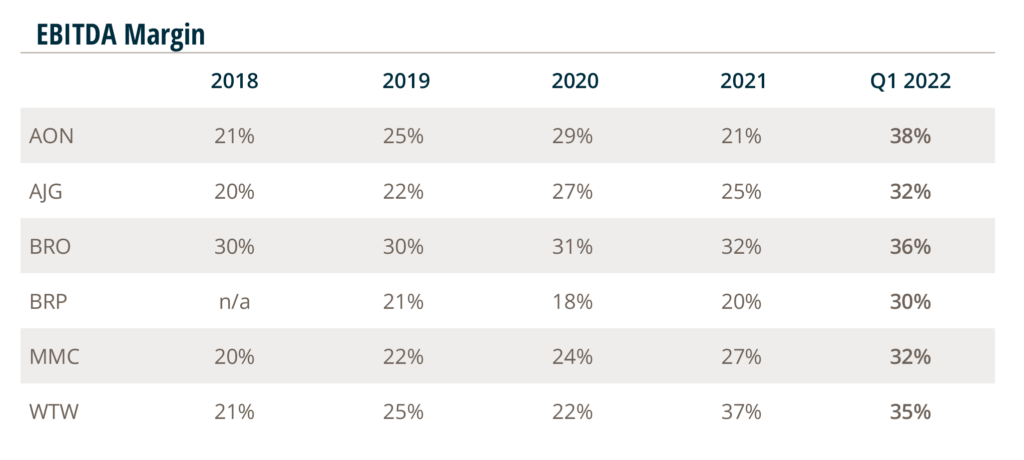

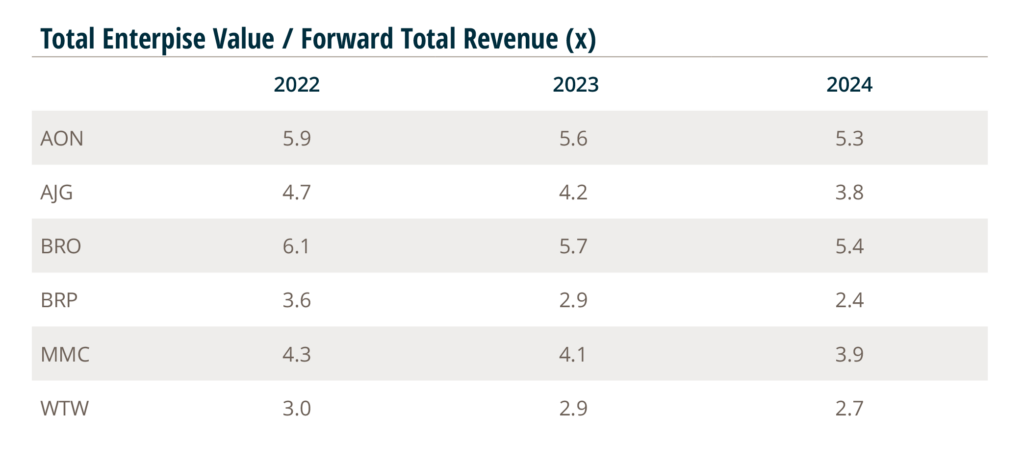

Year–to–date through May 31, 2022, MarshBerry’s Broker’s Index, comprised of six publicly traded insurance brokers Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW), and BRP Group, Inc. (BRP), has outperformed the S&P 500 and Dow Jones Industrial Average (DJIA) indices.

This highlights the resilience of the insurance brokerage industry during stock market volatility, rising inflation, tightening monetary policy, a potential recession, and weaker consumer confidence.

Despite macroeconomic headwinds, the insurance distribution companies delivered strong first quarter results and signaled continued confidence in their organic growth and financial positions for the rest of 2022.

Shares of insurance companies are considered relatively defensive as they typically remain more stable during market volatility. Clients and businesses will continue to need coverage even when there is an economic slowdown. In the Property & Casualty (P&C) space, businesses still require coverage during recessions, including home and auto insurance, cyber, workers compensation, and flood insurance.

Following the solid first quarter results from the MarshBerry Broker Index, many management teams have confidence that their firms will meet their goals for 2022. July quarterly earnings reports will provide color on the ongoing moderation of price increases and the impact of rising inflation on loss costs and exposure growth.

-5.4%

Broker Composite

-12.9%

S&P

-9.1%

Dow Jones

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.

Source: S&P Global Market Intelligence, Company Reports, FactSet 5/31/22. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization. AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BRP = Baldwin Risk Partners; MMC = Marsh & McLennan Companies, Inc.; WTW = Willis Towers Watson Public Limited Company.