Focused Insights: Is the Market Getting Closer to a Potential Fed Pivot? November 2022

As the Fed continues to monitor inflation, all eyes are on the economy and indicators for potential recession. Will the Fed continue to be hawkish in its approach? Or will it pivot when signs point to economic instability or hardship? The insurance industry needs to prepare for either scenario.

This year has seen the fastest U.S. interest rate increases in over 30 years, with the Federal Reserve (Fed) hiking the Federal Funds rate by over three percentage points since March 2022.

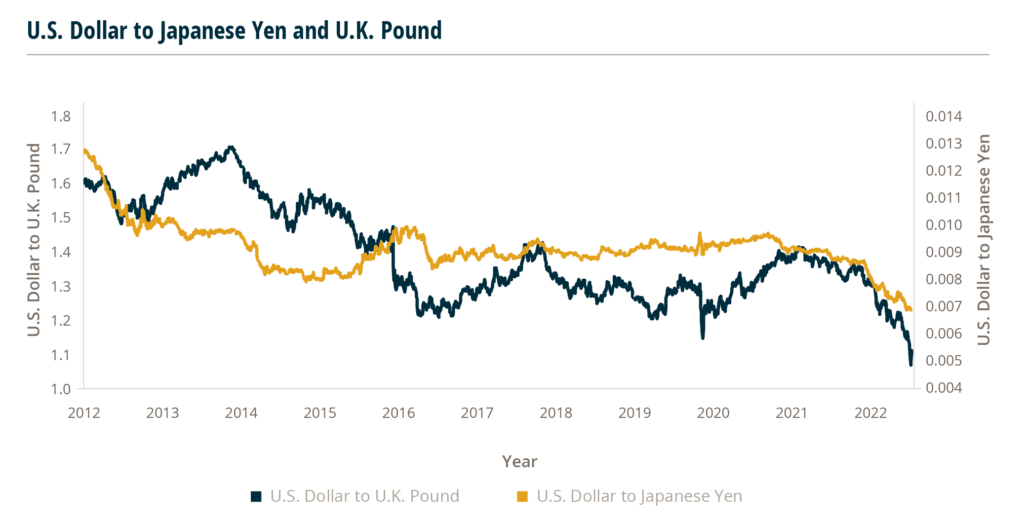

On November 2, the Fed raised interest rates for the fourth consecutive meeting with a 0.75-point rate hike. This tightening monetary policy, which followed the near–zero rates in 2020–2021, has contributed to concerns around recession and is creating volatility in equities. This uncertainty has also led to a sharp rise in mortgage interest rates as lenders are concerned about the overall financial health of consumers in a slowing economy. The U.S. weekly average 30–year fixed–rate mortgage was 7.1% (as of November 10, 2022), up from 3.85% a year ago, according to Freddie Mac.1 Furthermore, the Fed’s hawkishness this year has contributed to a notable strengthening in the U.S. dollar vs. global currencies.

3+

Percentage Point Increase

in Federal Funds Rate

Since March 2022

.75

Interest Rate Increase

for the Fourth

Consecutive Meeting

7.1%

U.S. Weekly

Average 30-year

Fixed-rate Mortgage

The Fed has been raising interest rates in an effort to bring down record high inflation while trying to keep employment and economic growth relatively stable. Prior to the November 2 Fed meeting, there was speculation that a Fed pivot, or a less hawkish stance, could be around the corner given signs of weaker U.S. economic growth. A Fed pivot would mean either slowing the pace of rate hikes or stopping altogether. However, Fed Chairman Powell gave some hawkish statements at the November 2 Fed conference, stating: “We still have some ways to go, and incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected.” In the Fed briefing, Powell also noted that the central bank is strongly committed to a policy stance that will bring inflation near its target of 2%. By comparison, consumer inflation (as measured by the Consumer Price Index) in September reached an 8.2% annual pace.2

Following the latest Fed rate hike, stocks fell the next day (November 3, 2022), with the Nasdaq closing down 1.7% and the S&P 500 down 1.1%, which indicates that investors may be less optimistic about a pivot in the near future.

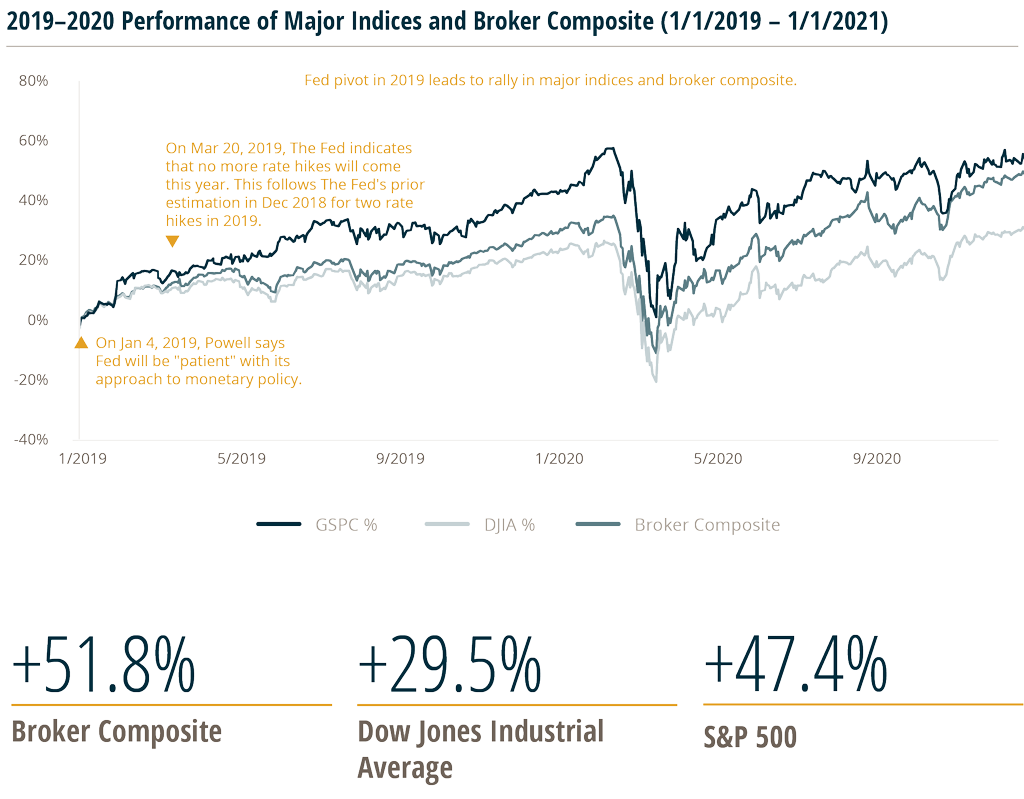

For comparison, in 2018, the Fed took a path toward monetary policy “normalization” and increased rates from emergency low levels as a way of decreasing the size of the Fed’s balance sheet. The result was recession concerns and a 9% drop in the S&P 500 in December 2018. In January 2019, Fed Chairman Powell said: “We’re always prepared to shift the stance of policy and to shift it significantly if necessary.” Investors took this as a sign of a shift in stance and subsequently equities began moving up. When the Fed signaled that it would end its rate hikes in March of 2019, the S&P 500 rebounded and ended the year past its prior all–time high.

A Fed pivot could mean different scenarios:

- The Fed stops raising rates.

- The Fed becomes less aggressive with its hikes (continuing them at a slower pace).

- The Fed starts cutting rates, which could mean shifting away from tightening monetary policy and towards a more expansionary one.

Investors may hope for a pivot, and a subsequent rebound, in equities to ease their recession worries. However, some Wall Street analysts expect that a sudden pivot would happen only in the case of drastic economic issues (e.g., a meaningful recession), and likely involve a sharp drop in the market.

Here are some points to consider when looking at possible implications of a Fed pivot vs. continuing the current path of increasing interest rates.

The Strength of the U.S. Dollar

The Fed’s aggressive monetary policy has driven the U.S. dollar to historically high levels vs. several global currencies, including the Japanese yen, British pound, and the Chinese yuan. The nominal broad U.S. dollar index, a measure of the trade–weighted value of the USD vs. other advanced and emerging currencies, has increased by 10% since May 2021.3 This is the largest increase since 2014–2016.

This increasing strength of the U.S. dollar relative to other global currencies is impacting some global economies and currencies, while weighing on some U.S. companies and economic growth. As the Fed raises rates, treasury yields tend to increase creating an influx of cash from global investors seeking low risk returns in a time of economic and political uncertainty. As concerns around global recession, the conflict in the Ukraine, and global inflationary pressures mount—the demand for U.S. dollars to purchase treasuries contributes to the divergence in currency valuations.

The rising costs of energy in many European countries and rising costs of other major goods globally are also impacting the global economy. Emerging market economies are seeing food and supplies piling up in ports. Several countries are having challenges paying for food imports priced in USD as higher U.S. interest rates and rising commodity prices contribute to their trade issues. There are reports of thousands of containers filled with food stationed at ports in Pakistan. As the Federal Reserve continues to tighten monetary policy, the U.S. dollar’s strength versus currencies in emerging and developing markets will add to inflation and debt pressures for these developing economies, the International Monetary Fund stated in its global outlook.4,5

A strong U.S. dollar may help companies and individuals who are traveling abroad or are purchasing (or importing) goods or services from foreign countries in foreign currencies. As the cost of U.S. products becomes more expensive compared to the cost of foreign products, there is a propensity for consumers to purchase the relatively cheaper imported products. This in turn increases the trade deficit, which acts as a drag on GDP growth, as currency flows out to purchase the imported goods. However, this also may be a tool that can help temper inflation as it extracts currency from the U.S.

Risk of U.S. Recession, Cooling Labor, and Housing Markets

“No one knows whether this process will lead to a recession or, if so, how significant that recession would be,” said Fed Chairman Powell at a news conference in September 2022.

However, some financial groups such as Goldman Sachs, are cautioning the Fed on going too far. The investment bank noted in October that there is likely somewhat greater risk that the Fed’s rate increases may “cause a recession that is not necessary.”6

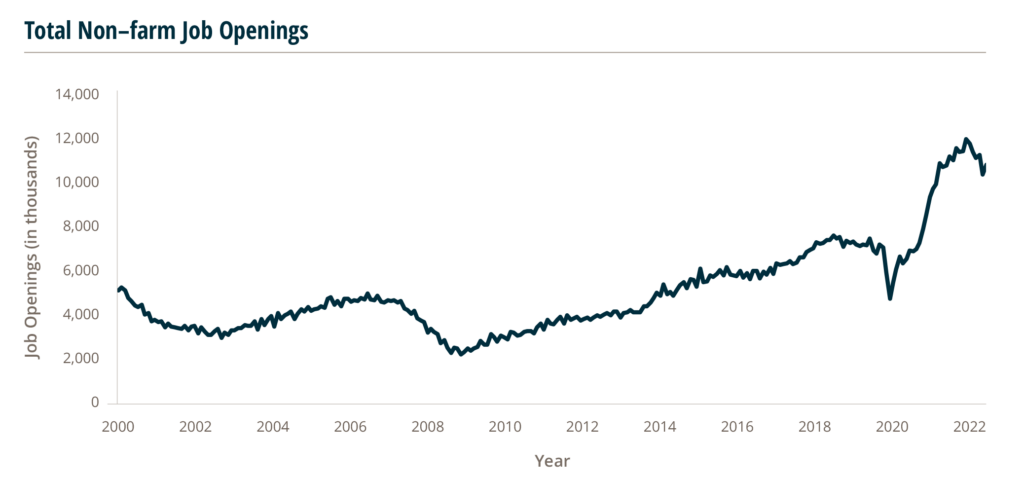

Some analysts see weaker job market data, indications of easing inflation, or a greater slowdown in the economy potentially changing the Fed’s hawkish stance. The labor market is showing signs of cooling as the number of U.S. job openings fell by 1.1 million postings or by 10% in August vs. July—the second–largest drop registered by the Job Openings and Labor Turnover since 2000.

The U.S. housing market is also slowing, with sales of newly constructed homes down 10.9% month–over–month in September 2022 and down 17.6% year–over–year (YoY). Residential investment, which is considered a proxy for home sales and homebuilding, contracted at a 26.4% annual rate from June to September.7 While residential investment accounts for only 4% of the U.S. economy, housing is seen as a bellwether for the rest of the economy, with homeownership being the biggest source of wealth among U.S. families. As they feel pinched, an otherwise resilient consumer could pull back on their spending, sending ripples across the economy.

How the Fed Decisions May Impact the Insurance Industry

If the Fed were to continue its aggressive stance on raising interest rates, contributing further to volatility in equities and risking recession in the U.S., insurance carriers may see slower premium expansion as business investment decreases and asset prices soften. For the insurance industry, while historically stable during recessions, it’s still important for brokers to understand how they might be affected. Here are some things to consider:

- Insurance carriers may see slower premium expansion as business investment decreases and asset prices soften. Depending on the magnitude of a recession, we would expect this event to have a neutral to adverse impact on the bottom line of insurance agents and brokers.

- Insurers with longer–tail liabilities or settlement periods may see more adverse impacts on underwriting results, given they will be paying for claims that may not be settled for many years after policy expiration. This is a double–edged sword where claim costs may be heightened in an inflationary environment, while invested assets (most of which are in fixed maturity investments) will begin to experience better returns in a higher interest rate environment. While this may not be intuitive, we would expect this to generally have a positive impact on insurance agents and brokers as carriers will be forced to push through upward rate adjustments to offset the adverse development that is likely to impact underwriting results. Higher premiums will result in high commissions for their distribution partners.

- Carriers may experience lower returns from their investment portfolios in slowdowns compared to higher growth periods. This occurs on a couple of notable fronts of the general carrier’s investment portfolio:

- As prevailing interest rates increase, the price of fixed maturity investments decreases. This is due to the inverse relationship of interest rates and price of fixed maturity investments. While short–term in nature, as these investments will mature at par value if held to maturity, this will still be a short–term hit to the surplus adequacy of carriers.

- Equity securities, whether publicly or privately held, are likely to go down in value in a recessionary environment. As carriers mark their equity portfolio to market valuations, this too will adversely impact carriers’ surplus adequacy.

- In either of these situations, agents and brokers will likely benefit as carriers will be incentivized to push rates higher to supplement investment portfolio returns with improved underwriting results. However, there is also the outside chance that carriers start to push back on commission rates, which are near historically high levels, paid to their distribution partners. This would be an adverse implication to agencies and brokers.

- As prevailing interest rates increase, the price of fixed maturity investments decreases. This is due to the inverse relationship of interest rates and price of fixed maturity investments. While short–term in nature, as these investments will mature at par value if held to maturity, this will still be a short–term hit to the surplus adequacy of carriers.

While the Fed’s future moves are uncertain, insurance agencies, brokerages, and carriers may want to consider doing some advanced scenario planning and assess how they will maneuver through potential volatility and macroeconomic changes in both scenarios, either a continuation of the current policies or an unexpected change in direction.

- https://fred.stlouisfed.org/series/MORTGAGE30US

- https://www.cnbc.com/2022/11/02/fed-rate-hikes-could-go-even-further-than-expected-as-powell-commits-to-stomp-out-inflation.html

- https://www.franklintempleton.co.uk/articles/strategist-views/quick-thoughtswhy-the-us-dollar-matters

- https://www.bloomberg.com/news/articles/2022-10-15/soaring-dollar-leaves-food-piled-up-in-ports-as-world-hunger-grows

- https://www.imf.org/en/Publications/WEO/Issues/2022/10/11/world-economic-outlook-october-2022

- https://www.cnn.com/2022/10/24/economy/goldman-sachs-accidental-recession-warning

- https://www.cnn.com/2022/10/28/investing/premarket-stocks-trading