Industry Insights April 2022

MarshBerry’s Perspectives for HighPerformance (PHP)

Insights from our proprietary financial database to help drive your business.

Key Insights from MarshBerry’s Proprietary Financial Management System Perspectives for High Performance (PHP)

Here are four notable insurance industry insights based on important metrics within the insurance brokerage sector.

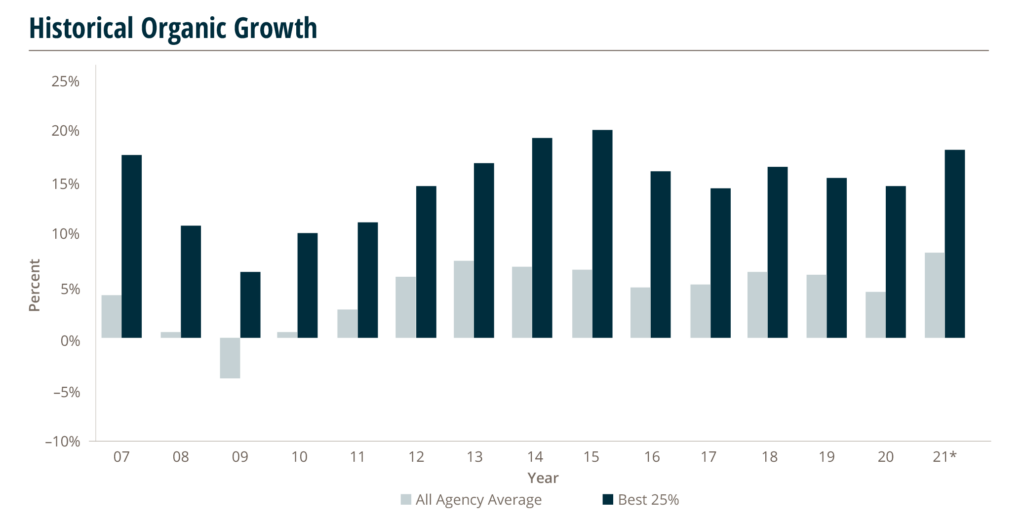

Organic Growth, All Agency Average and Top Performing 25% Agencies Historical Organic Growth

The pandemic in 2020 impacted the All Agency Average organic growth; however, the Best 25% of firms did not see as much of a dip in organic growth that year. This suggests that top-performing firms grew at a similar rate throughout the pandemic, whereas other firms did not do as well. Top performing firms also saw less of a decrease in organic growth during the pandemic than in the prior recession, possibly indicating that they are better positioned to handle volatility and business shifts.

During the recovery in 2021, many firms saw a nice lift in organic growth, from 4.6% in 2020 to 8.3% that year. This was likely attributed to several factors:

- Rising inflation lifted asset prices and higher premiums, leading to an increase in commissions

- Ongoing recovery post–COVID–19 led to better demand in 2021

- Pent–up demand and business were potentially pushed from 2020 into 2021 due to restrictions, less travel, and fewer in–person meetings in 2020

In future periods of economic slowdown or volatility, top firms appear better positioned to maintain organic growth levels.

*2021 data is preliminary.

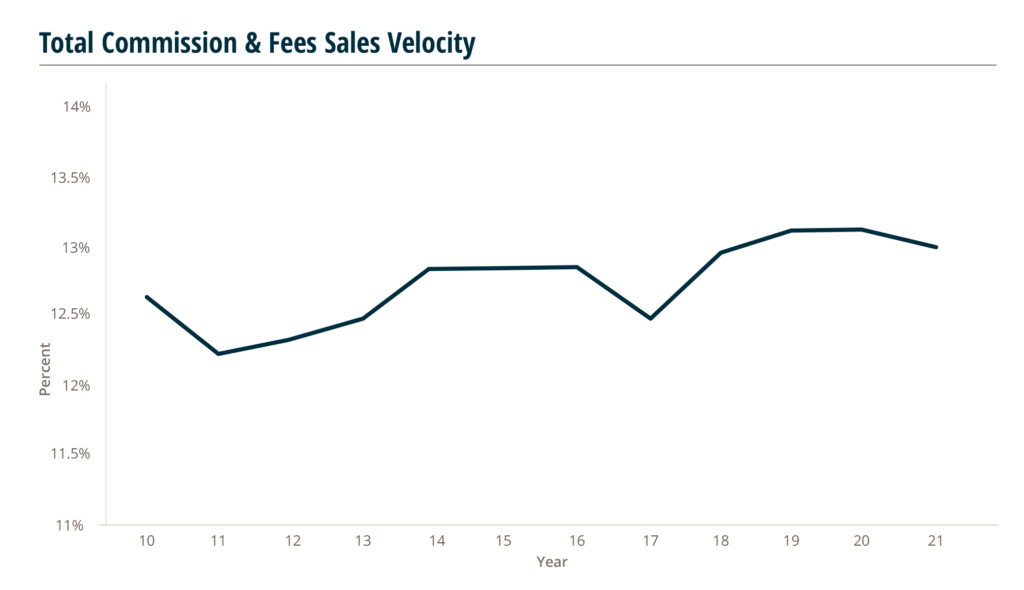

Sales Velocity

Sales velocity (new business as a percentage of prior year commissions and fees) continues to hover around 13% for the fourth year, albeit finishing 2021 slightly down compared to 2020. Despite gains in overall organic growth, additional sales velocity appears to be lagging — which suggests that many firms are experiencing better–than–average leakage and retention rates rather than purely writing new business. Lower leakage rates are likely propelled by hardening rates (e.g., higher premiums resulting in more commission income) and increased exposure base (which could be boosted by an uptick in economic activity and/or inflation).

MarshBerry recommends that brokers strive for 15–20% sales velocity to produce predictable, profitable organic growth.

The average firm tends to fall short of this goal, which leaves them susceptible to external factors that they cannot control.

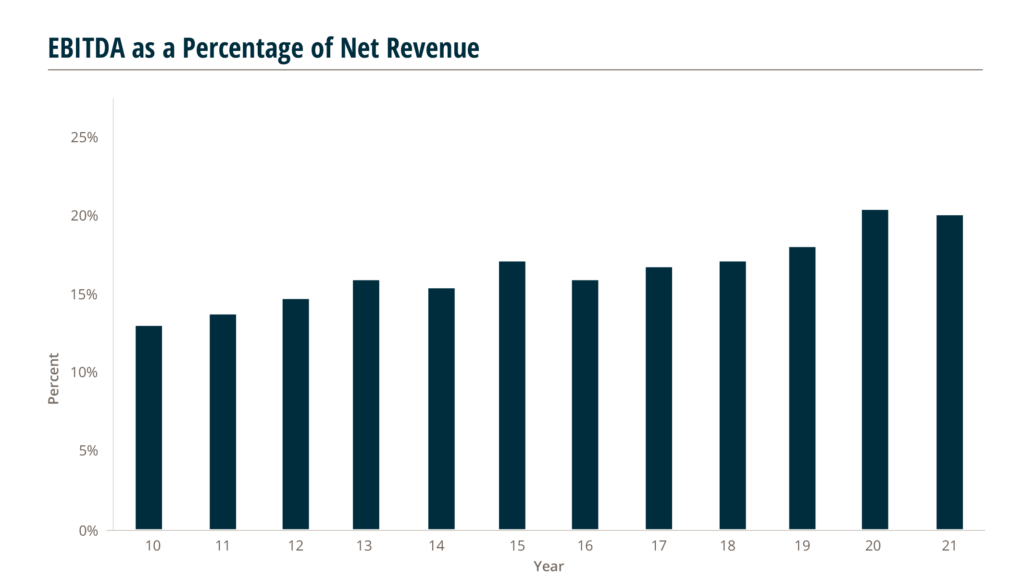

EBITDA Margin

Agency and brokerage profitability reached a peak in 2020 as many firms cut back on hiring and other discretionary expenses, particularly in the first half of the year, and other selling and operating expenses naturally declined amidst travel restrictions and stay–at–home orders. It’s interesting to note that profitability has been on an upwards trend over the past decade, although the bump in 2020 was unparalleled relative to prior years. Looking ahead to 2022, the question on the minds of many is how long can firms sustain this momentum?

As in–person business activity resumed, 2021 saw a slight softening to profitability levels. However, the industry average is still outperforming its historical pace, which suggests that many firms have been able to sustain profitability gains over the pandemic — or are at least able to offset them against reductions in other expenses. While it’s likely that virtual meetings and remote work will continue to suppress line items like Travel & Entertainment and Facilities expenses below pre–2020 levels, moderation in this area is likely as business travel resumes and hybrid/in–office activity picks up. Compensation is another area that is expected to put downwards pressure on profitability in 2022 due to tight labor market conditions.

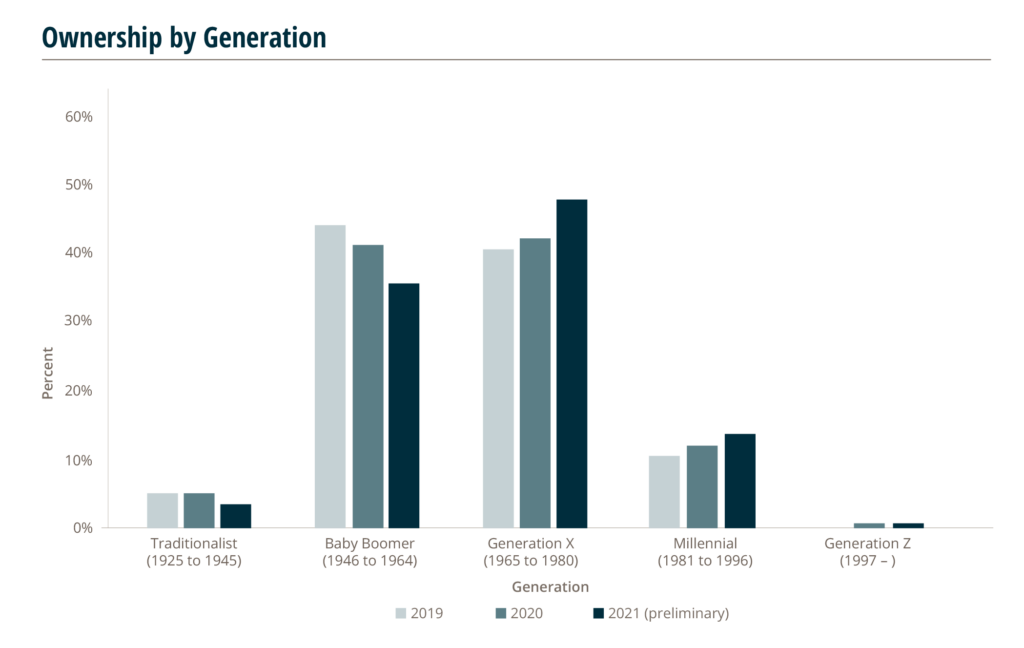

Ownership Shift

In recent years there has been a noticeable shift in ownership age within the private insurance brokerage firms according to MarshBerry’s proprietary financial management system, Perspectives for High Performance (PHP). At the end of 2019, the Baby Boomer generation, defined as those born between 1946 and 1964, accounted for the largest share of ownership among the generational groups, representing over 44% of firm ownership. However, Generation X (born 1965 to 1980) has since surpassed the Baby Boomers as the leading generational group in broker ownership, while the Millennial generation has also seen an increase over the past two years.

While decline in ownership share was expected as members of the Baby Boomer generation entered retirement age, other factors including soaring valuation levels and the realities of the COVID–19 pandemic may have prompted some owners to exit sooner than planned, whether that be through internal perpetuation or external sale.