Public Broker Performance May 2022

MarshBerry’s Broker’s Index

The latest performance and insights on the public broker composite.

MarshBerry Broker Index Continues to Outperform

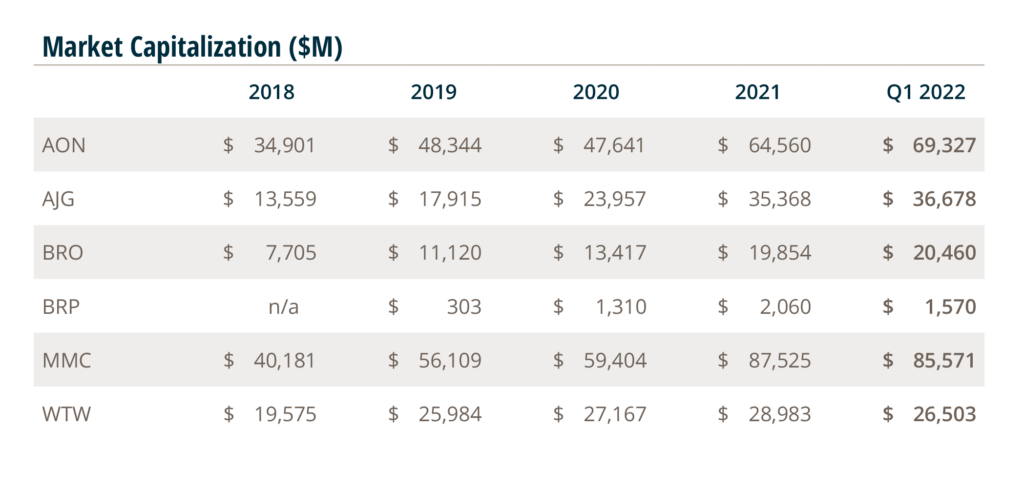

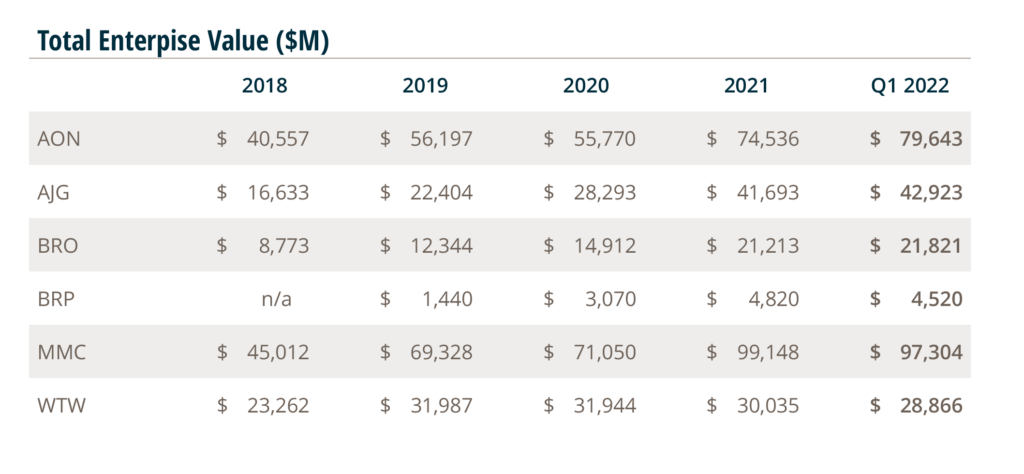

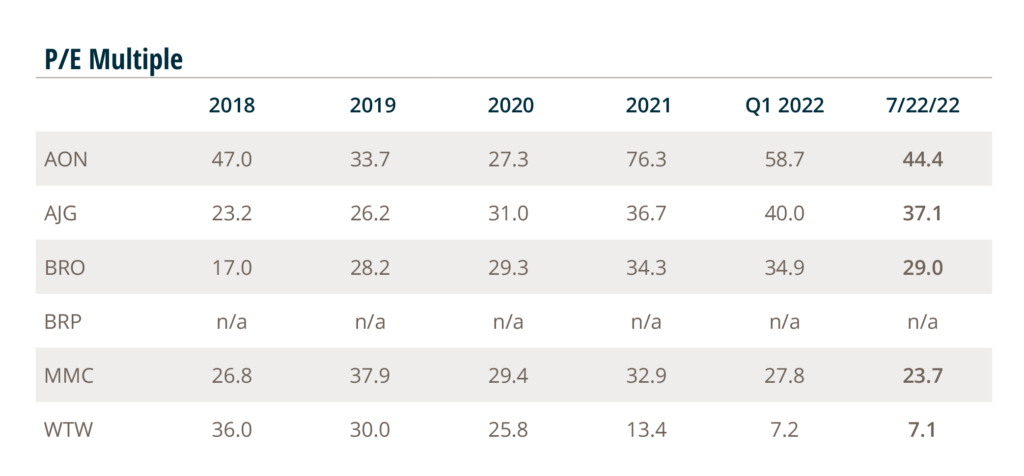

Through April and May 2022, six publicly traded insurance brokers reported results for the first calendar quarter of 2022: AJG, BRO, MMC, BRP, Aon plc. (AON), and Willis Towers Watson Public Limited Company (WTW).

Below are notable themes and take–aways from these earnings reports and recent stock performance.

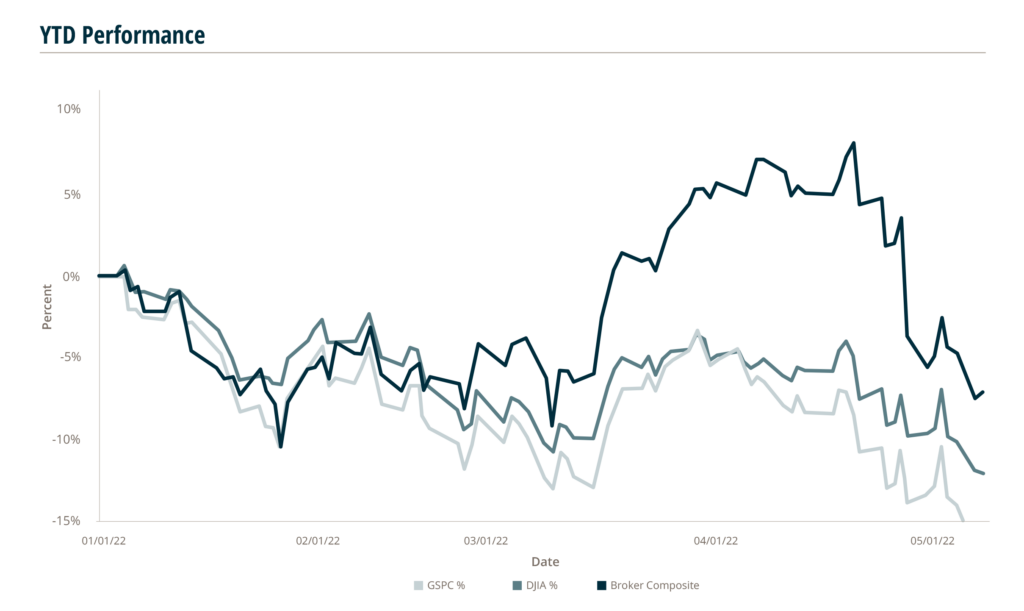

- Once again, the broker composite index outperformed benchmark indices year–to–date, through May 10, 2022, highlighting the resilience of the insurance brokerage industry. While all the indices declined during the first quarter of 2022 due to continued concerns around inflation, tightening monetary policy, a potential recession, and other worries, the broker composite outperformed both the DJIA and S&P 500.

- Although numbers are down across the board, investors are signaling that the insurance distribution industry has continued to deliver strong financial performance despite challenging macroeconomic factors.

Strong Start to 2022

- Insurance brokers started off 2022 with strong results which were attributed to a combination of improving new business, strong retention, and continued rate increases.

- Most brokers reported organic growth rates in the range of 8%–10% for the quarter. MMC reported organic revenue growth of 10% during 1Q22, in line with the 10% organic growth rate achieved in 4Q21. This was its fourth consecutive quarter of double–digit growth and the highest first quarter underlying growth in over two decades with each of their businesses showing strength.

- At the low end of the range, AON reported 1Q22 organic growth 8% of vs. 4Q21’s 10%. Commercial Risk and Consumer Benefit Solutions and Human Capital had strong results in the first quarter. Commercial Risk saw “growth in every major geography and particular strength across renewals and retention.”

Broker Composite

-7.1%

S&P

-12.1%

Dow Jones

-16.8%

Still Optimistic About 2022

- The outlook for 2022 remains optimistic even with the potential of a recession taking place in the near term. WTW noted on its earnings call that, “current macroeconomic challenges, including high inflation and tight labor supply, will continue to create demand for WTW services. A potential recessionary environment only intensifies the need for consulting and risk management solutions.”

- BRP echoed a similar sentiment, stating that during uncertain times, “we feel our clients are more open–minded to conversations and different perspectives. This is the type of environment we feel that we can accelerate growth.” The company forecasts all business units to produce organic growth rates in the mid–to–high teens.

- M&A activity got off to a slow start in Q1, but most brokers expect deal activity to ramp up for the remainder of 2022. Demand is still strong with buyers adding both talent and volume. There is still a significant amount of capital pushing its way into the insurance space and with the industry showing resiliency during tough times, management teams expect M&A activity to remain robust throughout the year. Most brokers have a robust pipeline of prospects and will look to complete deals throughout the remainder of the year.

- Overall, the first quarter results from the insurance brokers came in fairly strong, with management teams confident that the brokers will meet their goals for 2022. Although there will most likely be macroeconomic challenges for the remainder of the year, most view this as an opportunity to get in front of clients and help accelerate their growth.

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.

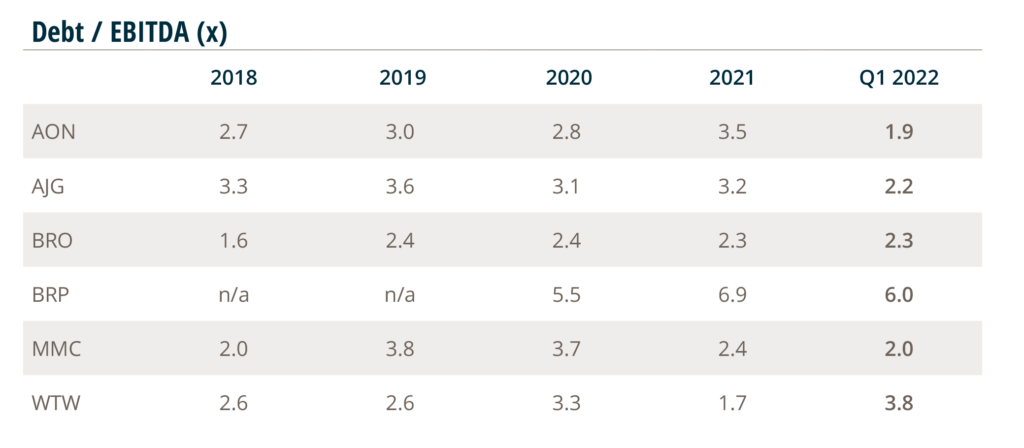

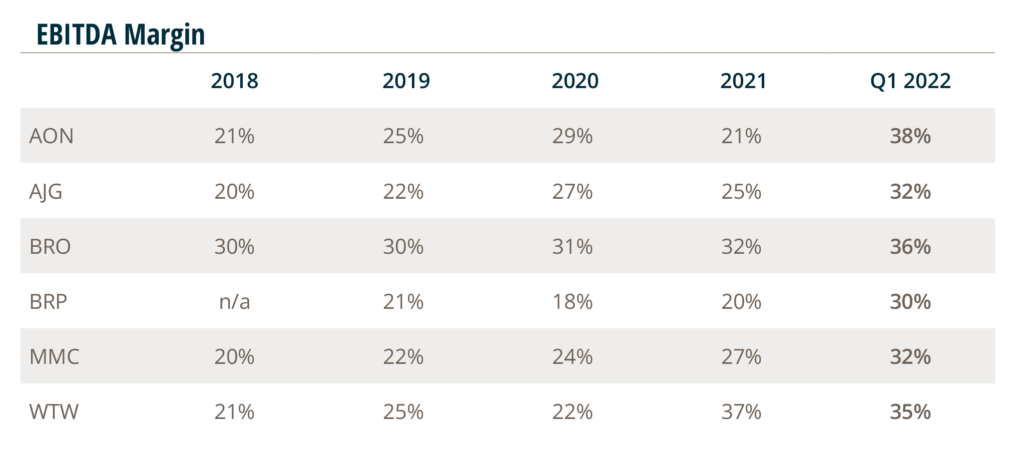

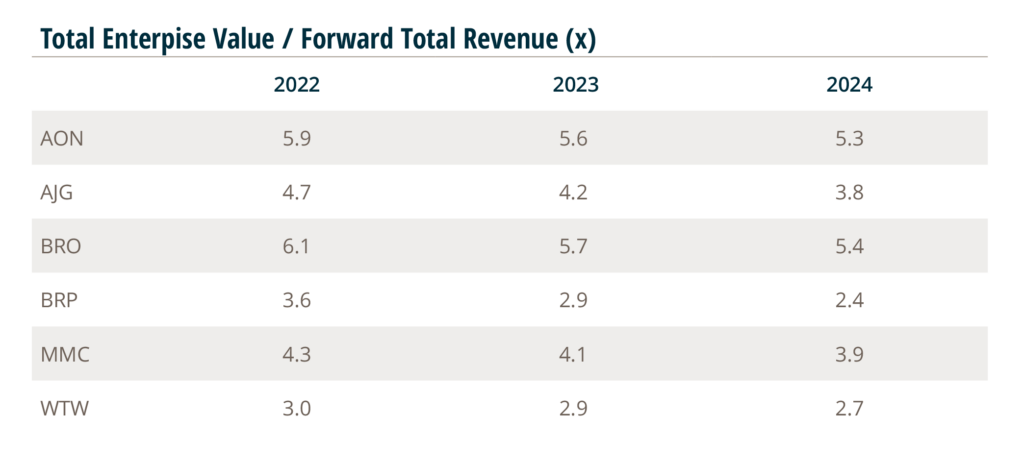

Source: S&P Global Market Intelligence, Company Reports, FactSet 4/30/22. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization.

AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BRP = Baldwin Risk Partners; MMC = Marsh & McLennan

Companies, Inc.; WTW = Willis Towers Watson Public Limited Company.