Focused Insights: The Impact of Inflation April 2022

MarshBerry’s WayPoint offers macroeconomic indicators relevant to your brokerage or agency, industry insights from our proprietary database, updates on the M&A market and key transactions from the previous month, and a market overview from the six publicly traded retail brokers on a monthly basis.

Inflation and Interest Rate Increases Make Headlines

What’s the Impact on Insurers and Brokers?

In March, U.S. inflation rose to 8.5%, the highest since December 1981 — up from February’s 7.9% annual rate. Pandemic–related supply chain issues, expansionary monetary policy, the Russia–Ukraine conflict, high oil prices, and a tight labor market all contribute to rising costs. Analysts expect inflation to remain far above the Federal Reserve System (Fed) target level of around 2% for some time, creating challenges for Property & Casualty (P&C) insurers and brokers.

Expect Rate Increases as The Federal Reserve Combats Inflation and a Depressed Economic Environment

Due to the ongoing surge in inflation, economists now project that the Fed will announce two half–point rate hikes at the next meetings in May and June. After the June meeting, the Fed funds rate would increase to 1.25% — 1.5%.

On March 16, 2022, the Federal Reserve (Fed) raised the federal funds rate a quarter–point and signaled more increases this year.

Despite the Fed’s stated intention of implementing a series of future rate hikes, it will undoubtedly be cautious to avoid the risk of a potential recession. Many analysts see the Fed aiming for a balance of maintaining growth while taming inflation with its policies.

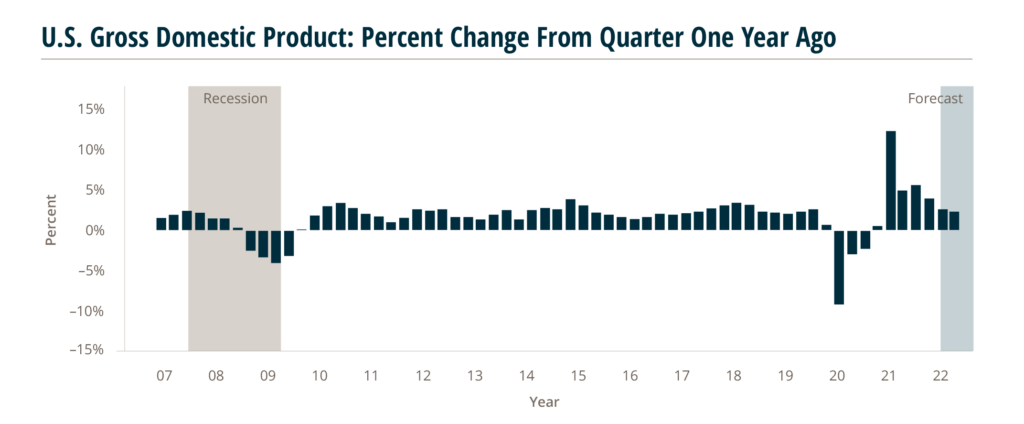

While U.S. GDP grew at a solid 5.7% in 2021, analysts project slower economic growth this year, with 2022 GDP growth expected to increase by 3.7%. Forecasters surveyed by the Federal Reserve are also forecasting positive, albeit moderate, economic growth for the next two years, with 2.7% GDP growth in 2023 and 2.3% in 2024.

Another concern is the shape of the U.S. Treasury yield curve, which briefly inverted on April 1, 2022. An inverted yield curve warrants attention because it’s a warning sign that has preceded almost every recession over the past 60 years. When the yield, or return, on a longer–term note is lower than a short–term note, investors are more pessimistic about economic conditions in the future, as shorter–duration notes typically offer lower yields because risks are considered more predictable over a shorter time frame.

There’s additional risk of slowing economic growth.

Federal Reserve Bank of Philadelphia Survey of Professional Forecasters (forecast periods).

The Impact of Rising Inflation on Insurers’ Solvency and Profitability

High inflation impacts the value of investments held on insurers’ balance sheets. Insurers tend to have a conservative investment strategy and invest mainly in fixed–income investments. According to the Insurance Information Institute, in 2020, P&C insurers held about 27% of their assets in stocks and 55% in bonds. Insurers face the risk that income from these bond investments will fall short in comparison to rising inflation rates. Inflation risk is even more significant in bonds with long maturities, which may have fixed lower yields.

According to Fitch Ratings, P&C insurers potentially face fewer investment risks than life insurers as the sector has lower asset leverage (2.2x for P&C firms at year–end 2020 vs. 9.0x for life insurers). Over the last ten years, life insurers have invested more in long–term assets like corporate bonds, commercial real estate, and alternative assets for income. Shorter portfolio durations expose P&C firms to less risk from lower interest rates.

2.2X

Asset Leverage for P&C Firms

At Year-End 2020

9.0X

Asset Leverage for Life Insurer Firms

At Year–End 2020

Some insurers could see higher loss ratios as inflation and the cost of claims rise. Auto insurers are already facing pressures and seeing higher loss ratios in 2021, impacted by the rising costs of repairs and claims. According to the Auto Care Association, the consumer costs of motor vehicle equipment and other expenses are up 20% in 2022 vs. 2021. Homeowners’ insurance margins are reduced by the rising cost of materials, labor, and elevated CAT losses.

“Broadly speaking the underwriting community is worried about property CAT losses, the impact of inflation on loss cost, and … cyber–related claims.”

COO John Doyle on MMC’s 4Q21 call

The Risks of Ongoing Inflation to Insurance Brokers

As interest rates increase with more aggressive Fed action, borrowing costs are likely to stay at manageable levels for now. Rates could increase over time in 2023, impacting the borrowing costs of private equity investors looking to acquire large insurance brokers. This may prompt a re–evaluation of pricing levels.

Insurance rates would likely remain firm in an inflationary environment as carriers anticipate the increase in future claims costs. Certain insurance lines, such as Cyber, Umbrella, and Wind–exposed property, are seeing robust rate increases. In March 2022, public brokers reported continued insurance rate increases through 4Q2021, with several of them anticipating rates to remain firm in 2022. On Arthur J. Gallagher & Co.’s (NYSE: AJG) 4Q2021 earnings call, CEO J. Patrick Gallagher commented:

“I see difficult P&C market conditions continuing throughout 2022. That’s because our risk-bearing partners remain cautious on rising loss costs.”

Commission income for brokers will likely remain robust due to increased exposures coming out of the COVID–19 downturn and inflation–driven premium increases. “Inflation in general would be a bit of a tailwind for us because when we look at past cycles, Marsh & McLennan & Companies, Inc. (NYSE: MMC) tends to do a bit better in inflationary periods than what preceded them, so … probably a mild benefit because of exposure unit growth, principally,” commented CEO Dan Glaser on MMC’s 4Q2021 earnings call.

Wage inflation could continue to increase in a highly competitive job market. Low levels of unemployment and the Great Resignation are contributing to the challenges of filling new and existing positions.

Increasing expenses could pressure margins, but some brokers are making changes to offset higher costs. Willis Towers Watson Public Limited Company’s (NYSE: WTW) CEO Carl Hess said on the company’s 4Q2021 earnings call, they are taking measures to manage expenses:

“One of the pillars of our program is capitalizing our scale to move back–office work to centers of excellence that we think will improve client and colleague experience and outcomes but should also allow for relief on the cost pressures that we might have in an inflationary market.”