Focused Insights: Bird In the Hand: Exploring All Options When Selling Your Business Vol III, Issue 2

Why cognitive biases suggest that a “bird in the hand” isn’t always better than “two in the bush” when it comes to selling your insurance brokerage.

The phrase “a bird in the hand is worth two in the bush” is an ancient proverb dating back to the 15th century. It was originally rooted in the activity of hunting as a way to express satisfaction in having caught one prey, rather than pursuing two which may get away.

Today, the proverb meaning is similarly used to express that it’s generally better to be content with what you already have for certain, rather than risk losing it for something that might be better but is uncertain. In many cases, it’s a common human experience to weigh a sure thing against uncertain possibilities. It’s a logical and safe approach.

Many business owners, faced with the prospect of selling their largest asset, often feel this sense of contentment and certainty when fielding an offer for their business from a prospective buyer. Especially if that offer checks the box and exceeds expectations of the firm’s value in the owner’s head. After all, what else matters?

In M&A deals, there are plenty of risks that can arise — but probably none greater than the risk of receiving a “good” offer without exploring the broader market.

Cognitive Bias In Decision Making

One of the biggest reasons sellers jump at the first offer that comes in the door when selling their business involves the scientifically proven phenomenon known as “cognitive bias” due to natural human heuristics.

Heuristics are the mental shortcuts that many of us use to help solve problems or make decisions quickly and efficiently. The concept of “go with your gut” is a natural heuristic usually driven by personal experience and instinct, and not always rooted in unbiased data analysis or detailed risk assessment and can result in poor decision making.

Cognitive biases are the systematic errors in thinking that come from relying on these mental shortcuts, resulting in illogical or irrational decisions. There are numerous biases, affecting a wide range of behaviors including decision making, judgment, beliefs and social interactions. Examples include:

- Confirmation bias happens when you look for information that supports your existing beliefs and rejects data that goes against what you believe. This can lead you to make biased decisions when you don’t factor in all relevant information.

- Anchoring bias is the tendency to rely too heavily on the first piece of information you learn; when your final judgement is influenced most by information that was gained early in the decision-making process and ignored information that came later. Think of this as a “first impression” bias.

- Loss aversion bias explains why the pain of losing something is psychologically twice as powerful as the pleasure of gaining something. It refers to an individual’s tendency to prefer avoiding losses over acquiring equivalent gains.

- Regret aversion bias occurs when a decision is made to avoid regretting an alternative decision in the future. Regret can be a powerless and discomforting state, and people sometimes make decisions to avoid this outcome.

- Zero risk bias reflects our preference for absolute certainty. Our tendency is to opt for situations where we can completely eliminate risk.

Cognitive biases can affect most people’s abilities to make the best decision for themselves, leading them to favor information that confirms how they already feel. Personal experiences, emotional influences, even social factors strongly influence how people interpret information that they need to make decisions.

It’s curious how many business owners will take the long journey for making a decision on who to use as their office copy machines vendor (Canon, IBM, or Panasonic), often meeting with 4–5 different reps. Yet, when making the biggest decision of their lives — selling their business — choose to jump at the first offer, or worse, be unrepresented at the table by an experienced M&A advisor.

Why Do Sellers Choose NOT to Have an Advisor Help Them?

Here’s a common scenario: A business owner who may (or may not) be looking to sell is approached by an interested buyer who makes an enticing offer that feels fair. Maybe even more than fair. They are excited. (Possibly an anchoring or first impression bias.) In many cases, the business owner thinks they may jeopardize the offer by thinking about it too long, or shopping around or hiring an advisor. The buyer may even suggest that “this offer won’t last for long” or say they “won’t wait” for the seller to hire a consultant. The threat of losing an offer is more powerful than the possibility of gaining more by waiting. (Loss aversion bias.) After all, a bird in the hand is worth two in the bush.

In situations where an owner is actively considering selling their firm on their own, it’s usually because they believe they know their business the best. They know the value of their firm (or have a value in mind) and believe they can adequately represent themselves when negotiating offers for their business.

However, selling your firm isn’t the same as running your firm. What many don’t realize is, the act of selling a firm has less to do with understanding the business, and more to do with understanding the M&A process, current market conditions, the competitive landscape, and the mindset of the buyers.

In this current M&A environment, where the demand for quality firms outweighs the supply, top performing firms often hold the upper hand. (Many don’t know that.) However, the buyers in this industry are far more experienced in the process of negotiations and dealmaking, some with multiple transactions each year. How many firms have you sold? For most, this will be probably the first and the last.

The Benefits of Working With an M&A Advisor

As an insurance broker and business owner, you advise clients every day — helping them find the right insurance coverage for their businesses, their properties, and for their families. You’re an expert in your field and wouldn’t recommend clients to go it alone.

On the flip side, you work with advisors all the time to help you make the best financial decisions, to make key strategic decisions for your business, to manage your retirement portfolio, to do your taxes. So, why not to sell your business?

At its highest level, the core benefit of working with an experienced M&A advisor is to ensure a deal meets your objectives and leads to the best possible outcome for you.

Here are some of the specific benefits of working with an advisor if you are considering selling your insurance brokerage:

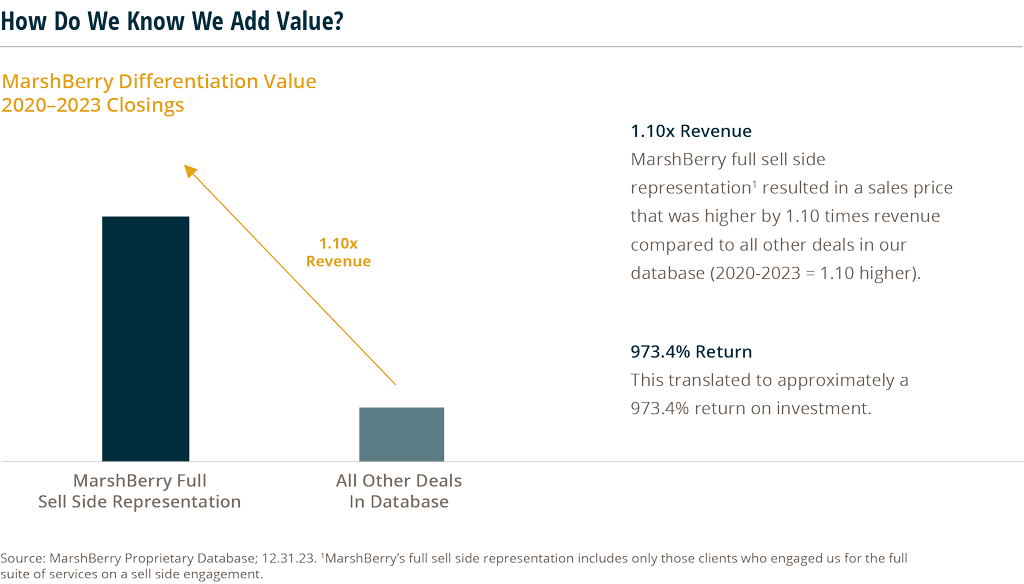

- Better financial outcomes. While no advisor can guarantee “more money” when taking on a sell side M&A project, most will be able to negotiate a deal that is “at market or better.” Data shows that firms with experienced representation receive more money in final transactions. This chart shows the difference that advisory representation can have on a deal.

- More buyers. An experienced investment bank or M&A advisory firm has a vast network of contacts and potential buyers. Not only do they have the network, but they know these buyers, know what they are looking for, know their negotiating style, know what their culture is like, and can help guide you towards the best options. It’s all about finding the best buyer for your business.

- Negotiating terms that are in your best interest. Hiring an advisor is more than just about the final price. A skilled consultant will negotiate better terms of the agreement, and ensure the partnership is a good match. They can better identify and prioritize the issues that impact the deal, without emotion, and without bias. Perhaps most important, a good advisor knows what terms a buyer will accept if you ask but likely not offer without prompting.

- Avoiding pitfalls during the process (and after the deal). In any deal it is not a matter of “if” issues will arise but rather “when” they will arise. The due diligence process during M&A deals is often something very new to sellers and requires the unique skills of an advisor to guide the seller through it. Due diligence is for both the buyer and seller to identify and address any concerns, questions, or potential risks in the transaction. This thorough examination of the deal could mean the difference between tremendous success or disastrous failure of a partnership.

A Case Study On Cognitive Bias and Advisory Impact

Here’s a recent experience with a client that highlights the difference an M&A advisor makes: A sell side client met with a potential buyer (“Buyer A”) and fell in love. The seller was convinced that this was the best possible (financial) deal and was very hesitant to wait and explore other options. In the seller’s mind, it was a done deal. Financially, culturally and emotionally it was the perfect fit.

But after finally agreeing to meet with a few other buyers, the shine on “Buyer A” slowly wore off as they fell in love again — with “Buyer B.” Aside from the deal with “Buyer B” being financially better and featuring better terms, there were better opportunities with this partner, and the simpatico of their personalities made it a much better cultural fit. In the end, the client couldn’t even remember what made “Buyer A” so attractive.

This is a perfect example of how cognitive bias can lead people to make the wrong decision (or at the very least, not the best decision). Emotional decisions are usually the most susceptible to these biases. In this case, the logic of “a bird in the hand is worth two in the bush” created such a strong cognitive bias, that exploring other options was frightening.

For every logical proverb, there’s a completely opposite philosophy that can sound equally logical. In some cases, the proverb “nothing ventured, nothing gained” may be a more suitable approach when it comes to exploring options for selling your business.