Public Broker Performance Vol III, Issue 2

MarshBerry Broker Index

Get the latest performance and insights on the public broker composite.

MarshBerry Broker Composite Index: Market Update and Q1 2024 Earnings

During the period from January 1, 2024, through April 30, 2024, six public brokers, as measured by MarshBerry’s Broker Index, outperformed the Dow Jones Industrial Average (DJIA). The S&P 500 Index (GSPC) outperformed both the Broker Index and DJIA for this period.

The following publicly traded insurance brokers are included in the Broker Index: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP).

3.5%

Broker Composite

0.3%

Dow Jones Industrial Average

5.6%

S&P 500

Illustration generated by MarshBerry with data sourced from Yahoo Finance. Date through 4.30.24

Q1 2024 Earnings Results

Overall, insurance brokers had strong earnings results in Q1 2024. Management teams were positive in meeting targets for Q1 2024 and further into 2024. Organic growth figures reported in Q1 2024 were generally comparable to those seen in Q4 2023. Most brokers reported organic growth rates in a range of 5%–15%.

- MMC reported Q1 2024 organic growth of 9%, compared to 7% in Q4 2023.

- BRO posted organic growth of 8.6% in Q1 2024, up from 7.7% in Q4 2023.

- AJG posted 9.4% organic growth in Q1 2024 (for AJG’s combined brokerage and risk management segments), compared to the firm’s 8.1% organic growth in Q4 2023.

- WTW posted 5% organic growth in Q1 2024, slightly below its 6% organic growth in Q4 2023.

- AON had organic revenue growth of 5% in Q1 2024, below the 7% posted in Q4 2023.

- BRP’s organic growth in Q1 2024 was 16%, compared to BRP’s Q4 2023 organic growth of 15%.

The Macroeconomic Environment

While some insurance brokers noted “unsettled” geopolitical currents with ongoing wars and major elections taking place in 2024, many also saw positive opportunities and continued economic growth for their firms in major markets.

BRO noted that the economic environment was similar to that of Q4 2023, with strong consumer spending; and companies having comparable levels of hiring and investment.

M&A Activity

AJG continued its M&A strategy in Q1 2024 completing 12 mergers totaling $70 million of estimated annualized revenue. AJG had approximately 50 term sheets signed or being prepared, representing around $350 million of annualized revenue.

BRO also remains active in M&A. “We continued to be an active buyer of businesses, domestically and internationally. Competition for quality businesses has not materially changed as compared to second half of 2023,” noted BRO in its Q1 2024 investor presentation. During Q1 2024, BRO completed six acquisitions with estimated annual revenue of $16 million.

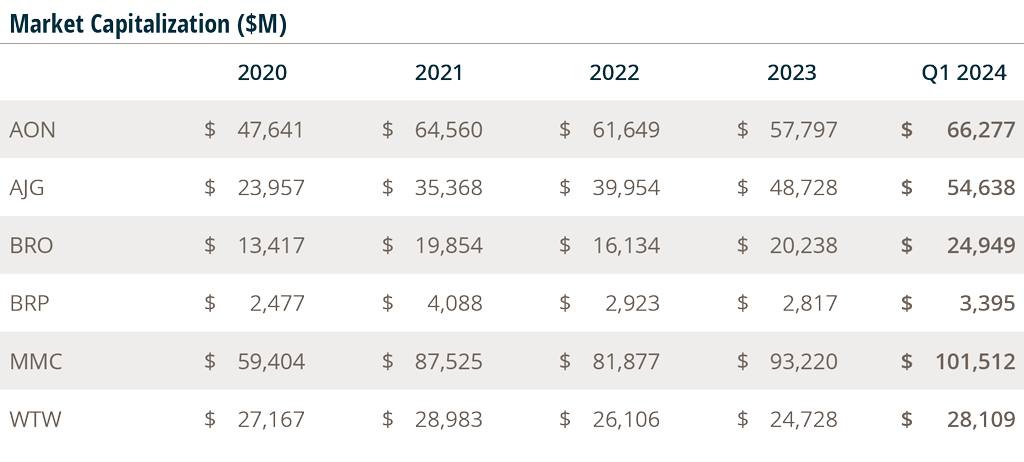

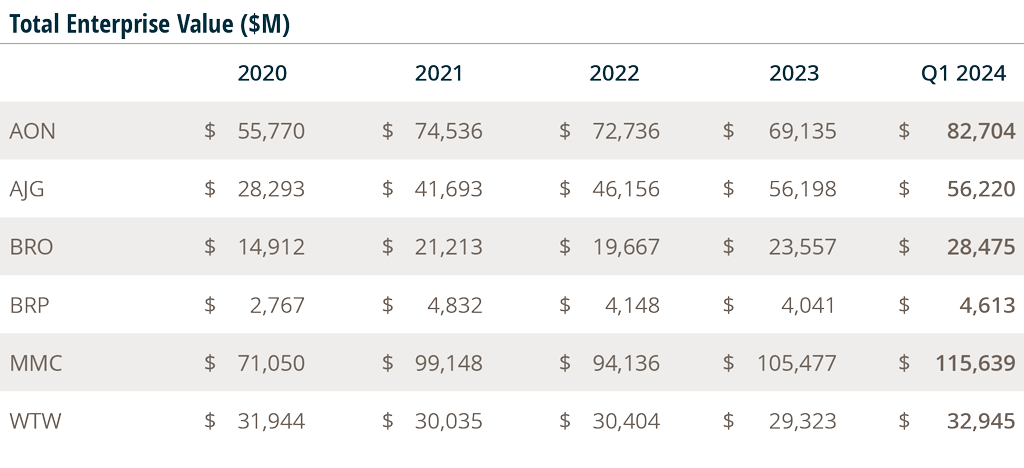

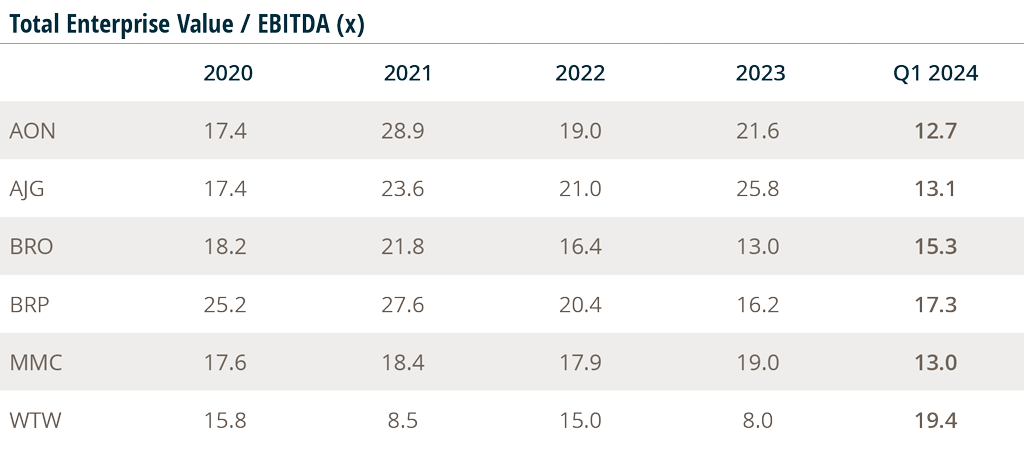

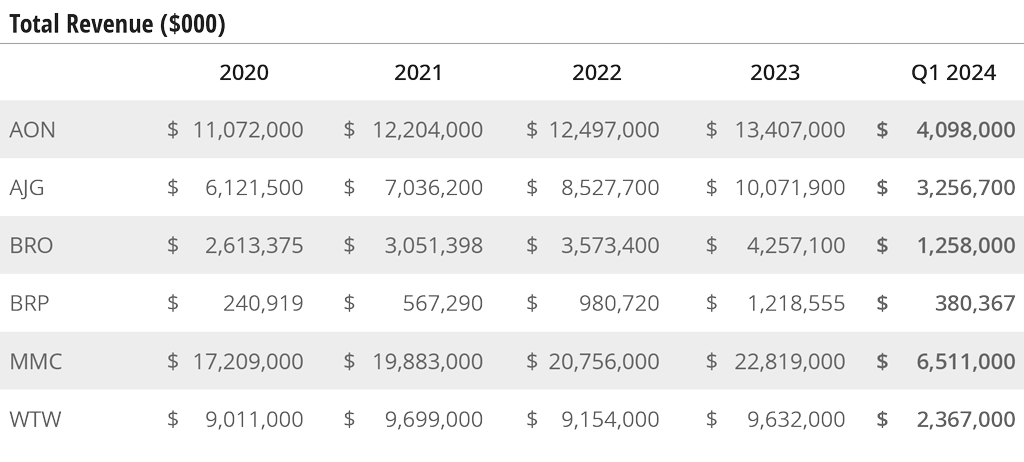

Public Broker Comps

Source: S&P Global Market Intelligence, Company Reports, FactSet, 5.13.24. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization. AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BRP = Baldwin Risk Partners; MMC = Marsh & McLennan Companies, Inc.; WTW = Willis Towers Watson Public Limited Company.