U.S. Macroeconomic Indicators May 2022

Market Trends and Current Statistics

Key U.S. macroeconomic indicators that are likely to impact firms within the insurance industry.

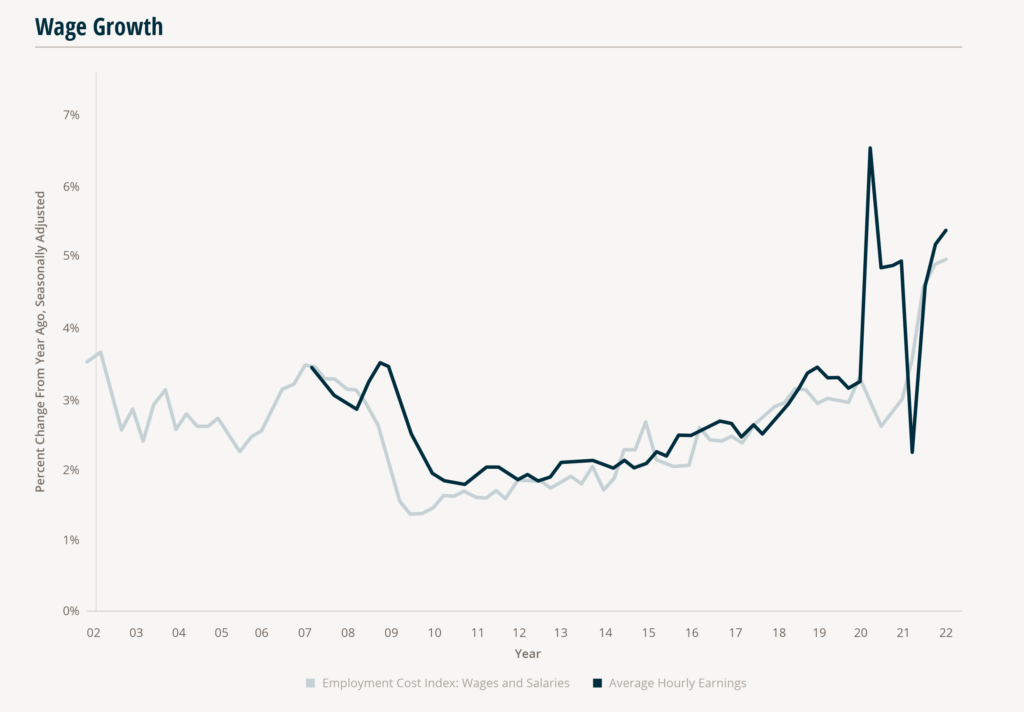

Wage Growth

In the first quarter of 2022, the U.S. Bureau of Labor Statistics’ Average Hourly Earnings Series and Employment Cost Index (ECI) both recorded some of the highest increases year–over–year since the metrics were first reported in 2007 and 2002.

Average hourly earnings recorded an increase of 5.4% in 1Q2022, the second highest increase on record. However, the highest recorded increase was in 2Q2020 because of pandemic–induced shutdowns.

5.4%

Increase in Average Hourly Earnings in 1Q2022

Low wage industries such as leisure and hospitality cut payroll while higher–paying professional service industries were able to adapt to remote work.

This resulted in a dramatic jump in average wages in that quarter.

The ECI is calculated in such a way that it is not influenced by employment shifts among occupations and industry categories, and as a result the ECI avoided similar increases in 2020. However, the index has now recorded record highs for three straight quarters, matching increases in average hourly earnings and indicating that the economy is indeed experiencing rising labor costs. These increases may be attributed to soaring inflation paired with current labor market conditions, where labor force participation persists at a percentage point below pre–pandemic levels, job openings are at all–time highs, and the rate of job quits remains elevated.

4.4M

Americans Quit Their Jobs in April 2022

MarshBerry’s article: “Three Keys to Success in the Great Reshuffle” discussed proactive measures firms can take as the Great Resignation shows no signs of slowing in 2022. Almost 4.4 million Americans quit their jobs in April 2022, which is consistent with the quit rate in March 2022.

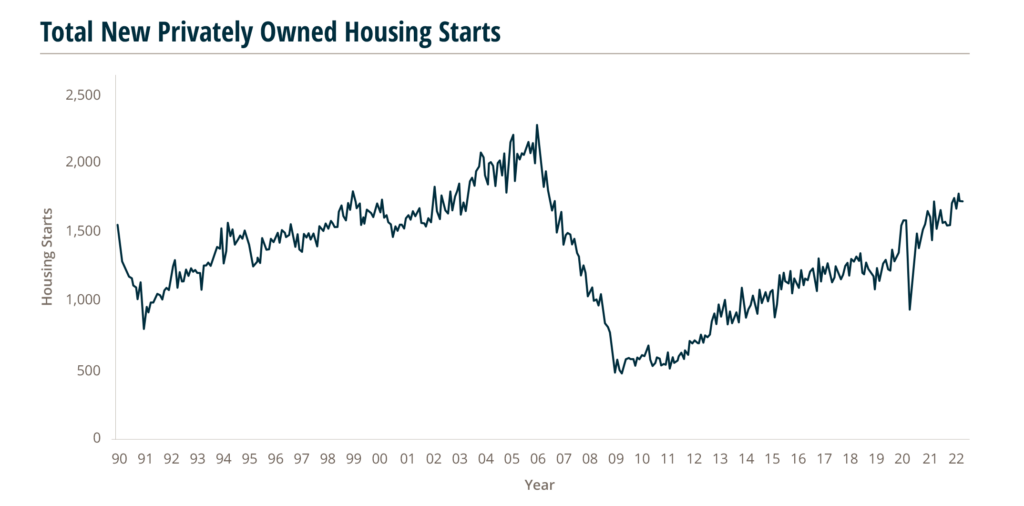

Construction Spending Rises Less than Expected in April; Housing Starts Come in Below Expectations

While construction spending continues to register increases, homebuilders are facing headwinds of high material and labor costs, as well as increasing mortgage rates in 2022. “Rapidly rising interest rates combined with ongoing home price increases and higher construction costs continue to take a toll on builder confidence and housing affordability,” the National Association of Home Builders said in a statement. These are important metrics to monitor for brokerages and carriers that focus on the construction market.

April construction spending in the U.S. saw an increase of 0.2% month–over–month, vs. the 0.3% increase seen in March 2022, below economists’ expectations for a 0.5% increase for April. U.S. construction spending rose 12.3% year over year vs. April 2021. Expansion in residential expenditures supported overall growth in April, while public spending continued to drop.

U.S. housing starts fell by 0.2% month–over–month to 1.724 million units (annualized) in April, below analyst projections for a decrease to 1.766 million units. March housing starts data saw a downward revision to 1.728 million, from the previously reported 1.793 million.

April figures were largely boosted by multi–family starts, which rose 15.3% month–over–month. Single–family housing starts, which comprise the biggest share of homebuilding, decreased 7.3%. This is likely correlated with the 30–year fixed mortgage rate reaching around 5% for the first time in over ten years as the Fed hikes interest rates to calm inflation. However, the continued low inventory combined with high demand is providing support for the homebuilding sector.

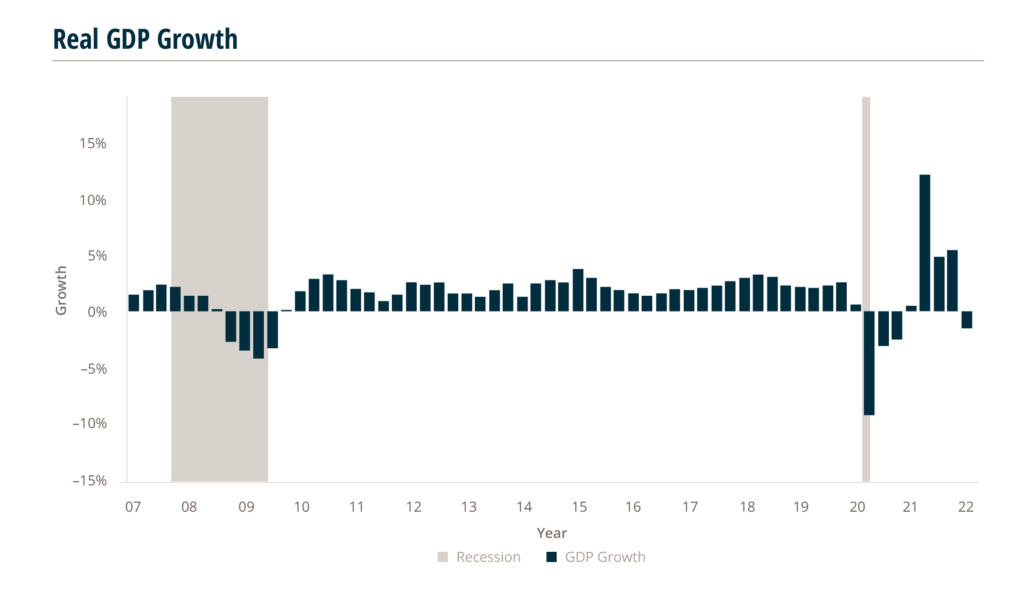

Real GDP Sees Unexpected Decline in 1Q2022

Real Gross Domestic Product (GDP) decreased at an annual rate of 1.5% in 1Q2022. This was an unexpected decline since the economy in 2021 was coming off its best performance since 1984. Real GDP reflected decreases in private inventory investment, exports, federal government spending, as well as rising imports. Several factors combined to weigh against growth for the first three months of 2022, including: continued COVID–19 impacts, surging inflation, and the Russian invasion in Ukraine. Some core economic activity did hold up fairly well — business investment rose by 9.2% and consumer spending was up 2.7% for the quarter.

Forecasts for 2Q2022 are calling for Real GDP to rise to 2.3% and annual growth in 2022 is projected to come in around 2.5%. Most forecasts are downgrades from what was previously predicted due to the weak GDP data reported in the first quarter. Downside risks are plentiful which could lead to a potential recession sometime this year or next.

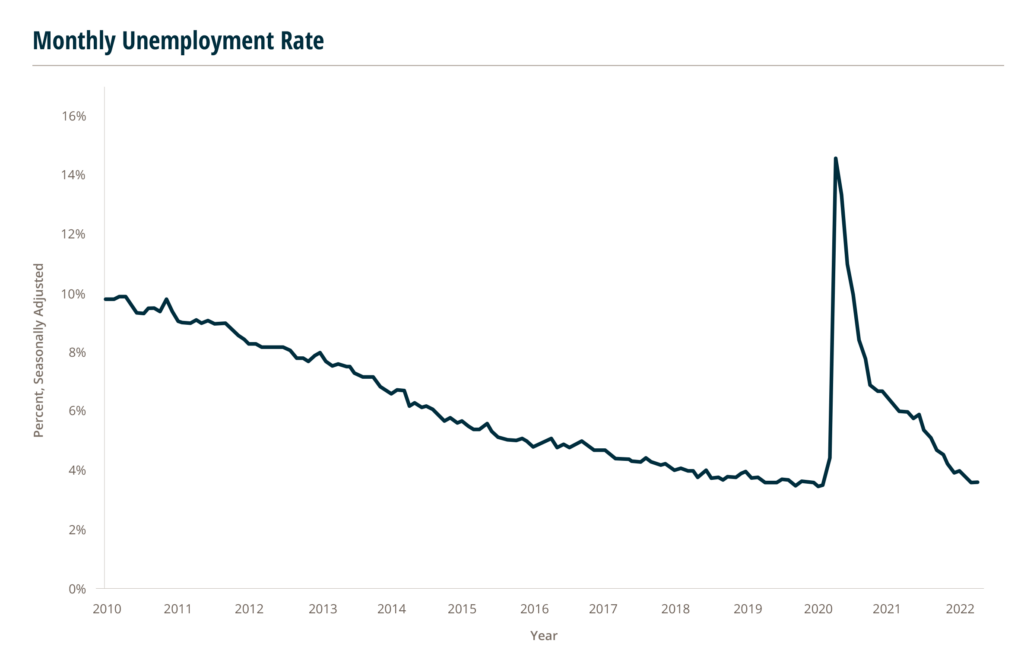

Unemployment Rate Remains Unchanged in May as Labor Market Continues to be Strong

May 2022’s unemployment rate was unchanged compared to the prior month’s 3.6%, and above economist expectations of 3.5%. There continues to be a gap of about five million more job openings than available job seekers.

Given the report, analysts see the Fed hiking rates at each of its two meetings this summer.

Source: U.S. Bureau of Labor Statistics, May 3, 2022

Economists noted that indications of slowing wage growth would potentially lead to the Fed reassessing its plans for rate increases, as the Fed focuses on quelling record high inflation.

The U.S. Bureau of Labor Statistics reported the unemployment rate, for people aged 16 and over, held steady for the second month in a row at 3.6%, after declining from the 3.8% rate in February 2022.

The economy added 390,000 jobs in May, vs. the 428,000 jobs added in April, led by broad–based gains.

The number of unemployed persons was 6.0 million, flattish vs. April’s 5.9 million and March’s 6.0 million.

These numbers are closer to the employment metrics pre–COVID: the unemployment rate in February 2020 was 3.5%, with 5.7 million unemployed people. The unemployment rate has declined in consecutive months since we saw it peak in April 2020 at 14.7%.