Focused Insights: Maximizing Shareholder Value May 2022

As insurance brokers navigate record high inflation, interest rate increases, and a potential economic slowdown, it’s vital that firms proactively position themselves to grow organically. As the market shifts, there could be an increasing chasm between firms that are well positioned to grow organically vs. those who can only grow during robust economic times.

How Can You Maximize Shareholder Value in This Market?

Deal demand for insurance brokerages is still very strong and the external environment has not yet had an impact on the marketplace. Borrowing costs remain manageable in the near–term. However, there could be an increase into 2023 as the Federal Reserve has taken a more hawkish stance. This would likely impact borrowing costs of private equity investors who are acquiring large insurance brokers. This could prompt an evaluation of valuations for smaller, non-platform insurance brokerages, reinforcing the importance of brokers to plan and execute a strategy that maximizes long–term value.

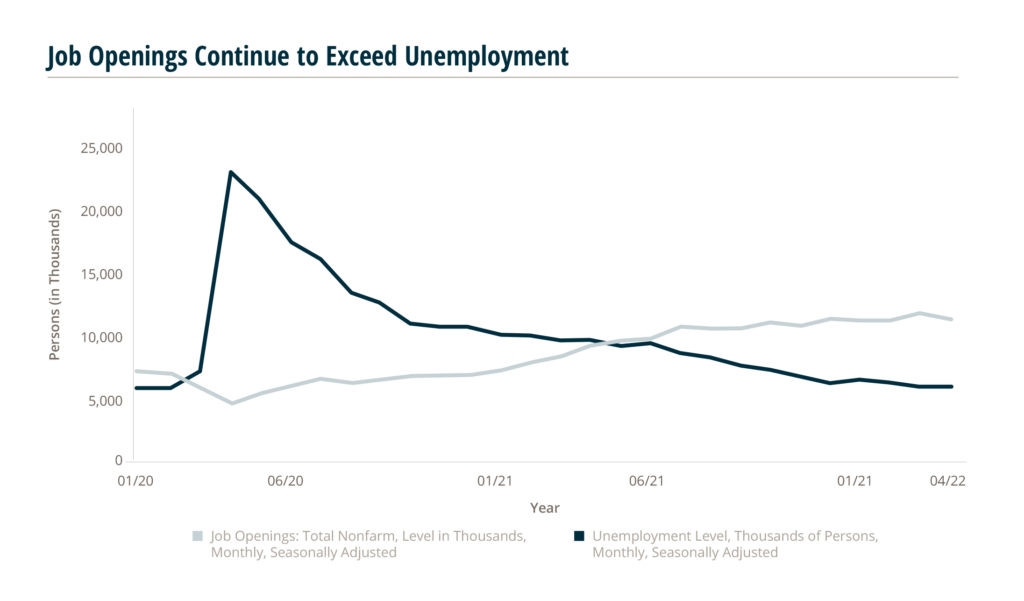

The Fed’s plan to manage rising inflation while maintaining reasonable economic growth will influence its rate hike decisions in 2022. The extremely tight labor market may also have an impact: the current difference between the total number of jobs and total number of workers is about five million. According to the Fed minutes from the May 3–4 meeting, many Fed members see half–point rate hikes as “appropriate” during the next June and July meetings. Economists also believe that the overheated job market will contribute to the Fed’s potential path of a half–point rate hike at its next meeting, following a half–point hike on May 4, 2022.

For firms looking to maximize shareholder value, it is key to map out a strategic plan that identifies the tactical issues needed to achieve those goals.

For example:

New Sales Talent:

According to MarshBerry’s Perspectives for High Performance (PHP), our proprietary financial management system, only 28% of producers are under the age of 40 in average firms — compared to 41% in the best 25%. Is your firm actively building its bench with new sales talent to be competitive in the marketplace?

28%

Of Producers are Under the Age of 40 in Average Firms

41%

Of Producers are Under the Age of 40 in Best 25% Firms

Training and Development:

Are you creating an environment of Million Dollar Producers — or babysitting non–producing producers? Often executives set the bar too low and are limited to only what agents/brokers are currently producing. Instead, look at the bigger picture and compare your production to hundreds of producers from across the country from different demographics and experience levels. Invest in quality training and development programs that will drive producer validation and increase new business production.

Succession Planning:

As the average age of insurance firm owners continues to increase across the industry, are you investing time and effort into equity succession planning? Broad ownership can motivate producer– stakeholders to drive new business production and organic growth. A clear perpetuation strategy for key staff can also help create a strong feeling of purpose and motivation for the team.

Diversification:

Research shows that diverse teams are more effective at solving difficult problems and reaching multiple markets and customer segments. Failing to embrace diversity may lead to missing out on groundbreaking thoughts, ideas, and innovation, which might otherwise lead to new revenue streams.

With the evolving marketplace, high inflation, and tighter monetary policy, how is your firm taking action to create long–term growth goals? Firms that are laser focused on high growth will continue to expand into new product lines, build their customer base, and focus on employee development — despite current economic conditions.