Industry Insights Vol II, Issue 8

MarshBerry’s Perspectives for High Performance (PHP)

Insights from our proprietary financial database to help drive your business.

Avoiding The Pareto Principal In The Commercial Lines Customers Vs. Commission Distribution

The Pareto Principle, also known as the 80/20 rule, expresses the concept that roughly 80% of consequences come from 20% of the causes.

Applying this principle for managing commercial lines customer accounts illustrates the importance of keeping service personnel from getting bogged down in the weeds of working with smaller accounts.

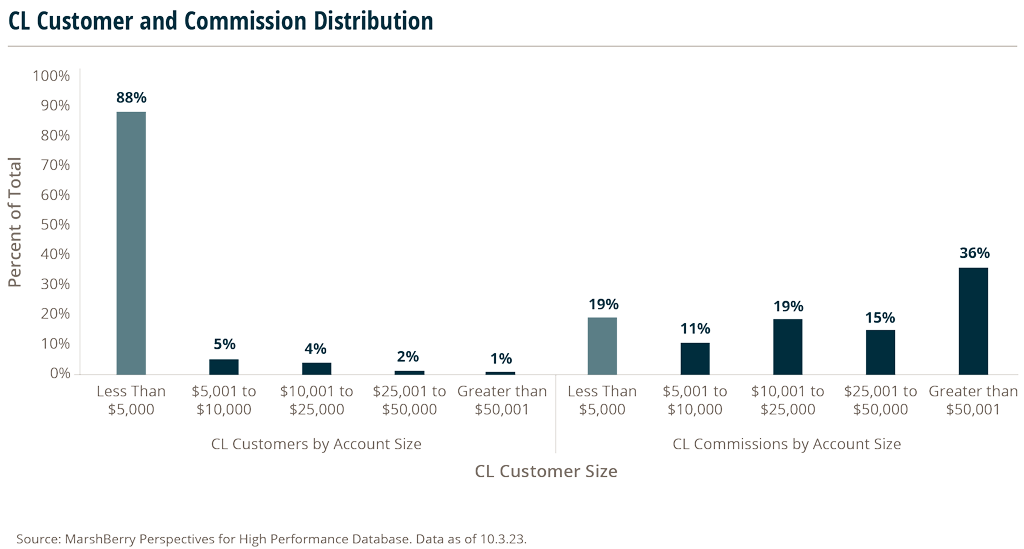

Within MarshBerry’s proprietary Perspectives for High Performance (PHP) database, smaller commercial lines accounts (those that are smaller than $5,000) account for 88% of commercial lines customers. While these smaller accounts represent the majority of commercial lines customers within the database, they only account for 19% of the database’s total commercial lines commission.

Said another way – 88% of commercial lines customers account for only 19% of the commissions.

In contrast, accounts that are greater than $50,000 in size represent only 1% of total commercial lines customers, yet account for 36% of total commissions within the database.

Removing the smaller accounts from the equation means that 12% of customers result in 81% of commercial lines commissions in PHP.

This breakdown mimics the Pareto 80/20 rule where there is an unequal relationship between inputs and outputs. In this case, showing that 81% of commissions come from only 12% of accounts. And inversely, only 19% of commission comes from 88% of accounts.

Employing good technologies or creating a small business unit allows your service personnel to spend less time on the volume of smaller accounts that only account for a small percentage of your revenue.

Non-producing Producers Can Hurt Organic Growth

The main responsibility of an insurance brokerage producer is to sell and generate new business. However, many firms have people with a “Producer” title that have minimal new business production each year. These non-producing producers may be one of the biggest threats to a firm’s commission and organic growth.

To address the challenges around non-producing producers, organizations need to assess motivation through new business production goals and compensation plans, as well as a culture of accountability within the firm. An organization should have a sales culture, complete with realistic targets and objectives for each producer that align with the organization’s overall growth goals. The producer’s goals should be married to their compensation.

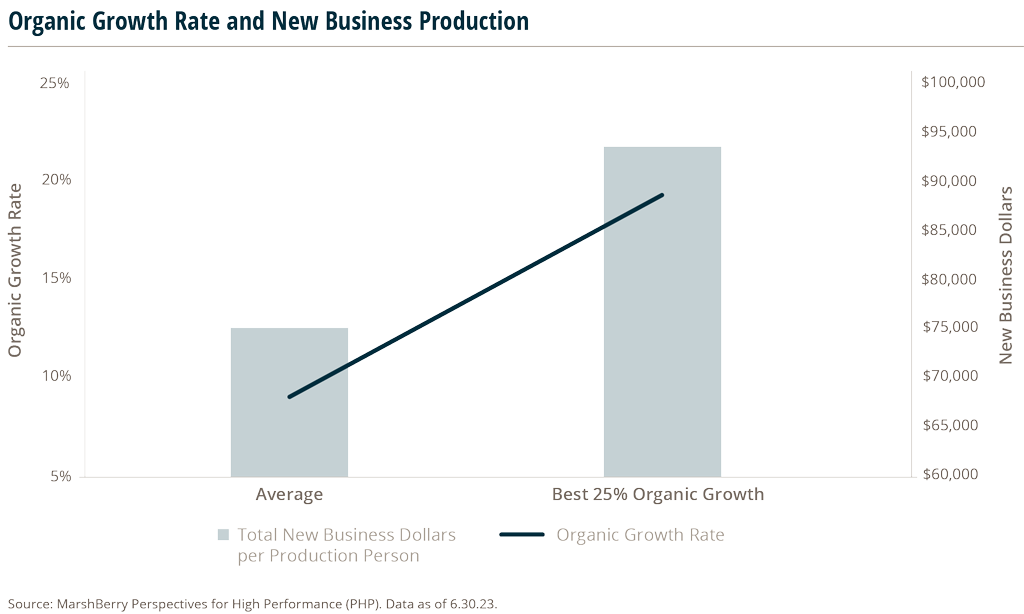

Firms that have clear new business goals for producers, including minimum annual new business requirement, tend to have higher organic growth rates and higher new business production. MarshBerry recommends a minimum annual new business threshold of $100,000 based on experience. If a firm treats non-producing producers who are not hitting minimum new business goals as producers, this can damage the firm’s productivity.

According to MarshBerry’s Perspective for High Performance (PHP) database, the Best 25% of firms based on organic growth have an average of $93,609 of total new business per production person compared to the overall average of $75,188. High growth firms that identify the actual producers within their organization, set realistic but aggressive new business goals, then hold them accountable – will likely boost organic growth rates.

Accountability accelerates performance

Managers should review the goals and progress with their producers on a quarterly basis and hold producers accountable to them. Far too often brokerages set goals but never discuss them, let alone enforce them. High growth firms set realistic but aggressive new business goals for their producers and hold them accountable – often resulting in 50% higher organic growth rates.