U.S. Macroeconomic Indicators Vol II, Issue 8

Market Trends and Current Statistics

Here are key U.S. macroeconomic indicators that are likely to impact brokerages within the insurance industry.

What Does An Economic Soft-landing Mean For The Insurance Industry?

After years of an economic downfall looming, the sky may be brightening for the U.S. economy. Many are predicting the soft-landing that once seemed out of reach may finally come to fruition. It’s more than just Wall Street forecasts or economist predictions – some economic indicators are pointing to a soft landing or even a period of growth for the economy.

These include:

- Unemployment rate: The unemployment rate is currently near a 50-year low at 3.9% (as of October 31, 2023) with more job openings than job seekers.1 This suggests that the labor market is strong and that businesses are still hiring and likely to hold on to workers.

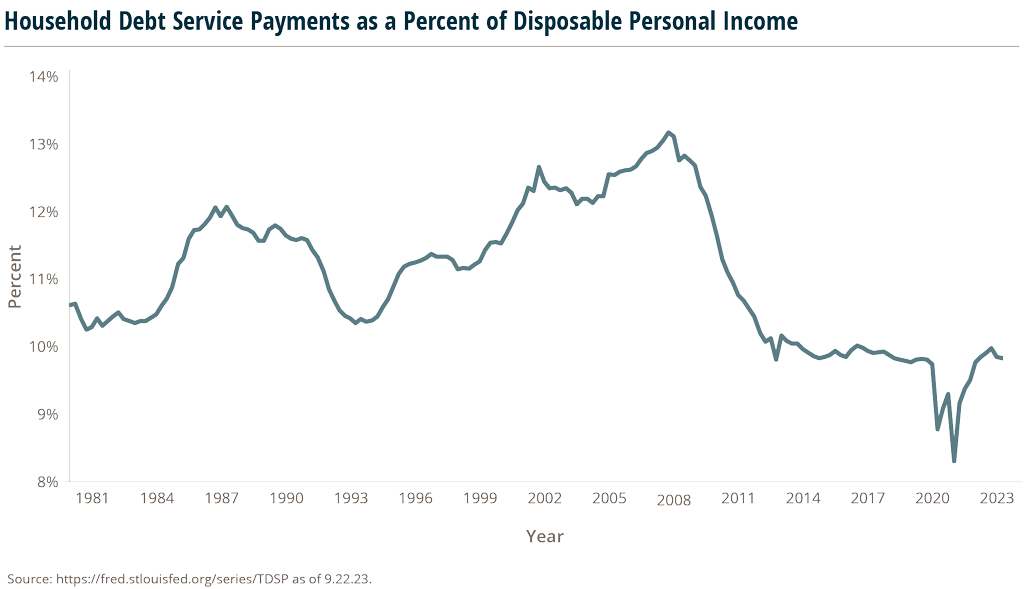

- Household debt-to-income ratio: While the household debt-to-income ratio has risen slightly since the end of the pandemic it is still near its lowest level in decades.2 This suggests that households are in a good financial position to withstand continued higher interest rates.

- Business balance sheets: Generally, businesses have strong balance sheets with low levels of debt and high levels of cash. This suggests that businesses are well-positioned to invest in new technology and people, to continue growing their business.

- Consumer spending growth: Consumer spending growth has slowed in recent months, but it remains positive.3 This suggests that consumers are still spending and that the economy is still growing.

In addition to these indicators, the Federal Reserve announced on November 1, 2023, that it would “pause” additional short-term interest rate hikes, partially due to rising long-term rates which could effectively help slow the economy.4

Overall, the economic indicators suggest that the U.S. economy is on track for a soft landing. The labor market is strong, households and businesses are in good financial positions, and the Fed is moving cautiously.

The impact of a soft landing on the insurance industry

A soft landing for the U.S. economy could have a positive impact on the insurance industry, including:

- Increased demand for insurance: A strong economy leads to increased consumer and business spending, which in turn leads to increased demand for insurance. Businesses and consumers are more likely to buy ancillary insurance when they are confident about the future of the economy.

- Higher premiums: As demand for insurance increases, combined with continued elevated inflationary conditions – insurance distributors can continue to raise premiums. This would lead to increased revenue and profitability for insurance companies, perpetuating the hard market.

- Lower claims: A soft landing could also lead to lower claims for insurance companies. This is because there would be fewer job losses, bankruptcies, and other economic hardships that lead to insurance claims.

- Investment gains: Insurance companies invest a large part of their premiums. A strong economy could lead to higher investment gains for insurers.

Specifically, certain lines of insurance fare better during times of positive economic outlook, including:

- Property and casualty insurance: Businesses and homeowners are more likely to buy more robust property and casualty insurance policies when they are confident about the future of the economy. Insureds may increase number of policies as well because they are more likely to invest in new projects and assets.

- Life insurance: Consumers are more likely to buy life insurance when they are confident in their job security and financial future.

- Health insurance: Businesses are more likely to offer additional health insurance benefits to their employees when they are profitable. Employees or the self-employed are also more likely to be able to afford health insurance premiums when they have a steady income.

Overall, a soft landing is likely on the horizon and would be positive for the insurance industry. Insurance brokers, carriers and consumers would benefit from a better business environment, greater investment returns and more stability.

Strength In E&S Sector Continues, But So Do The Challenges

Growth in Excess and Surplus lines (E&S) premiums continue at a brisk pace with ongoing flows of hard-to-place admitted market business increasing. The U.S. E&S sector is projected to see direct underwriting profits in both 2023 and 2024 due to continued high demand and the strong pricing environment, according to Fitch Ratings. The ongoing hard market pricing in most lines is helping to keep pace with loss costs. Most lines are seeing double-digit growth in direct written premiums driven by higher prices and greater policy volume.

E&S quarterly premiums have risen sharply since Q3 2021. For trailing twelve months (TTM) 9/30/23, premiums in California are up 6% from the year before, Florida is up 27%, and Texas is up 26%.

The non-admitted market has continued to benefit from risk shifting from admitted markets to E&S, as hard to place business increases. Increased catastrophes in states such as Florida and California are driving business into the E&S space which writes hard to place and unique risks.

When buyers want custom coverage or specifically structured coverage, they tend to look to E&S firms. Growth in surplus lines premiums is projected to increase at an impressive pace, but the segment isn’t immune from challenges. Here are just a few of the challenges that may impact the E&S industry:

- Economic inflation: While inflation has moderated over the last few months, analysts still maintain concerns around potential interest rate increases in 2024.

- Social inflation: Rising costs of claims payout and litigation beyond that of inflation is known as social inflation. This measures the increase in perceived value by jurors and claims holders which has increased dramatically over the past two years, pushing claims above what was expected.

- Medical inflation: This reflects the increase in costs to support medical developments, including the cost of new and advanced procedures and treatments. It also may include the increased usage of these medical treatments.

- Nuclear verdicts: These tend to involve exceptionally high jury awards that go above what is considered a reasonable or rational amount.

- Natural catastrophes: Over the past decade extreme weather-related events have become more frequent and more severe. The ever-evolving nature of these events makes them harder to predict, causing increased underwriting losses. (See WayPoint: Adapting to Climate Change, Catastrophes, and How Risks Are Mitigated.)

- Cyberattacks: Cyberattacks can range from malware attacks to social engineering scams and ransomware attacks, and they can hurt businesses. The average ransom demand by cyber criminals in the first half of 2023 was $1.62 million. This is a 47% increase over the previous six months and a 74% increase over the past year.5 Cyber threats are the top business risk globally for 2024, even ahead of economic slowdowns and supply chain issues.

While the demand for E&S coverage continues to rise, some analysts see the pace of companies entering the sector slowing. New entrants in the space also face challenges, including reinsurance capacity constraints and rising reinsurance rates. The Vesttoo scandal that involved fraudulent letters of credit also saw some firms having to replace reinsurance capacity that was secured through Vesttoo.

Overall, the E&S market is expected to see strong growth into 2024 as it benefits from business flowing from the admitted market space and ongoing hard market. According to Fitch Ratings, direct statutory premiums in the E&S space were nearly 9% of total property & casualty (P&C) premiums, up from 5% of total P&C premiums in 2018.

State Of U.S. Auto Insurance Market

The U.S. auto industry is experiencing supply issues of new and used vehicles, supply of qualified laborers, and even a shortage in the supply of insurance capacity as carriers exit some markets. These shortages in the supply of goods and services have caused upward pressure on policy rates, pushing U.S. consumers’ premiums higher.

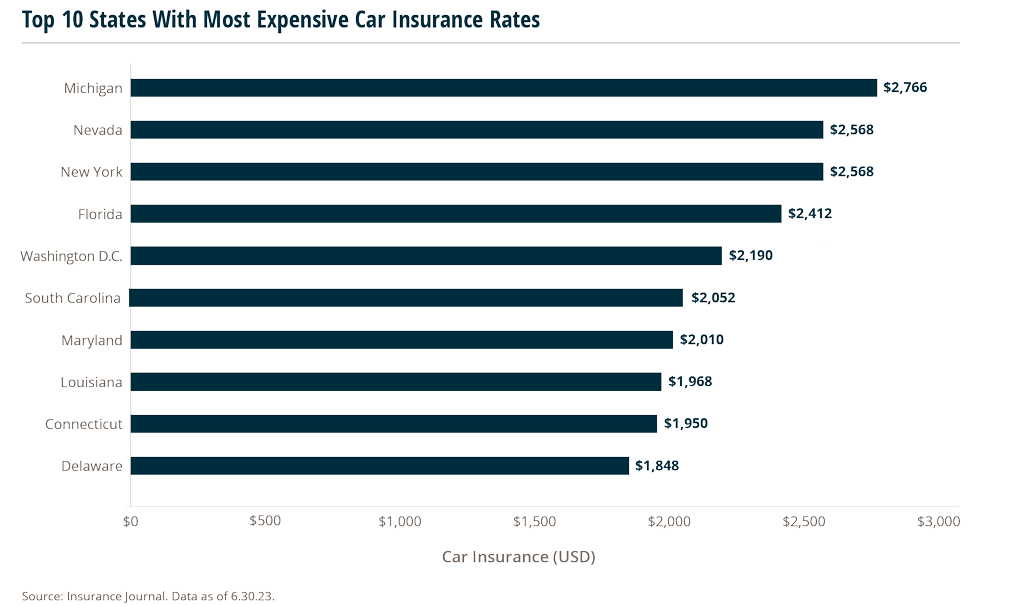

National premium and rate hikes

Through the twelve-month period ended 10/31/23 the Bureau of Labor Statistics (BLS) determined actual motor vehicle insurance costs increased by 19%, far exceeding expectations of 8.4% earlier this year.6 The U.S. average of annual premiums for full auto coverages exceeded $1,700 in 2023, with potential increases yet on the way.7

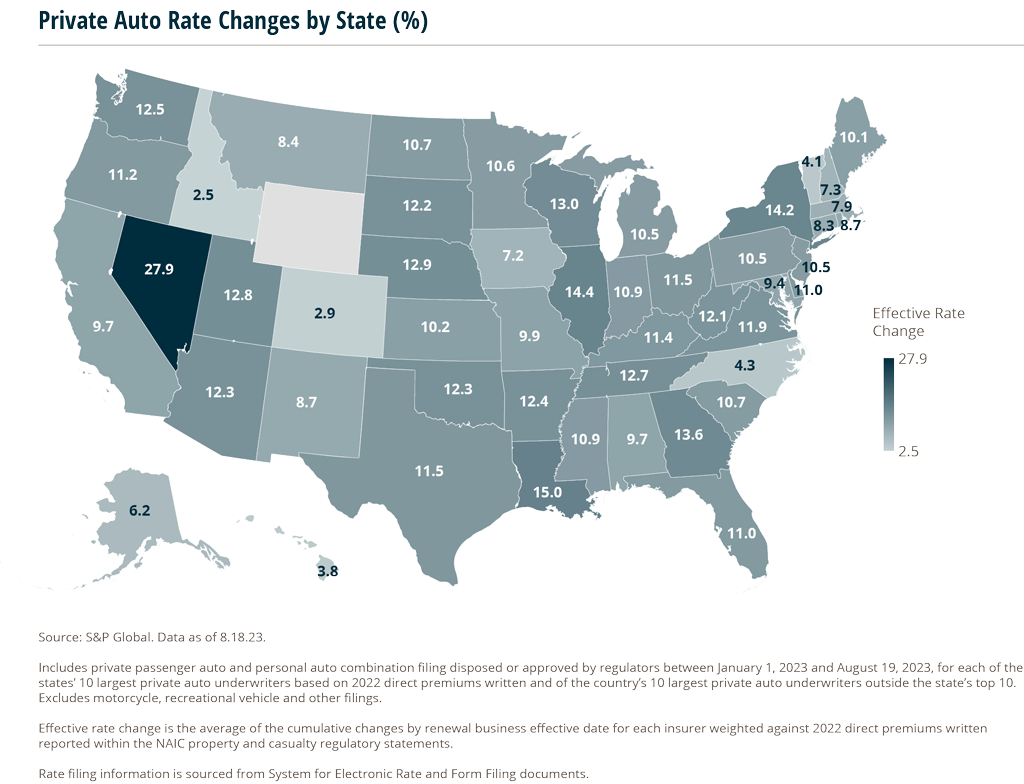

Most states have experienced a rate increase through YTD August and overall, U.S. auto owners experienced an 11% effective rate increase over this same period. Of the approved rate filings, 32 states reported double-digit rate increases during this time.

According to Insurance Journal, auto insurance rates are expected to increase another 200 basis points through the end of 2023 to reach an effective annual increase of 21%.8

Past rate increases have been attributed to higher claims settlement costs (with repair cost increases far exceeding current inflation levels) and a greater frequency of high-cost claims.

While many states were able to take much needed and substantial rate increases, others such as California, only approved minor increases which many argue isn’t nearly sufficient to meet insurers’ needs in the market. As a result, there has been a mass exodus of carriers from California in 2023, including State Farm, Kemper, Nationwide Private Client, Berkshire Hathaway’s AmGUARD, and Falls Lake. These carriers are either not taking new applications for personal lines business, actively non-renewing current policies, or canceling coverages entirely.

Overall inflation impact on auto insurance

According to the BLS, headline inflation as measured by the Consumer Price Index (CPI) for the trailing 12 months (TTM) period ending October 2023 (not seasonally adjusted) increased by 3.2%. Focusing on vehicle-related price inflation, the BLS determined the following for TTM October 2023:

- Automobile insurance: Increased by 19%

- Vehicle maintenance and repair costs: Increased by 10%

- New vehicles: Increased by 2%

- Used cars and trucks: Declined by 7%

As storm counts rise, so do claims settlement costs with more insureds requiring costly payouts from hail, wind, and flood damages. 2022 and 2023 were some of the most challenging weather periods in history with 41 unique $1 billion weather events in totality. With continued extreme weather events expected, and repair and replacement costs on the rise, premiums will move in lockstep as insurers seek profitability. The unavoidable conclusion is costs are up, requiring premiums to increase as a result.

The road ahead for U.S. auto insurance

The road ahead for U.S. auto insurance is full of uncertainty through the end of 2023 and into 2024. Despite inflation cooling, and nearly normalized levels in the third and fourth quarter of 2023, vehicle production and repair costs remain high, coupled with supply shortfalls in part due to U.S. autoworkers going on strike in 2023. Collectively, the likely impact on the cost of insurance will result in maintaining current levels as insurers look to protect profits and hedge against current and future losses.

Sources:

1 https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

2 https://fred.stlouisfed.org/series/TDSP

3 https://tradingeconomics.com/united-states/consumer-spending

5 https://finance.yahoo.com/news/cyber-insurance-claims-frequency-severity-170000207.html

6 https://www.valuepenguin.com/state-of-auto-insurance-2023#section-2

7 https://www.cnbc.com/select/car-insurance-is-on-the-rise-in-2023-heres-how-to-save/

8 https://www.insurancejournal.com/news/national/2023/08/03/733308.htm