Public Broker Performance Vol II, Issue 7

MarshBerry Broker Index

Get the latest performance and insights on the public broker composite.

Marshberry Broker Composite Index: Market Update And Q2 2023 Earnings

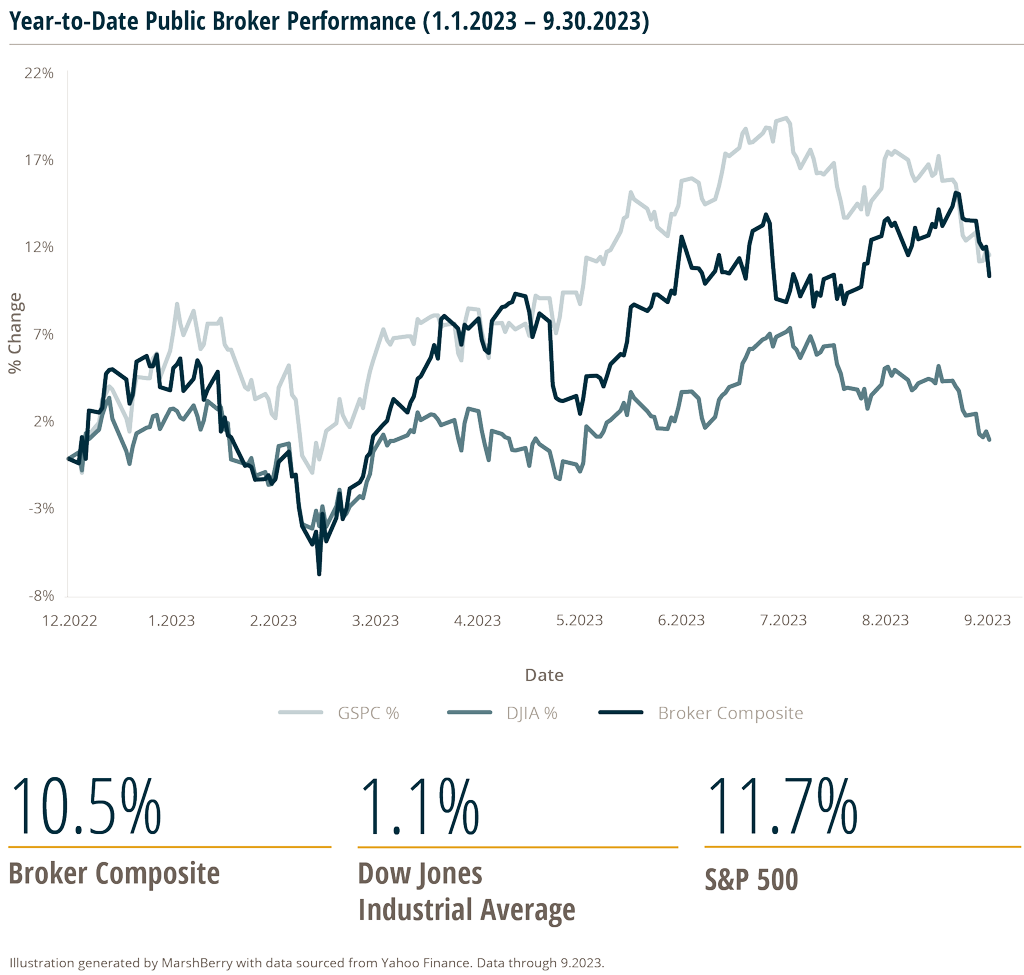

During the period from January 1, 2023, through September 30, 2023, six public brokers, as measured by MarshBerry’s Broker Index, outperformed the Dow Jones Industrial Average (DJIA), highlighting the strong fundamentals and relatively recession-resistant qualities of the insurance brokerage industry. However, the S&P 500 index outperformed both the brokers group and the DJIA during this period.

The following publicly traded insurance brokers are included in the Broker Index: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP).

Q2 2023 Earnings Results

Insurance brokers reported overall strong earnings results for Q2 2023, which were attributed to a combination of improving new business, ongoing insurance rate increases, and strong retention. Organic growth figures reported in Q2 2023 were generally comparable to those seen in Q1 2023. Most brokers reported organic growth rates in a range of 6%-16%; compared to 7%-13% in Q1 2023.

- Marsh & McLennan Companies, Inc. (MMC) reported organic revenue growth of 10% in Q2 2023, vs. 9% for first quarter 2023, and 7% organic growth in Q4 2022.

- Brown & Brown, Inc. (BRO) reported organic growth of 11.2% in Q2 2023, vs. 12.6% in Q1 2023 and 7.8% in Q4 2022.

- Arthur J. Gallagher & Co. (AJG) posted for its combined Brokerage and Risk Management segments 10.8% organic growth in Q2 2023, vs. 9.7% organic growth in Q1 2023 and 11.7% organic growth in Q4 2022.

- Willis Towers Watson Public Limited Company (WTW) posted 7% organic growth in Q2 2023, below the 8% organic growth in Q1 2023, but above the organic growth rate of 5% in Q4 2022.

- Aon plc. (AON) reported organic revenue growth of 6% in Q2 2023, vs. 7% in Q1 2023, and 5% in Q4 2022. The firm noted that its Aon United strategy and Aon Business Services platform helped drive its performance.

- Ryan Specialty Holdings, Inc. (RYAN) again reported strong organic growth of 16.1% in Q2 2023 (against the 22.3% organic growth in Q2 2022), compared to 12.9% in Q1 2023. The firm saw broad strength across its lines of business, especially in many individual lines of business and in property.

- BRP Group, Inc. (BRP) once again reported organic growth that was higher than the public broker group average, with Q2 2023 organic growth of 22% vs. Q1 2023’s organic growth of 23%. This organic growth was driven by broad-based strength across the segments.

The Macroeconomic Environment

While leaders at some insurance brokers noted concerns about the macroeconomic environment, such as persistent inflation and geopolitical uncertainty, most are confident in their continued growth and that of their clients.

BRO CEO, President & Director J. Powell Brown said on BRO’s Q2 2023 earnings call: “We expect business leaders will remain cautious regarding the pace of their hiring and how much they will invest over the coming quarters…While the overall rate of inflation continued to slow, business leaders remain cautious regarding the level of investment in their business in the second quarter, but incrementally are feeling better than they did in Q1 and Q4 of last year.”

Despite concerns about elevated inflation and a potential slowdown, Ryan remains confident in the strength of the E&S space. Chairman & CEO Patrick G. Ryan commented on the Q2 2023 earnings call: “Throughout the second quarter, the E&S marketplace remained robust… Looking ahead, we expect favorable specialty insurance market dynamics to persist, and we remain confident that 2023 will continue to be another strong year for our firm.”

MMC President, CEO & Director John Quinlan Doyle commented on the Q2 2023 earnings call that concerns about a slowdown remain, stating: “I think there is still a meaningful risk of recession. And in fact, where we do have exposure in other parts of the world, we have economies in recession currently… And inflation overall, we do think is beneficial to the company. We’re not again immune to some of the challenges that we confront from an inflationary environment in our expenses, but overall, it’s a bit of a benefit.”

Mergers & Acquisitions Activity

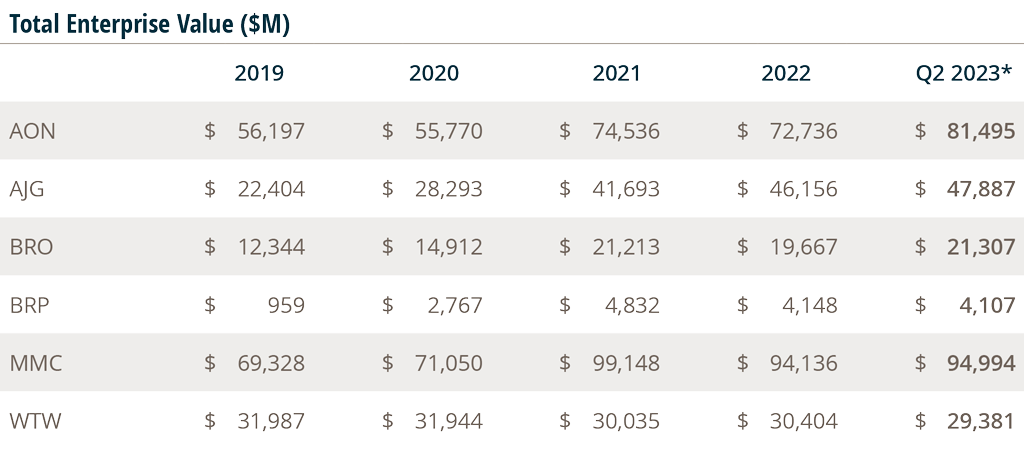

BRO noted that it was active in M&A, but volume continued to slow for the industry. However, there is still high competition for high-quality companies. BRO CEO, President & Director J. Powell Brown said on the firm’s Q2 2023 earnings call about M&A: “The level of deals primarily from financial backers continued to slow during the second quarter. As a result, we’re seeing fewer bidders for businesses and valuations have come down slightly from their peak, but that doesn’t mean that a good business won’t trade at high multiples.”

AJG had another active quarter in Q2 2023, with 14 new tuck-in brokerage mergers completed (in addition to the Buck acquisition completed in April 2023), accounting for about $349 million of annual revenue including Buck. AJG’s integration efforts of the Buck merger have begun, and Chairman, President & CEO J. Patrick Gallagher noted the firm is “excited about our combined prospects.” AJG continues to have a strong pipeline, with almost 55 term sheets signed or being prepared, which is over $700 million in annual revenue.

On RYAN’s Q2 2023 earnings call, the firm noted that its M&A pipeline continued to be robust, and the company remains disciplined in the pursuit of acquisitions.

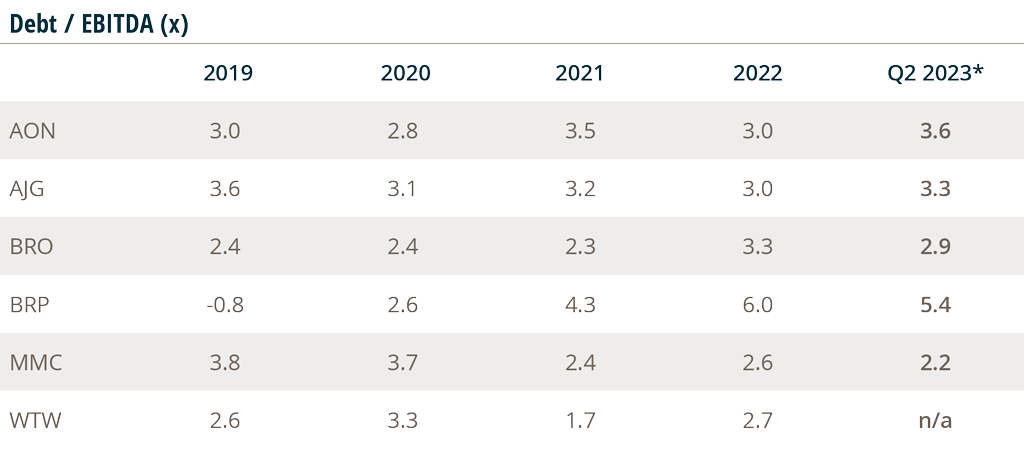

BRP CEO Trevor Baldwin said on the Q2 2023 earnings call: “We continue to kind of remain active and opportunistic around our pipeline of opportunities and keep that live. Our priority remains de-levering the business down below our long-term range of 4.5 turns.”

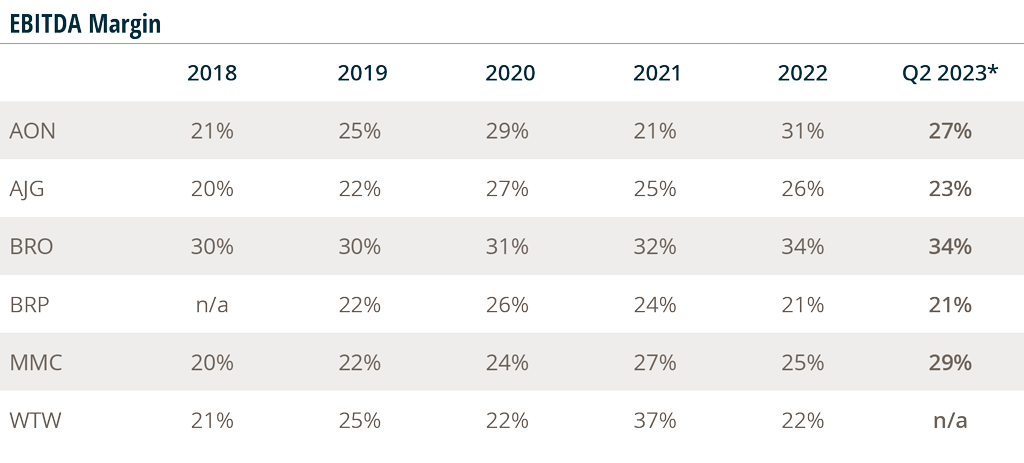

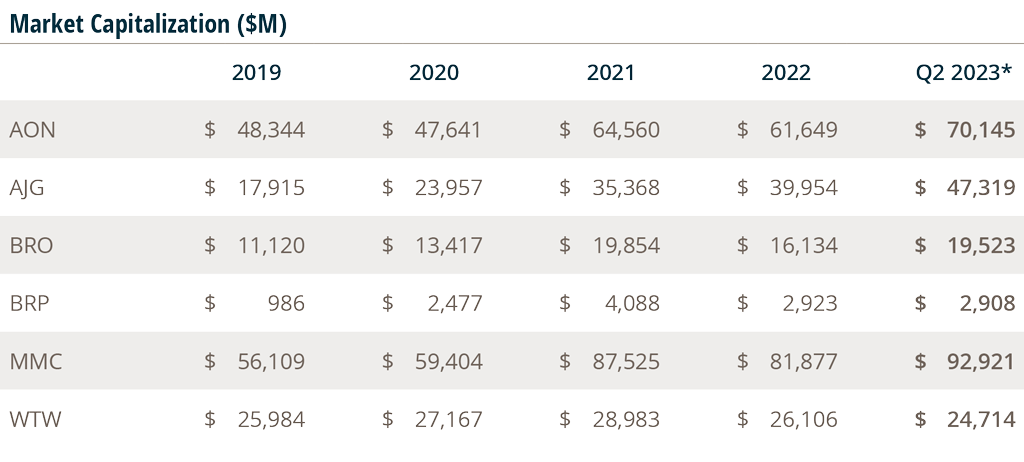

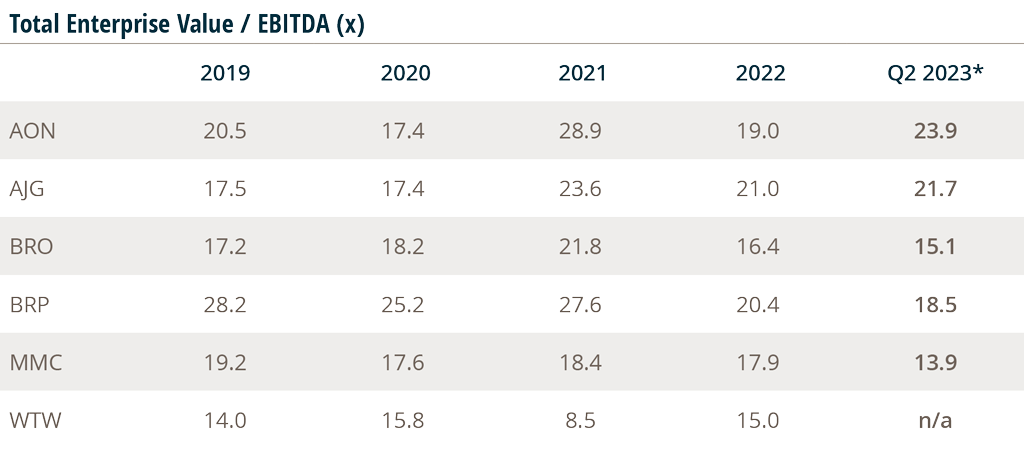

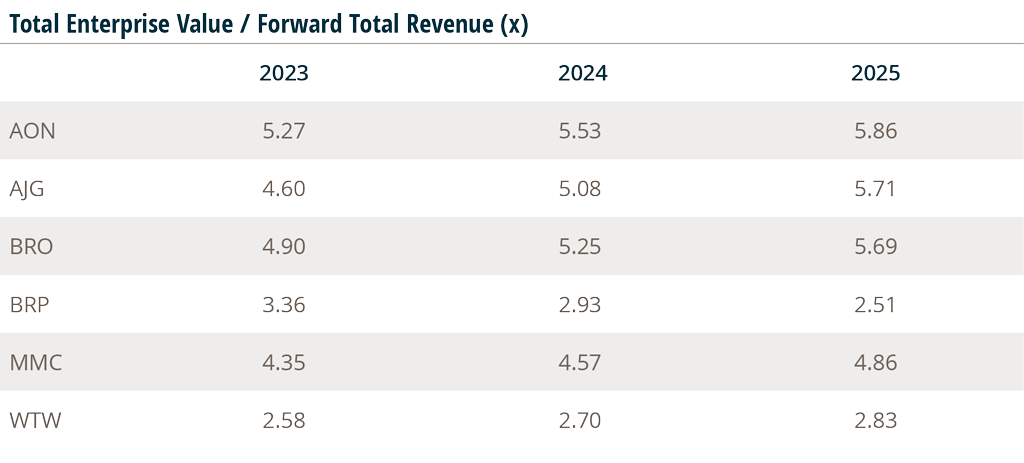

*Results as of Q2 2023

Source: S&P Global Market Intelligence, Company Reports, FactSet, 10/10/23. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization. AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BRP = Baldwin Risk Partners; MMC = Marsh & McLennan Companies, Inc.; WTW = Willis Towers Watson Public Limited Company. 2023.

The MarshBerry Broker Index is a composite of market data on the following companies, sourced from Yahoo Finance: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only. This information is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy.

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.