M&A Market Update Vol II, Issue 8

The Latest Deals and Insights

Who’s buying? Who’s selling? MarshBerry highlights the current M&A market and provides a look at recent transaction activity.

M&A Activity For Insurance Brokerage Targets A Strong Finish In Q4 2023

2023 has been a year of conflicting economic projections, keeping consumers and investors on their toes. As overall inflation numbers have eased – the Federal Reserve’s interest rate-hiking campaign seems to have peaked, holding rates steady for the past two meetings. For buyers and sellers in the insurance brokerage merger & acquisition (M&A) world, this should be a positive sign of things to come. Over the past year, buyers have seen their share of challenges in the availability and higher cost of capital. For sellers, they have seen more scrutiny and due diligence by buyers who have become more selective in their targets.

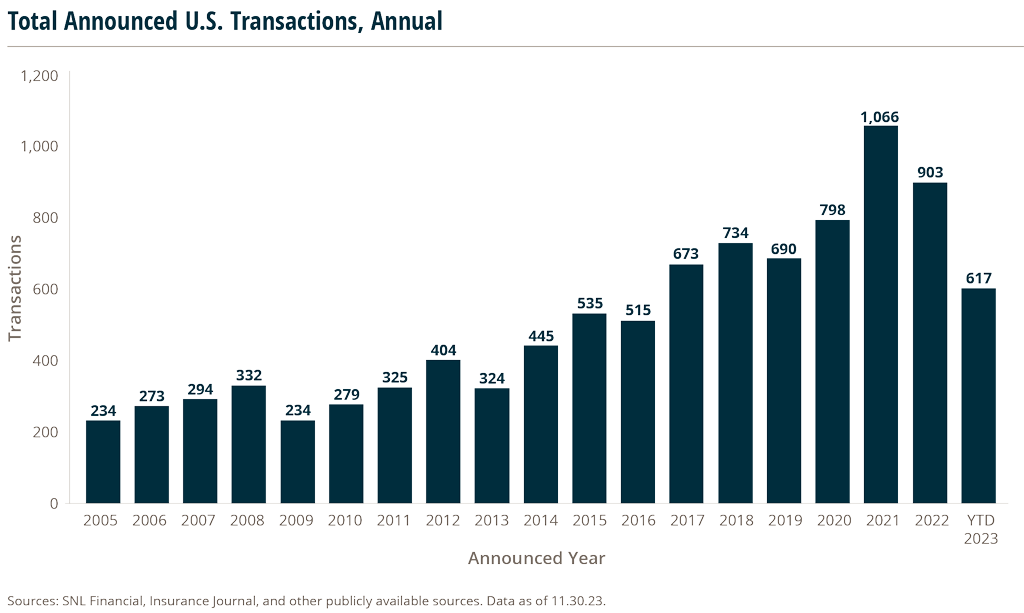

The fourth quarter of the year has historically been the most active. With 89 announced transactions added in October and 74 added in November – bringing 2023’s total U.S. transactions to 617. However, these numbers can be deceiving as some buyers seem to be completing transactions but delaying announcements, or foregoing announcing altogether. Only time will tell how comparable this year’s deal count will be to prior periods.

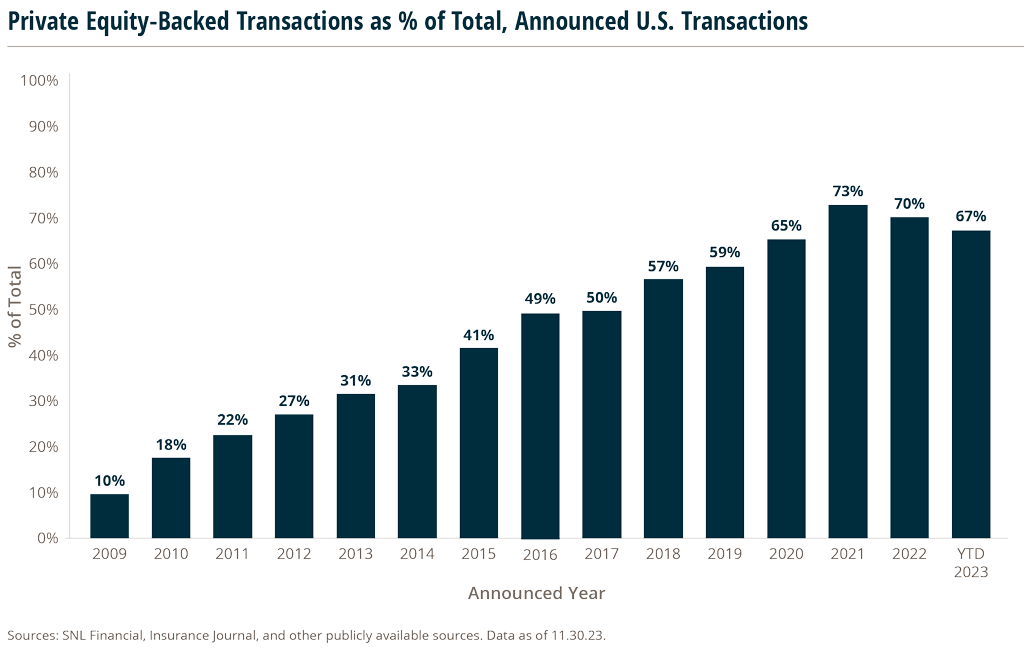

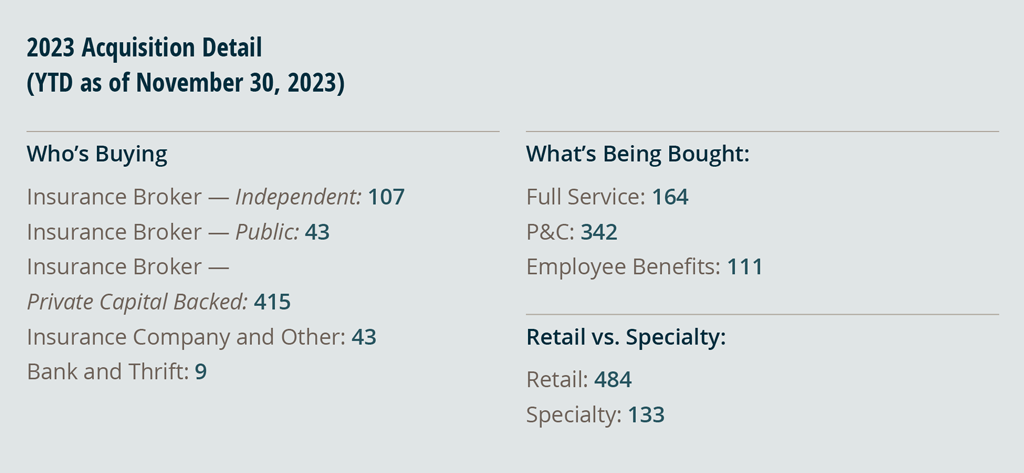

Private capital-backed buyers account for 415 of the 617 transactions (67.3%) through November. Total deals by these buyers increased at a Compound Annual Growth Rate (CAGR) of 11.1% since 2018, with a marked increase after the onset of the pandemic.

Deals involving specialty distributors as targets account for 133 transactions (or 22%) of the total 617 deals in 2023. Specialty firm deals increased by a CAGR of 22% from 2018 through 2022, a trend that is anticipated to continue as traditional retail brokers expand into the wholesale and delegated authority space.

Through November, independent agencies as buyers accounted for 107 transactions (or 17.3%) – in line with 17.2% in 2022. Bank and thrift as buyers accounted for nine announced deals (or 1.5%) – down from 2% in 2022.

Deal activity from the marketplace’s most active acquirers has remained strong in 2023. Ten buyers accounted for 45.9% of all announced transactions, while the top four (BroadStreet Partners Inc., Inszone Insurance Services, Inc., Hub International Limited, and Accession Risk Management Group) account for 23.5% of the 617 total transactions.

Notable Transactions

- October 30: Risk Strategies Companies announced that it acquired Fairmount Benefits, a Pennsylvania-based specialty insurance brokerage and consulting firm focused on developing and administering employee benefit programs for corporate employers. Fairmount offers customized solutions, strategic guidance and implementation support in all lines of employee benefits and has established specializations in helping clients with funding mechanisms, pharmacy cost management, benefit technologies and employee engagement. MarshBerry served as the advisor to Fairmount Benefits on this transaction.

- November 3: Hub International Limited announced that it acquired Franklin Financial Group (FFG). A hybrid wealth management firm/insurance agency, FFG assists businesses and individuals with complex employee benefits, insurance and other financial needs. FFG will join Hub Mid-Atlantic. MarshBerry served as the advisor to Franklin Financial Group on this transaction.

- November 24: Arthur J. Gallagher & Co. announced that it acquired Hughes Insurance Agency (Hughes). Headquartered in Queensbury, N.Y., Hughes provides commercial, personal, and life and health insurance services to individual and business clients in the Northeast. Hughes will operate as part of Gallagher Agency Alliance, an M&A model that partners with agencies specializing in small business Property & Casualty insurance and employee benefits. MarshBerry served as the advisor to Hughes Insurance Agency on this transaction.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2023 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.