M&A Market Update Vol II, Issue 7

The Latest Deals and Insights

Who’s buying? Who’s selling? MarshBerry highlights the current M&A market and provides a look at recent transaction activity.

How Will The Expiration Of TCJA Impact M&A?

If you thought the economic rollercoaster of 2023 was nauseating enough, you might want to buckle up for 2024 and 2025. After three quarters of economic uncertainty around inflation, interest rates, recession predictions, and the Fiscal Responsibility Act (FRA) – it may feel like we’re rolling into Q4 2023 in relatively good shape, all things considered. And perhaps we are. But looming on the horizon are federal fiscal policy decisions that could impact individuals and business owners in 2025 and beyond.

In addition to the FRA’s temporary suspension of the $31.4 trillion debt ceiling until January 1, 2025 – also on the federal government’s “problems to solve” list for 2025 is the expiration of the Tax Cuts and Jobs Act (TCJA) of 2017 (aka, the Trump tax cuts).

The TCJA effectively lowered the tax brackets for nearly all individuals, including the top income bracket which dropped from 39.6% to 37%. Those restructured income tax brackets as a result of the TCJA are set to expire at the end of 2025 and revert back to 2017 levels, which will affect most Americans and corporations.

The question is, with the U.S. economy still in an uncertain state, will lawmakers in 2024 or 2025, regardless of political party, really allow middle America to take on a tax increase by letting the TCJA expire? And if a deal is struck prior to the expiration, and ordinary income tax rates are held firm, what’s the alternative plan to keep the U.S. fiscally prudent?

Tax increases somewhere else will most likely be the result, with the most likely targets being the top one percenters, and/or business owners, and/or capital gains.

While 2023 insurance brokerage merger & acquisition (M&A) activity has been hampered by the challenging economic conditions, there might be deeper financial concerns around tax implications in 2025 that could force the hand of some business owners.

Today, there is no federal regulation or changes to tax codes to create any sense of urgency for M&A deals to close in 2023. However, as 2024 rolls through the chaos of an election year and speculations around these fiscal policy decisions, firms that may be considering selling will most likely ramp up their timeline to avoid the possible tax implications in 2025 and beyond.

So – while demand for quality firms has continued to be strong through 2023, the supply of sellers has the potential to increase in 2024 and 2025, depending on when any tax changes go into effect. Sellers will have to step back and consider that if taxes go up, how much do they have to grow organically to ensure net proceeds are neutral. As a result, M&A activity will likely begin to accelerate in early 2024 and continue through the uncertainty.

M&A Market Update

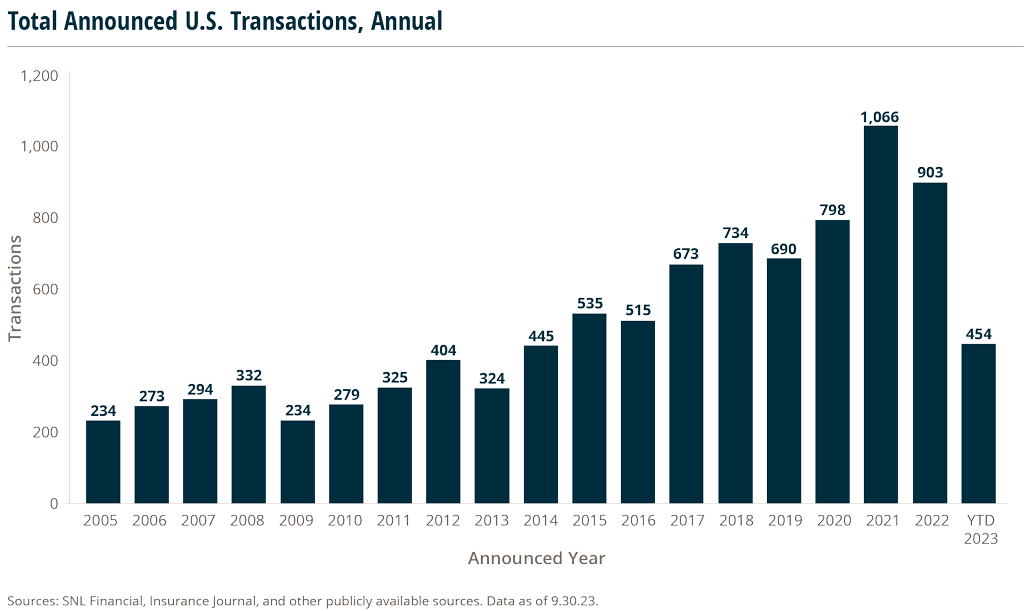

Through September 30, 2023, there have been 454 announced insurance brokerage M&A transactions in the U.S.

Private capital-backed buyers have accounted for 334 of the 454 transactions (73.6%) through September, which is nearly a 4% increase from the proportion of announced transactions at this time in 2022. Total deals by these buyers increased at a compound annual growth rate (CAGR) of 11.1% since 2018, with a marked increase after the onset of the pandemic.

Through September, independent agencies as buyers accounted for 60 transactions (or 13.2%) – down from 17.2% in 2022. Bank and thrift as buyers accounted for five announced deals (or 1.1%) – down from 2% in 2022.

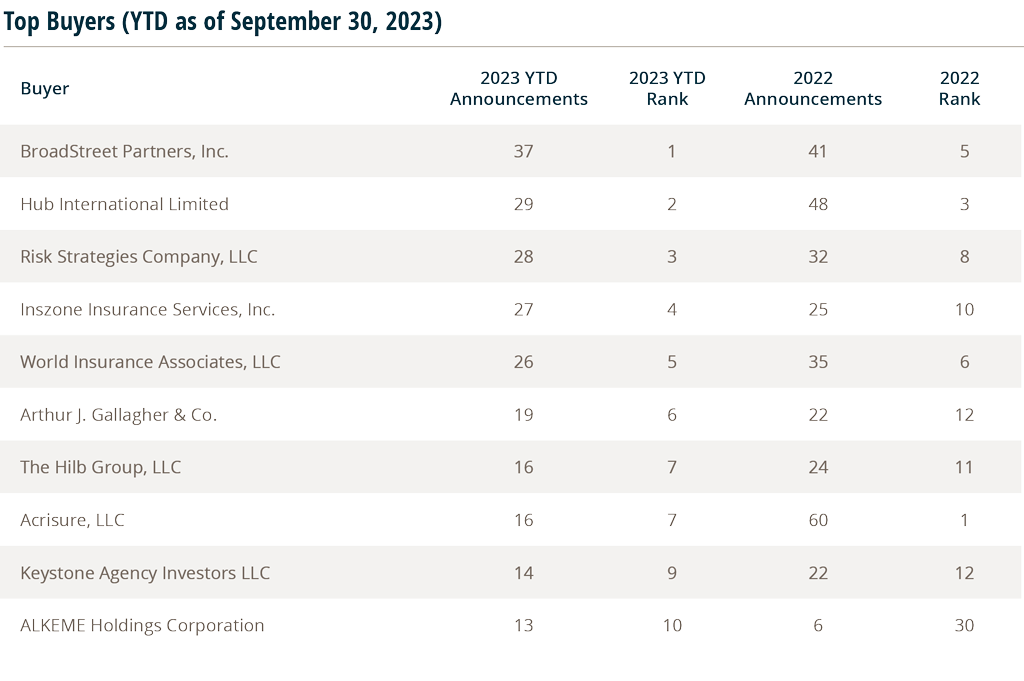

Deal activity from the marketplace’s most active acquirers has remained strong in 2023. Ten buyers have accounted for 49.6% of all announced transactions, while the top four (BroadStreet Partners, Hub International, Risk Strategies and Inszone) account for 26.7% of the 454 total transactions.

Notable Transactions:

- September 7: Simplicity Group Holdings announced it acquired wholesale broker Hancock Brokerage. Based in Louisiana and founded in 1997, Hancock has provided life insurance, disability insurance, long-term care, and annuity solutions to agents and advisors. This transaction signifies Simplicity’s 8th specialty transaction of 2023.

- September 11: 2022 Top 10 U.S. Broker USI Insurance Services announced a substantial new equity investment of over $1 billion from its existing shareholder, KKR. As part of this agreement, KKR and USI will acquire shares of USI that are currently held by Caisse de dépôt et placement du Québec (CDPQ) and certain other investors. A majority of CDPQ’s holdings, more than 50%, will be purchased in the transaction. Consequently, KKR will become the largest single shareholder of USI upon the completion of the deal.

- September 20: Risk Strategies announced it acquired human resources and employee benefits firm orchestrateHR Inc. and its affiliate, Ebenconcepts Company. Dallas, Texas-based orchestrateHR offers a broad range of services including human resources and technology consulting, third-party administration, and associated administrative outsourcing services. Ebenconcepts Company is an HR consulting and custom employee benefits brokerage with offices across the U.S. Ebenconcepts Company is also an MGA able to provide a comprehensive suite of employer-funded and voluntary insurance products.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2022 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.