Focused Insights: The Future of Bank-Owned Insurance Rests On Commitment To Growth Vol II, Issue 7

In this Section

- A History Of Bank-Owned Insurance Offerings

- Why Did Banks Look To Add Insurance Products To Their Offerings?

- Selling And Managing Insurance Is Harder Than It Looks

- Why Are Banks Acquiring Less And Divesting More?

- How Can Banks Compete With Other Insurance Brokerages?

- What Other Strategic Options Are Available To Banks?

Following the recent high-profile divestitures of insurance brokering businesses in 2023 by banks such as Truist Financial (closed in April) and Eastern Bankshares (announced in September), Cadence Bank announced on 10/24/23 that it was selling its insurance operations to Arthur J. Gallagher & Co. MarshBerry served as an advisor to Cadence Insurance, Inc. (Cadence) on this transaction.

The sale of Cadence, the second largest bank-affiliated insurance brokerage in the U.S., represents a continuing trend by banks looking to bolster shareholder value amidst record-high valuations for insurance brokerage firms. And now, for the first time in nearly two decades, divestitures of bank-owned insurance brokerages have outpaced acquisitions.

For banks looking to continue operating in, or enter, the insurance brokerage business, there are still plenty of opportunities to compete and succeed. However, it will take deep commitment by leadership and strong strategic plans to help drive organic growth in this competitive space.

A History Of Bank-Owned Insurance Offerings

The history of banks selling insurance products goes back to the late 1700’s when banks in Europe and the U.S. began offering marine insurance services, an essential component of international trade. During the 1800’s, banks expanded their insurance offerings to include life and property insurance in response to the growing demand for risk management solutions in an increasingly industrialized and urbanized world.1

However, the Glass-Steagall Act of 1933 (also known as the Banking Act of 1933) marked a significant turning point for banks selling insurance in the U.S. The primary goal of the Act was to separate commercial banking activities from investment banking activities, making it difficult for banks to engage in insurance activities.2 Subsequent legislation, the Bank Holding Company Act of 1956, built upon the principles of Glass-Steagall, further restricting the ability of banks to engage in non-banking activities, including insurance.3

The strict separation between banking and other financial activities remained mostly intact until the late 1990’s – when it was challenged by the Barnett Bank of Marion County case (in 1996) and partially repealed through the Gramm-Leach-Bliley Act (in 1999). 4,5

Why Did Banks Look To Add Insurance Products To Their Offerings?

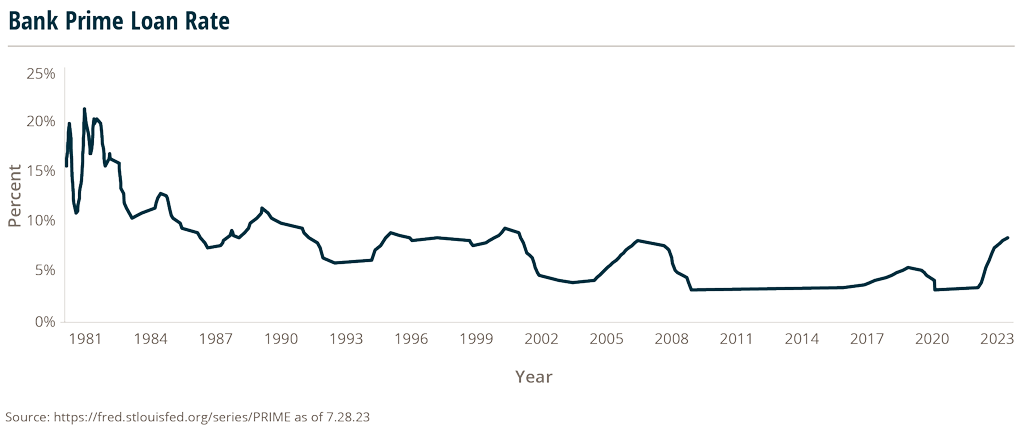

When the changes to federal law permitted them to sell insurance – there was a rush to acquire independent insurance agencies by banks. Adding insurance services to their portfolio allowed them to diversify their revenue streams – with something that wasn’t dependent on interest rate fluctuations. Coming out of the high-interest rates of the early 1980s, when bank prime loan rates touched 20%, and into the early 2000’s, when rates dropped down to 4% – banks were looking to drive more fee-based income by cross-selling insurance to banking customers.

Today, this still makes sense, as many banks use their size and expertise to offer customers a wide range of financial services that are interconnected. By offering insurance products to their customers, whom they already have a financial relationship with, they can cross-sell to a known audience and deepen those relationships. A bank with a portfolio of insurance products can offer life, home, or auto insurance to customers who already have mortgages or car loans with the bank.

Additionally, by getting customers to bundle banking and insurance with a single provider, it creates higher retention rates as customers are less likely to switch to another institution. And building stable customer relationships is a competitive advantage.

Selling And Managing Insurance Is Harder Than It Looks

Since the early rush of banks acquiring insurance services, there has been a steady increase in banks divesting their insurance offering.

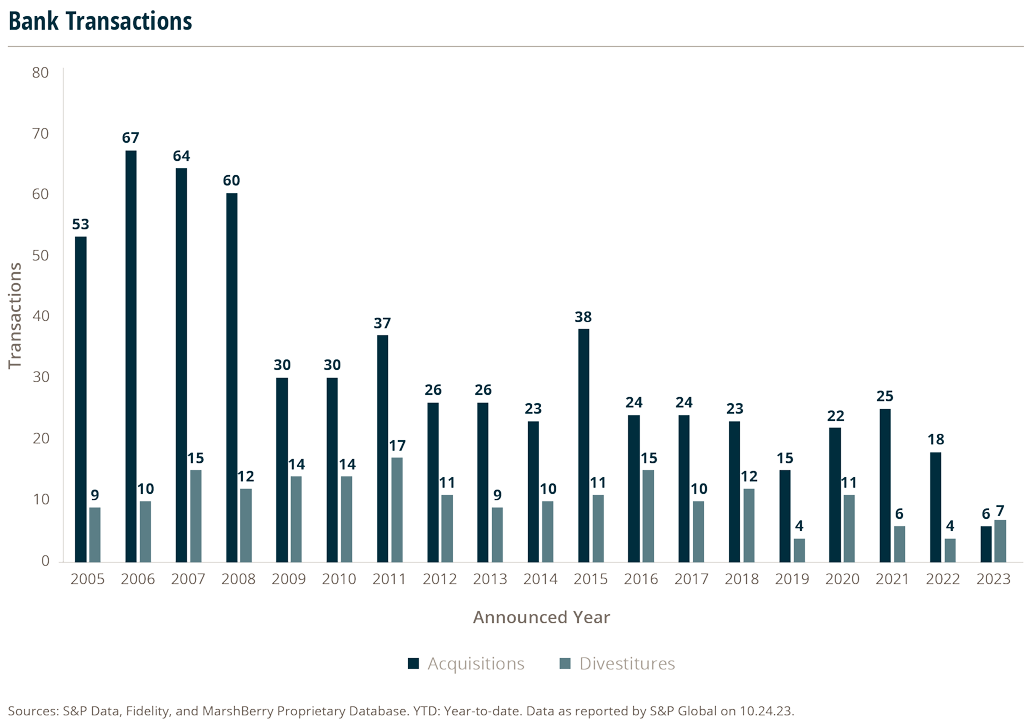

Since 2005, there have been 611 announced acquisitions of insurance brokerages by financial institutions, while there have been 201 announced divestitures.

Many of the earlier divestures arose when the parent bank was acquired by another bank that didn’t share the acquired bank’s appetite for the insurance brokerage space.

While the marketable synergies between banking and insurance seems obvious, there are specialized complexities to insurance brokerage. Traditional insurance brokers have deep knowledge of insurance products, underwriting processes, and risk management – something that some banks struggle to master.

Here’s why:

- Different sales cultures. Banks often have a sales culture focused on banking products such as loans and deposits, while the sales culture for most insurance brokerages is commission-based. This misalignment can impact the motivation and effectiveness of bank employees in selling insurance.

- Carrier relationships. Some insurance carriers do not align with the insurance referrals from bank relationship managers. Traditional insurance brokers have established long-standing distribution networks and partnerships with carriers. Banks may need to invest in building and maintaining their distribution channels, which can be costly and time-consuming.

- Referrals between business lines. Successful internal referrals are dependent on creating and maintaining trusting relationships, which some banks have difficulty fostering due to employee turnover or conflicting department goals.

These challenges could be contributing to the overall decline in the number of acquisitions of insurance brokerages by banks for the past 15 years. In 2007, these transactions represented approximately 21.7% of total announced insurance brokerage M&A transactions. By 2012, that percentage dropped to 6.4%, and in 2022 was only 2% of total deals.

Now, for the first time in nearly two decades, announced divestitures of bank-owned insurance brokerages have outpaced announced acquisitions. This year (through 10/24/23) there have been seven divestitures of insurance brokerages by banks – versus six acquisitions.

Why Are Banks Acquiring Less And Divesting More?

In the current economic environment, a combination of converging factors may be enough to discourage certain banks from aggressively acquiring insurance brokerages, while presenting opportunities for others to divest their current holdings. Here are some of those factors:

- Private equity is driving up valuations. Since 2010, the number of private equity (PE) backed buyers have increased from three buyers to over sixty – helping to push insurance brokerage valuations to all-time highs. Current valuations are significant premiums to the original investments made by banks to acquire their brokerage. At the same time, PE buyers are making it difficult for bank buyers to acquire brokerages by bidding up valuations, forcing bank buyers to back off due to the difficulty justifying the premium valuations for their buy and hold strategy.

- Balance sheet pressure. Additionally, with the Federal Reserve tightening credit and increasing the discount rate, bank investments are under pressure to increase their balance sheet capital.

Wayne Walkotten, Executive Vice President at MarshBerry states, “The truth is – current bank valuations do not fully reflect the value of their insurance subsidiary. With the valuations that insurance brokerages are presently commanding, publicly traded bank holding companies’ market capitalization is most likely undervalued relative to the sum-of-the parts of the operating companies.”

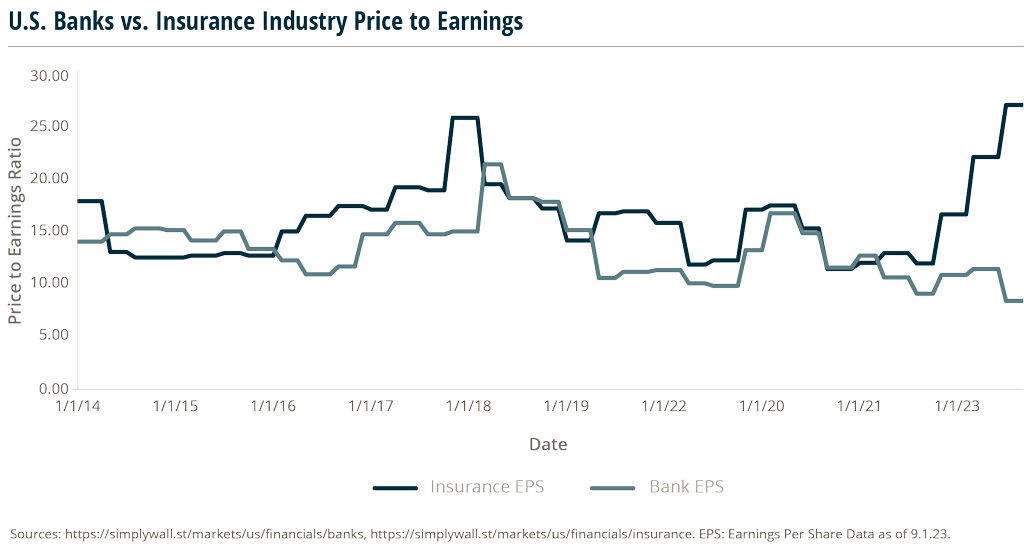

The price to earnings ratio (PE ratio) (as of 9/1/23) of regional banks is 8.4x, while the PE ratio of public insurance brokers is 27.2x.6,7 Based on the insurance subsidiary contributing ~8% of the holding company’s earnings per share (EPS), market capitalizations could increase by 15% if that value was unlocked by divesting.

- Commercial real estate challenges. Also looming on the horizon are the challenges in commercial real estate, an area of concentration for many regional banks. With commercial occupancy lower since the pandemic, decreases in property valuations, and mortgage rates increasing – financial institutions are preparing for tougher times ahead for their loan portfolios, due to delinquencies and foreclosures.

- Talent acquisition and equity incentive challenges. Banks typically are not able to create competitive equity incentive plans for their brokerage businesses. This puts them at a competitive disadvantage to non-bank brokers, including private, PE backed, and public, for attracting and retaining the right type of insurance talent.

The convergence of these factors creates a financial incentive for financial institutions to reconsider their strategic priorities and perhaps consider divesture of their insurance business.

How Can Banks Compete With Other Insurance Brokerages?

Bank-owned brokerages face most of the same challenges shared by all insurance organizations. With capital constrained and the ongoing fight for talent, banks must consider doubling down on their commitment to their insurance business. Here are the key initiatives to improving the organic growth of the business:

- Improve cross-selling initiatives. Financial institutions need CEO-level commitment to the cross-selling of the insurance brokerage business across the organization. This is still the holy grail that many organizations have not made a priority. This includes cross-functional sales teams, across not only lines of insurance, but including bank relationship managers and wealth management.

- Invest in specialized talent. The ongoing investment in new insurance producers with sales experience outside of insurance or expertise in insurance sales is imperative for building the sales team and fulfilling a perpetuation plan. This includes equity incentive programs that can attract, retain, and reward high-performing producers.

- Improve sales velocity. Sale velocity (new business development) for insurance brokerage is a key performance indicator for measuring the efficiency and effectiveness of the sales process. Banks need to ensure that all brokerage producers are on the same page through better strategic planning, sales management, accountability, and mentorship.

- Leverage technology. Investing in digital tools, platforms and other resources that can provide producers with compelling value propositions can be a differentiator and help prospecting in a more efficient manner. Then, online quoting, application, and claims processing systems can improve the customer experience and improve retention.

What Other Strategic Options Are Available To Banks?

The challenge of implementing these “double-down” initiatives for some may be the required investment. These financial commitments may be outside the budget of banks at a time when they are fighting off the effects of inflation and looking to improve their balance sheets. If a bank is not willing to make these ongoing investments in their insurance brokerage, they should consider these other strategic options:

- Position the business for a financial sponsor to take a minority stake. By divesting a portion of the insurance business, banks can optimize their capital and leverage ratios and unlock additional value for reinvestment or to distribute to shareholders.

- Search for a majority or outright sale to a strategic buyer or investor. A bank can unlock maximum value of their insurance business versus the overall valuation of the bank by selling outright to one of the many interested buyers.

The acquisition landscape for insurance brokerage continues to be favorable, as consolidation trends in the industry remain strong. Prices buyers are willing to pay for banks’ insurance subsidiaries remain elevated, giving banks a number of viable options in this dynamic economic environment.

MarshBerry brings decades of experience in the bank insurance space and has advised on over 250 acquisitions and divestitures of insurance brokers by banks. MarshBerry is also the #1 Investment Bank in insurance distribution, and has represented more clients in insurance brokerage and distribution segment than any other investment bank in the U.S.

Sources:

1 https://ecollections.law.fiu.edu/cgi/viewcontent.cgi?article=1359&context=faculty_publications

2 https://www.federalreservehistory.org/essays/glass-steagall-act

3 https://www.federalreservehistory.org/essays/bank-holding-company-act-of-1956

4 https://tile.loc.gov/storage-services/service/ll/usrep/usrep517/usrep517025/usrep517025.pdf

5 https://www.ftc.gov/business-guidance/privacy-security/gramm-leach-bliley-act