U.S. Macroeconomic Indicators December 2022

Market Trends and Current Statistics

Here are key U.S. macroeconomic indicators that are likely to impact brokerages within the insurance industry

Insurance Brokerage 2022 Outlook vs. Reality

In early 2022, insurance brokers had generally optimistic outlooks for the year, but noted some concerns around rising geopolitical tensions, supply chain issues, monetary tightening, ongoing effects of the pandemic and inflation. Marsh & McLennan Companies, Inc. (MMC) was optimistic about growth in 2022, driven by factors including projected above-average GDP growth, continued firm property & casualty (P&C) pricing conditions and inflationary impact on exposures.

By the end of the third quarter, many brokers saw even greater uncertainty from the impact of continued inflation, federal fund rate increases and geopolitical tensions. However, they remained confident in their abilities to meet their growth targets for 2022.

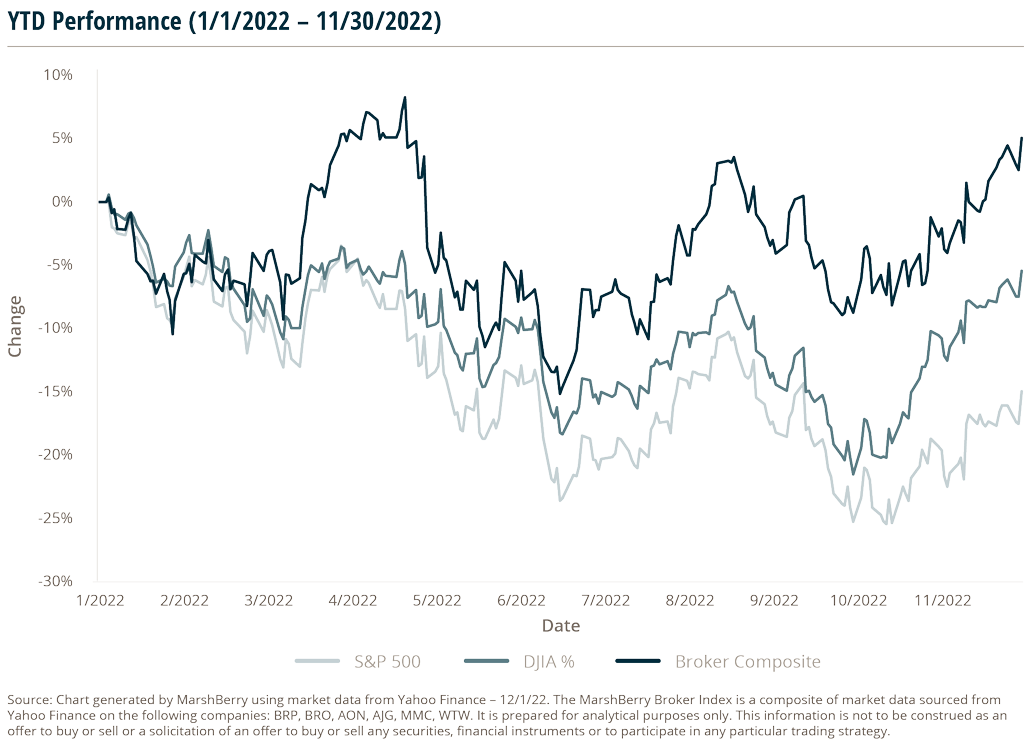

The broker index is a composite comprised of publicly available market data gathered on six publicly traded insurance brokers: Arthur J. Gallagher & Co. (AJG), Aon plc (AON), Brown & Brown, Inc. (BRO), MMC, Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP). As a group, the composite has outperformed the Standard & Poor’s 500 (S&P 500) and Dow Jones Industrial Average (DJIA) through November 2022.

Based on company earnings calls, these insurance brokers reported overall positive results for Q3 2022, which were attributed to a combination of improving new business, strong retention and continued insurance rate increases. But overall organic growth figures reported were slightly lower in Q3 2022 vs. Q2 2022.

Here is what three public insurance brokers guided for 2022 on their Q4 2021 earnings call compared to their updates on their Q3 2022 earnings calls.

MMC

- Q4 2021: Gave guidance for “underlying revenue growth of mid-single-digit or better margin expansion and solid growth in adjusted Earnings Per Share (EPS).”

- Q3 2022: The firm sees full year 2022 organic growth coming in as high-single digits and solid growth in adjusted EPS

BRP

- Q4 2021: Organic growth would come in at modestly above its long-term 10%-15% target given momentum around strong organic growth and partnerships.

- Q3 2022: Organic growth was far above the public broker group average in Q3 2022 at 28% with double-digit growth across all sectors. For Q4 2022, guidance for organic growth is in the high teens which would equate to organic growth for the full year of approximately 20%. This is about in-line with its early 2022 guidance for “organic growth coming in at modestly above its long-term 10% – 15% target.”

AON

- Q4 2021: Company guided to mid-single-digit or greater organic revenue growth, margin improvement and double-digit free cash flow growth for full year 2022.

- Q3 2022: The Company reiterated its projections earlier in the year: mid-single-digit or greater organic revenue growth, margin improvement and double-digit free cash flow growth for the full year 2022. AON remained consistent with its guidance throughout 2022.

Overall, most public insurance brokers’ predictions (made back in January and February) for 2022 performance were accurate despite the challenges this year presented. Firms continued to be confident throughout 2022 in their abilities to execute and meet their organic growth goals, while acknowledging an increased level of macroeconomic volatility, driven by recession risk, the Fed’s interest rate hikes, continued high inflation and geopolitical conflicts.

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information. The MarshBerry Broker Index is a composite of market data sourced from Yahoo Finance on the following companies: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only.

The Social Inflation Factor in Insurance Costs

In the insurance industry, social inflation refers to the causes of rising costs within insurance beyond general economic factors. Caused by shifts in societal beliefs, social inflation can explain rising costs for claim payouts, loss ratios and how much policy holders are willing to pay for coverage. It also accounts for the increases in claims values beyond that being related to traditional stressors such as demand or supply chain pressures.

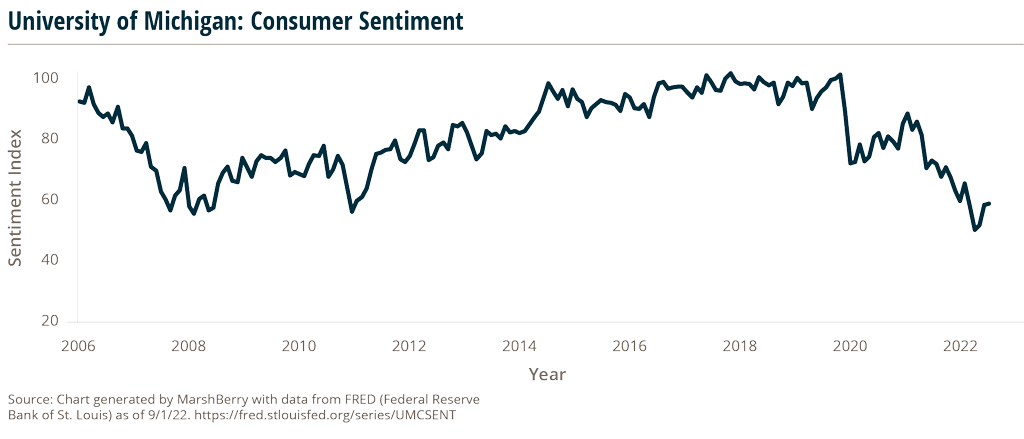

If consumers believe prices are going up for everything due to “inflation,” then we expect them to be willing to pay more in insurance premiums.

Conversely, if insurers understand this, they can push premiums up without fear of losing customers, worsening inflation.

Social inflation is especially threatening because unlike general economic inflation that can be mitigated using pricing models and loss reserves, social inflation is difficult to predict and fight. The impact can be seen in the number and severity of outsized jury awards, length of legal proceedings and increases to statutory limits on non-economic damages. Commercial auto, professional liability, product liability and Directors and Officers liability tend to be the most impacted by social inflation.1

As inflation headlines scroll across news sites, some people may become desensitized to cultural attitudes and rising litigation costs. As greater clarity and information around CEO salaries and company profits are released, people (and jurors) may become more aware of monetary values and may tend to sympathize more with claimants. This could lead to higher payouts on insurance claims, driving higher losses for insurers, prompting increases in premiums — all due to social inflation.

2022 Holiday Sales May Be Less Predictable

The holiday sales period, between October and December, is both particularly important for retailers and a barometer for consumer sentiment. This year it is likely to be impacted by high inflation, recession concerns and retail supply chain issues. But there are indicators that the U.S. shopper continues to be resilient. Holiday sales can be an indicator of the strength of the economy as consumer spending accounts for almost 70% of U.S. GDP.

Some early indicators of the strength of holiday sales in 2022 include Amazon’s warning of a slowdown in holiday sales, which the company noted could be caused by continued high inflation, tighter consumer budgets, and energy costs.2

S&P Global Market Intelligence projects that real holiday sales from October through December will decrease 1.2% year-over-year (YoY), when adjusted for inflation.3 Without adjusting for inflation, S&P sees nominal sales increasing by 4.5% YoY, which is higher than before the pandemic, but below the “lofty rates seen in recent years.”

The National Retail Foundation (NRF) issued a rosier forecast, predicting retail sales to grow 6% – 8% YoY during November and December. This is below 2021’s holiday sales increase of 13.5% YoY but above the holiday retail sales average increase of 4.9% in the last ten years, according to the NRF.

Data from Chase Bank also indicates consumers are still confident. Chase card spending increased by 8% on a three-year Compound Annual Growth Rate (CAGR) basis in Q3 2022 driven by increases in discretionary purchases.4

Retail sales during the 2022 holiday sales period could give some good insight into whether consumers believe the U.S. is entering a recession, and how much pressure the consumer is feeling from higher prices and a potentially shifting job market. Furthermore, holiday sales performance may be a helpful predictor of consumer behavior and economic conditions in 2023. Moody’s chief economist Mark Zandi commented: “If Christmas turns out to be a bust, or worse than I’m anticipating, then my year-end 2023 in general will be significantly darker.”5

- https://www.iii.org/article/social-inflation-hard-to-measure-important-to-understand

- https://www.reuters.com/markets/us/amazon-forecasts-fourth-quarter-sales-below-estimates-2022-10-27/

- https://www.spglobal.com/marketintelligence/en/mi/research-analysis/nominal-holiday-sales-up-real-sales-down.html

- https://www.jpmorgan.com/insights/research/holiday-shopping

- https://www.barrons.com/articles/retailers-holiday-sales-companies-that-will-come-out-on-top-51668729381