Industry Insights Vol III, Issue 2

MarshBerry’s Perspectives for High Performance (PHP)

Insights from MarshBerry’s proprietary financial database to help drive your business.

What’s Your “Real” Organic Growth?

Since 2018, the insurance industry has seen a steady increase in insurance premium costs for insureds, caused by inflation, more strict underwriting criteria, and less capacity from carriers. As of December 31, 2023, average commercial P&C premium has increased for 25 consecutive quarters. While trending down, Q4 2023 ended with average premiums up 7% from the previous quarter.

This hard market environment has certainly tested brokers’ ability to place affordable coverage for their clients. However, the results for most brokerages have been six years of solid year-over-year organic growth. In many cases, double-digit organic growth. But is this “real” organic growth? Is this growth generated through strategic decisions and new business-generating hard work?Not really. Much of this growth is coming purely from insurance rate increases and exposure growth in existing books of business.

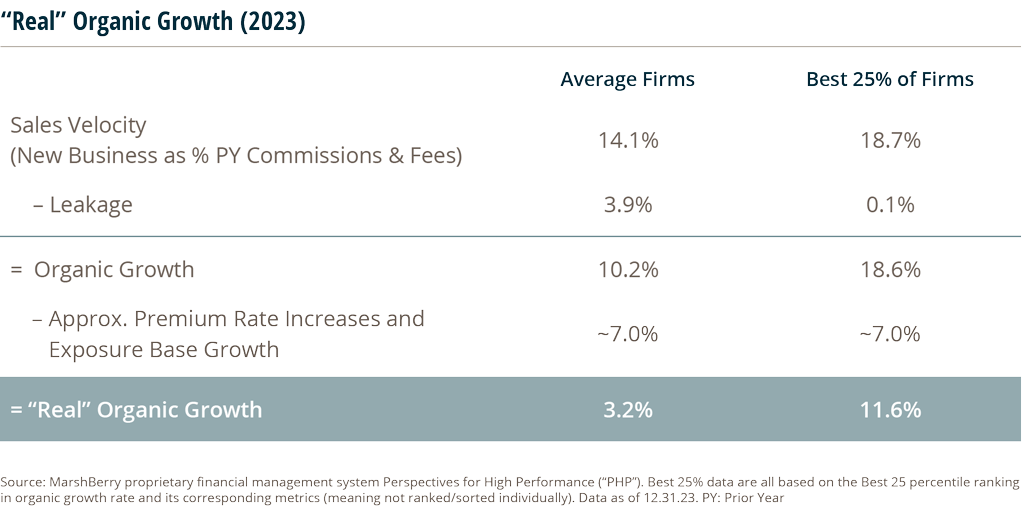

In fact, according to MarshBerry’s proprietary financial management system, Perspectives for High Performance (PHP), in 2023 the average firm achieved an organic growth rate of 10.2%. This was achieved through an average sales velocity of 14.1% (new business as a percentage of prior commission income) minus 3.9% leakage (which includes rate, retention and exposure changes). But MarshBerry analysis shows that approximately 7 percentage points of that 10.2% organic growth was driven by premium rate increases and exposure base growth in the existing book of business — leaving only 3.2% as “real” organic growth (10.2% minus 7%) for the average firm.

Average firms should be concerned. This hard rate environment won’t last forever. As inflation starts to stabilize and the market softens, firms will start to see their clients focusing more on price, especially if the firm’s service hasn’t been exceptional with added value beyond simply placing coverage.

While average firms saw organic growth of 10.2% in 2023 — top performers (the best 25%) organically grew an average of18.6%. This is where differentiation lies.

These peak performers achieved outsized sales velocity (18.7%) and superior retention (leakage of only 0.1%). As a result, these firms on average are achieving “real” growth of approximately 11.6%. (18.6% less the 7% related to the help from rate and exposure growth.)

Such firms are making strategic decisions to create more value for their clients, creating differentiation from their competitors, and establishing a sales culture where everyone understands the goals.

Top performing firms are driving predictable, profitable, organic growth. These firms are driving “real” organic growth. How? The key to top performer success is partially due to the collective focus on driving new business (sales velocity) and policies in force (PIF), which demonstrates a commitment to a long-term strategy, regardless of external market conditions. After all, when this hard market high tide recedes, only those with a sustainable sales process that have added value to their clients’ business will be prepared to continue driving meaningful organic growth.

The Impact of Continued Elevated Inflation On Insurance Carriers

After showing signs of moderating in 2023, inflation remains elevated compared to pre-pandemic levels and above the Fed’s targeted rate of 2%. The core PCE price index, a key inflation measure, rose more than expected in March 2024. This follows February’s report of consumer prices coming in above economists’ expectations.

Elevated inflation has contributed to rising insurance premiums, higher costs, and increased claims expenses at insurance carriers. Carriers have also seen higher investment returns (helped by a higher interest rate environment) leading to improved profitability.

But carriers continue to be impacted by extreme weather events, rising claims costs driven by inflation, increasing litigation and settlement expenses — thus rates are expected to continue increasing.

According to Alera Group’s P&C Market Outlook, many lines of business could see additional increases between 1% and 10% in 2024. The firm projects that commercial auto and commercial property will see higher price increases ranging between 10% and 15%, due to extreme weather events, higher repair costs, and loss severity and frequency. While capacity is projected to improve in some lines, such as workers’ compensation and Directors and Officers (D&O) — commercial auto and commercial property are likely to see capacity decreases in 2024.1

Rate increases have helped insurer profitability, but some economists project that some segments of the insurance industry will not generate the adequate returns to cover the cost of capital in 2024 and 2025 due to inflation’s negative impact on claims costs. Above average inflation continues to drive up claims costs, including settlement amounts, labor, medical expenses and attorney fees.

Ongoing social inflation continues to impact insurers. This means there is an increase in claim severity above what could be anticipated under the normal scope of claim trends and economic inflation. Claims inflation has contributed to carriers increasing premiums and restricting coverage limits. “It’s been a gradual climb over the last decade or so. I think it will get worse before it gets better,” said Jason Kunert, head of claims at Amwins Group. There’s also concern around outsized jury awards, many that are over $10 million.2

Overall, as the specter of higher general inflation potentially lingers into 2024, many insurers are having to continue to manage pricing and costs; as well as underwriting discipline. However, insurance companies are benefiting from better investment opportunities, as Treasury yield levels help boost returns. This can help carriers build an investment portfolio that is diversified, liquid, and robust, to offset risks of liabilities.