U.S. Macroeconomic Indicators November 2022

Market Trends and Current Statistics

Here are key U.S. macroeconomic indicators that are likely to impact brokerages within the insurance industry.

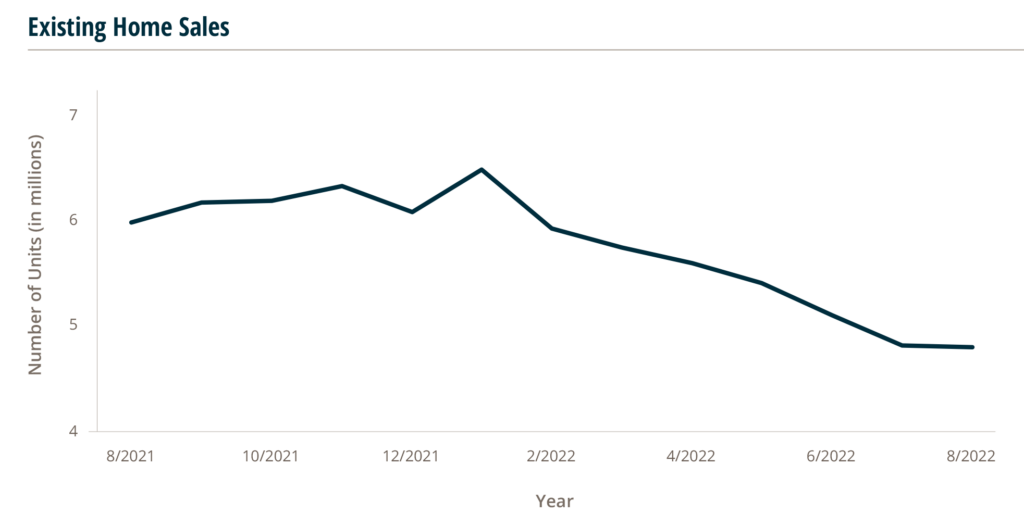

Existing Home Sales Drops Amidst Recession Concerns, But Average Home Prices Continue To Be Resilient

While the U.S. isn’t officially in a recession yet, current market indicators are starting to wear on the housing market. With continued inflation, rising interest rates, a slowing of economic growth, and volatility in the stock market—home buyers are reading the recessionary tea leaves and are beginning to pull back on their historic frantic buying spree.

As of November 1, the average 30–year mortgage rate reached 7.2%—its highest level since 2002. With it, mortgage applications are down to their lowest level in 22 years, and existing home sales dropped nearly 20% YoY in August.1 Fannie Mae predicts that 2022 total year existing single–family home sales will decline 18.1% from 2021 sales and further forecasts a 20.8% decline in 2023.2

The pullback by potential home buyers isn’t the only thing contributing to the slowdown in home sales. Potential home sellers are also taking stock of the current market conditions and recognizing the poor financial decision behind trading their current home’s low mortgage rate for a new home with a rate that might be double.

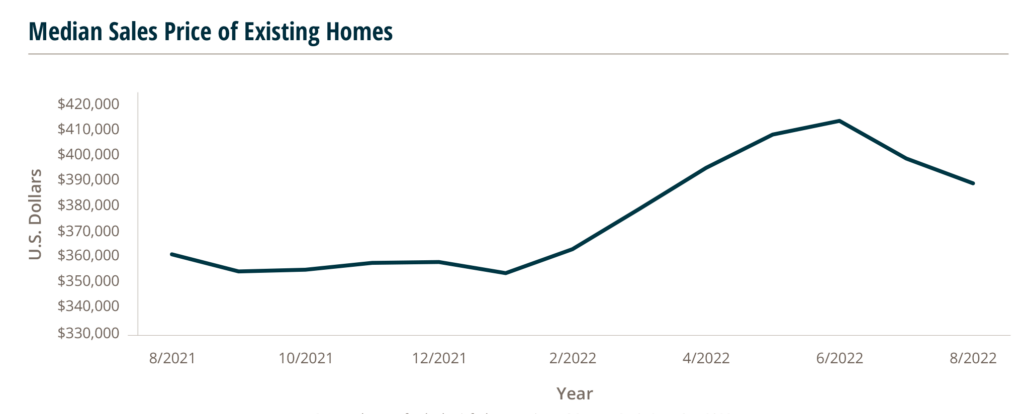

However, despite increasing mortgage rates, and the decreasing number of buyers and sellers—the average price for an existing home is still historically high. In June, the median price for a home was a record $413,800. Only in July and August have prices started to dip (attributed to the seasonality of home sales), with the most recent data showing the average price for a home in August at $389,500. This price is still an 8% increase from a year earlier—with predictions that home prices will continue to stay level or even rise in early 2023.1

Source: https://fred.stlouisfed.org/series/HOSMEDUSM052N, 10/1/2022

Part of the reason home prices haven’t adjusted downward with rising mortgage rates is that there is still an imbalance of more buyers versus the inventory of new and existing homes that are available.

Ultimately, financial experts are predicting that home prices will fall sometime later in 2023—by as much as 5-10%—under the pressures of further interest rate increases and the possibility of recession. Even so, at a 7% decline, home prices would still be 32% above peak–pandemic prices in March of 2020.3

Any significant drop in home prices may have further negative impact on economic growth. Drops in home value can lead to a drop in consumer confidence about the economy, a reduction in home equity for which to borrow against, which ultimately leads to a drop in consumer spending.

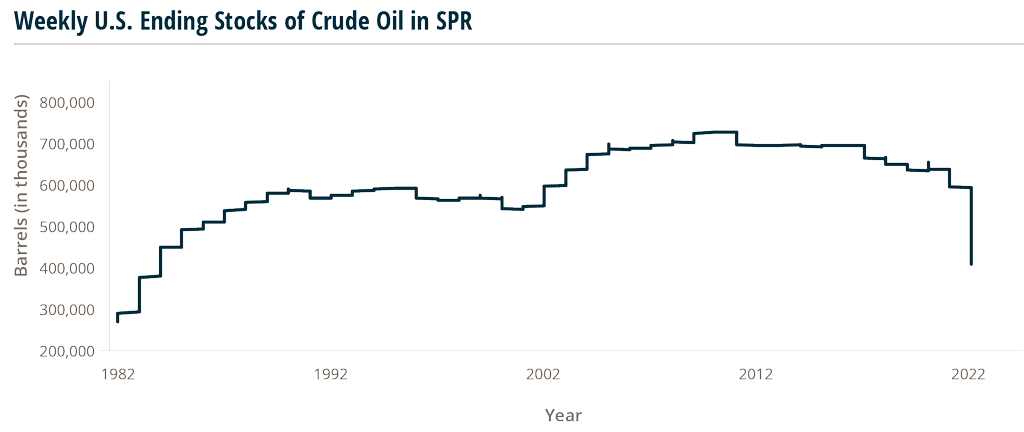

This is the biggest cut in oil supply since 2020, and it risks adding another shock to the world’s economy.

Opec Cuts Oil Production Adding Further Stress To Global Inflation

The Organization of Petroleum Exporting Countries (OPEC) and its allies announced it will reduce output by two million barrels a day in November.4 OPEC+ officials defended the move as necessary to protect the oil industry and their own economies from the risk of a global slowdown. For now, the U.S. can tap into the Strategic Petroleum Reserve, but supplies are starting to run low:

This is the biggest cut in oil supply since 2020, and it risks adding another shock to the world’s economy. There is currently little to no production elasticity available to meet any increased demand for oil, and the Northern Hemisphere is heading into winter which typically requires increased energy consumption. A constraint in the oil supply will most likely keep inflation elevated for longer, influencing central banks to continue raising interest rates, hurting the global economy, and increasing the likelihood of tipping into a recession.

As inflation in 2022 continues to impact costs across the board (insurance rates included), brokers may want to get out in front of their clients before they start to look for their own ways to save money. If a broker is proactive with insurance solutions or in communicating price increases, so clients are not caught off–guard by the level of rate increases, this could help boost the client’s experience and in turn, retention. Brokers could suggest modifying coverage to opt for different deductible levels in exchange for lower premiums or they can offer additional services that appeal to clients. Finally, firms can show that they are actively working to aid their clients by letting clients know that they researched multiple carriers in order to find the best rates for them.

Labor Force Shortage Could Wreak Havoc On U.S. Economy

As the war for talent rages in an inflation riddled economy, solutions to inhibit continued economic instability may come from surprising places. One such remedy may lie in foreign policy, specifically immigration reform.

The U.S. is currently seeing a surge in job openings, with levels remaining at historic highs according to the U.S. Department of Labor.5 This is not a surprise as the work force participation rate is at a 20–year low, and still on the decline.6

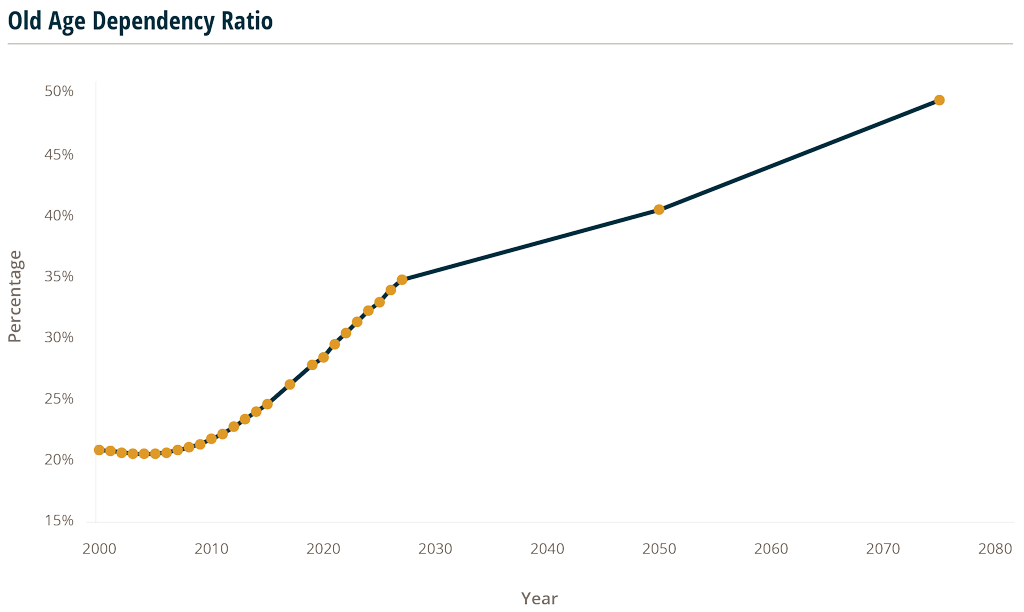

So, what is causing this gap between open jobs and work force participation? Quite simply—the proportion of working age adults in the population is decreasing.

The “old age dependency ratio,” which measures the number of individuals aged 65+ per 100 people of working age (defined as those ages 20–64), has increased rapidly in the past 50 years. This ratio is influenced by mortality rates, fertility rates, and migration. The jump from 14.2% in 1950 to 30.4% in 2022 has been highly influenced by the declining fertility rate and increasing average life span.7 In other words, less babies are being born and people are living longer.

The current fertility rate, or the average number of babies born per female, in the U.S. of 1.7 has been decreasing since the 1950’s and is now below the replacement rate.8 “Replacement rate” is the level at which a population exactly replaces itself from one generation to the next. The U.S. has been under this important metric since 1980.

The decline of the population and therefore shrinking labor force, exacerbated by lower levels of labor force participation, threatens to disrupt labor markets and slow down economic growth. In addition, the increasing average age of Americans threatens the sustainability of pensions and social systems set up to support retirees.

The lack of workers and increase of retirees pushes the bounds of systems as 10,000 baby boomers retire every day from now until 2030.9

Without some sort of alternative solution the current pressure put on the labor market and the economy in general is not sustainable.

Increasing the number of job seekers will assist in cooling wage growth and boost overall productivity as jobs are filled and production increases to more optimal levels. Changes in the U.S. immigration policy could contribute positively to this pending economic crisis. Migrants are on average younger than the current average population with larger proportions of working age people, along with higher labor force participation rates.7 Because people tend to immigrate when they are younger, and have higher fertility levels, they serve as a catalyst for growing the current and future work force, fulfilling crucial open job opportunities.

The current work force trajectory is not sustainable. Finding ways to counteract the decrease in working age adults will be crucial to maintaining production and service levels in the U.S. to support a growing and diverse economy.

- https://www.forbes.com/advisor/mortgages/real-estate/housing-market-predictions/

- https://www.fanniemae.com/newsroom/fannie-mae-news/economy-expected-contract-further-2023-fed-appears-resolved-tame-inflation

- https://finance.yahoo.com/news/morgan-stanley-home-prices-drop-192606093.html

- https://www.bloomberg.com/news/articles/2022-10-05/opec-panel-recommends-2-million-barrel-cut-to-output-limits

- https://www.pbs.org/newshour/economy/labor-department-says-u-s-job-openings-remain-at-historic-highs

- https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

- https://data.oecd.org/pop/old-age-dependency-ratio.htm#indicator-chart

- https://www.imf.org/en/Publications/fandd/issues/2020/03/can-immigration-solve-the-demographic-dilemma-peri

- https://www.seniorliving.org/life/baby-boomers/